Weekly Summary: October 3 – October 7, 2022

Key Observations:

- This week exemplified a pattern of “bad” economic news is “good” news for financial markets and vice versa. However, Thursday’s trading patterns showed that a concerted effort of hawkish Fedspeak can sometimes overcome relatively weak economic data. It has become increasingly clear that most Federal Reserve (Fed) officials are speaking with one hawkish voice as almost identical words have been used to portray their “individual” views.

- OPEC+ agreed this week to cut their daily oil production by 2 million barrels per day (bpd) beginning in November. But since many members of OPEC+ are not producing at their allocated levels, the actual production cuts are estimated in the 0.9 — 1.1 million bpd range. By early afternoon on Friday, oil prices were set to have their biggest weekly gains since March. We remain very committed to our energy investments. Energy has been one of our favored sectors for quite some time.

- As we have highlighted in our last two weekly commentaries, we have become concerned increasingly about a possible financial market “dislocation” of some kind due to extreme moves in currencies, interest rates, commodities, and to a lesser extent equities. Lower liquidity in many financial markets has led to more volatility. Concerns over financial stability have become more widespread this week. We suppose that this helps explain why many financial markets have been so quick to react “favorably” to poor economic news. In our opinion, many investors are hoping that poor economic data will dissuade the Fed from pursuing its very aggressive monetary tightening policies for fear of a financial “accident.” Such market moves appear to be trying to front-run a Fed decision to “pause.” Financial markets appear to be “data dependent.”

- It remains our belief that the Fed will remain on its aggressive trajectory of raising rates. We continue to foresee 75 basis point increase in the federal funds rate at the Fed’s next meeting in November, to be followed by an additional 50 bp hike at its December meeting. We prefer to see more economic data before committing to any hikes into next year.

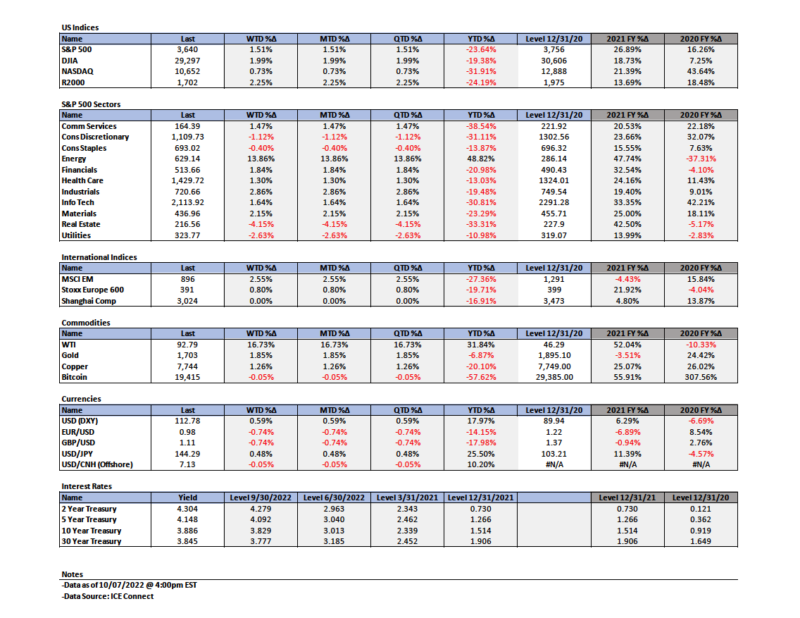

The Upshot: Our general investment approach remains the same as depicted in last week’s commentary. We maintain our preference for big cap high quality stocks with good balance sheets, relatively stable cash flows and stable margins. Volatility across sectors continues to be supportive of a well-diversified portfolio for long term investors. On a selective basis, we remain favorably disposed towards energy, health care, financials and growth stocks – including selected high quality tech stocks. For those so inclined, the 10-year Treasury bond could be an attractive hedge in a diversified portfolio for the possibility of a U.S. recession. Interest rates appear to have been the main driver of equity markets as well as other financial markets for quite some time. In our opinion, the 2-year Treasury yield and the 10-year treasury yield have shown signs, at least in the short term, of topping at just over 4.3% and 4.0%, respectively. We assume continued volatility across virtually all financial markets. We maintain our belief that selective stock picking will continue to play a critical role in outperformance. Seasonal factors could also affect financial markets’ behaviors. We anticipate that downward revisions in Q3 results could further pressure equities.

“Bad” Economic News = “Good” News for Financial Markets, Fedspeak Also Counts

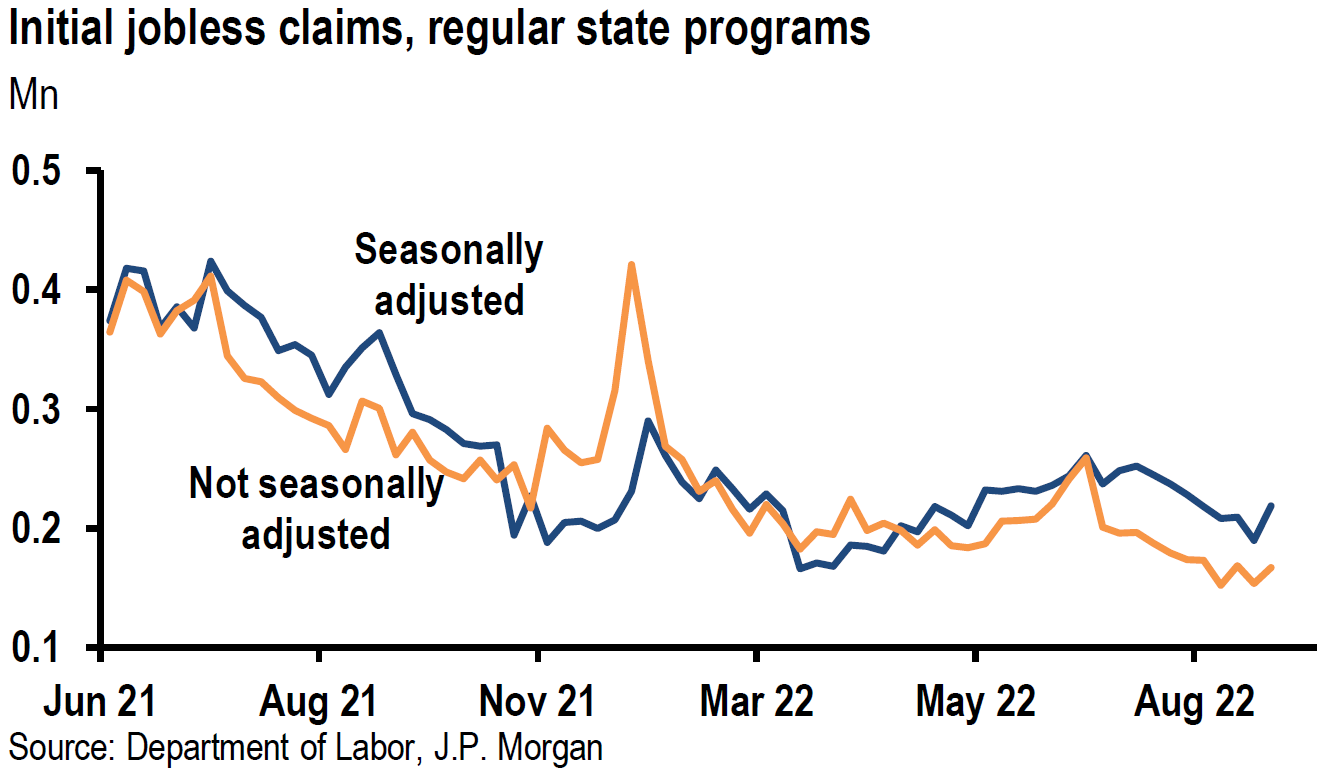

This week could be easily typified as a “bad news was good news” week for many financials markets and vice versa. Economic growth, labor market or inflation data that could be characterized as weaker than expected typically led to lower interest rates, lower U.S. dollar (USD) and higher equity prices. But even this strong recent pattern could not withstand “Fedspeak” on Thursday when the president of the Minneapolis Fed, Neel Kashkari, asserted that he and his colleagues were “quite a ways away” from bringing down inflation. Cleveland Fed president Loretta Mester added that U.S. inflation was “unacceptably high.” These comments only bolstered Atlanta Fed president Raphael Bostic’s statements of the prior day: “We should not let the emergence of (economic) weakness deter our push to lower inflation … We must remain vigilant because this inflation battle is likely still in the early days.” The higher-than-expected initial jobless and continuing jobless unemployment insurance claims were indications of a less-tight labor market, and “bad” or weaker economic data. This news initially reversed a decline in pre-market equity prices. However, the Fedspeak overwhelmed the data on Thursday, which led to a downturn in U.S. equity prices, higher interest rates and a stronger USD.

