Weekly Summary: February 21 – 25, 2022

Key Observations:

- Huge market reversal on the first full trading day of Russia’s Ukraine invasion – equities go from lows to close at or near highs for the day. “Safe-haven” trades such as The U.S. Dollar (USD) and gold trade off their highs.

- Mostly indiscriminate selling on day one of “full” invasion provided opportunity for selective buying across ALL sectors in the face of “maximum” uncertainty.

- Apart from invasion of Ukraine, February economic data was very encouraging. Global February economic resiliency confirms the likelihood that re-opening trade will endure, including travel-related equities.

- We suppose the Federal Reserve (Fed) will remain very hawkish in spite of Ukraine invasion.

The Upshot:

Hopefully, the Russia-Ukraine hostilities will be relatively short-lived, so that a global economic rebound then could occur in the manner that we foresee. We continue to contemplate a higher interest rate environment, a lower USD for 2022, generally strong but volatile commodity prices, and selective equity markets outperformance in Europe and emerging markets (EM) relative to U.S. equities. We continue to envisage a robust global economy and higher-than-consensus inflation rates. We also suppose continued volatility in financial markets, including equities. The increased uncertainties in regard to economic growth and inflation rates due to the Ukraine invasion has led us to look to ALL sectors for the most attractively-priced stocks on a risk/reward basis with underlying strong balance sheets and sustainable cash generation. We presume that the Fed will raise the federal funds rate by 25 basis points (bps) at its mid-March meeting.

Beginning of Ukraine Invasion

The primary focus of financial markets this week continued to be on the intentions of Russia’s president Vladimir Putin in regard to Ukraine. Early this week, Putin recognized two pro-Russian separatist areas within eastern Ukraine as independent and sent in Russian troops to support these two regions. There has been fighting for eight years in these regions between Russian separatists and Ukraine soldiers. Soon after these actions were taken by Russia, U.S. President Biden described such actions as the beginning of “an invasion” of Ukraine. A limited set of U.S. sanctions were then imposed on Russia with the threat of more severe sanctions to come that would be more commensurate with any further invasion into Ukraine.

Acceleration of Ukraine Invasion

According to a CNN evening report on February 23, U.S. Secretary of State Antony Blinken said in that evening’s interview with ABC News that “everything we’ve seen over the past 24 to 48 hours has Russia putting the final touches on having its forces in place across all of Ukraine’s borders … to be ready for a full on invasion.” On Wednesday, Ukraine’s parliament approved the government’s state of emergency declaration, which would be imposed across Ukraine starting midnight. That same day, The New York Times disclosed that Putin declared the start of a “special military operation” in Ukraine. Putin went on to “pledge” that he would aim for the “demilitarization and denazification of Ukraine” but did not intend to occupy Ukraine. Evidently, the Kremlin – Russian government – contends “that Ukraine’s military threatens Russia and that it is run by neo-Nazis.” Putin claimed that he was responding to pleas for assistance from the leaders of the Russian-backed separatist territories in Ukraine. Putin then warned against anyone trying to interfere with his plans. Such interference would be met by a Russian response that “will be immediate and will lead to such consequences as you have never before experienced in your history … We are ready for any turn of events.” Putin characterized Ukraine’s aspiration to join NATO as a “dire threat to Russia.” President Biden pledged new sanctions against Russia.

Financial Markets Reacted Quickly

Bloomberg communicated subsequently that Russia “hit” military targets in Ukraine on Wednesday night Eastern Standard Time (EST). Bloomberg also claimed that Russia confirmed war against Ukraine. Financial markets reacted quickly. Brent crude prices spiked to at least $101 per barrel (bbl) and WTI traded over $95/bbl. This was the first time since 2014 that Brent crossed the $100/bbl threshold. Early on February 24, these prices exceeded $105/bbl and $100/bbl, respectively. The price of wheat, soybeans and corn all traded more than 5% higher, gold was higher, cryptocurrencies spiked lower, USD rose. Global equity futures and stock markets were lower as well.

Cyberattacks – Possible and Real

On February 23, British newspaper The Daily Mail relayed that the U.S. warned of possible cyberattacks by Russia on banks, power plants, water treatment facilities, communications, satellites used for GPS navigation, farming, automation and oil exploration facilities. U.S. Homeland Security Secretary Alejandro Mayorkas said that it was the responsibility of the U.S. to be prepared for possible cyberattacks even though there have not been any specific threats. Nevertheless, the U.S. remains on high alert against such possible attacks. The American news website Axios disclosed on February 23 that a cyberattack hit Ukraine government websites and banks on that same day.

