Weekly Summary: April 18 – April 22, 2022

Key Observations:

- The World Bank and the International Monetary Fund (IMF) lowered their global GDP growth forecasts for 2022 as they “see trouble on the way.”

- Most recent economic data continue to show robust U.S. economic growth but many surveys indicate that consumers and businesses begin to lose confidence about future business conditions to the extent that inflation concerns become the focus.

- Rising Treasury yields could have far reaching repercussions. China’s monetary policies might be more targeted to the extent that these yields surpassed those of comparable China bonds for the first time in more than a decade.

- Federal Reserve (Fed) chair Powell indicated that a 50 basis points hike is “on the table” at the May 3-4 Fed meeting, and that front-loading tighter monetary policy could be appropriate. For the remaining doubters of his resolve to rein in elevated rates of inflation, Powell even referred to Volcker’s resolve to “stay the course” as he led the policy of very aggressive interest rate hikes to lower inflation rates, even as they eventually led to a recession.

The Upshot: Our general approach remains constant. Many long-term investors could strive to maintain a diversified portfolio comprising high quality stocks of companies that have strong balance sheets, somewhat predictable cash flows and an ability to maintain strong profit margins. Additionally, these portfolios could include at least some exposure to commodities. Given the great amount of uncertainty surrounding the Russia-Ukraine war (war), repercussions from China’s “zero-COVID-19” policies, inflation and slowing economic growth, we maintain our preference for a well-diversified portfolio. As companies report earnings, we will continue to focus on managements’ guidance with respect to future results and particularly on discussions of profit margins. We contemplate many instances of lowered guidance on earnings, revenues and/or margins. Furthermore, we foresee volatility continuing across financial markets and higher interest rates as they continue on their volatile path. We maintain our conviction that the Fed will be very aggressive in implementing tightening monetary policies, both in terms of front-loading interest rates hikes, as well as an aggressive quantitative tightening (QT) policy to reduce its nearly $9-trillion balance sheet.

Possible “Trouble on the Way”

We accept that the people of Ukraine, in the words of Creedence Clearwater Revival, “see the bad moon a-rising” and that they “see bad times today.” To the extent possible, they should also heed the admonishment of “Don’t go around tonight; Well it’s bound to take your life.”

Fortunately for the rest of the world, the situation is not nearly as dire. But it appears that globally, we “see trouble on the way.” Generally, economic data reflecting current business activity continues to be expansionary. But the “troublesome” aspect of many surveys is to the extent that survey respondents cite inflation as their primary concern, they typically become more pessimistic about business conditions looking out six to twelve months. This is one of the reasons that managements’ guidance will continue to be a critical component of their stock price reaction to “earnings calls.”

The IMF and World Bank Lowered 2022 Global GDP Forecasts

The Russia-Ukraine war is a principal reason why both the World Bank and the IMF released this week their lowered estimates for global GDP growth in 2022. The World Bank cut is January forecast of 4.1% GDP 2022 growth to 3.2% citing mostly the war and COVID-19 related lockdowns in China, while warning of “exceptional uncertainty.” The IMF cited similar factors in downgrading their 2022 global GDP forecast from 4.4% down to 3.6%. The IMF estimate for 2021 global GDP growth was 6.1%. The IMF noted “unusually high uncertainty surrounding [their] forecast” with downside risks “dominating” including “a possible worsening of the war.” Additional negatives that might dampen its growth forecasts could be a “sharper than anticipated deceleration in China” due to its “zero-COVID-19” policy and to the emergence of more virulent and contagious versions of coronavirus. The IMF now also projected inflation to be elevated for longer than its January forecast “driven by war-induced commodity price increases and broadening price pressures.” Its new 2022 inflation projections are 5.7% in “advanced economies” and 8.7% in “emerging market and developing economies (EMs).” These rates are 1.8% and 2.8% higher, respectively. Like many financial market participants, these two financial institutions are changing their forecasts because they “see trouble on the way.”