Source: JP Morgan, US: Initial claims jump but stay low (10-6-2022)

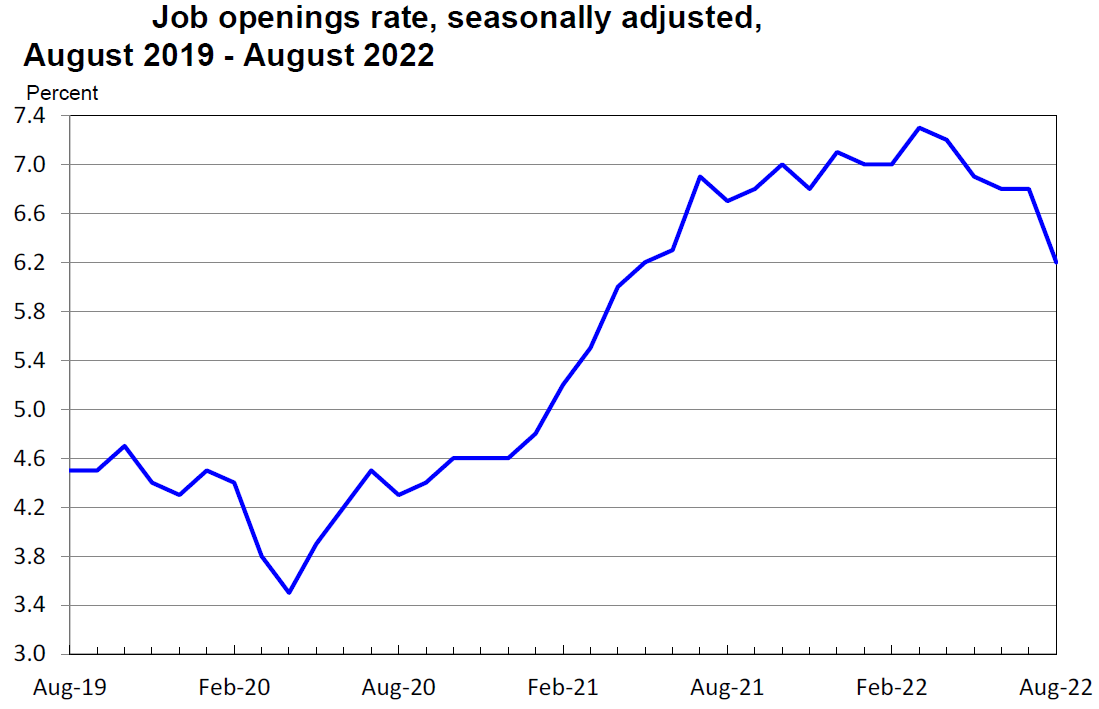

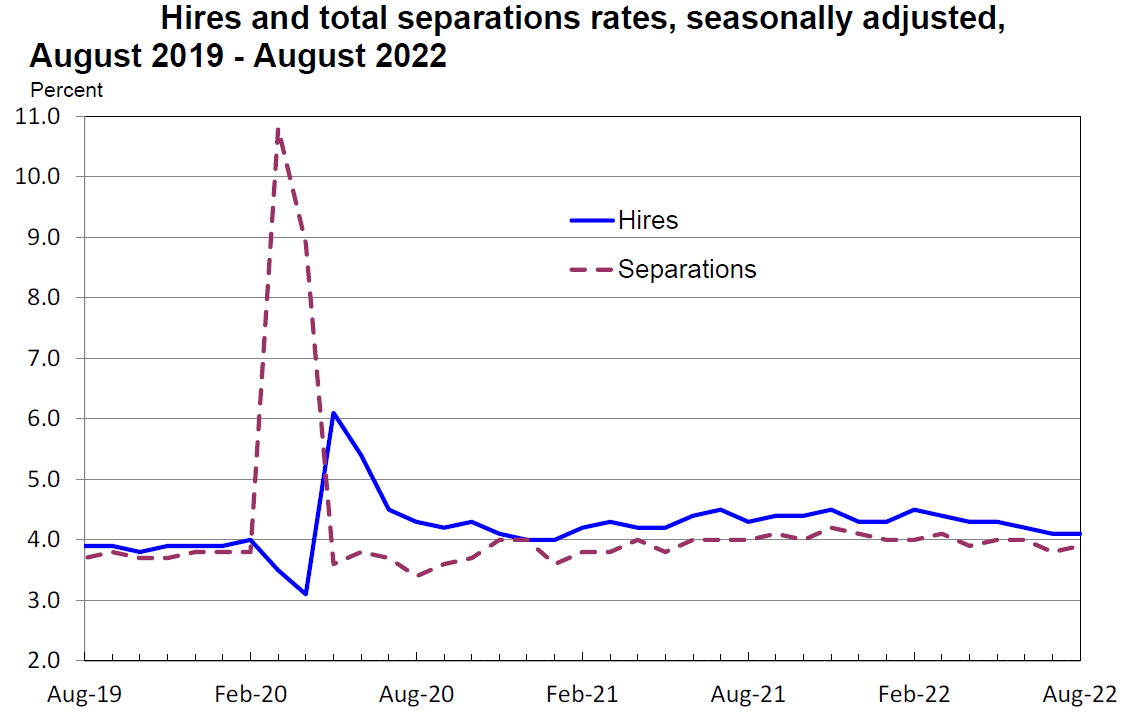

Source: US Department of Labor, Job Openings and Labor Turnover – August 2022 (10-4-2022)

“Counting Stars” Recommended for CBs

In the current economic and financial turbulence, we postulate that many of the world’s central bankers (CBs), including our own Fed, along with many investors and traders might be thinking: “I feel something so right; Doing the wrong thing; And I feel something so wrong; doing the right thing.” These lyrics were extracted from OneRepublic’s song “Counting Stars.” On September 23, the UK government announced its disastrous fiscal plan, which included unfunded tax cuts. The financial markets’ reaction to this announcement was proof that there is a limit to what will be tolerated and accepted: “And I don’t think the world is sold; On just doing [accepting] what we’re told.” Given the very poor forecasts of governments and CBs, as well as wrongheaded policies since the start of the pandemic, perhaps we would all be better off if they all adopted OneRepublic’s advice: “No more counting dollars, we’ll be counting stars.” Celestial gazing might enable such officials to “see” things more clearly.

