Weekly Summary: March 20 – March 24

Key Observations:

- The banking crisis depicted in last week’s commentary continued to command the attention of the Federal Reserve (Fed) as well as the financial markets. The Fed chose to hike the federal funds rate by 25 basis points (bps) at this week’s meeting as it strove to balance financial stability risks alongside its goal of reining in inflation. Many government officials both in the U.S. and abroad, and including Fed and Treasury officials, tried to instill “confidence” in the banking systems of the U.S. and Europe. The goal was to “calm down” depositors of banks as well as the financial markets in general. The complexion of the crisis seemed to change daily. On Friday, the focus revolved mostly around Deutsche Bank, which saw its stock price decline by at least 11% that day. A major European bank index was at least 5% lower that day as well.

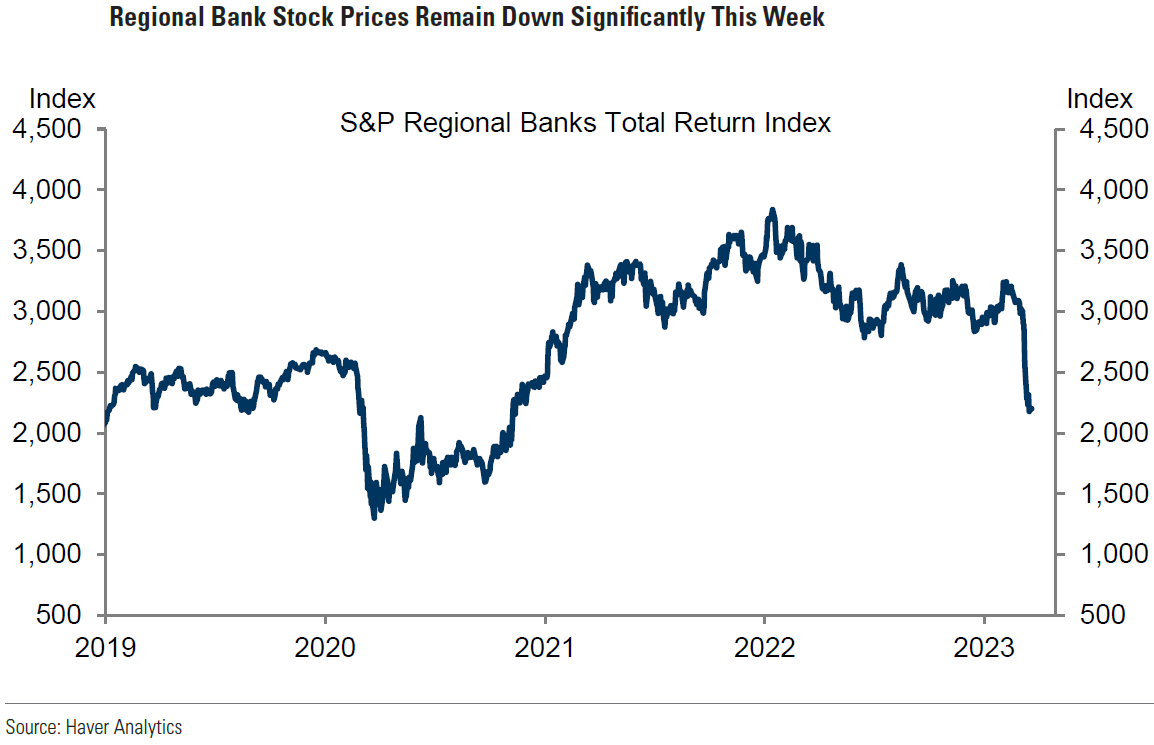

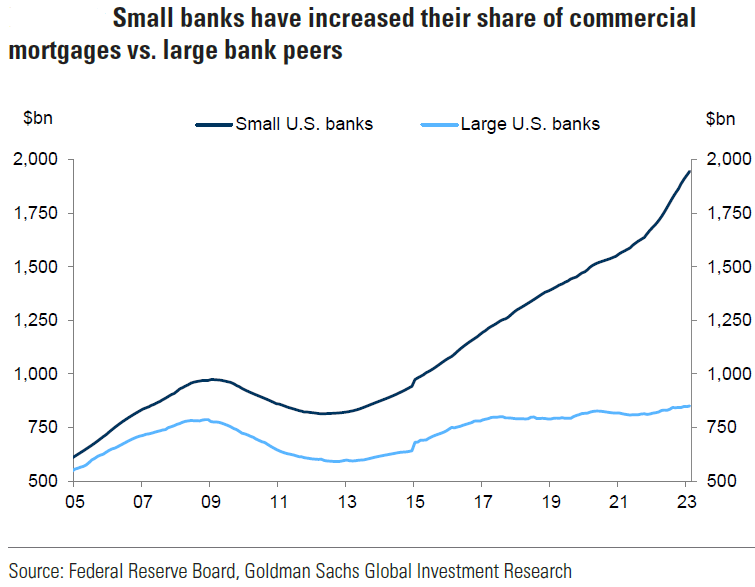

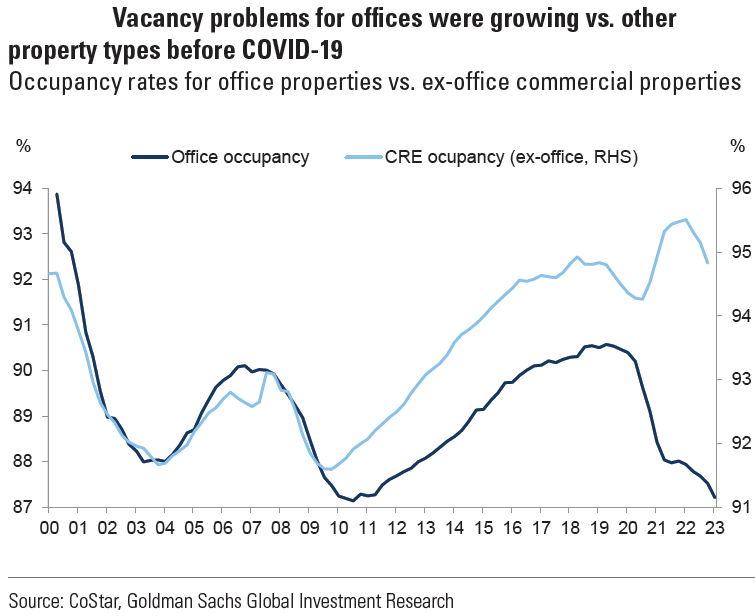

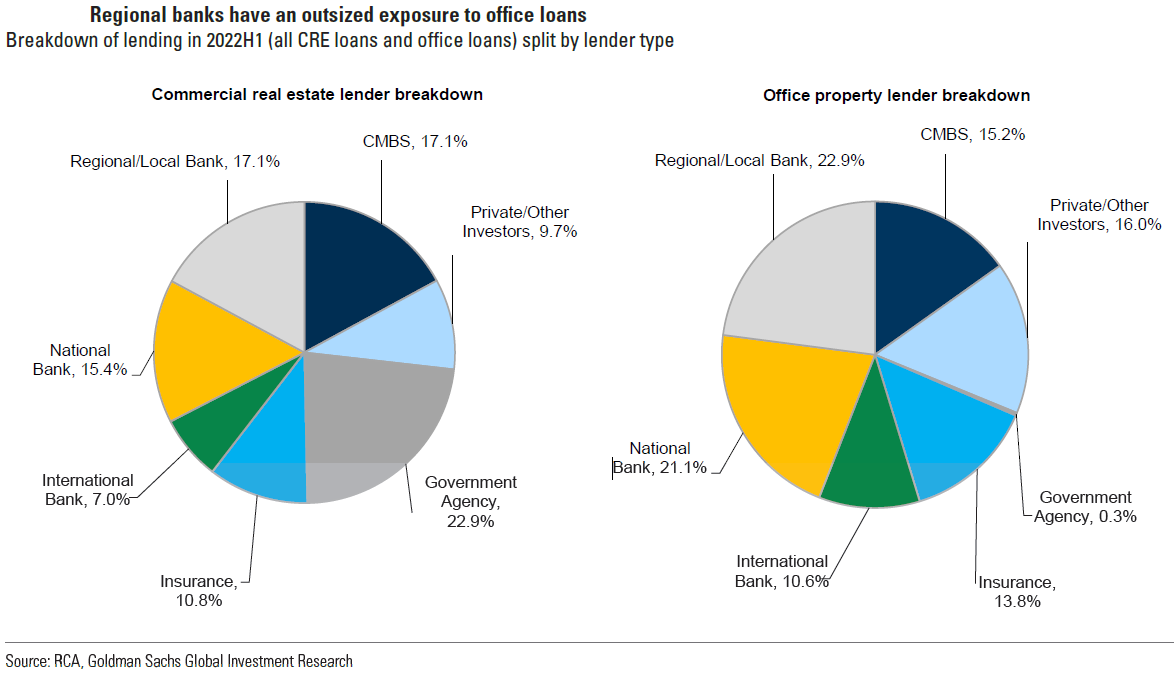

- The most immediately pressing issue for the Fed was to ensure financial stability. The Fed tried to assure bank depositors that their entire deposits were “safe.” We do not think that these assurances will halt deposit outflows. At best, we could envision a slowdown in deposit outflows. We surmise that the rise in funding costs of banks along with uncertainties regarding the stability of bank deposits will tighten credit conditions, which could lead to a slowdown of economic growth that could dampen inflation as well. We anticipate that the smaller regional banks would be “hit” the hardest and face the most uncertainty. We foresee that commercial real estate could be very exposed to a further downturn. We anticipate a widening of credit spreads.