Small Business Pessimism Increases for Future Business Conditions as Inflation Concerns Increase

The National Federation of Independent Business (NFIB) released last week its small business optimism index for March. Inflation had replaced February’s top concern of labor quality. This index was lower for the third straight month and fell to its lowest level since August 2020. But it was the severe downturn in the percent of small business owners who expected better business conditions over the next six months that drove the overall reading lower. In fact, the percent of owners who expected better sales over the next six months dropped to the lowest level in this survey’s 48-year history. It has been our contention for quite some time that in general, small businesses have been hurt disproportionately more relative to larger enterprises from supply chain constraints and disruptions. We suspect that this could explain at least partly many months of underperformance by the Russell 2000 – the small-cap U.S. stock index – relative to other major U.S. stock market indexes.

Contrast Robust Current Economy and Future Concerns = Volatility

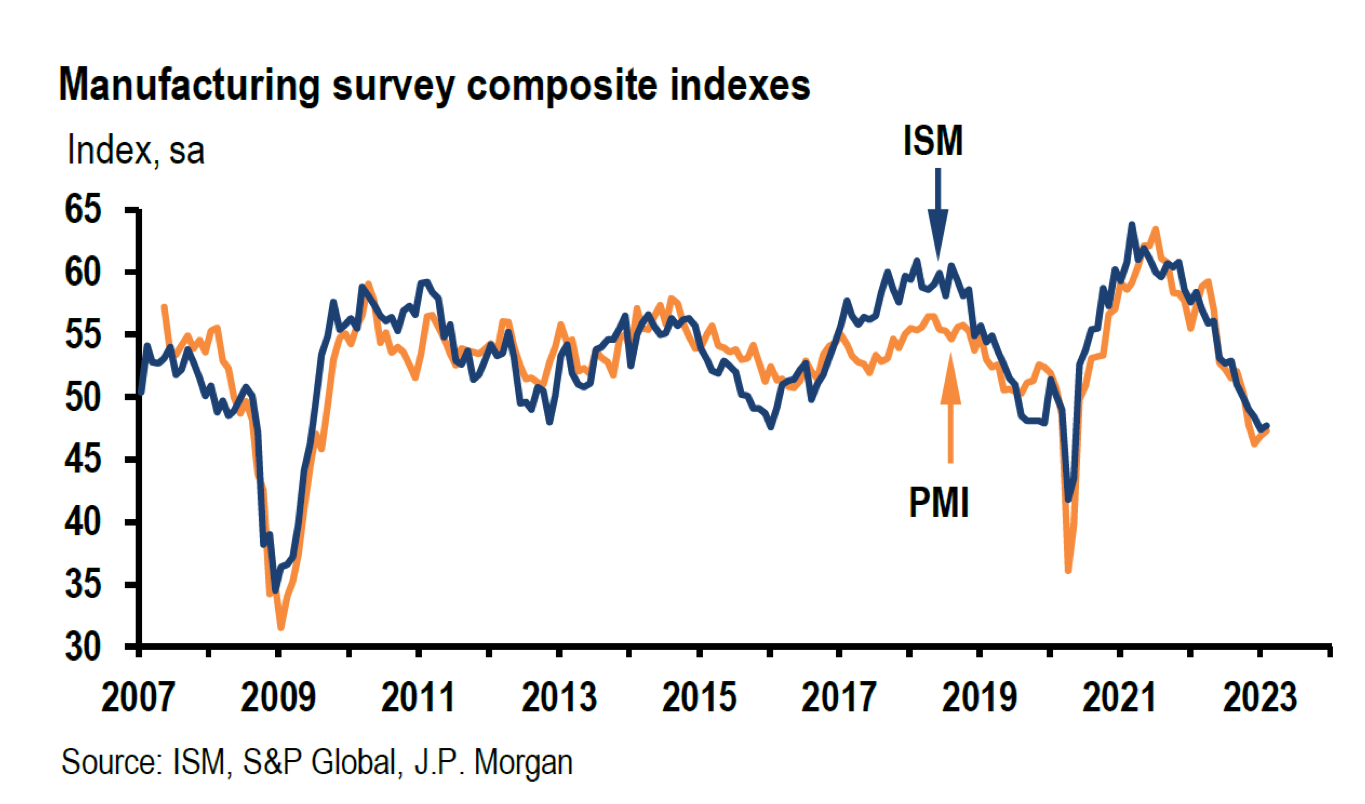

At the end of last week, the Federal Reserve Bank of New York released its Empire State Manufacturing Survey. Responses for this survey were collected between April 4 and April 11. According to this survey, “business activity picked up markedly in New York State.” In particular, new orders and shipments grew “strongly” and unfilled orders increased. But we maintain that the “problem” embedded in this survey was that the prices paid index hit a record high and that prices received remained elevated. Once again it appears that concerns over high inflation are what made many firms “significantly less optimistic” about their six month outlook. In our opinion, the results of this survey encapsulate one of the principal dilemmas of today’s financial markets – do we take solace in economic data that generally continues to show a robust U.S. economy or do we worry about the many uncertainties that might transpire. This week has been a very good example of why volatility of many financial markets could continue for quite some time. We postulate that the markets’ focus will continue to shift in unpredictable ways. The