Financial Stability Concerns

In our opinion, to understand better the movements of financial markets in the past couple of weeks, we should start with the events of September 23. On that day, the UK government’s tax cut proposal precipitated a dramatic rise in interest rates on “gilts” – British government bonds – and a greater-than 3.5% drop in the British pound versus USD. Our last two weekly commentaries have highlighted our increasing concern since that day of a potential financial market “dislocation” of some kind, given the relative illiquidity in many financial markets and the extreme volatility of many financial markets. Since that time, many analysts, investors and Fed officials have also joined in our concern of financial market dislocations in the guise of “financial stability.” In a speech last Friday, vice chair Lael Brainard focused on “risks to the financial system” that could be precipitated from “spillovers” from one country to another. “We are attentive to financial vulnerabilities that could be exacerbated by the advent of additional adverse shocks. For instance, in countries where sovereign or corporate debt levels are high, higher interest rates could increase debt-servicing burdens and concerns about debt sustainability, which could be exacerbated by currency depreciation. An increase in risk premiums could kick off deleveraging dynamics as financial intermediaries de-risk. And shallow liquidity in some markets could become an amplification channel in the event of further adverse shocks.” Brainard added later that the Fed’s “policy deliberations are informed by analysis of how U.S. developments may affect the global financial system and how foreign developments in turn affect the U.S. economic outlook and risks to the financial system.” It is quite evident from these remarks that Brainard shared our concerns on financial stability. Last week, the Bank of England (BOE) stepped in to stabilize the UK bond market that in turn stabilized the British pound versus USD. The BOE achieved needed stability by offering to buy long-dated gilts in whatever quantity was necessary until mid-October. It also announced that it would cease selling gilts until the end of October.

Potential Financial Market Disruptions in UK and Japan

Prior to the UK experience, Japan’s Mistry of Finance chose to intervene in the currency markets to stabilize the yen against USD. The yen’s rapid depreciation versus USD was exacerbated by the Bank of Japan’s (BOJ) insistence on maintaining its ultra-low interest rate policies. In both the UK and Japanese cases, it was the rapidity of change along with the extreme moves in financial markets that seemed to require an immediate response by a government entity. Rapid and extreme moves can often give the appearance of “disorderly” markets. The Japanese case is less clear than the UK example of whether the markets were in fact disorderly. We believe that the BOE had little choice but to act to stabilize its bond and currency markets. Reports of the poor financial health of Credit Suisse that surfaced early this week, exacerbated financial stability concerns.

Financial Stability Concerns and Fed Policies

Financial stability is predicated on confidence. The financial crisis of 2008-2009 was an extreme illustration of what can happen when there is a loss of confidence in financial systems. We are not suggesting that the current situation is even remotely similar to such a crisis. Many analysts and investors are beginning to wonder what sort of financial emergency would precipitate Fed action to avert a financial crisis. We surmise that a mere general concern by the Fed of such possibilities would be insufficient for the Fed to deviate from its expressed laid out monetary tightening path. It is our opinion that it would take an “imminent” threat to financial stability for the Fed to change its course. The latest Fedspeak of this week has made it very clear that Fed officials are speaking with one voice in reiteration of their determination to stay on a very aggressive monetary tightening path until they see “compelling” evidence that inflation is diminishing. When Fed officials see a loosening of financial conditions – reflected by a decrease in interest rates, USD and an increase in equities – Fedspeak increases to ensure the markets are aware of the Fed’s unwavering stance on tightening financial conditions. Since interest rates appear to be driving equities and currencies, we will assume that hawkish Fedspeak will be commensurate with bond market moves and volatility.

Financial Markets’ Reaction to ISM Manufacturing PMI

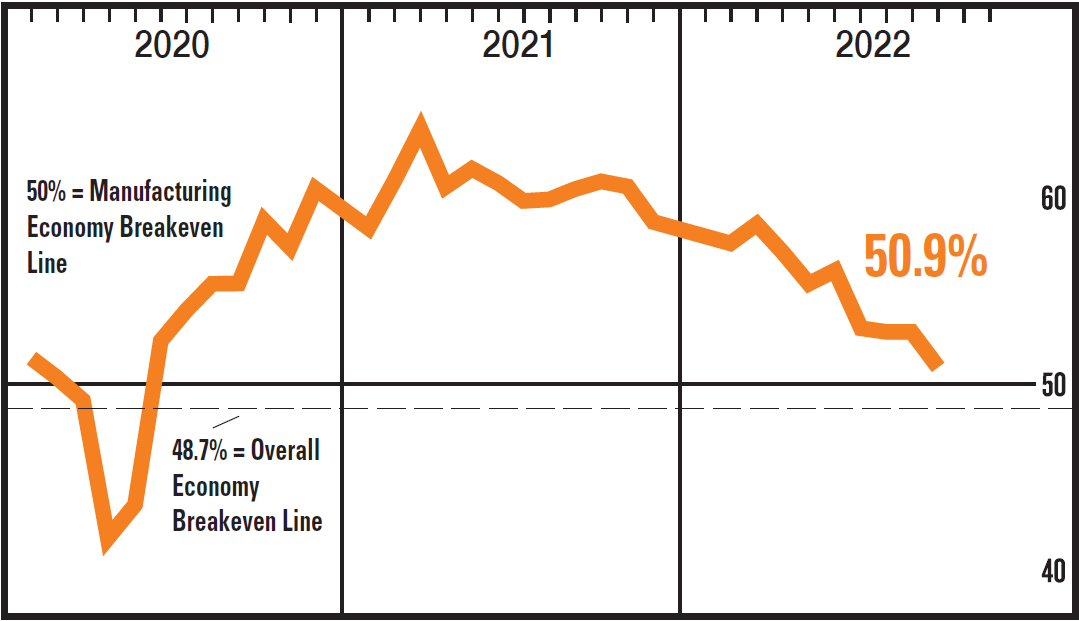

We maintain that financial stability concerns are what is principally behind this week’s financial markets’ dramatic swings on economic news announcements. It seems like the worse-than-expected Institute for Supply Management (ISM) U.S. manufacturing Purchasing Managers Index (PMI) for September triggered higher U.S. equity prices, lower interest rates and a lower USD. Although still expansionary at a reading of 50.9%, it was the lowest since May 2020 and was 1.9% lower than August. Many of the underlying components fell into contractionary territory, including new orders and employment indexes. New export orders also fell further into contractionary territory, and reached the lowest level since June 2020. Prices slowed “notably” as supply chains eased. Slower-than-expected construction spending in August contributed to a slowing U.S. economy portrayal. Since many financial market participants are “fearful” of a market dislocation of some kind if the Fed adheres to its very aggressive tightening monetary trajectory, they seem to be anticipating and welcoming any economic evidence that possibly could dissuade the Fed from its stated course of action. In low liquidity markets typified by relatively light positioning, it doesn’t take much to have exaggerated market moves.

Source: Manufacturing Business Survey Committee, ISM Manufacturing PMI (10-3-2022)

S&P Global Manufacturing PMI for U.S. and Eurozone

The better-than-expected U.S. S&P Global manufacturing September PMI had little if any impact on Monday’s trading. The headline reading of 52.0 in September was 0.5% higher than in August, indicating subdued operating growth. But output and new orders returned to growth as firms expanded their workforce at the fastest pace since March of this year. Some input prices softened even as selling prices rose modestly. Concerns regarding inflation and client purchasing power weighed on expectations to cause them to be lower than their August levels. The European S&P Global manufacturing PMI for September showed a much more troublesome mix. The headline level was 48.4 – down from 49.6 in August – and it hit a 27-month low as the manufacturing slowdown accelerated in September. Many firms “downwardly adjusted their operating schedules in line with lower order books.” Business confidence fell to its lowest level since May 2020 as it slipped back into negative territory on recession fears. For the first time since April, rates of input costs and prices received accelerated, mostly due to “soaring” energy prices. But supplier delivery delays were the least widespread for almost two years “as improved raw material availability and a drop in demand helped ease pressures on vendors.”

Markets’ Reaction to Decrease in U.S. Job Vacancies

On Tuesday, U.S. financial markets followed with similar market reactions with the announcement of the August Job Openings and Labor Turnover Survey (JOLTS) report. The focus was on the unexpectedly-large 1.1 million drop in U.S. job openings to 10.1 million job vacancies versus an expected level of roughly 11 million openings. The August level was the lowest since June 2021 and the one-month decline was the most since the height of the pandemic in 2020. The general interpretation of the great decline in job openings was that the U.S. labor market had begun to cool and that the great imbalance of demand over supply of labor was becoming less extreme. The decline in vacancies brought the ratio of job openings per unemployed worker down from July’s ratio of 2.0-to-one to the August figure of 1.7-to-one. According to pre-pandemic standards, this was still a very high ratio and still represented a tight U.S. labor market. Since the Fed’s current main focus is on the “extremely” tight labor market, there was little surprise at financial markets’ very “favorable” reaction to such a strong indication that the labor market was starting to “loosen.”

