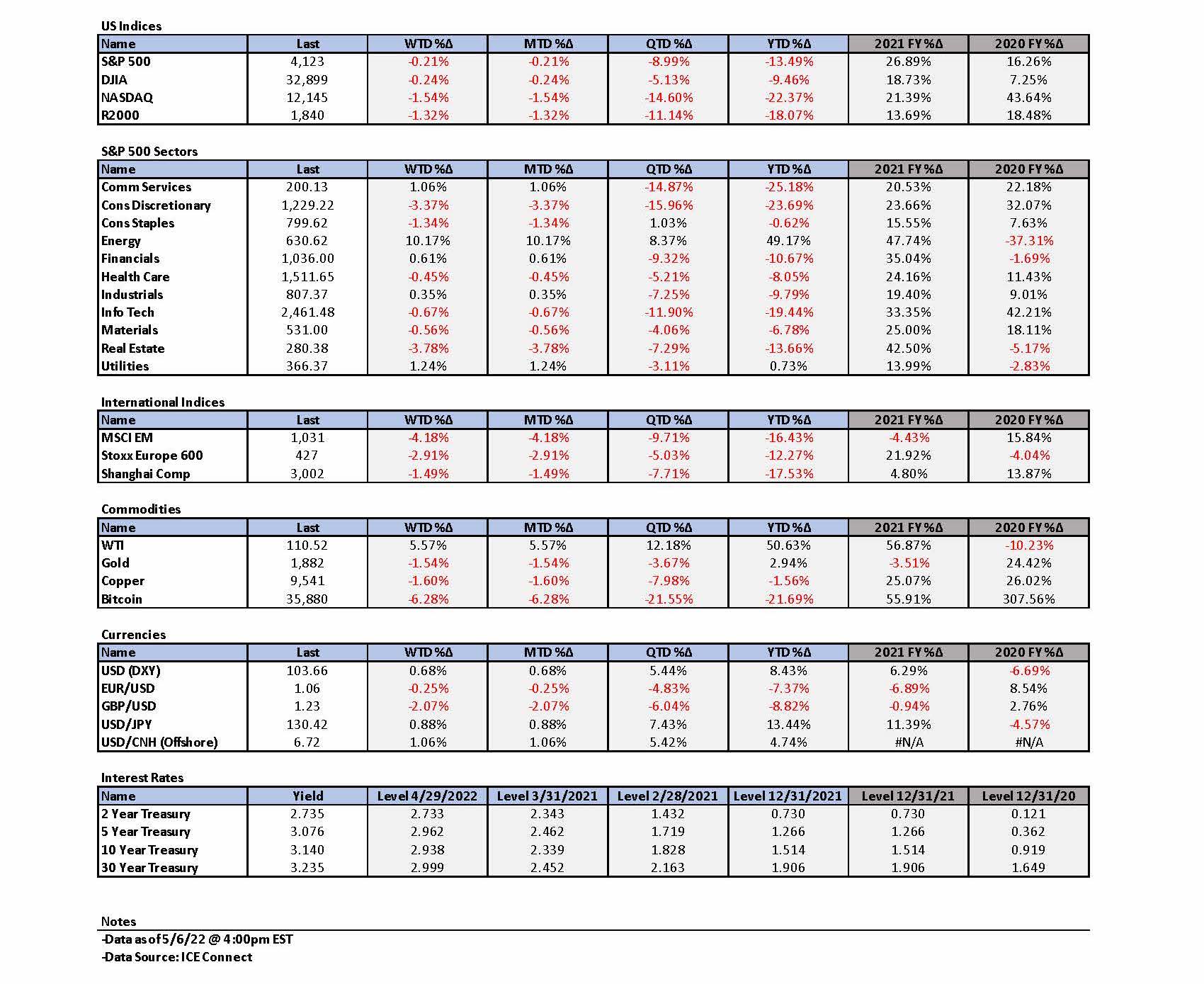

Weekly Summary: May 2 – 6, 2022

Key Observations:

- We view the Federal Reserve’s (Fed) latest stance and pronouncements as hawkish. Although the Fed ostensibly committed to raising the federal funds rate by 50 basis points (bp) at its next two meetings, it indicated that it will be increasingly data dependent.

- Increasing number of variables are amplifying uncertainties as possible outcomes multiply. The combination of these variables has the potential to extend and even exacerbate inflationary pressures as well as to slow global economic growth. Stagflation and inflation risks increase.

- Financial market volatility has increased during the past two weeks. Indiscriminate selling may provide opportunity to “upgrade” long-term portfolios. We expect volatility to continue – both up and down.

- We trust that the Fed may need to exceed the “neutral” federal funds rate and raise rates into “restrictive” territory as “expeditiously” as possible.

The Upshot: Since Russia’s invasion of Ukraine on February 24, potential variables affecting the real global economies as well as global financial markets continue to proliferate. Forecasting has become increasingly difficult as uncertainties increase. We continue to prefer diversified portfolios that consist of high quality big cap stocks as well as include some commodity exposure. We will continue to look for opportunities to take advantage of market volatility. We expect that financial market volatility will continue for at least as long as the Ukraine-Russia war (war) persists. China’s COVID-19-related lockdowns and global central bank policies only add to the uncertainties. Most financial analysts continue to project strong earnings growth for U.S. companies for the remainder of this year. We view many of these projections as unrealistic – especially in regard to maintaining profit margins. Even though we acknowledge the more perilous aspects of forecasting, we still understand that global economic growth projections will be lowered and many inflation projections will be revised higher to the extent the war persists and China lockdowns continue to interrupt and constrain supply chains. We suppose that analysts will have to incorporate at some point such changes into their projections. Furthermore, we will continue to expect higher interest rates in a volatile upward trajectory until we are convinced otherwise. On the Fed meeting day, many analysts were very quick to announce their opinion that interest rates had hit their peak and that the broad-based U.S. dollar (USD) had peaked as well. We will await for further evidence before we join this group thinking.