- In our opinion, it appears that many analysts and investors remain complacent and that many assume a rather predictable and linear slowdown in economic growth. But we agree with Fed chair Powell that recessions typically do not follow a linear path. We also don’t expect an economic slowdown of any kind in the current environment to follow a linear path. We expect this path to be “bumpy,” much like a generally downward trajectory of inflation has been bumpy. We envision a possible economic slowdown in response to a credit contraction cycle. We could see this adhering to an irregular “step function” in which sudden changes might occur. We have little doubt that many “surprises” and uncertainties remain ahead.

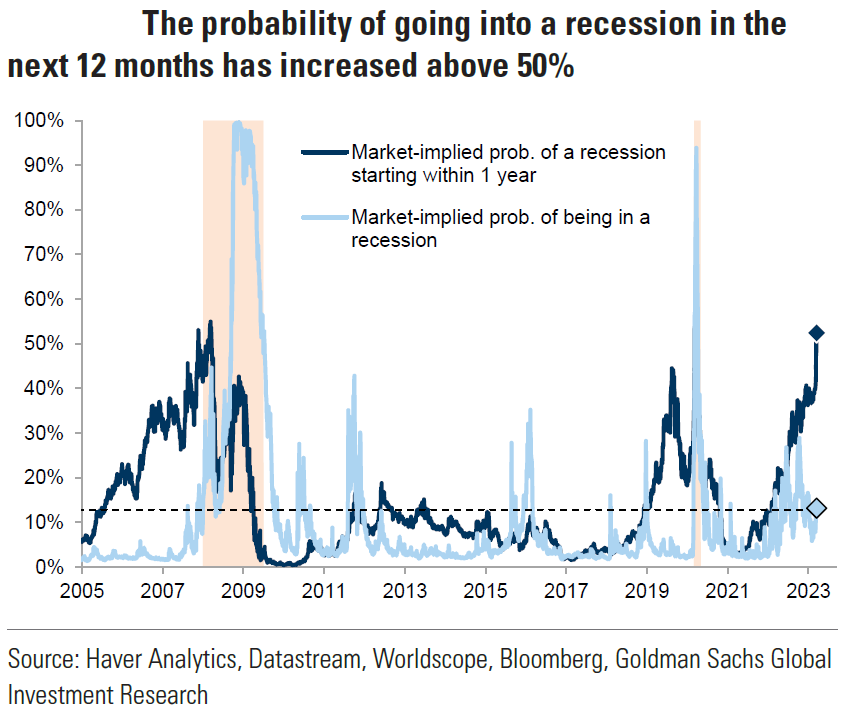

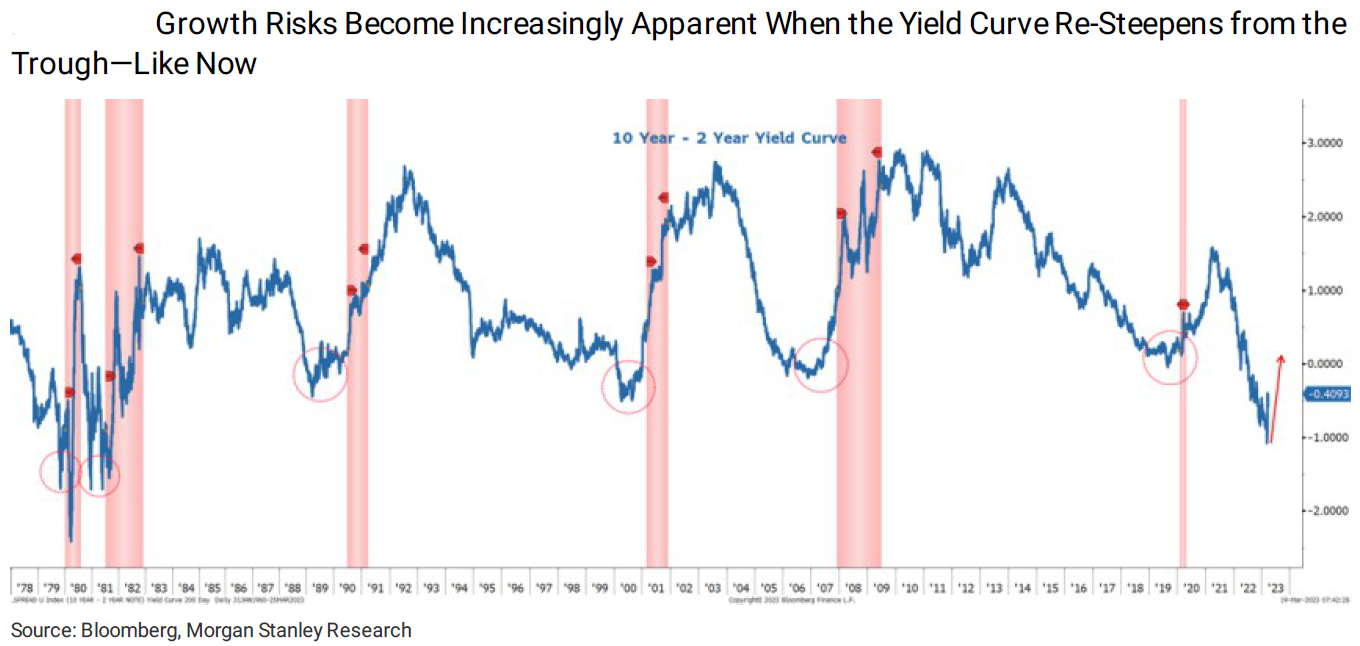

- We have often highlighted a deepening inverted yield curve as a worrisome indication of a possible upcoming recession. The two-to-10 year-Treasury yield curve inversion rose to as much as 108 bps the day before the banking crisis became an issue. Early Friday, this inversion traded as low as roughly 30 bps. This was characterized as a “bull steepening” of the yield curve that was driven mostly by a lower two-year Treasury yield. This particular pattern can typically signify that a possible recession could be fast approaching. We now view that recession risks have become more elevated.