U.S. Factory Orders

The new orders for U.S. manufactured goods – factory orders – for August was also announced on Tuesday and was roughly flat month-over-month (m/m). Excluding transport, factory orders increased 0.2% m/m versus a 1.1% drop in July m/m. We assume that the factory orders had no impact on Tuesday’s trading activity.

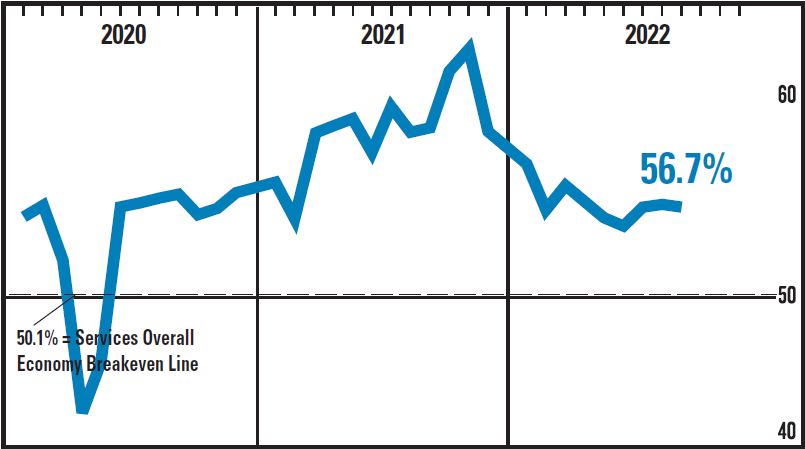

Markets’ Reaction to ISM Services PMI

The U.S. ISM services PMI for September exceeded expectations of 56.0 with a 56.7 reading, which was 0.2% lower than it was in August. Price pressures continued to ease as supplier deliveries grew at a slightly slower rate. Respondents to this survey noted that “there have been improvements regarding supply chain efficiency, operating capacity and materials availability.” But perhaps most troublesome for the Fed achieving its goal of reining in inflation was that employment improved from 50.2 in August to 53 in September. This relatively “good” economic news initially had the expected “negative” financial market reaction of lower equity prices, higher interest rates and stronger USD. Equity prices staged a rather impressive rally later that day to reach positive levels briefly before closing with losses, but substantially above their lows for the day.

Source: Services Business Survey Committee, ISM Services PMI (10-5-2022)

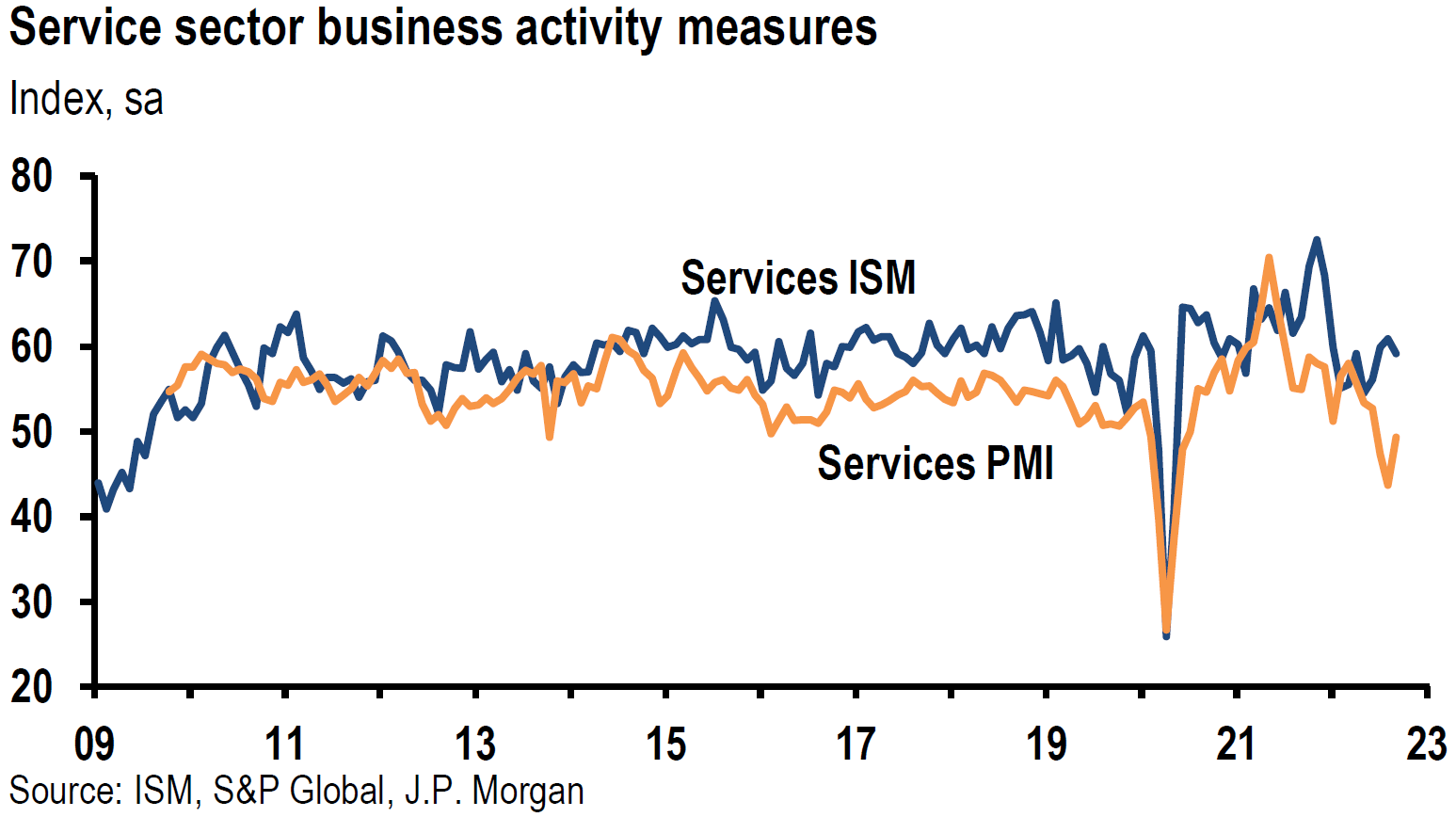

Source: JP Morgan, Wednesday data wrap: all’s well (ex-housing) (10-5-2022)