volatility in fixed income markets has been noteworthy, particularly during the past two weeks. The only recent time that fixed income volatility approached current levels was during the depths of the pandemic in March 2020. Even the effects that interest rates have on equities has become less predictable. On Tuesday of this week, interest yields spiked higher and yet all major U.S. stock indexes closed higher with Nasdaq performing best. But on Thursday, when yields spiked higher again, all the major U.S. averages traded lower with Nasdaq notably underperforming the S&P 500 and the Dow. The Nasdaq is typically considered to be most sensitive to interest rates, so Thursday’s performance would be the more expected result. As we will explain later, Fed chair Powell’s Thursday remarks exacerbated the downturn in U.S. stocks. Thursday was also noteworthy due to the continued strength of the “re-opening trade” led by airline stocks. Airline Q1 results and Q2 guidance were both very positive. This shows that if conviction is strong enough for a particular sector or company, it may be able to overcome negative market sentiment and higher interest rates. We anticipated accurately the strength of this sector at the end of last year.

Source: Goldman Sachs Global Economics Comment: Is the World Deglobalizing, Slowbalizing or Newbalizing? (Struyven/Hatzius) (4/18/2022)

Fed’s Beige Book

A further confirmation of U.S. robust economic growth was the Fed’s Beige Book release mid-week, which described economic activity as expanding at a “moderate pace.” This latest Beige Book edition incorporated information collected on or before April 11. The Beige Book compiles mostly “qualitative” information across the 12 Federal Reserve Districts from their various sources and is published eight times a year. The Beige Book continued to show the now familiar story: tight labor markets, supply chain backlogs, and elevated input costs all contributing to posing challenges in meeting demands for firms’ products. But unfortunately, the Beige Book also confirmed concerns about the future: “Outlooks for future growth were clouded by the uncertainty created by recent geopolitical developments and rising prices.” Firms in most Districts also “expected inflationary pressures to continue over the coming months.”