Fed as the “Breeze”

We view the song “Call Me the Breeze” written and sung by J.J. Cale (see live version with or without Eric Clapton) as loosely analogous to the Fed’s current monetary stance as we see it. We chose to use the “Breeze” as a metaphor for the Fed, and we regard the Fed’s hawkish policies to “keep blowing down the road” in a relatively consistent manner unless the Fed sees something “unexpected.” In other words: “Ain’t no change in the weather [economic and/or inflation data] … Ain’t no change in me [the Fed’s policies].” In the press conference after the Fed statement of its decision was posted mid-week, Fed chair Powell indicated that 50 bps hikes in the federal funds rate will be “on the table” at each of the next couple of meetings if the Fed saw what they expected to see in the upcoming economic and/or inflation data. Powell indicated that the Fed observed indications that the core personal consumption expenditure (PCE) inflation rate was peaking, or at least “flattening out.” We interpret this to mean that the Fed will in fact raise the federal funds rate by 50 bps at each of the Fed’s next two meetings even if inflation has peaked. In answering a question, Powell also stated that a 75 bps increase was not “actively being considered” by the Federal Open Market Committee (FOMC). As soon as financial markets were convinced that a 75 bps was now “off the table,” U.S. equities staged a dramatic and a broad-based rally, Treasury yields traded lower, the two-to-10-year part of the yield curve steepened and the broad-based USD traded lower. Many investors and analysts evidently now saw a more “dovish” and “less hawkish” Fed. We did not share this view. We never expected the Fed to consider a 75 bps hike over the next two meetings and we thought that the Fed maintained its very hawkish stance. But we were not surprised by the markets’ reactions given that so much “bad news” was recently priced into financial assets. This rally could have extended even substantially further. However, the more equities rise in a very quick upturn, the more quickly many of these gains will dissipate in our estimation. We expect volatility to continue – both up and down. It is generally accepted that markets characterized by sustained downturns can often exhibit very steep and quick equity rallies. We suppose that this is one of those times. The volatility in financial markets over the past two weeks has been particularly extreme.

Extreme Volatility – Indiscriminate Selling – Opportune Time to “Upgrade” Portfolios

It did not take long for extreme volatility to reassert its presence after the Fed’s meeting this week. Much of the markets’ reactions were reversed the very next day. In contrast to a very broad-based U.S. equity rally mid-week, Thursday saw a very broad based retreat. USD reversed its losses and traded at a new record 20-year high. Interest rates rose and the two-to-10-year yield curve steepened even more as the 10-year Treasury yield traded at least as high as 3.1% and closed with a yield over 3.0%. We characterized the selling of U.S. equities on Thursday as “indiscriminate.” It is our very strong opinion that it is on days such as Thursday, when long-term investors can “upgrade” their portfolios so as to take the best advantage of indiscriminate selling. Such an “upgrade strategy” would involve selling a stock which might have had disappointing earnings and/or guidance, more uncertain prospects, more possible competition, an unclear strategy, a less than “ideal” balance sheet and cash flows, etc. and replacing it with a stock of a company that has good earnings, solid prospects, a clearly defined strategy, relatively sustainable profit margins, etc. In other words, the type of big-cap quality company which we have been recommending for long-term investors in this uncertain environment. When a stock is lower mostly because equity markets trade lower, why not take advantage and purchase these type of stocks to replace stocks with more uncertain prospects and which have traded lower due to their own idiosyncratic problems, as well as due to market factors? It has been my experience that the risk/reward inevitably skews in favor of the companies with more certain fundaments, and which are not stocks of a “broken” narrative or a relatively uncertain future. Given a choice, we would prefer a stock with less fundamental risk as we interpret such risk and one that trades lower mostly due to general market risks. It is therefore a useful exercise to understand why a particular stock has traded lower.

More Variables, More Uncertainty

As we have indicated in our recent commentaries, uncertainties have continued to intensify along with the rapid increase in variables. Variables include the Ukraine-Russia war and the associated sanctions against Russia, China’s COVID-19 related lockdowns pursuant to its “zero-Covid-19” policy, and recent USD broad-based strength. China lockdowns have proved to be very disruptive to supply chains and these lockdowns also have a large impact on demand for many types of commodities, including energy. Furthermore, these lockdowns tend to slow global economic growth and to increase global inflation. The Fed even highlighted the Russia-Ukraine war and China’s lockdowns as tending to skew inflation prospects higher.

Eurozone Commits to Reduce Russian Energy Purchases

The announcement by the European Commission early this week that Europe intends to impose an embargo against Russian oil by year end is yet another variable. However, Hungary and Slovakia will be allowed to import Russian oil through 2023 under existing contracts. Europe also intends to reduce its imports of Russian natural gas by two-thirds within one year. Crude oil and natural gas prices have risen this week partly due to the Europeans actions. If China lockdowns were not in place, energy price increases could have risen materially more. The number of possible outcomes has multiplied in a commensurate fashion.

Forecasting Becomes More Difficult

Led by the U.S. Fed, global central banks and their anticipated tightening of monetary policies only add to the mix of uncertainties. This has made forecasting a much more treacherous exercise. Powell acknowledged such difficulties at his mid-week press conference. He stated that it’s “a very difficult environment to try to give forward guidance 60, 90 days in advance so the path for policy over the medium term remains open-ended.” It is statements like this that support our thesis that the Fed is data dependent when adopting the specifics of their monetary tightening policies.

Why Two More 50 Basis Point Hikes are “On the Table”

Then why did Powell indicate very strongly that hikes in the federal funds rate of 50 bp are “on the table” at each of the Fed’s next two meetings? He also indicated that the FOMC was broadly in agreement with this stance. But he prefaced this stance with the assumption that “we see what we expect to see” in terms of economic and inflation data before these next two meetings. We suppose that Powell was willing to give this limited guidance because the Fed is “behind the curve,” and they know it. What does the Fed expect to see? Powell indicated that he thinks that there is a good chance that the core PCE inflation rate might have peaked or that it is at least flattening. So Powell is committed essentially to two 50 bp increases at the next two Fed meetings even if inflation rates have peaked. Yes, he did take a 75 bp rate hike “off the table,” but only for the next two meetings. Why couldn’t the Fed actively consider such an increase at a later time if the conditions become more “appropriate?” Beyond the next two meetings, the Fed anticipates “that ongoing increases in the federal funds rate will likely be ‘appropriate.’” Powell also made it clear that it will take more than one month of economic and inflation data to change any of the Fed’s policies. In this context, Powell stated that the Fed would have to be convinced that inflation was “in fact under control” and starting to come down before it would be appropriate to go back to 25 bp increases.