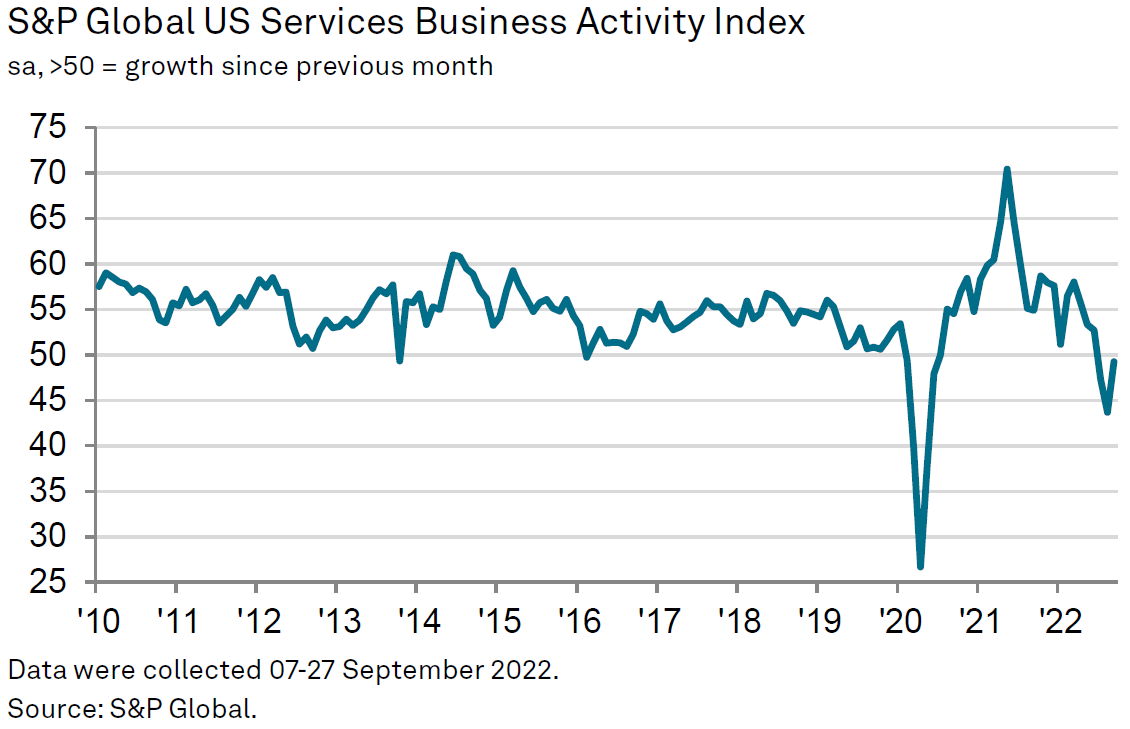

S&P Global Services PMI for U.S. and Eurozone

The S&P Global U.S. services PMI was announced on Wednesday and continued to show a much lower level than its ISM counterpart in September. However, the September reading showed a dramatic improvement from 43.7 in August to 49.3 in September. The rate of job creation softened to the slowest this year “as challenges finding and retaining staff persisted.” Business expectations for the year ahead reached their highest level in four months. Some reductions of input prices led to cost pressures easing for the fourth consecutive month and selling prices rose at the slowest pace since the end of 2020. We suppose that this PMI report mostly was ignored by markets in favor of the ISM report. The S&P Global Eurozone Services PMI fell further into contractionary territory dropping from August’s 49.8 level to 48.8 in September. September’s level was the lowest since February 2021. “Weak demand conditions were underscored by a renewed reduction in backlogs of work.” Employment levels continued to rise, but at the slowest pace since April 2021. Both input costs and prices received accelerated to three-month highs. Business confidence “slumped” to levels similar to the start of the COVID-19 pandemic.

Source: S&P Global, S&P Global US Services PMI (10-5-2022)

ADP Report

We suspect that the ADP report of a 208,000 private sector jobs increase in September – which was roughly in-line with expectations – had little effect on Wednesday’s trading. The annual pay increase for “job changers” rose 15.7% in September, down from a revised 16.2% gain in August. This was the biggest monthly deceleration in the three-year history of this particular data. For “job stayers,” annual pay in September was 7.8% higher year-over-year (y/y), compared to a revised 7.7% in August. We viewed the pay increases in a favorable manner as there were signs of a possible deceleration of wage gains.

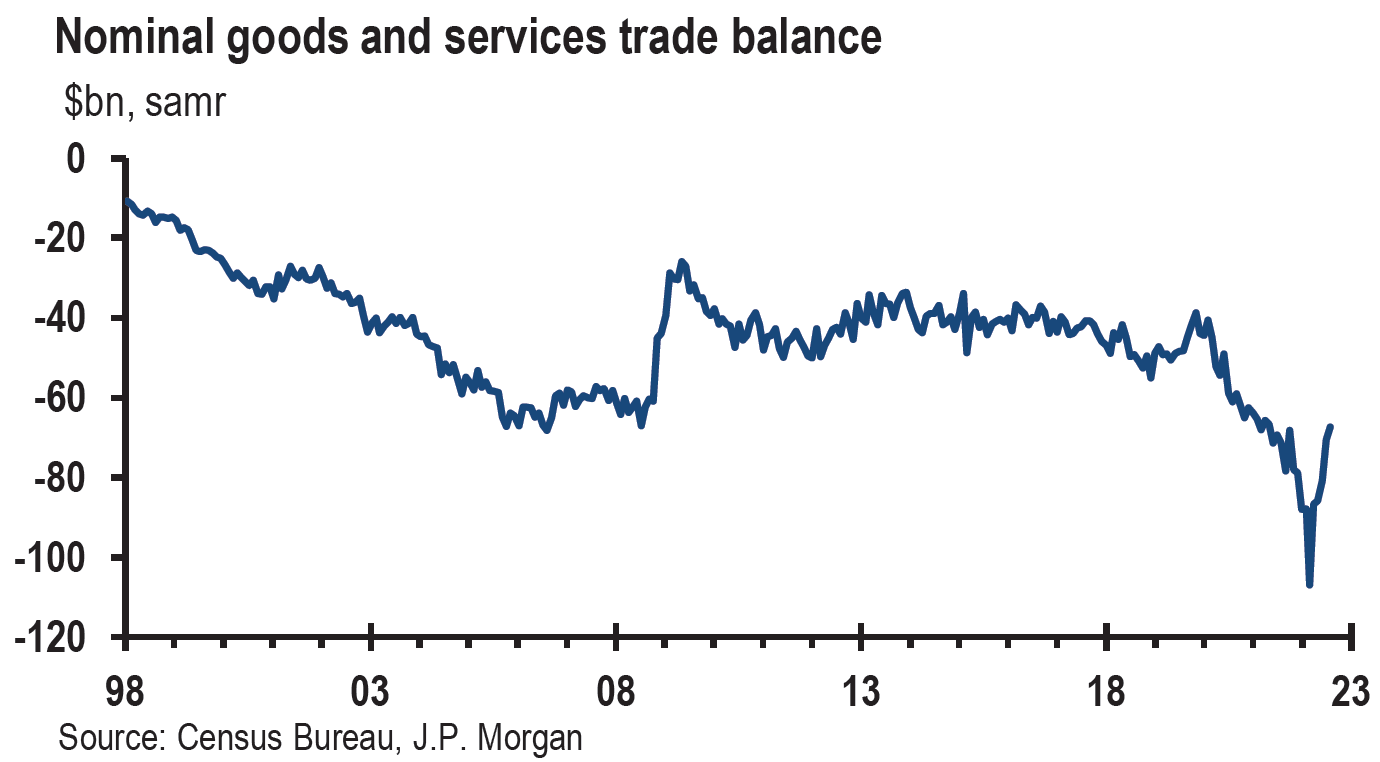

Shrinking U.S. Trade Deficit

The August U.S. trade deficit for goods and services narrowed $3.1 billion from July’s level to $67.4 billion, roughly in line with expectations. August exports were $0.7 billion less than July exports and imports were $3.7 billion less than July’s. For the three months that ended in August, the average goods and services deficit decreased $6.2 billion, with average exports up $1.5 billion and imports down $4.7 billion. According to J.P. Morgan (JPM) on October 6, “net trade looks to contribute meaningfully to third-quarter GDP growth, perhaps as much as 3.0%.” JPM does not expect a positive contribution from net exports to continue beyond the third quarter. We are very much in doubt that the trade deficit had any meaningful impact on Wednesday’s trading.