The Upshot: Our general investment approach remains the same as depicted in last week’s commentary. We maintain our preference for quality stocks with good balance sheets, relatively stable cash flows with stable margins. Volatility across sectors continues to be supportive of a diversified portfolio for long term investors. We continue to stress that stock selectivity in the current environment is of paramount importance.

Late Thursday morning, we thought that it was highly likely that U.S. equities traded at a level that would be at least a short-term peak. We thought that the risk-reward no longer justified full positions in many stocks. We also detected what we would characterize as much complacency in regard to economic trends, which many investors and analysts viewed as perhaps predictable and evolving slowly. We suppose that future economic and inflation trends could evolve in a sudden-and non-linear patterns.

We envision a highly uncertain environment in the near term and perhaps the medium term as well. We trust that a tightening credit cycle exacerbated by the evolving banking crisis could be more unpredictable than if tightening credit were solely due to the Fed’s policies. We continue to foresee deposit outflows from many regional and smaller banks.

Beginning in October and entering this year, we favored selected growth/tech stocks that were not in need of short-term financing. We thought that such stocks could command a premium valuation in a slowing growth environment. We highlighted this preference in our March 10 commentary. We maintain our belief that such quality growth companies will continue to demand premium valuations. But given the increased uncertainties due to the banking crisis and the amount of appreciation of some of these stocks, we would advise trimming positions at these latest elevated prices for some of these stocks.

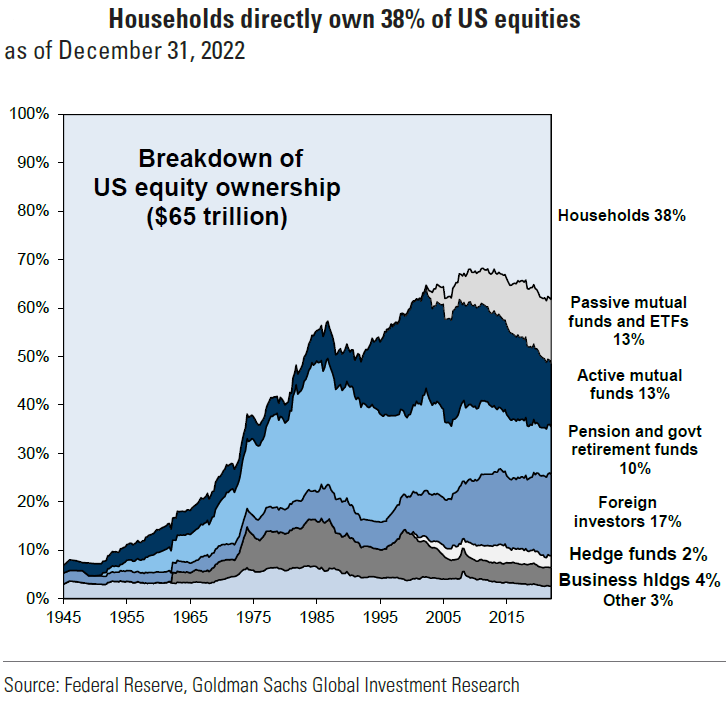

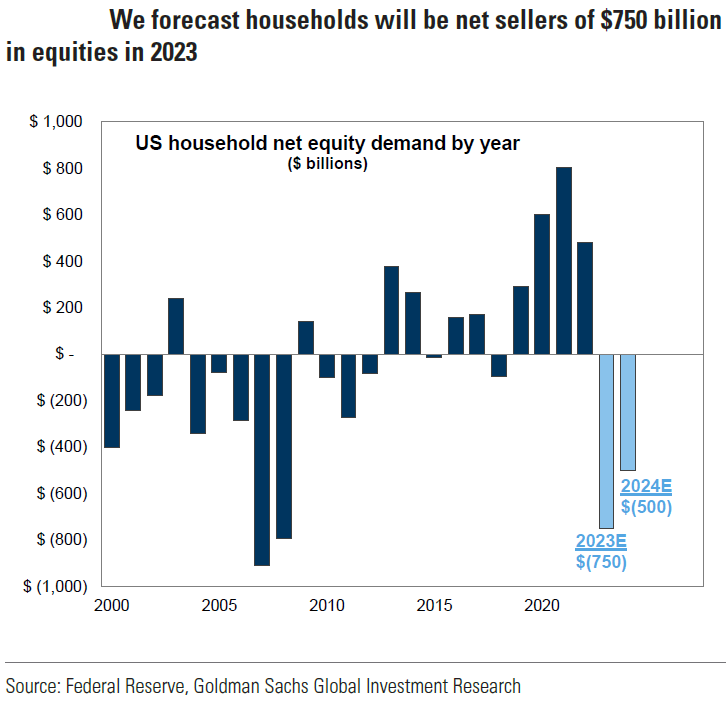

Source: From TINA to TARA: Exploring the drivers of household equity demand (3-22-2023)

Banking Crisis = Change in Fed’s Narrative for March Meeting

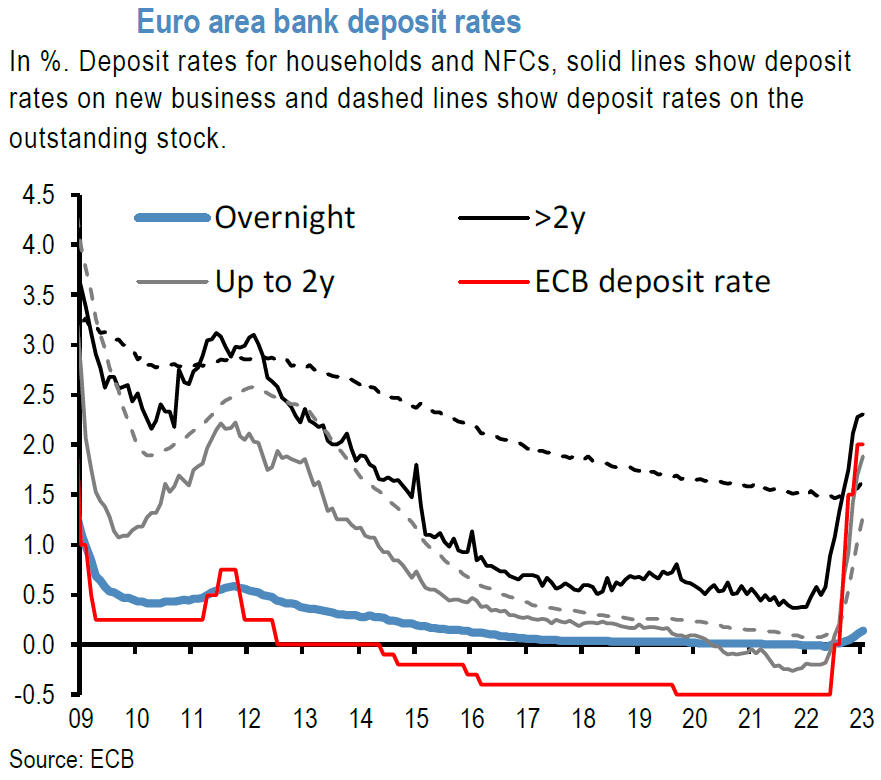

The banking crisis depicted in last week’s commentary changed the Fed narrative quite substantially from what was planned prior to that crisis. The debate was whether the Fed would raise the federal funds rate either 50 bps or 25 bps, and how high the federal funds “terminal” rate would be depicted according to the Fed’s “dot plot.” Subsequent to the crisis, the debate centered on whether the Fed would “pause” its hikes and not raise at the March meeting, or whether it would raise the rate 25 bps. The dot plot shows each of the Federal Open Market Committee’s (FOMC or Committee) participants indication of what they perceive to be the appropriate “terminal” funds rate. It also gives indications about expected inflation rates and real GDP growth rates, as well as unemployment rates for 2023 and subsequent years. The dot plot is part of the Fed’s Summary of Economic Projections (SEP). The main question was really about how to balance financial stability concerns versus reining in inflation to eventually achieve the Fed’s targeted 2% rate of inflation. We indicated in our prior commentaries that we thought the Fed would hike 25 bps at the March meeting. Financial markets also priced in this as the most likely outcome. Many very well-regarded analysts thought that a pause was most likely. On March 22, the Fed announced a 25 bps hike. We indicated last week that the 50 bps hike by the European Central Bank (ECB) of its key policy rate and its explanations made it perhaps easier for the Fed to hike as well. The ECB was confronted also with possible financial stability issues. On Thursday, the Bank of England (BOE) and the Swiss National Bank (SNB) each hiked their key policy rates as expected. BOE hiked 25 bps and SNB 50 bps.