Fed Raising Rates to “Neutral” and Maybe to Restrictive Territory

But whatever the details in regard to inflation might be, the Fed will be looking to get to the neutral federal funds rate “expeditiously,” i.e., quickly. The neutral federal funds rate is thought of as a rate that neither stimulates nor dampens economic growth. It is our impression that many economists currently think that this rate is roughly 2.5%. Powell freely admitted that he is not sure what this rate is at present. He commented that there is a lot of “false precision” in estimating a neutral rate. Powell quickly added that once the Fed achieved a neutral rate, the Fed would “not hesitate” to raise rates further into “restrictive” territory if it were “appropriate.” When Powell first talked of the Fed raising rates into restrictive territory, he used the word “required” in lieu of “appropriate.” He later made a point of clarifying what he meant. He said that he misspoke when he used the word “required” or “necessary,” but meant to say “appropriate.” We interpret this clarification to mean that the bar is not very high for the Fed to keep raising rates into restrictive territory. In answering a question on why he chose to invoke former Fed chair Paul Volcker’s name, Powell answered that it was because Volcker had the “courage” to do what he thought was “right” to curb inflation even if it led to a recession. These statements sound to us like a very “hawkish” Fed chair. Although Powell expressed his belief that a “soft” or “softish” landing without a recession is possible, it would nevertheless be “challenging” for the Fed to rein in inflation sufficiently without causing at least a mild recession.

Essential to Reduce Inflation Rate

Powell characterized inflation as “much too high” and the labor market as “extremely tight” and that it continues to show strength. He then reiterated his opinion that it is “essential” to bring down inflation “expeditiously.” As we have highlighted many times previously, Powell is convinced that price stability is a needed prerequisite to ensure a stable and growing economy with a robust, steady and growing labor market. We agree with Powell on this point and that reining in inflation must be consequently the principal goal under the present circumstances. In addition to a tight labor market, Powell often refers to the robust balance sheets of consumers and businesses when he opines that the U.S. economy will be resilient enough to absorb a tight monetary policy. Excess savings accumulated during the pandemic is another salutary factor. We agree that this is true up to a point. A restrictive monetary policy works through to the real economy by its effects on financial conditions – including the wealth effect through financial assets. Restrictive policies can help lower demand and thereby lower inflationary pressures. But there is a flipside to the “good” attributes of solid balance sheets of consumers and businesses. This helps account for why the U.S. economy has remained resilient so far in spite of inflationary pressures. It is our contention that the Fed might have to raise interest rates into restrictive territory precisely because of the resiliency of consumers and businesses. Higher than anticipated interest rates may be needed to lower demand sufficiently to become more closely aligned with supply.