Source: JP Morgan, Wednesday data wrap: all’s well (ex-housing) (10-5-2022)

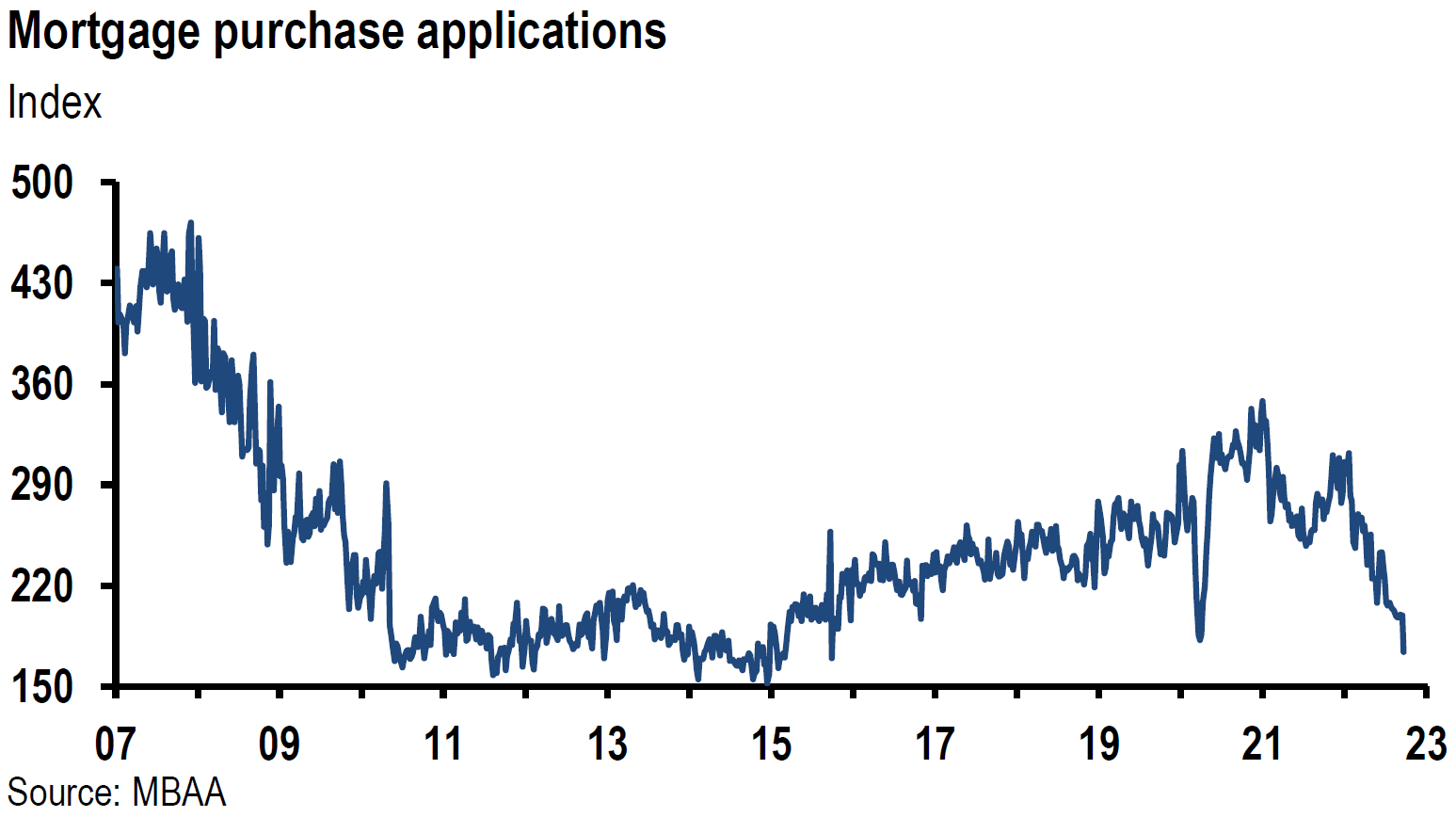

Weaker U.S. Mortgage Applications

The continued decline of mortgage applications to purchase a home in the U.S. last week dropped 13% from the prior week and were 37% lower y/y. At this point, general housing weakness is expected and we assume that it has little effect on daily trading patterns.

Source: JP Morgan, Wednesday data wrap: all’s well (ex-housing) (10-5-2022)

Markets’ Reaction to a Better-than-Expected U.S. Nonfarm Payroll Employment Report

The better-than-expected U.S. nonfarm payroll employment for September was announced on Friday and increased by 263,000 versus the consensus estimate of 255,000 and the 315,000 August increase. This was the smallest monthly gain since April 2021. Private payrolls for September ere 288,000 higher in September versus the median forecast of 275,000, which was also the revised August gain. The prior three-month average gain of payrolls was 382,000 and the average monthly gains for 2022 was 420,000. The average monthly job gains were 562,000 for 2021. The leisure and hospitality sector showed the most robust job gains for September at 83.000 and was followed by healthcare with an additional 60,000 jobs. Employment in the leisure and hospitality sector is still 1.1 million below the February 2020 pre-pandemic level. Including this month’s gains, health care employment finally returned to February 2020 levels. The unemployment rate fell 0.2% m/m and returned to July’s level of 3.5%. The unemployment level decreased partly due to the drop in the labor force participation rate of 0.1% m/m back to July’s 62.3% level. Average hourly earnings rose 0.3% m/m and was 0.2% lower to a rate of 5.0% y/y that was in line with consensus. As we indicated in last week’s commentary, wage gains of this magnitude are not consistent with the Fed’s target of a 2% rate of inflation. This mostly “good” economic report was greeted by a mostly “bad” market response – higher interest rates, lower equity prices and a stronger USD. The biggest adverse reaction in U.S. financial markets was in equities. We found it of particular interest that there was a more dramatic rise in interest rates of many European countries. It was as if they were playing catch-up to U.S. interest rates. We understand that the more exaggerated move higher in European rates might explain the very initial muted positive response in USD. For the time being, we are maintaining our view that at least in the short term, the 2-year Treasury yield will not materially exceed the 4.3% level and that the 10-year yield should be contained at about the 4% level. The markets’ reaction on Friday provided a further tightening of financial conditions. There was no need for additional hawkish Fedspeak on Friday.

Bottom Line

For the time being we are maintaining our basic investment approach as expressed in last week’s commentary. We continue to prefer high quality big cap stocks that offer good balance sheets, as well as relatively stable cash flows and profit margins. A well-diversified portfolio for long term investors will be most likely the preferred approach.

We assume continued volatility across virtually all financial markets. We would only buy selected stocks during market downturns. We remain concerned about relative illiquidity in many financial markets. We remain focused on the many ramifications of the sharp appreciation of USD relative to many currencies. We are apprehensive over the possibility of a financial market “dislocation” attributable to extreme volatility and relative illiquidity. As the U.S economy weakens, we expect credit spreads to widen.