“Calm Down” – Not so Easy to Accomplish

We thought that central banks (CBs), along with other government entities, were trying to achieve financial stability by trying to “calm things down.” In this context, we were reminded of the song “Calm Down” as sung by Rema and Selena Gomez. Unlike the current context, the singers even thought that a kind of “lockdown” might even be necessary to achieve a “calm down.” It seemed that the Fed, along with the U.S. Treasury Department were trying to convey the idea of “calm down” mostly by assurances that the US. banking system was “sound” and “resilient.” They also endeavored to prevent any further “bank runs” by trying to assure depositors that their deposits over the $250,000 limit covered by FDIC insurance were “safe.” Like many prominent bankers Citigroup’s CEO Jane Fraser also tried to calm down things. On Wednesday she said that “this is not a credit crisis. This is a situation where a few banks have some problems and it’s better to make sure we nip it in the bud.” It appears that Fraser was trying to assure the public that the current crisis was not “systemic” but “idiosyncratic.” However, quick action was needed to prevent a systemic problem. According to Blomberg News on March 22, Fraser warned that mobile money was a “game changer.” She said that “mobile apps and consumers’ ability to move millions of dollars with a few clicks of a button mark a sea change for how bankers manage and regulators respond to the risk of bank runs.” We would like to reiterate that “confidence” is “required” for financial institutions to function efficiently. In the end, only confidence in a financial institution can prevent a “run” on a financial institution. We will examine carefully the Fed’s decision making at its March meeting to try to decipher whether the Fed was able to stay on the path of reining in inflation while calming down things sufficiently to instill confidence in the U.S. banking system so that financial stability might be restored.

Changes in FOMC Statement

The Fed continued to see “modest growth in spending and production.” Job gains “have been robust” was replaced by job gains have “picked up” and “are running at a robust pace.” References to the Ukraine-Russia war were dropped. Assurances were highlighted: “The U.S. banking system is sound and resilient. Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, and inflation. The extent of these effects is uncertain.” The Fed is acknowledging that due to the banking crisis, tightening credit conditions will be developing apart from the Fed’s tightening monetary policies. The Fed should then be more circumspect in its policy adjustments. “The Committee will closely monitor incoming information and assess the implications for monetary policy.” Because of the unforeseen and uncertain credit tightening now, the Committee was left with no choice, other than to drop the “ongoing increases in the target range” language. This was replaced by the Committee anticipates that “some additional policy firming may” be appropriate in order to attain a sufficiently restrictive monetary policy to achieve a 2% inflation rate target. This new language did not commit the Fed to raising the federal funds rate further, nor did it prevent the Fed from hiking many more times. In answering a question during the press conference subsequent to FOMC’s announcement, Powell stressed the words “may” and “some” to highlight the Fed’s data dependency prior to determining a change monetary policy.

Fed’s March “Dot Plot”

The median dot for the federal funds rate for 2023 was left unchanged from December’s dot of 5.1% –5.0% to 5.25%. Powell expected that this would have been higher if it were not for the banking crisis. The median dot for real GDP growth for 2023 was lowered from December’s estimate of a 0.5% increase to 0.4%. Our prior commentaries have shown estimates of roughly 2.5% annualized real GDP growth in the first quarter (Q1). The Fed’s median dot implies negative real growth after Q1. The unemployment rate for the end of 2023 was lowered from 4.6% to 4.5% – compared to the current rate of 3.6%. Given that the March FOMC statement depicts job gains as having “picked up” and to be “running at a robust pace,” it is surprising that such a dramatic increase in the unemployment rate is expected. These are rather precipitous changes in a short period of time. It is difficult for us to envision how a recession could be avoided if these levels are achieved in 2023. Yet in his press conference, Powell continued to see that a “soft landing” path could still be possible. The median March dot indicated a Personal Consumption Expenditures (PCE) inflation rate of 3.3% – up from December’s 3.1% dot. Similarly, core PCE inflation was indicated at 3.6%, versus December’s dot of 3.5%.

Powell’s Press Conference

Mirroring the FOMC statement, Powell began the press conference by trying to restore confidence in the U.S. banking system. Powell referred to serious difficulties in a “small number” of banks in the past two weeks. He saw these banks as “outliers.” But Powell said that if “unaddressed,” even isolated banking issues could undermine confidence in healthy banks. Powell then described how the government, the Fed, the Treasury and the FDIC took “powerful” action to protect the U.S. economy and to strengthen public confidence in the U.S. banking system. These decisive actions included protecting all deposits, no matter the amount. Powell then took a “leap of faith” to say that these actions demonstrated that all deposits in the U.S. banking system are “safe” and that the U.S. banking system is safe. Powell was pressed again on the deposits question towards the end of the press conference. Powell’s answer was that we have “seen” that the government has the tools to protect depositors when there is a serious threat of serious harm to the economy or financial system, and that they are prepared to use these tools. Depositors should therefore assume that their deposits are safe. But it is our understanding that for all deposits to be fully guaranteed there must be first a determination of a systemic type of risk posed by the failing institution. Powell characterized the “systemic risk exemption” under which all deposits might be protected as involving a risk of contagion to other banks and to financial markets more broadly. Are we to assume that the failure of any bank could meet this standard? We doubt that many large depositors would feel comfortable with these assumptions. But under all of these scenarios, further action is needed before deposits may be fully guaranteed. It is NOT automatic. Trust is needed.

Treasury Secretary Yellen’s Desire to “Protect” Deposits – It’s All About Confidence

Roughly contemporaneously with Powell’s press conference, Treasury Secretary Janet Yellen was testifying before a Senate Appropriations subcommittee. According to CNBC on March 22, Yellen was asked whether the Treasury would try to circumvent Congress to insure all deposits fully. Yellen’s answer: “I have not considered or discussed anything having to do with a blanket insurance or guarantees of all deposits.” Many observers thought that Yellen’s comments precipitated a decline in U.S. stocks, and in particular shares of regional banks, during Powell’s press conference. Our view was that Yellen was merely indicating a legal boundary and was not providing any new information. There appeared to be a dramatic change of tone in Yellen’s testimony before a House panel the next day. “The strong actions we have taken ensure that Americans’ deposits are safe. Certainly, we would be prepared to take additional actions if warranted.” Powell’s carefully worded statements surrounding the “safety” of deposits in the U.S. banking system suggest that he is well aware of the issues. We view the statements of both Yellen and Powell as somewhat evasive. We realize that they are merely trying to instill confidence in the system so that depositors with funds over the FDIC insured limits will not withdraw their deposits from the smaller regional banks. Our own view is that evasive and somewhat misleading answers do not instill confidence in the system. We are not surprised to read reports of continued deposit withdrawals.