Labor Market Tightness

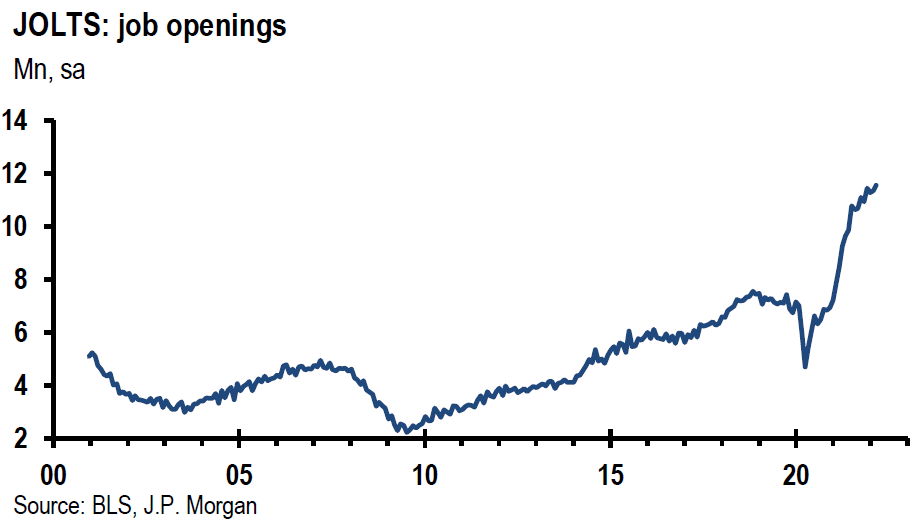

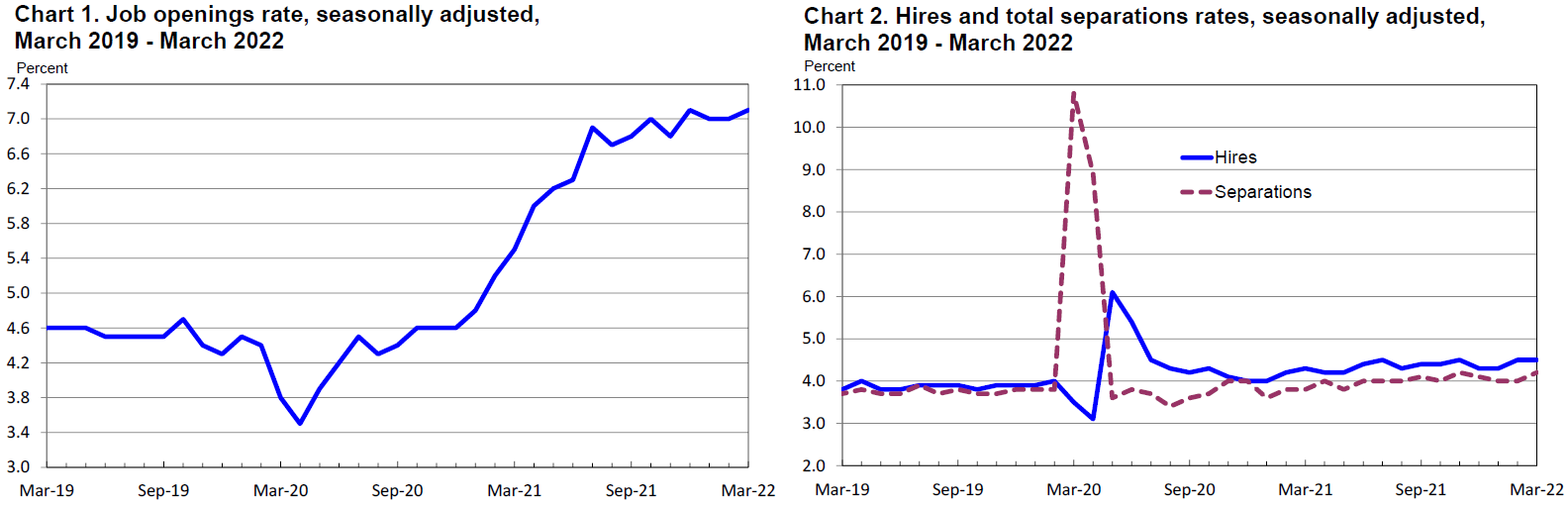

Powell continues to focus on the tightness of the labor market. Wages matter for inflation and in particular for the services sector where Powell pointed out that the pace of wage gains is now the highest in many decades and at recent rates is inconsistent with reaching the Fed’s long term objective of 2% inflation growth rates. Powell is also very concerned about a possible wage-price spiral that could exacerbate inflationary pressures if inflation expectations become “unanchored.” Powell assumes that by lowering overall demand in the economy, more restrictive monetary policies will lower demand for workers as well. The latest Job Openings and Labor Turnover Survey (JOLTS) data released this week indicates that the Fed’s job in helping to realign demand and supply for labor could be rather difficult. The Bureau of Labor Statistics (BLS) released the JOLTS data on Tuesday this week. The release reflected a record high level of job openings of 11.549 million, an increase of 205k from February’s total, on the last business day of March. Consensus estimates were for a decline in job openings. The Quits Rate was also at a record level of 4.536 million. On May 3, Goldman Sachs calculated that a job-workers gap hit a record high of 5.6 million workers, or 3.4% of the labor force. The increased tightness of the labor market reflected by this data all but assures that strong wage growth will persist for quite some time.

Source: J.P. Morgan, US: Job openings climb to a new record high (5/3/22)

Source: Bureau of Labor Statistics, JOB OPENINGS AND LABOR TURNOVER – MARCH 2022 (5/3/22)

QT

The only aspect of the Fed’s disclosures this week that did surprise us and that could be considered marginally dovish was the Fed’s treatment of QT – “quantitative tightening” – which refers to the reduction of the Fed’s balance sheet of nearly $9 trillion. The Fed previously announced that it would cap the pace of its balance sheet reduction at $95 billion per month – $60 billion of Treasuries and $35 billion of mortgage backed securities (MBS) and that it would gradually get up to those levels. Instead, the Fed announced that it would reduce its balance sheet at half the maximum amount for the first three months beginning on June 1, and then jump to the maximum cap of $95 billion per month beginning September 1. There would be no gradual increase. We totally discount the relevance of this unexpected announcement – especially because Powell admitted that he was not even sure what the effects of QT might be. He was hoping to better analyze these effects when he could better observe how financial conditions would be affected.