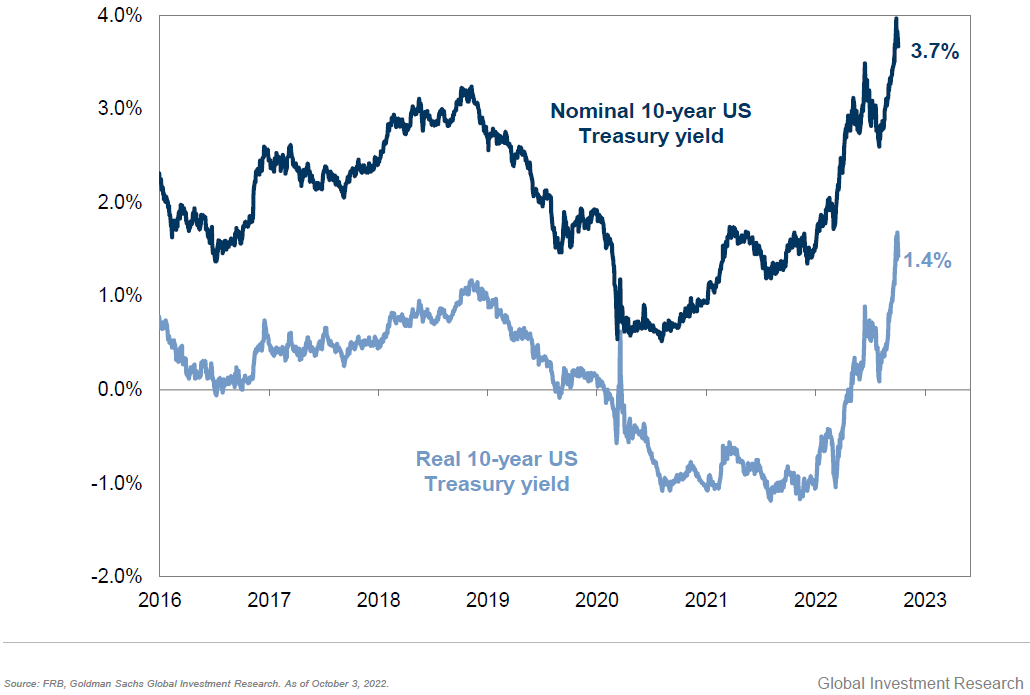

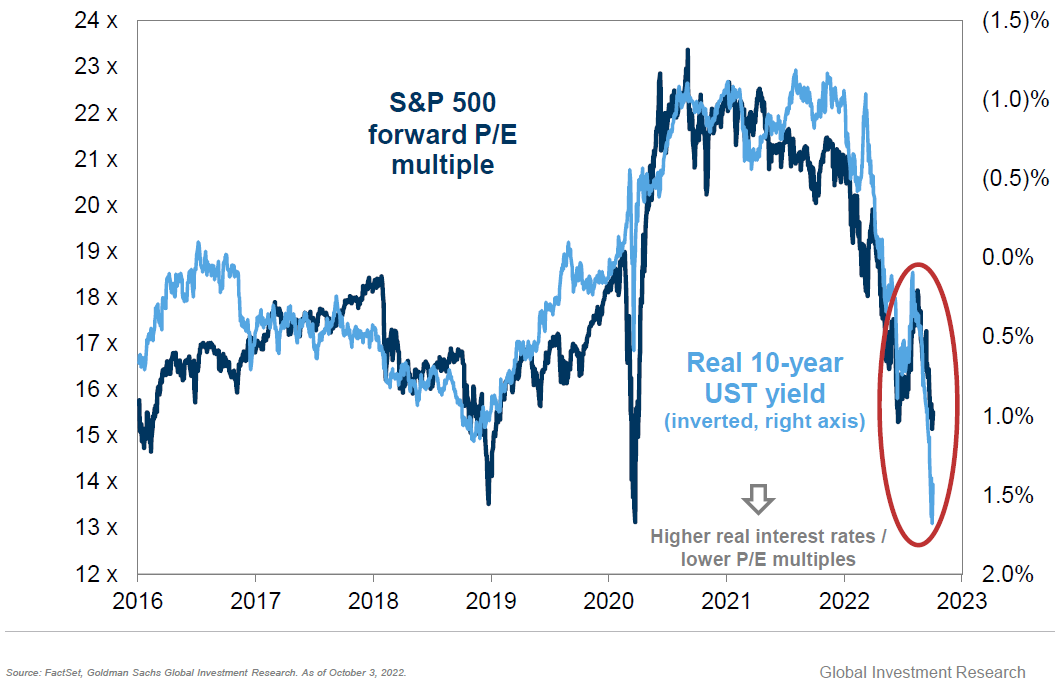

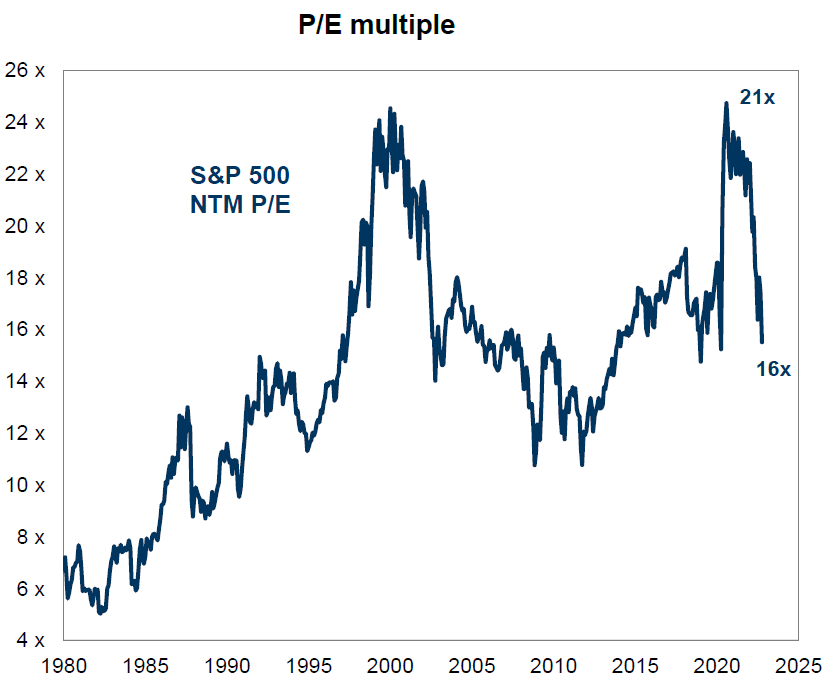

We understand that as the 10-year yield increases, it will pressure mortgage rates higher. It will also have an adverse effect on equity valuations as well as other long-duration assets. The longer dated the asset, the more that higher rates will negatively impact valuations. Growth stocks, including tech stocks, will continue to be particularly vulnerable. We maintain our belief, that for those long-term investors willing to hold such stocks through volatile periods, they will be most likely rewarded eventually on their high-quality big cap stocks.