Deposit Outflows

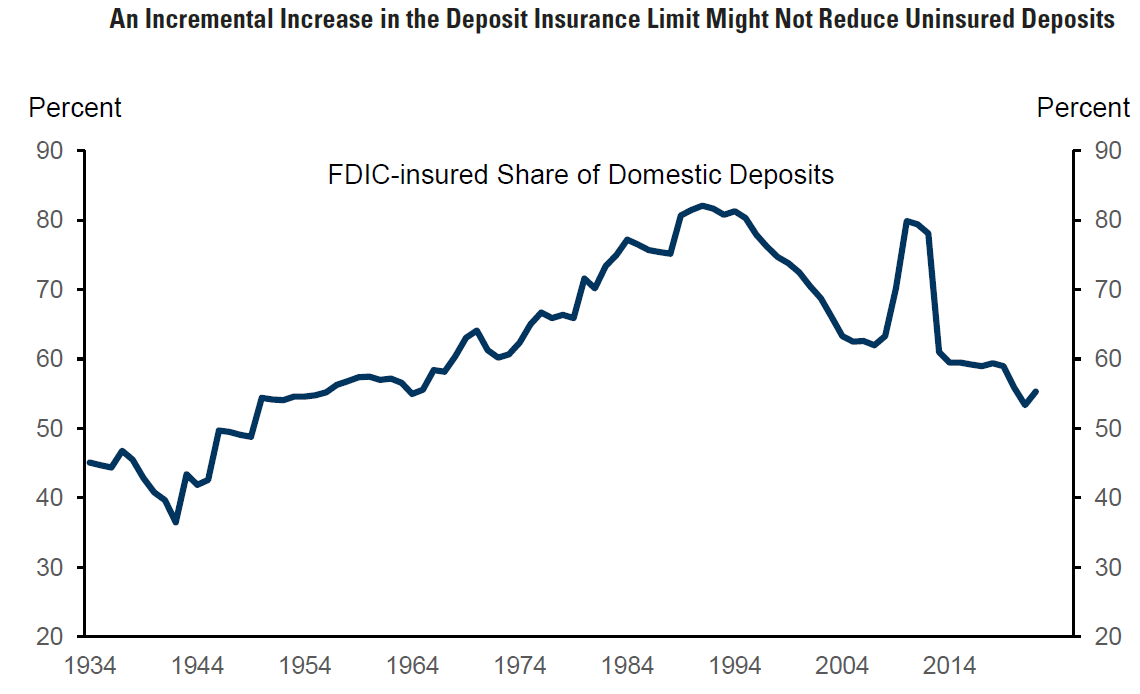

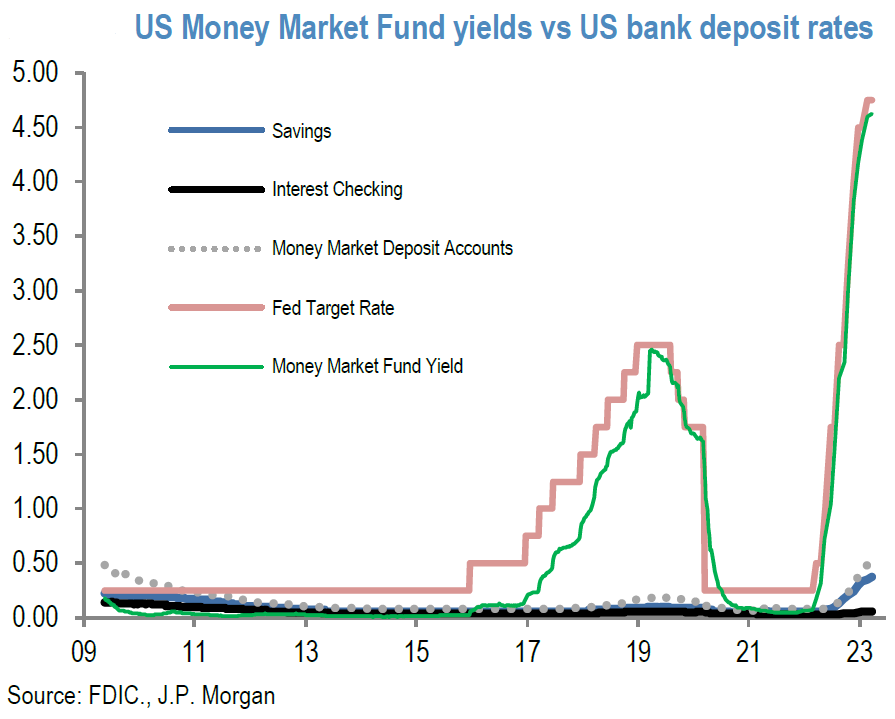

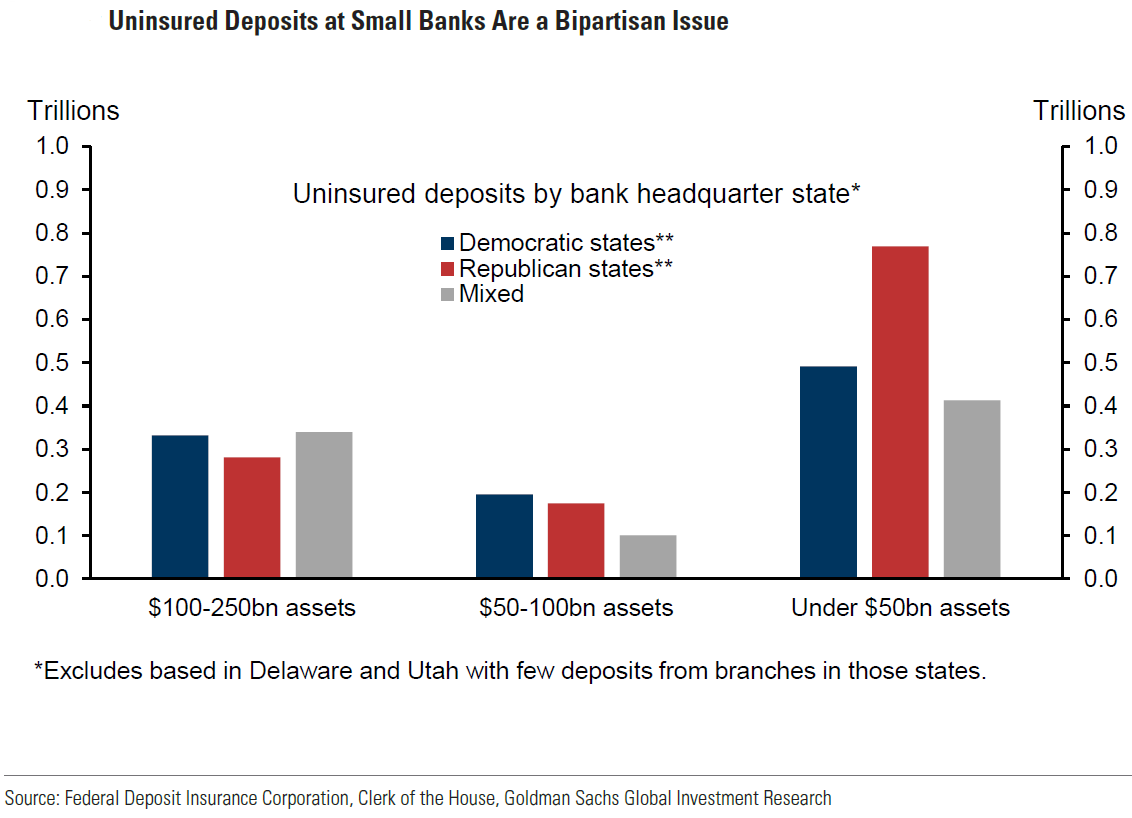

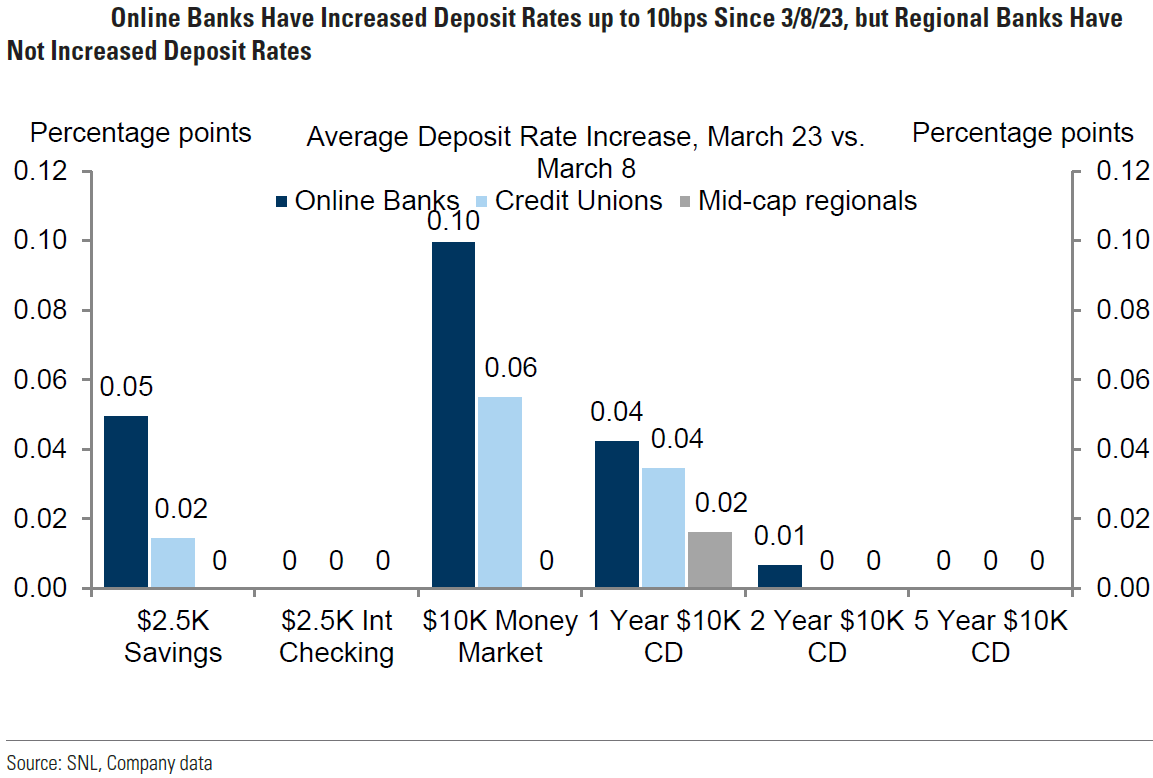

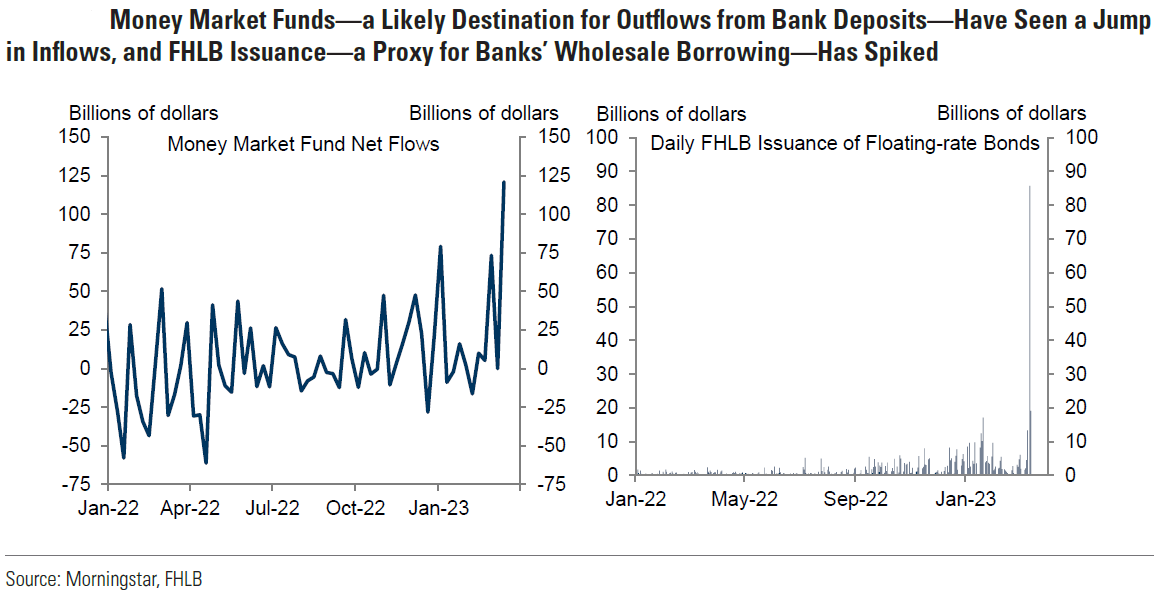

On March 22, J.P. Morgan (JPM) observed that the most “vulnerable” U.S. banks “likely” have lost around $1 trillion in deposits since the Fed began tightening monetary policy about one year ago. JPM estimated that approximately half of these outflows occurred before the Silicon Valley Bank (SVB) crisis and the other half of outflows afterwards. The pace was obviously accelerated. The Fed