Reaction by Ukraine

On February 24, Ukrainian president Volodymyr Zelensky “introduced” martial law on the “whole territory” of their country. Zelensky said that “Russia conducted strikes on our military infrastructure and our border guards.” He then added: “No panic. We are strong. We are ready for everything. We will win over everybody because we are Ukraine.” That same day, AP announced that “Russian troops launched a wide-ranging attack on Ukraine on Thursday.” The Russian military claimed to have “wiped out” Ukraine’s entire air defenses in a matter of hours. “Global powers have said they will not intervene militarily to defend Ukraine.” Ukraine’s foreign minister described the attack as a “full-scale invasion.”

Putin as the “Hoochie Coochie Man”

Given Putin’s actions and demeanor, we chose to label Putin a “Hoochie Coochie Man” as sung by one of the all-time great blues singers Muddy Waters. We can imagine Putin saying “I’m gonna mess with you” as he has clearly done this week. We can also conjecture Putin thinking “whole round world know we here.” No doubt, Putin has the whole world’s attention now and we all know that he is “a son of a gun.” Perhaps Putin is the ultimate personification of Muddy Waters’ Hoochie Coochie Man. Maybe we might even hear Putin declare one day: “Yeah, you know I’m a hoochie coochie man.”

Buying into “Maximum” Uncertainty

The “stage” has been set. It is our contention that on Thursday morning we were probably at “maximum uncertainty.” What sanctions would the U.S. and its NATO allies impose? Will this coalition hold? What will be Russia’s response to sanctions? How severe will be supply disruptions of oil, natural gas, grains, metals and other commodities? To what extent will inflation and inflation expectations rise and to what extent will global economic growth slow? How will such a slowdown vary among countries? Will Putin be successful in his goal to change leadership in Ukraine, and install a regime more sympathetic to Russian interests? How long will this “war” last and how will it end? What surprises will there be? Has Russia’s invasion of Ukraine really strengthened NATO? It is our position that once the shooting and/or war begins, it is almost inevitable that unforeseen developments and consequences follow.

What to Buy?

Could things get worse after February 24? Of course they could. Could stocks go lower? Of course. But it is our judgment that attractive entry points on a risk/reward analysis often present themselves when uncertainty seems to be at a “maximum” level as we see it. We thought that there were many such opportunities from the opening of U.S. equity markets on February 24. We recommended that opportunistic investors look across all sectors for their most favored stock selections. We have observed over many years that in times of maximum uncertainty investors should focus on the highest quality companies with strong balance sheets and good cash flow projections. This is especially true under present circumstances when many major central banks have embarked, or are about to embark, on tightening monetary policies, which will “drain” liquidity from the financial system. Furthermore, equities had already suffered a rather severe downturn going into the Russia-Ukraine crisis, which was the other reason why we were convinced that many stocks across all sectors at the financial market opening price levels on Thursday morning offered attractive entry purchase points. Many equity prices showed very dramatic and very quick positive reversals during this same day. At roughly the same time, many “safe” haven assets – such as gold and USD – started to retreat from their highs. We maintain our conviction that USD will head lower during the course of this year.