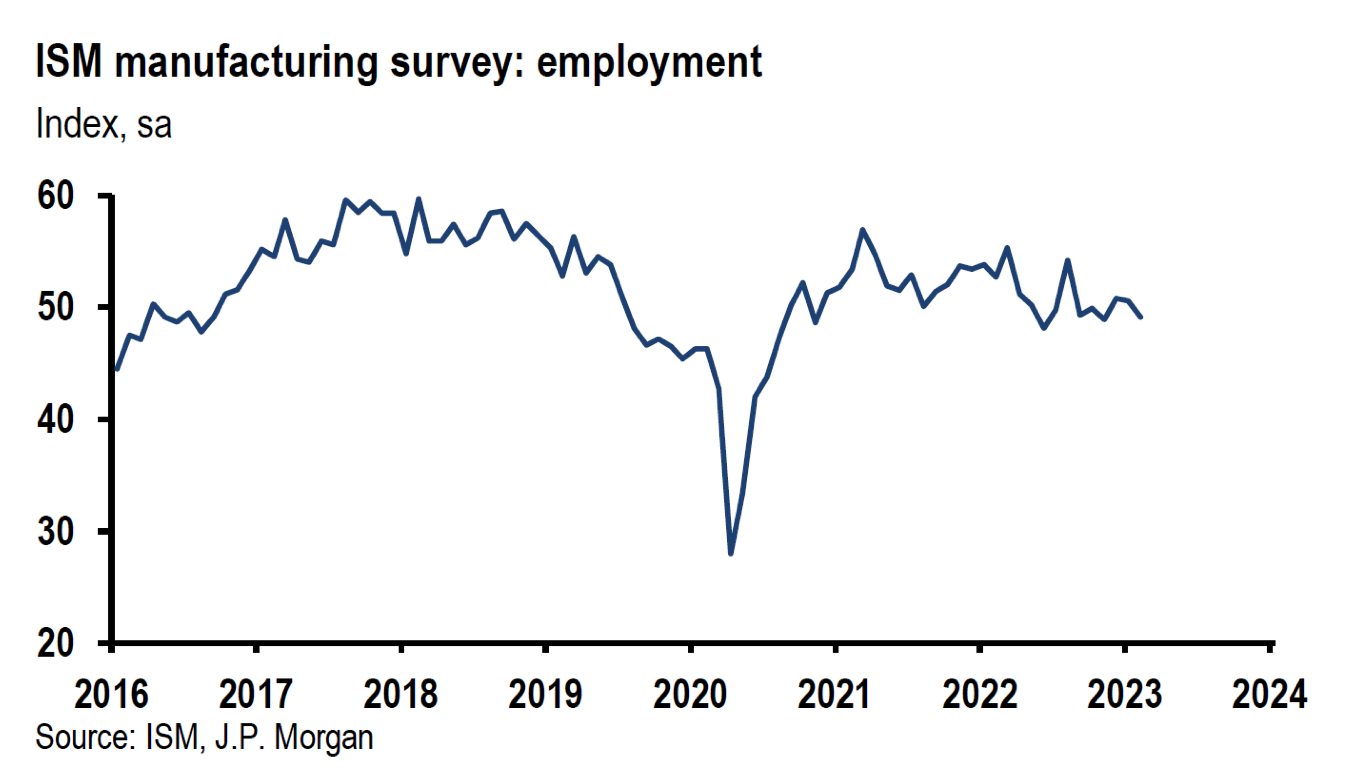

Philly Fed Manufacturing Index

The Manufacturing Index of the Federal Reserve Bank of Philadelphia was released on Thursday and was based on responses collected from April 11 to April 18. This index fell more than expected and pointed to a slowdown in manufacturing activity in this Bank’s region. The subindexes for shipments and new orders also declined, but employment increased. The prices paid index rose to its highest level since June 1979 and the prices received index continued higher as well. The six months ahead index for business conditions declined sharply although business was still expected to grow. This report was perhaps the least sanguine of the recent reports we have seen in regard to current business conditions.