has assured us that the pace of deposit outflows has slowed. But for how long? We remain wary. JPM estimates that almost $7 trillion of U.S. bank deposits are uninsured. JPM highlights the “uncertainty generated by deposit movements could cause banks to become more cautious on lending. This risk is heightened by the fact that mid- and small-size banks play a disproportionally large role in U.S. bank lending.”

Source: JP Morgan, Flows & Liquidity (3-22-2023)

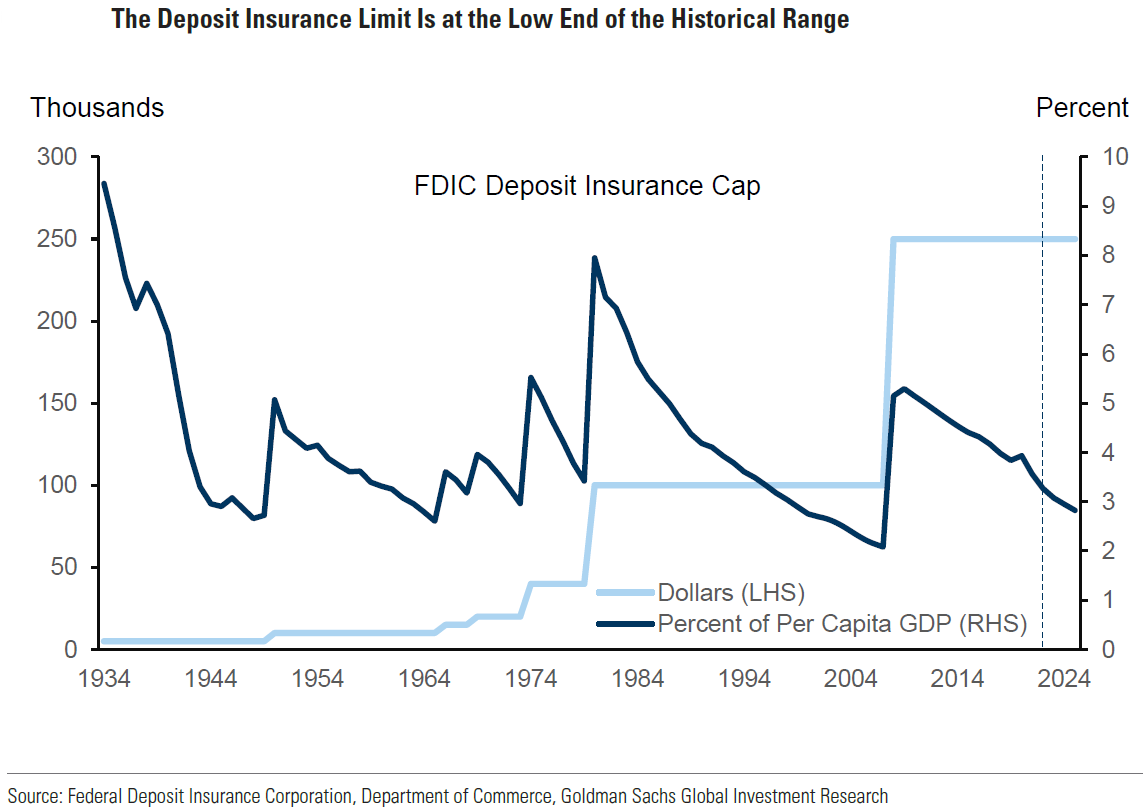

Source: Goldman Sachs, US Daily: More Questions and More Answers on Deposit Insurance (Phillips) (3-22-2023)