Selected U.S. Economic Data

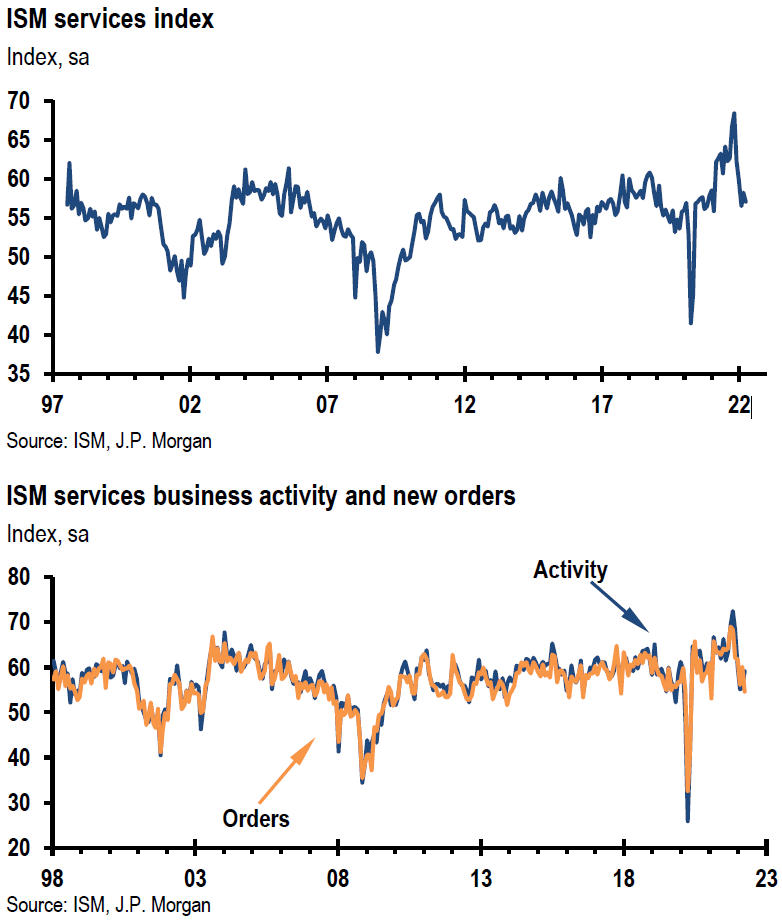

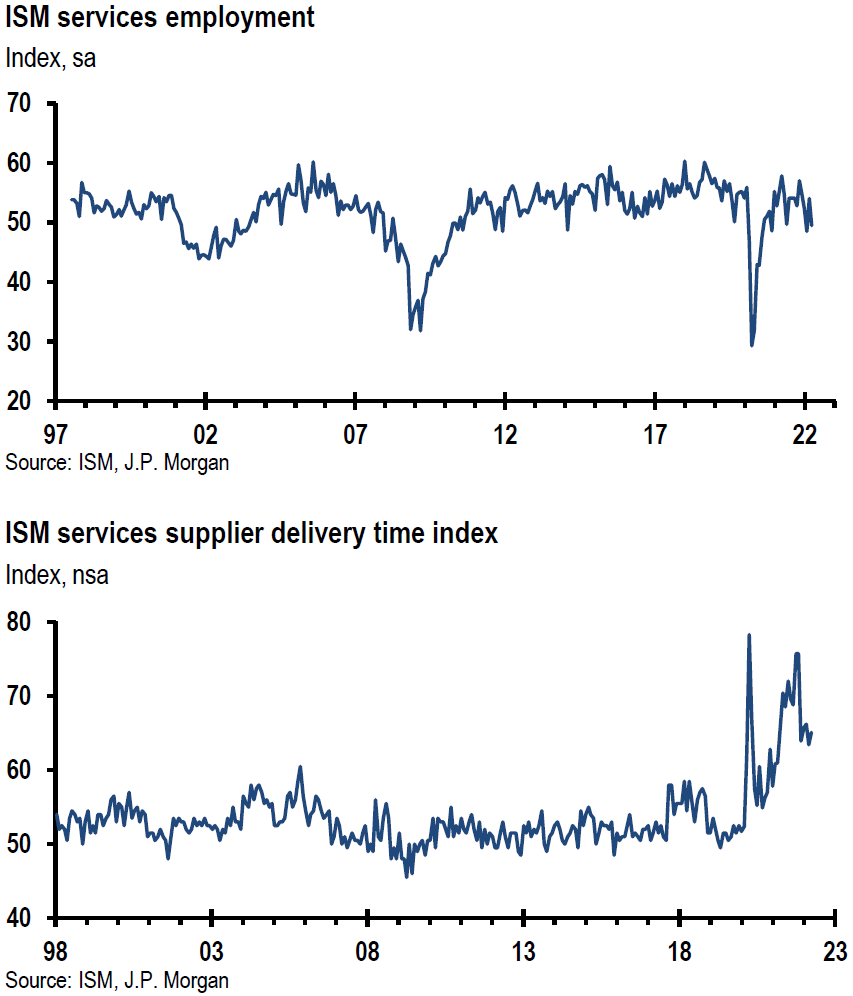

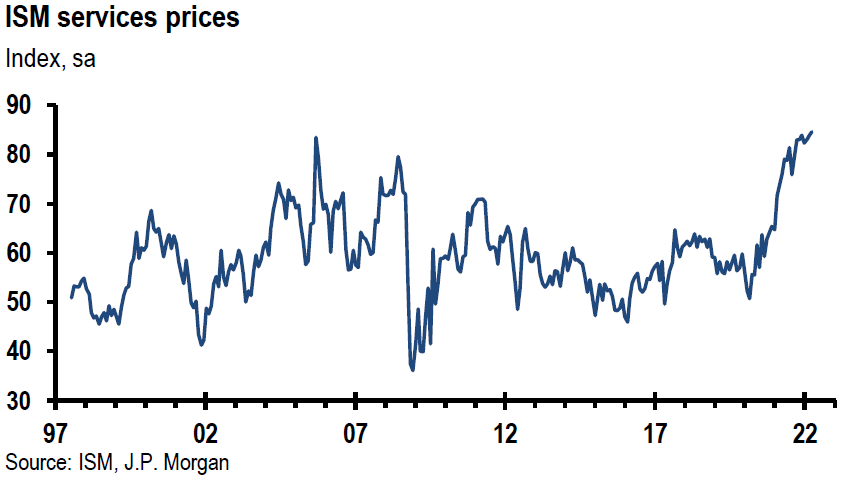

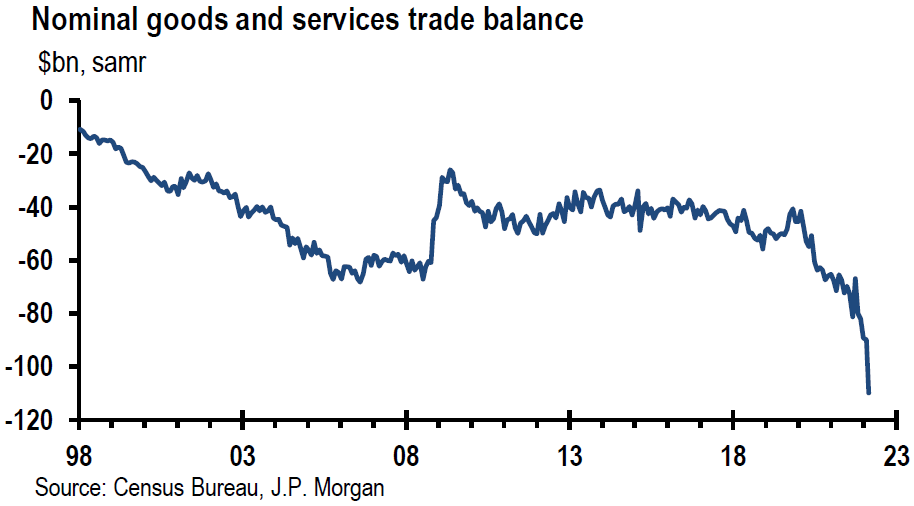

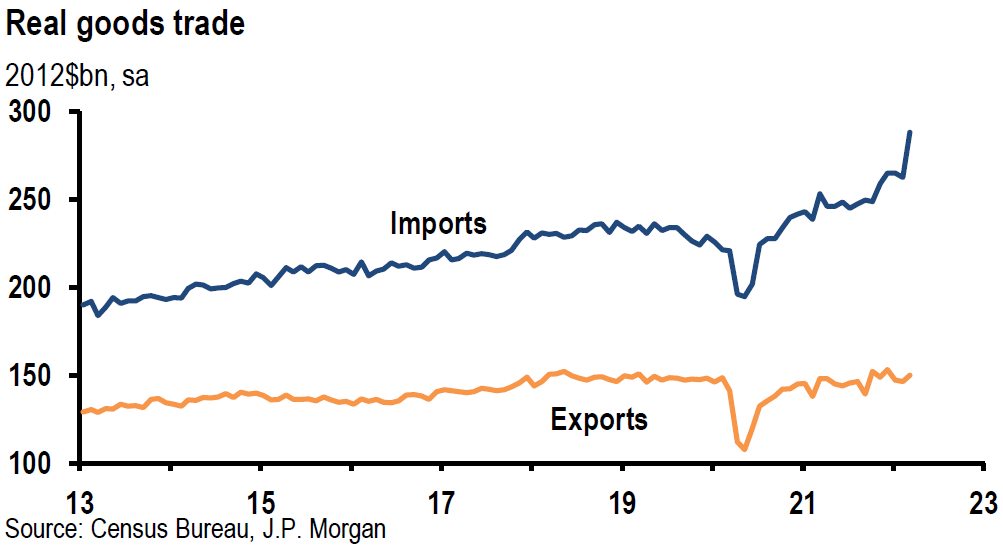

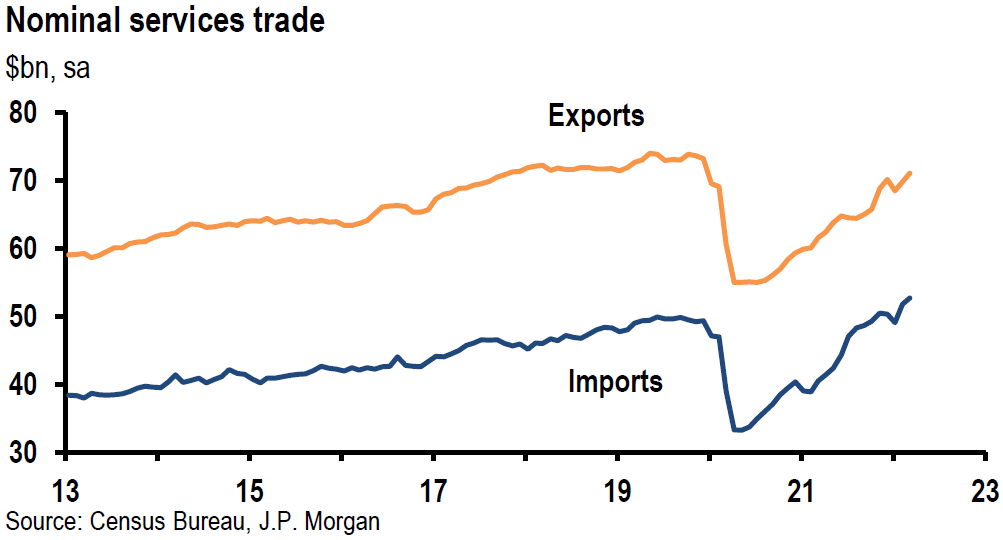

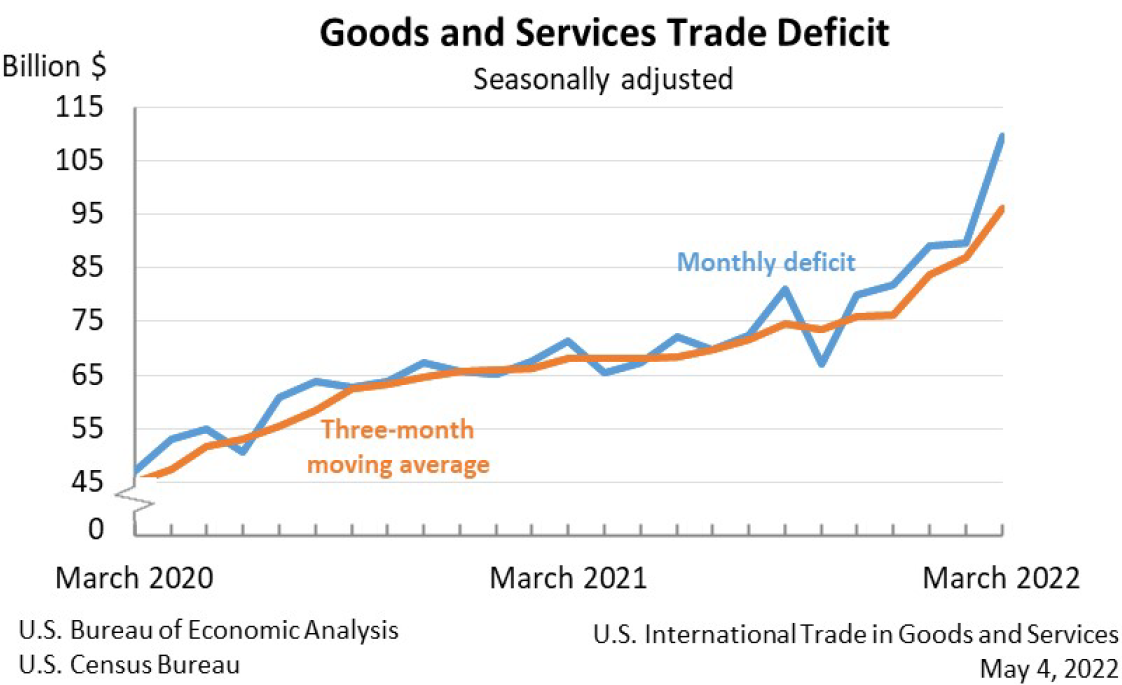

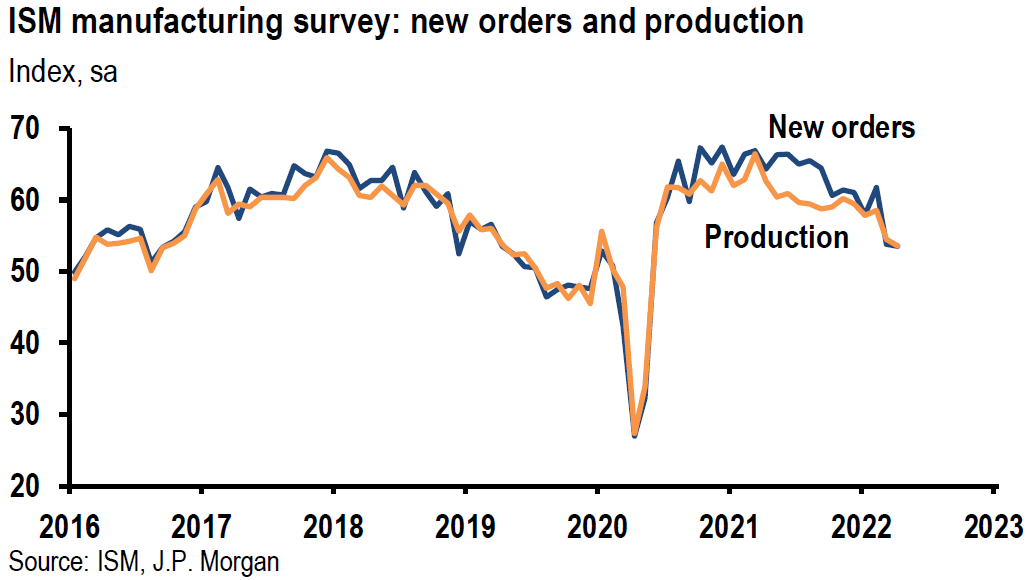

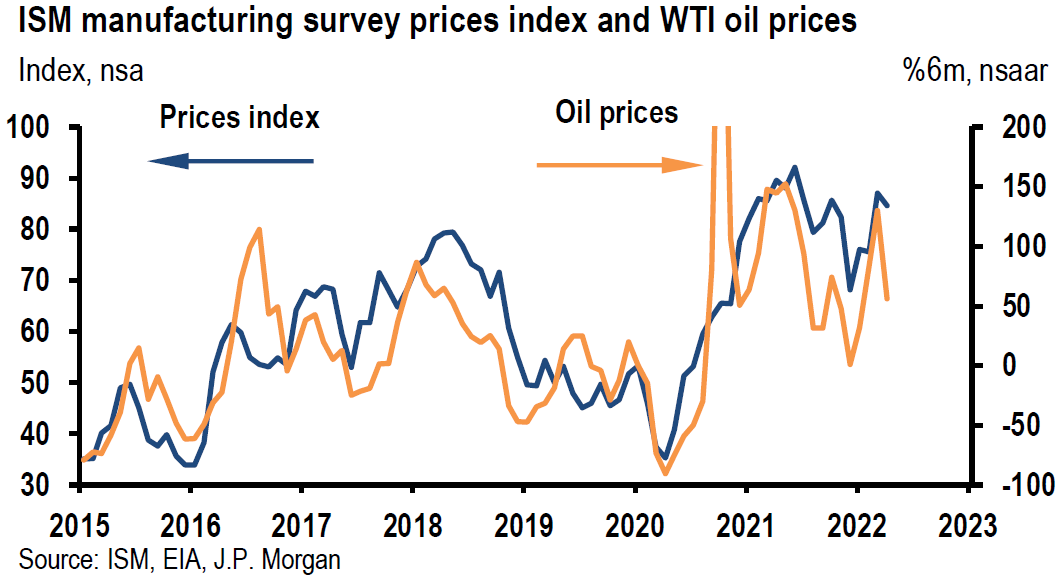

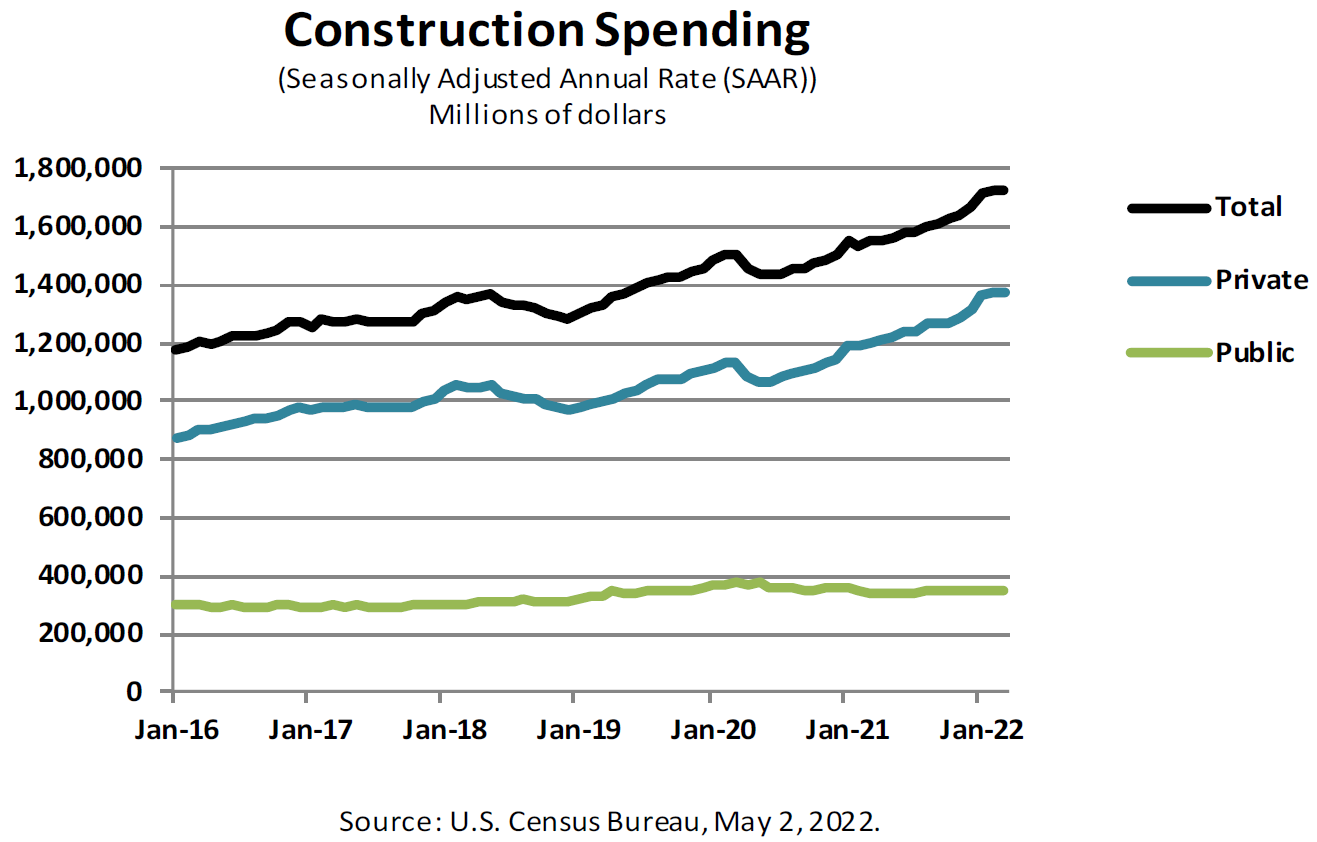

We characterize the U.S. economic data released this week as “mixed” which continues to show similar patterns of slowing, but still robust economic growth, as well as high wages and prices, continuing supply chain issues and materials shortages. The Institute of Supply Management (ISM) manufacturing U.S. April Index continued to expand but at a slower rate versus March. Although it maintained a level in the mid 50’s, it was the lowest reading since July 2020. The report characterized its results as showing that the “U.S. manufacturing sector remains in a demand driven, supply chain constrained environment.” Labor shortage problems were also cited. The ISM Services purchasing managers’ index (PMI) also was less than expected but the index level was still at a relatively robust level of 57.1. Most notably, the employment part of the index contracted slightly with a reading of 49.5, indicating the difficulty of finding qualified workers. The report contained the following summary: “There was a pullback in the composite index, mostly due to the restricted labor pool (impacting the employment index) and the slowing of new orders growth. Business activity remains strong; however, high inflation, capacity constraints and logistical challenges are impairments, and Russia-Ukraine war continues to affect material costs, most notably of fuel and chemicals.” The record March U.S. trade deficit – which was $20 billion greater than in February – was a very good indicator of continued strong U.S. demand.