U.S. Housing

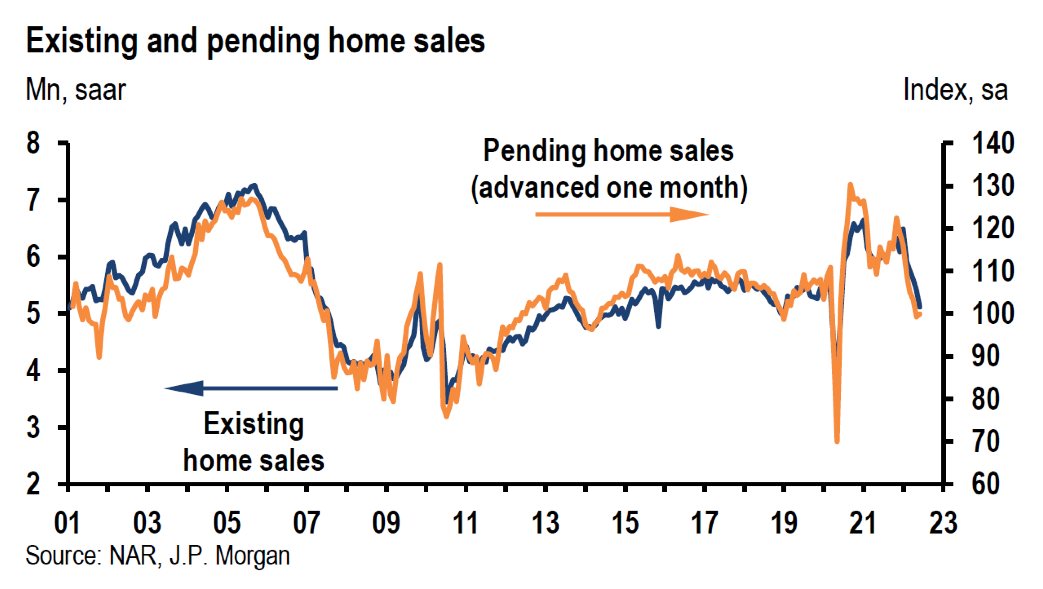

We would characterize the U.S. housing data released this week as mixed. The week began with the release of the National Association of Home Builders (NAHB) April sentiment index of home builders for newly built single family homes. This index fell for the fourth consecutive month to a seventh-month low. According to NAHB, “rapidly rising interest rates combined with ongoing home price increases and higher construction costs continued to take a toll on builder confidence and housing affordability.” Housing starts for March were released the following day. Very positive headlines indicating that housing starts hit their fastest pace in sixteen years, accompanied that release. Unfortunately, we thought that such headlines painted a distorted picture. It was the notoriously volatile multi-family component – more than five units – which had a big increase in March. But single family starts, which account for the biggest share of homebuilding, dropped 1.7% month-over-month (m/m) in March and were still above pre-pandemic levels. Building permits for single family homes fell even more – down 4.8% m/m. By comparison, multi-family starts increased 4.6% and their permits increased more than 10%. Finally, existing U.S. home sales for March were released mid-week and showed a 2.7% decrease m/m and a 4.5% decrease year-over-year (y/y). The median price for an existing home reached a record high of $375,000, an increase of 15% y/y and a 1.6% increase m/m. Prices continued to rise due to the very low supply of homes listed for sale. According to CNBC on April 20, there were 950,000 homes for sale, a 9.5% decrease y/y. At the current pace of sales, that level of inventory represented a two-month supply. The inventory of houses for sale was even worse for the lowest end of the market.

The most encouraging aspect of the current U.S. housing market in regard to future home construction is the dearth of housing inventory. On April 18, Goldman Sachs highlighted that the 30-year fixed-rate mortgage rate had increased 1.9% since the start of the year to an eleven year high of 5%. Given the excess demand for homes relative to supply, Goldman Sachs estimated that existing home sales would be only ”one-third as sensitive to changes in rates.” Goldman was even more optimistic in regard to housing starts, finding that “housing starts have historically been unresponsive to changes in mortgage rates in a supply-constrained environment” and that they still expect a 5% increase in housing starts for 2022 when compared to 2021.