U.S. Banking System – “Sound” and “Resilient”

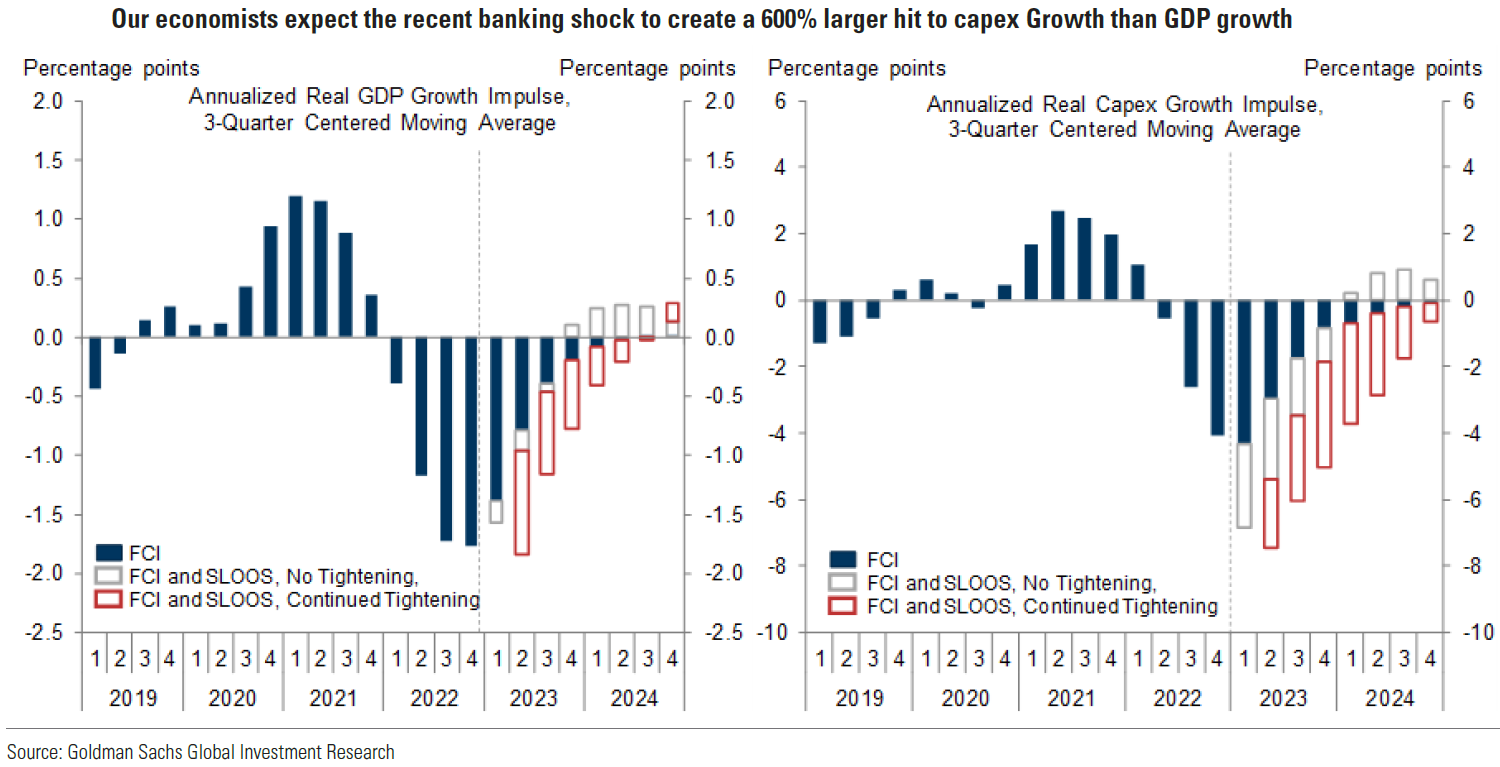

Powell characterized the U.S. banking system as “sound” and “resilient” with strong capital and liquidity. Powell thought there was a “long way to go” to get inflation lower to more acceptable levels, as well as that the road to getting there would be “bumpy.” Powell acknowledged that the events of the past two weeks would result likely in tighter credit conditions for households and businesses, and that it is too soon to determine the effects of these tighter conditions. However, it would be safe to assume that tightening credit conditions could weigh on demand for labor and on inflation. Powell postulated that tightening credit conditions might be equivalent to one rate hike and perhaps more. Furthermore, Powell estimated that a “significant” number of participants anticipated tightening credit conditions in their projections, and that “some” reflected this in their SEP forecasts. Powell also observed that traditional measures are ill-equipped to make such determinations. Such traditional measures tend to focus on rates and equities, and do not capture lending conditions. The Fed will try to discern the severity of any credit contraction, as well as the sustainability of any contraction.

Source: Goldman Sachs, US Daily: Monitoring Small Bank Stress: What We’ve Learned So Far (Yaro / Viswanathan / Mericle) (3-21-2023)

Banking Crisis Leads to Tighter Credit Conditions and Affects Fed’s Policies

Powell said that goods inflation has been trending lower for six months, but at a slower pace than was anticipated. Powell thought that it was “only a matter of time” before housing services would lessen as new leases were signed at “much lower levels of inflation.” Powell estimated that these two segments comprised 44% of core PCE inflation. Additionally, Powell still failed to see progress in the non-housing service sector, which comprises 56% of core PCE inflation. He trusted that a softening of labor demand and labor market conditions were needed for this to occur. Powell indicated that the Fed would be paying attention to the actual and expected effects of credit tightening. Additionally, Powell characterized SVB as an outlier – and not as an indication of weakness in the banking sector. SVB had an inordinate number of uninsured deposits and had excessive holdings of long duration risk. Powell recognized that policy tightening could also come from tighter credit conditions. Furthermore, Powell also did not seem overly concerned when asked about potential instability in the commercial real estate market (CRE), given its well-known concentrated funding from smaller regional banks. We view this as an example of complacency – that things will remain close to where they are presently. We are anticipating increasingly the onset of quick changes that could be abrupt.

Source: Goldman Sachs, Midday Market Intelligence: doves… (3-23-2023)

Source: Goldman Sachs, Global Markets Daily: CRE: Positioning for a Challenging Backdrop (Viswanathan/Karoui) (3-21-2023)

Non-Linear Changes Could Predominate

Powell assured his audience that “if we need to raise rates, we will.” Moreover, Powell indicated that the reduction of its balance sheet (QT) was working and that the Fed has not talked about changing its balance sheet strategy – “not something discussed yet.” Powell stated that no rate cuts during 2023 were contemplated in its base case. Additinally, Powell made an observation with which we wholeheartedly agree. Recessions tend to be nonlinear and models are linear. Therefore, recessions are hard to model. We would go a step further.