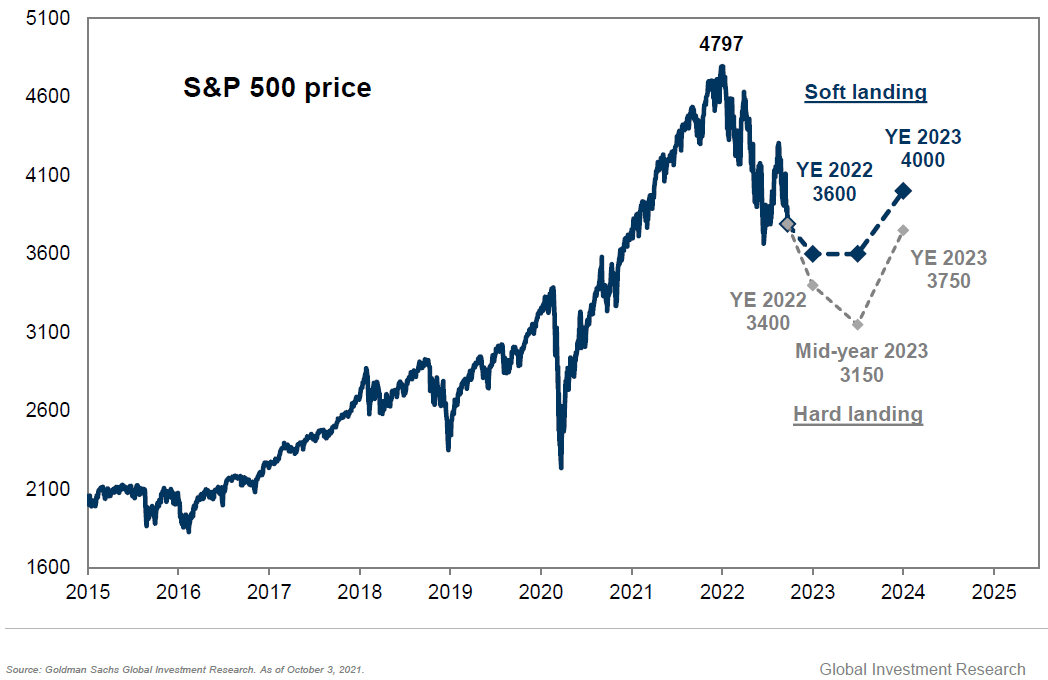

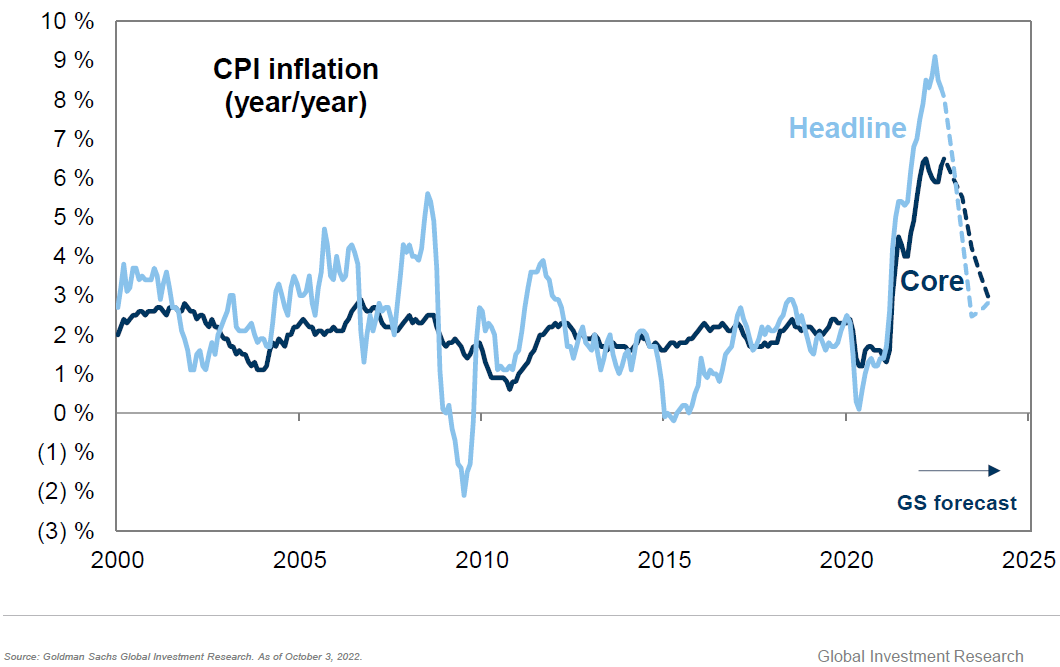

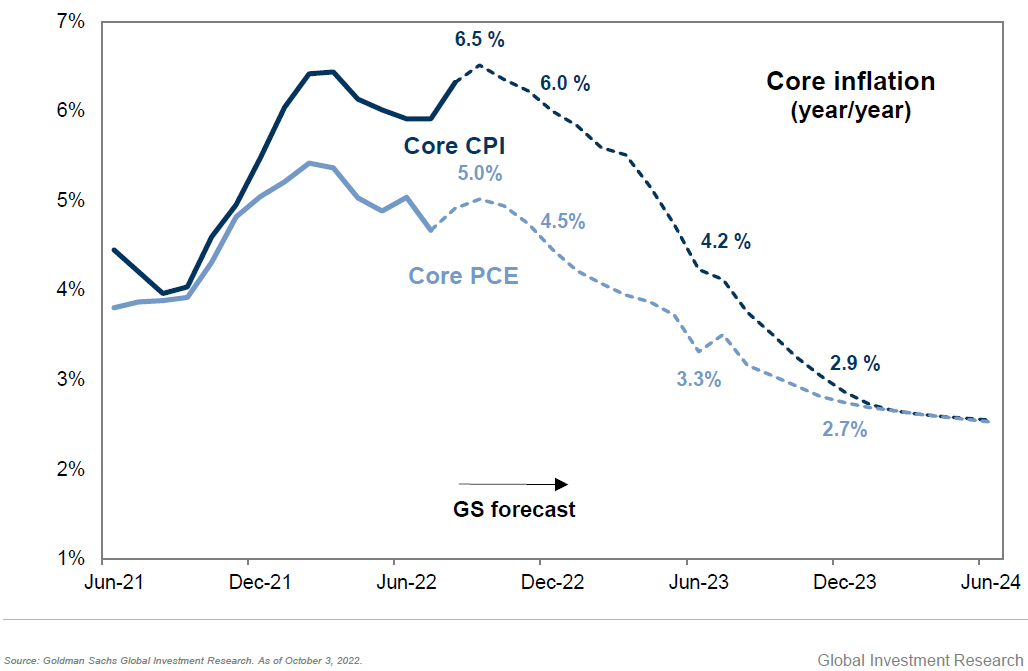

Source: Goldman Sachs Research, Where to invest now: Prepare for landing (10-4-2022)

Definitions

ISM services PMI – The Institute of Supply Management (ISM) services PMI (formerly known as Non-Manufacturing Index) is an economic index based on surveys of more than 400 non-manufacturing (or services) firms’ purchasing and supply executives.

ISM Manufacturing Index (PMI) – The ISM manufacturing index, also known as the purchasing managers’ index (PMI), is a monthly indicator of U.S. economic activity based on a survey of purchasing managers at more than 300 manufacturing firms. It is considered to be a key indicator of the state of the U.S. economy.

S&P Global Services PMI – The S&P Global US Services PMI is compiled by S&P Global from responses to questionnaires sent to a panel of around 400 service sector companies.

S&P Global Manufacturing PMI – The S&P Global US Manufacturing PMI is compiled by S&P Global from responses to questionnaires sent to purchasing managers in a panel of around 800 manufacturers.

Organization of the Petroleum Exporting Countries (OPEC) – The term Organization of the Petroleum Exporting Countries (OPEC) refers to a group of 13 of the world’s major oil-exporting nations. OPEC was founded in 1960 to coordinate the petroleum policies of its members and to provide member states with technical and economic aid. OPEC is a cartel that aims to manage the supply of oil in an effort to set the price of oil on the world market, in order to avoid fluctuations that might affect the economies of both producing and purchasing countries.

Credit Spread – The credit spread is the difference in yield between bonds of a similar maturity but with different credit quality.

Federal Funds Rate – The term federal funds rate refers to the target interest rate set by the Federal Open Market Committee. This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

Long Duration – Long Duration refers to the extended period of time that an asset is held. Depending on the type of security, a long-term asset can be held for as little as one year or for as long as 30 years or more.

Growth Stock – A growth stock is any share in a company that is anticipated to grow at a rate significantly above the average growth for the market. These companies generally do not pay dividends, instead growth stocks tend to reinvest any earnings they accrue in order to accelerate growth in the short term.

Fedspeak – Fed speak is a technique for managing investors’ expectations by making deliberately unclear statements regarding monetary policy to prevent markets from anticipating, and thus partially negating, its effects.

Financial Stability – Financial stability is a condition in which an economy’s mechanisms for pricing, allocating, and managing financial risks (credit, liquidity, counterparty, market, etc.) are functioning well enough to contribute to the performance of the economy.

Job Openings and Labor Turnover Survey (JOLTS) – The job openings and labor turnover survey are a monthly report by the Bureau of Labor Statistics (BLS) of the U.S. Department of Labor counting job vacancies and separations, including the number of workers voluntarily quitting employment.

ADP National Employment Report – The ADP National Employment Report is a monthly report of economic data that tracks the level of nonfarm private employment in the U.S. It is published by Automatic Data Processing, a company that handles payroll for about a fifth of all privately-employed individuals in the U.S. The ADP National Employment Report is also known as the ADP Jobs Report or the ADP Employment Report.

Trade Deficit – A trade deficit occurs when a country’s imports exceed its exports during a given time period.

Gilts – Government bonds in the U.K., India, and several other Commonwealth countries are known as gilts. Gilts are the equivalent of U.S. Treasury securities in their respective countries.

Factory Orders – Factory orders are economic indicators of the dollar value for goods from factories. Based on the U.S. Census Bureau, factory orders are categorized into two major groupings: durable and non-durable goods.

Nonfarm Payrolls – Nonfarm payrolls is the measure of the number of workers in the U.S. excluding farm workers and workers in a handful of other job classifications. The nonfarm payrolls classification excludes farm workers as well as some government workers, private households, proprietors, and non-profit employees.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/fast-answers/answersindiceshtm.html or http://www.nasdaq.com/reference/index-descriptions.aspx.

All data is subject to change without notice.

© 2024 NewEdge Capital Group, LLC