Source: J.P. Morgan US: Existing home sales drop across February and March (4/20/2022)

Source: U.S. Census Bureau and the U.S. Department of Housing and Urban Development: Monthly New Residential Construction, March 2022 (4/19/2022)

Source: Goldman Sachs US Daily: Will Higher Rates Put Out the Housing Fire? (Walker) (4/18/2022)

Effects of Higher Treasury Yields on China Policies

Some of the repercussions of the recent dramatic rise in U.S. Treasury yields are far from obvious. According to Bloomberg on April 17, China bond yields traded below comparable Treasury yields for the first time in more than a decade. We contend that this might explain the rather sudden drop of CNY –China’s on-shore yuan – more than 2% versus USD during this week to its lowest level in about eight months. On April 19, the South China Morning Post noted that the French bank Natixis thought that the Peoples Bank of China (PBOC) chose to take a cautious monetary approach to bolster China’s economy due to the “rapidly shrinking yield differential with the U.S. and instead appeared to adopt a much more targeted approach for the benefit of consumers and small business.” Natixis also expected that fiscal policy would play a role as well. The reason we care about a more cautious and targeted monetary approach by the PBOC is that such an approach might be less effective in terms of “lifting” Chinese economic growth when compared to a more widespread monetary easing. Given current inflationary concerns, we doubt that China wanted a depreciated currency at the present time. China’s dilemma is one of supply chain disruptions and not demand for its products. Slower economic growth from China might be expected to slow global growth as well. Furthermore, slower China economic growth might lower demand more for many materials or commodities, and thereby might lessen worldwide inflation. But slower growth might somehow affect supply chains as well. Therefore, we suppose that the inflationary impacts are somewhat less clear when compared to effects on global growth.

Source: Goldman Sachs Asia Views: Absorbing the Covid and commodities shocks (4/19/2022)