We would characterize the environment going forward as non-linear. We envision something akin to a “step function.” Most forecasts that we have analyzed appear to follow a linear path. Most seem to forecast gradual changes due to tighter credit brought on by the banking crisis. On March 22, Goldman Sachs (Goldman) forecast only a slight drag on real GDP growth of “1/4-1/2 pp … equivalent to the impact of 25-50 bps of rate hikes.” Goldman is forecasting also that the unemployment rate throughout 2023 will remain fairly stable near its current level of 3.6%. JPM forecast a slightly larger impact. We are not forecasting any specific impact. But whatever the impact, we foresee a series of rather abrupt changes. For example, many surveys that we have analyzed highlight the “hoarding” of workers even if they are not needed currently due to the recent difficulty of finding and retaining a desired level of workers. We could see a scenario where tighter credit standards, especially by smaller regional banks, could lead to a slower growth trajectory where fewer workers might be needed. Combine that with increased funding costs and a decrease in the availability of credit, and the perceived need and desire to “hoard” workers could dissipate very quickly. This would be true particularly for small- and medium-sized business where historically most jobs have been created. The unemployment rate might start to tick up more quickly and wage growth might become weaker even more rapidly. This would help bring down the inflation rate more quickly than most are forecasting.

“Bull-Steepening” Yield Curve Could be Sign Recession Fast Approaching

During the past few weeks, the two-to-10-year-Treasury yield curve inverted to over 108 bps the day before the SVB crisis “hit.” Friday morning this inversion was indicated as low as roughly 30 bps. The relative steepening of this part of the yield curve was driven mostly by the two-year yield trading lower. Bond prices rise when yields drop. That’s why the steepening of this yield curve is a “bull-steepening” yield curve. On March 20, JPM noted that after a severely inverted yield curve, the yield curve begins to steepen just ahead of a recession starting. Morgan Stanley’s chief U.S. equity strategist Mike Wilson made a similar observation. He noted that the yield curve bull steepened by 60 bps in a matter of days, and that has occurred only a few times in history. A severely inverted yield curve typically signals a recession within twelve months. But a strong bull steepening after a severely inverted yield curve could indicate that a risk of recession has become more elevated. A recession then is even more likely in an inflationary environment like we are experiencing currently because the Fed’s “hands are tied” in such circumstances.

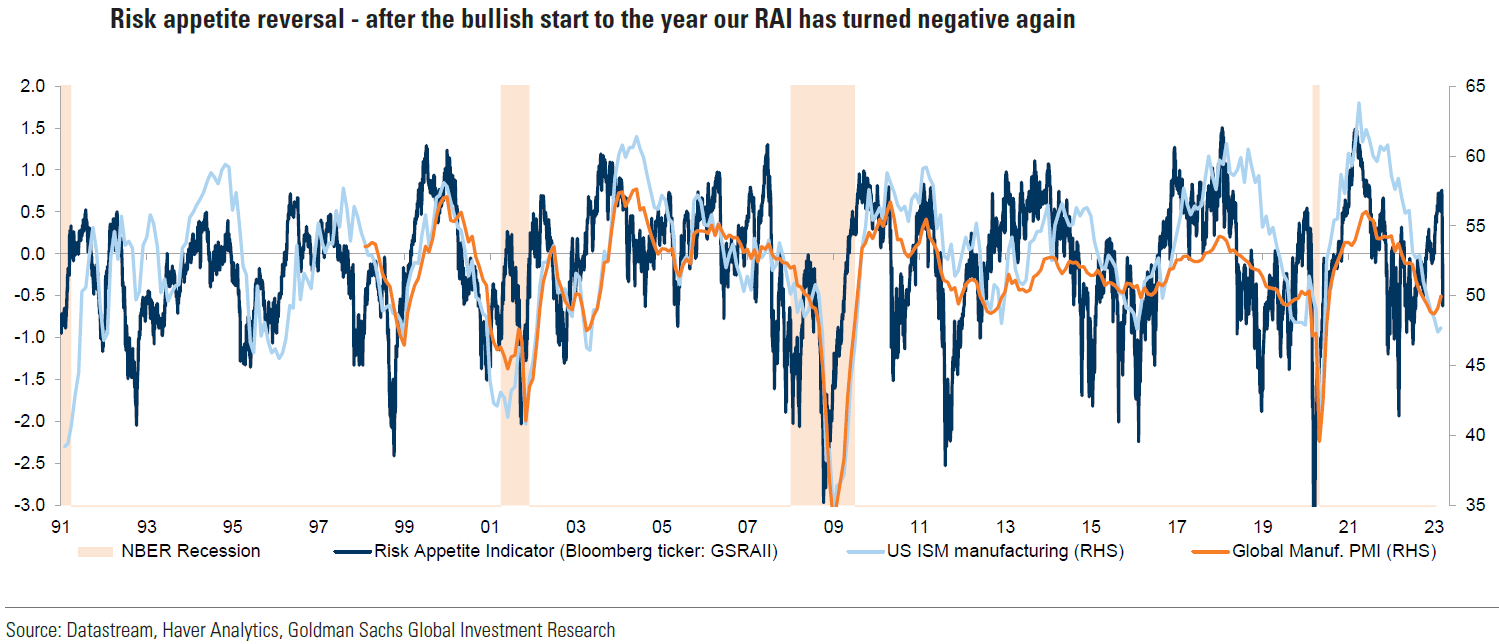

Goldman made similar observations on March 20, but with a slightly different perspective. Goldman’s Risk Appetite Indicator (RAI) declined “sharply” along with the increase of “stress” in the banks sector. Goldman viewed the recent bull steepening of the yield curve as “consistent with a late cycle ‘risk off’ move and equities underperforming bonds. However, so far equity vs. bond performance has not been particularly negative and bull steepening points to more headwinds.” Bull steepening has gotten more severe since March 20. Goldman saw “market-implied” recession risk for the next twelve months as over a 50% probability while equities then implied a 13% recession probability. Moreover, Goldman’s approximately 80 indicators of market stress also picked up, “which increases the risk of further financial conditions tightening.”

Source: Goldman Sachs, Tracking market stress and recession risk after the risk appetite reversal (3-21-2023)

Source: Morgan Stanley, Weekly Warm-up: This Is Not QE; Focus on the Fundamentals (3-20-2023)

Source: Goldman Sachs, Banks stress triggers sharp risk appetite reversal (3-20-2023)

Bottom Line

For the time being we are maintaining our basic investment approach as expressed in last week’s commentary. We continue to prefer high quality stocks that offer good balance sheets, as well as relatively stable cash flows and profit margins. We prefer a very diversified global portfolio for long term investors. We continue to stress that stock selectivity in this current financial environment is of paramount importance.

Late Thursday morning, we thought that it was highly likely that U.S. equities traded at a level that could be at least a short-term peak. We thought that the risk-reward no longer justified full positions in many stocks. We also detected what we would characterize as much complacency in regard to economic trends, which many investors and analysts viewed as perhaps predictable and evolving slowly. We suppose that future economic and inflation trends could evolve in a sudden and non-linear pattern.

Definitions:

Federal Open Market Committee (FOMC) – The Federal Open Market Committee (FOMC) is the branch of the Federal Reserve System that determines the direction of monetary policy specifically by directing open market operations. The committee is made up of 12 members: the seven members of the Board of Governors; the president of the Federal Reserve Bank of New York; and four of the remaining 11 Reserve Bank presidents on a rotating basis.

Fed Dot Plot – The Fed dot plot is published quarterly as a chart showing where each of the 12 members of the FOMC expect the federal funds rate to be for each of the next three years and the long term.

Inverted Yield Curve – An inverted yield curve describes the unusual drop of yields on longer-term debt below yields on short-term debt of the same credit quality. Sometimes referred to as a negative yield curve, the inverted curve has proven in the past to be a relatively reliable lead indicator of a recession.

Bull Steepener – A bull steepener is a change in the yield curve caused by short-term interest rates falling faster than long-term rates, resulting in a higher spread between the two rates.

Basis Points (bps) – A basis point is one hundredth of one percent, used chiefly in expressing differences of interest rates.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/fast-answers/answersindiceshtm.html or http://www.nasdaq.com/reference/index-descriptions.aspx.

All data is subject to change without notice.

© 2024 NewEdge Capital Group, LLC