Source: J.P. Morgan, US: ISM services survey moves down in April (5/4/22)

Source: J.P. Morgan, US: March trade deficit even wider than expectations (5/4/22)

Source: U.S. Census Bureau, MONTHLY U.S. INTERNATIONAL TRADE IN GOODS AND SERVICES, MARCH 2022 (5/4/22)

Source: J.P. Morgan, US: ISM manufacturing survey disappoints in April (5/2/22)

Source: U.S. Census Bureau, MONTHLY CONSTRUCTION SPENDING, MARCH 2022 (5/2/22)

BLS April U.S. Jobs Growth

The BLS April U.S. nonfarm payroll employment data was released Friday and increased by 428,000, slightly above consensus expectations and exactly equal to the revised lower level for March. The combined revisions for March and February showed a decrease of 39,000 jobs. The unemployment rate remained at 3.6% versus an expected decline to a pre-pandemic low of 3.5%. The labor force participation rate declined 0.2% to 62.2%, tied for the lowest rate this year and 1.2% below the February 2020 pre-pandemic level. Average hourly earnings increased by 0.3% month-on-month, below the expected level of 0.4%. The year-on-year increase was 5.5%, which was below the rate of inflation. We saw nothing in this report that would warrant any change in the Fed’s expected monetary stance.

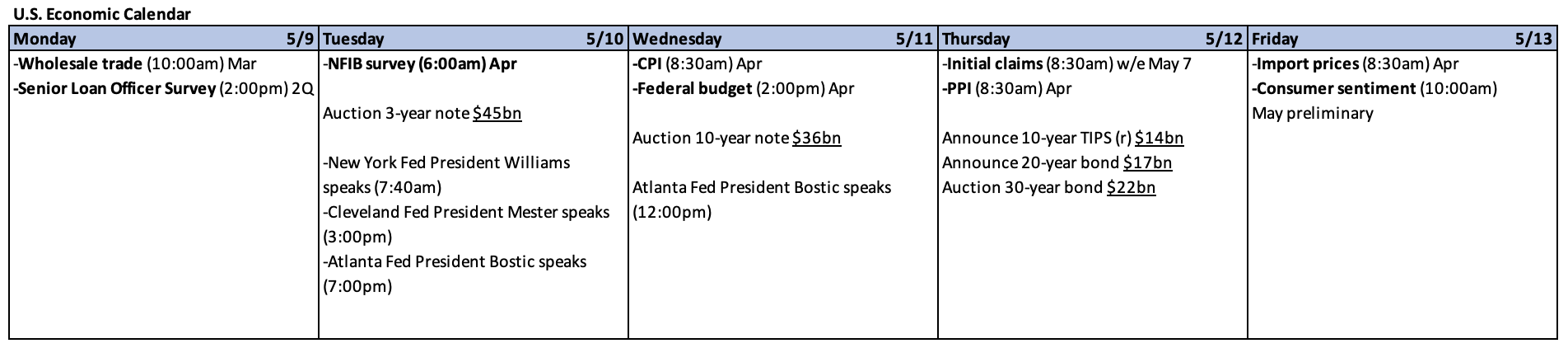

Bottom Line

We assume continued volatility across virtually all financial markets for at least as long as the war persists. Furthermore, we continue to forecast higher interest rates as part of a volatile trajectory. We foresee that most global economic growth rates will be revised lower and that most inflation forecasts will be revised higher than previously thought due to the war and Chinese coronavirus related lockdowns. Additionally, we assume that downward earnings revisions for many companies might soon reflect these patterns. Predictable margins should become increasingly important in evaluating appropriate investments. Managements’ guidance on future earnings and revenues could be a driving force behind stock market reactions during this earnings season. The strength of USD could make forecasting even more difficult as the number of variables affecting investment decisions continue to multiply.

Days of indiscriminate selling of equities may provide opportunities to “upgrade” long term portfolios. We trust that the Fed may need to exceed the “neutral” federal funds rate and eventually raise rates into “restrictive” territory as expeditiously as possible. We suppose increased future risks of stagflation and recession.

Our basic investment approach remains constant as expressed in our most recent commentaries. We maintain our preference for high quality stocks in a diversified portfolio with at least some commodity exposure.

Definitions

European Commission – The European Commission is the EU’s politically independent executive arm. It is alone responsible for drawing up proposals for new European legislation, and it implements the decisions of the European Parliament and the Council of the EU.

The Job Openings and Labor Turnover Survey (JOLTS) – A monthly report by the Bureau of Labor Statistics (BLS) of the U.S. Department of Labor counting job vacancies and separations, including the number of workers voluntarily quitting employment.

Quits Rate (Part of JOLTS) – The Quits Rate counts employees who left voluntarily. Exception: retirements or transfers to other locations are reported with Other Separations.

PCE Price Index (headline) – The PCE Price Index uses the personal consumption expenditures component of the Personal Income and Outlays report to derive the PCE Price Index, which is the third major component of Personal Income and Outlays showing how prices are periodically inflating or deflating.

Core PCE inflation – The “core” PCE price index is defined as personal consumption expenditures (PCE) prices excluding food and energy prices. The core PCE price index measures the prices paid by consumers for goods and services without the volatility caused by movements in food and energy prices to reveal underlying inflation trends.

Federal Open Market Committee (FOMC) – The Federal Open Market Committee (FOMC) is the branch of the Federal Reserve System that determines the direction of monetary policy specifically by directing open market operations. The committee is made up of 12 members: the seven members of the Board of Governors; the president of the Federal Reserve Bank of New York; and four of the remaining 11 Reserve Bank presidents on a rotating basis.

Inflation Dove (Dovish) – A dove is an economic policy advisor who promotes monetary policies that usually involve low-interest rates. Doves tend to support low-interest rates and an expansionary monetary policy because they value indicators like low unemployment over keeping inflation low. If an economist suggests that inflation has few negative effects or calls for quantitative easing, then they are called a dove or labeled as dovish.

Inflation Hawk (Hawkish) – An inflation hawk, also known in monetary jargon as a hawk, is a policymaker or advisor who is predominantly concerned with the potential impact of interest rates as they relate to fiscal policy. Hawks are seen as willing to allow interest rates to rise in order to keep inflation under control.

ISM Services PMI – The ISM Services PMI, also known as he ISM Non-Manufacturing Index, is an economic index based on surveys of more than 400 non-manufacturing firms’ purchasing and supply executives.

ISM Manufacturing Index (ISM) – The ISM manufacturing index, also known as the purchasing managers’ index (PMI), is a monthly indicator of U.S. economic activity based on a survey of purchasing managers at more than 300 manufacturing firms. It is considered to be a key indicator of the state of the U.S. economy.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/fast-answers/answersindiceshtm.html or http://www.nasdaq.com/reference/index-descriptions.aspx.

All data is subject to change without notice.

© 2024 NewEdge Capital Group, LLC