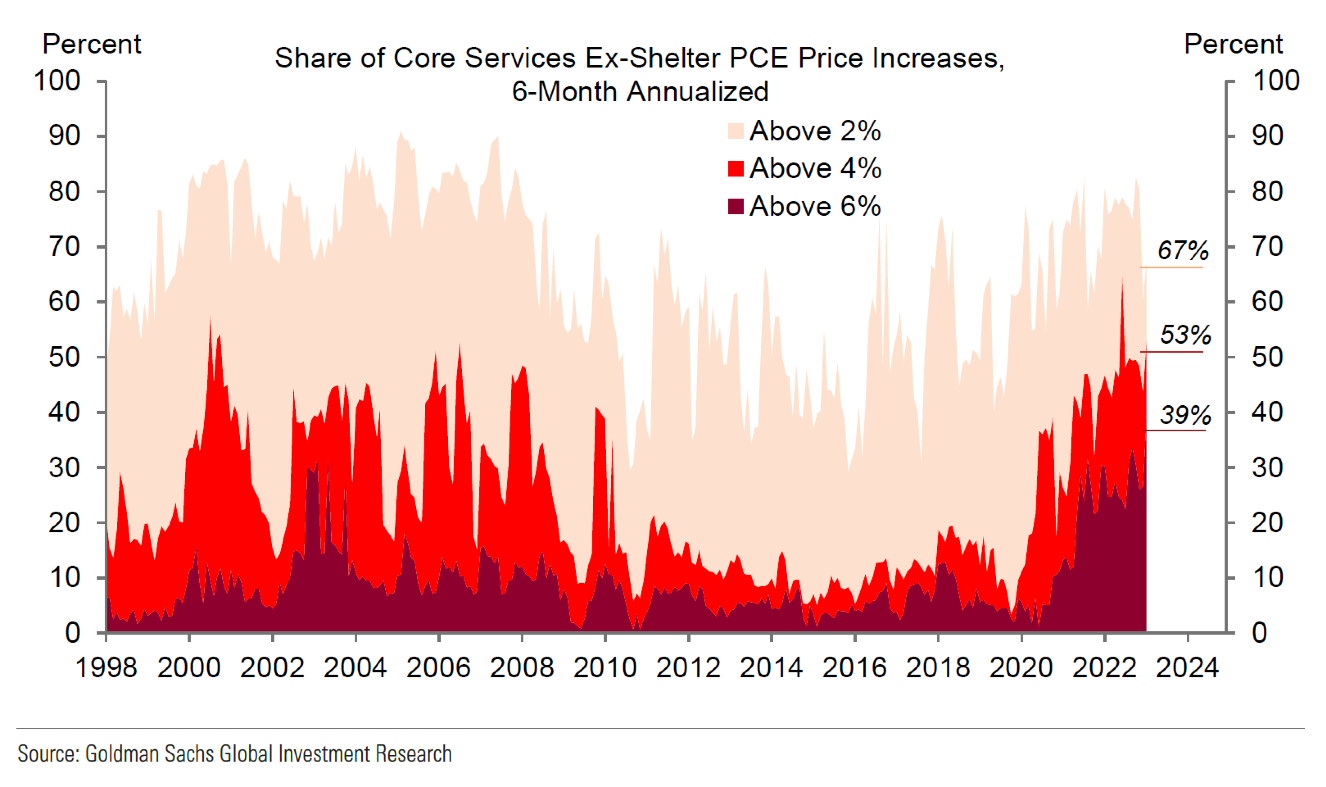

Latest Selected Inflation Data

Last week, U.S. March Consumer Price Index (CPI) and Producer Price Index (PPI) data were released. CPI rose 8.5% y/y and PPI rose 11.2% y/y – both multi-decade highs. This week German March PPI was released and showed a record high increase of 30.9% y/y. Excluding high energy prices, PPI was still a very high 14% y/y. Producer prices increased 4.9% m/m. The German PPI is merely the latest example of global inflation. We chose to emphasize the elevated inflation rates of change before we introduce Powell’s latest statements from his IMF panel participation on Thursday. We suppose that these very hawkish statements exacerbated the U.S. equity market downturn that same day.

In Powell’s Own Words – Ghost of Volcker

Some of Powell’s most revealing statements concerning future Fed actions include the following: “It is appropriate in my view to be moving a little more quickly” to raise interest rates. Powell added that the Fed is committed to raising rates “expeditiously.” “I also think there is something to be said for front-end loading any accommodation one thinks is appropriate. … I would say 50 basis points will be on the table for the May meeting.” Powell was adamant: “It’s absolutely essential to restore price stability.” He reiterated his belief that “economies don’t work without price stability.” Powell even indicated the Fed might go beyond “neutral.” “We’re really going to be raising rates and getting expeditiously to levels that are more neutral and then that are actually tight … if that turns out to be appropriate once we get there.” Powell went on to characterize the U.S. economy as “very strong” and the labor market as “extremely tight, historically so.” CNBC on April 21, highlighted that earlier that day Powell referenced former Fed chair Paul Volcker who is best known for “taming” inflation in the 1970’s and 1980’s by a very aggressive series of rate hikes that ultimately led to a recession. Powell was quoted as saying that Volcker “knew that in order to tame inflation and heal the economy, he had to stay the course.” We expected no less from Powell. The very explicit and pointed reference to Volcker should dispel any lingering doubts that anyone had about Powell’s resolve to rein in inflation, even at the risk of causing a recession.

Source: Goldman Sachs US Thematic Views: Against a volatile backdrop, buy stable stocks (4/18/2022)

Bottom Line

We assume continued volatility across virtually all financial markets for at least as long as the war persists. Also, we continue to forecast higher interest rates as part of a volatile trajectory. We suppose that a well-diversified portfolio of selected high-quality stocks that includes some commodity exposure could be the best strategy for many long-term investors. Our preferred approach is to anticipate and recognize “tradable bottoms” in equity markets so that we might take advantage of attractive entry points to purchase selected equities.

We foresee that most global economic growth rates will be revised lower and that most inflation forecasts will be revised higher due to the war and Chinese coronavirus-related lockdowns. Additionally, we assume that downward earnings revisions for many companies might soon reflect these patterns. Predictable margins should become increasingly important in evaluating appropriate investments. Managements’ guidance on future earnings and revenue could be a driving force behind stock market reactions in the upcoming earnings season.

We anticipate a continuing debate over whether to focus on relatively robust current U.S. economic growth or whether to emphasize instead lowered consumer and business confidence over the next six to twelve months when continued high inflation rates become the dominant concern. We suppose that this debate will lead to continued financial market volatility driven by shifting market preferences.

We were not surprised by any of Powell’s statements this week. Powell continues to try to emphasize his hawkish monetary stance. Perhaps his reference to Volcker will finally convince the doubters of his resolve. We believe that at least we should mention also Russia’s “test-firing” of a new intercontinental ballistic missile this week that has a range of 6,000 to 9,300 miles and that is capable of carrying nuclear weapons. According to the Associated Press on Wednesday, Putin wants the West to “think twice” before “harboring any intensive aggressive intentions against Russia.” Putin also highlighted that this new ballistic missile was built exclusively from domestic components and would therefore be impervious to any further sanctions.

Definitions

S&P 500 Index – The S&P 500 Index, or the Standard & Poor’s 500 Index, is a market-capitalization-weighted index of the 500 largest publicly-traded companies in the U.S. re-positioning

NASDAQ – The Nasdaq Composite Index is the market capitalization-weighted index of over 2,500 common equities listed on the Nasdaq stock exchange.

DJIA Index – The Dow Jones Industrial Average (DJIA) is a price-weighted index that tracks 30 large, publicly-owned companies trading on the New York Stock Exchange (NYSE) and the Nasdaq

Russell 2000 Index – The Russell 2000 Index is a stock market index that measures the performance of the 2,000 smaller companies included in the Russell 3000 Index. It is made up of the bottom two-thirds in company size of the Russell 3000 index.

International Monetary Fund (IMF) – The International Monetary Fund is an international organization that promotes global economic growth and financial stability, encourages international trade, and reduces poverty.

Basis Points (bps) – A basis point is one hundredth of one percent, used chiefly in expressing differences of interest rates.

Consumer Price Index (CPI) – The Consumer Price Index (CPI) is a measure that examines the weighted average of prices of a basket of consumer goods and services, such as transportation, food, and medical care. It is calculated by taking price changes for each item in the predetermined basket of goods and averaging them.

Gross Domestic Product (GDP) – Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of a given country’s economic health.

Re-opening trade – The reopening trade means buying stocks that will benefit from an open economy, domestically and globally.

Producer Price Index (PPI) – The producer price index (PPI), is a group of indexes that calculates and represents the average movement in selling prices from domestic production over time. It is a measure of inflation based on input costs to producers.

Emerging Market Economy (EM) – An emerging market economy is the economy of a developing nation that is becoming more engaged with global markets as it grows. Countries classified as emerging market economies are those with some, but not all, of the characteristics of a developed market.

Beige Book – The Beige Book is a report produced and published by the U.S. Federal Reserve. The report, referred to formally as the Summary of Commentary on Current Economic Conditions, is a qualitative review of economic conditions. The Beige Book is published eight times each year before meetings held by the Federal Open Market Committee (FOMC) and is considered one of the most valuable tools at the committee’s disposal for making key decisions about the economy.

World Bank – The World Bank is an international organization dedicated to providing financing advice, and research to developing nations to aid their economic advancement.

Developed Market Economy (DM) – A developed economy is typically characteristic of a developed country with a relatively high level of economic growth and security. Standard criteria for evaluating a country’s level of development are income per capita or per capita of gross domestic product, the level of industrialization, the general standard of living, and the amount of technological infrastructure.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/fast-answers/answersindiceshtm.html or http://www.nasdaq.com/reference/index-descriptions.aspx.

All data is subject to change without notice.

© 2024 NewEdge Capital Group, LLC