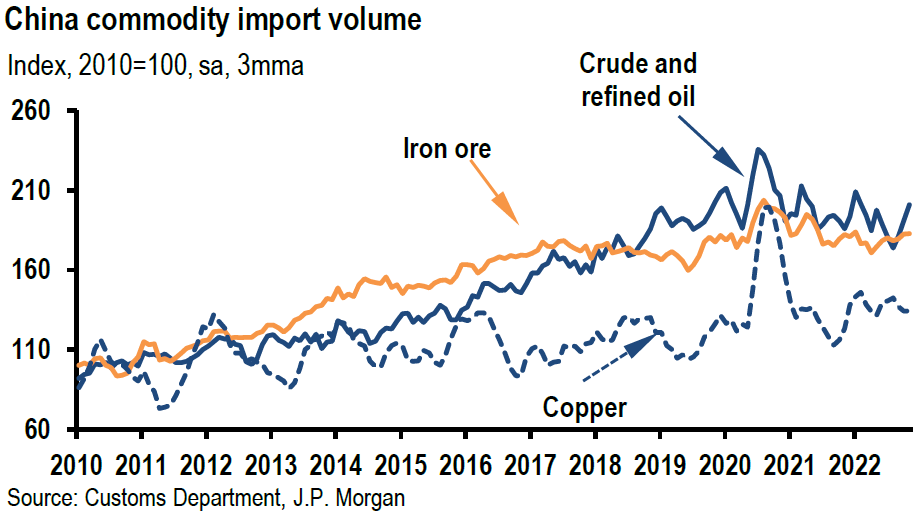

World is “Short” Commodities

Given the vastness of the combined amount and importance of commodity exports from Russia and Ukraine, the Russia-Ukraine situation could easily exacerbate inflation. On February 22, J.P. Morgan (JPM) characterized the world as “short commodities.” JPM estimated that tradeable commodity inventories were 25% lower in the aggregate over the past six months. The recent peak level of aggregate commodity inventories of 64 days of consumptions occurred in April, 2020. The current level of 48 days is a five-year low. Moreover, there is limited spare productive capacity for most commodities. For quite some time, we have been recommending commodities as a very effective hedge against inflation – this included energy stocks and their underlying commodities. We became cautious on our preference for energy in our weekly commentary dated February 11. “At least in the short run, we now foresee a possible volatile period for oil prices and energy-related securities from their relatively elevated price levels.” February 11 continues to be the peak level for XLE for a period that extends for more than two years. XLE is an ETF that tracks a market-cap-weighted index of U.S. energy companies in the S&P 500. From the February 11 closing prices through intraday trading levels on February 24, XLE was 5.91% lower while the WTI price rose by 2.41%.

Trading Commodity-Related Equities Compared to Underlying Commodity Prices

We highlight the divergence between the price movements of XLE versus the price of crude oil to show that trading and/or investing in commodity stocks is often not a straight-forward exercise. As Goldman Sachs likes to point out frequently, commodities are “spot price” assets whereas equities are not. Equities are very much “forward-looking” assets. Our experience has taught us that the relationship between the equity price of a commodity-based stock and the underlying commodity can be unpredictable. Sometimes the stock price “leads” the commodity and sometimes the pattern is reversed. For example, oil prices might rise and stay elevated for months and the energy stocks might not follow the upward trajectory. This would happen if the holders of energy stocks believed that the move higher in oil prices was not sustainable. We have experienced other occasions when oil prices have collapsed and energy equities started to move higher ahead of oil prices. An equity investor in energy stocks could then be a buyer as long as there was an expectation that oil prices were “bound” to rise within a reasonable time frame – say six months. The commodities trader does not have that luxury. Their timing needs to be more precise. Many current owners in energy stocks like to point out that their stock holdings are discounting a much lower price of oil when compared to the actual oil price. This can be comforting, but is not determinative. Perhaps the current prices of energy stocks are simply assuming lower future energy prices. The lower-than-expected stock prices are essentially then providing a cushion for the time that oil prices do in fact trade lower. There is no assurance, however, that this “value” gap will close in any foreseeable manner.

Underlying Global Economic Trends

Just as in last week’s commentary, we think it again appropriate to decipher the underlying trends in financial markets, the global economies and inflation trends apart from the Russian attack on Ukraine. We thought that the most informative economic data released this week were the “flash” Purchasing Managers’ Indexes (PMIs) of the Eurozone released on Monday of this week and that for the U.S. released on Tuesday. These flash PMIs, which reflect business activities, are both preliminary readings. Flash estimates are based typically on approximately 85% of the final number of replies that are expected for each monthly survey. Both sets of February PMI data showed very resilient consumers, businesses, economies and still strong inflationary trends. Better-than-expected and quick rebounds from the negative effects of the Omicron variant were prominently displayed.

Source: Goldman Sachs, A strong profit cycle but peaking margins: identifying companies vulnerable to wage growth (2/23/2022)

Source: Goldman Sachs, US Economics Analyst: More Jobs than Workers: A New Measure of Labor Market Tightness (2/18/2022)

Eurozone PMIs

The Eurozone Composite, which incorporates both manufacturing and services sectors, hit a five-month high as of Monday, February 21. The services activity index rose from January’s 51.1 level to 55.8, which was much higher than expected. Any reading above 50 indicates an expansion of business activity. The February rebound was precipitated by the relaxation of COVID-19-related restrictions, the rise in future expectations, new orders and the improvement of job growth. Manufacturers reported increased production due to higher demand and fewer bottlenecks. The services sector future output expectations registered the highest readings since last June. The easing of supply delays in the services sectors was not sufficient to overcome inflationary pressure due to rising wages and higher energy costs. The end result was the sharpest rise in average prices of goods and services in the history of Eurozone PMIs. Increasing demand led to the largest increases in backlogs of uncompleted work in six months. Prices received by service sector companies were the highest ever recorded and those received by manufacturers were near record highs. The chief business economist at IHS Markit commented that “demand has again outstripped supply, handing pricing power to producers and service providers.”

Source: HIS Markit Ltd., IHS Markit Flash Eurozone PMI (2/21/2022)

U.S. PMIs

The February IHS Markit flash U.S. Composite PMI readings, released Tuesday, February 22, showed a similar pattern of a rather remarkable rebound in business activities from January levels. This was especially true for the services sector which rebounded to a reading of 56.0 from January’s 51.1 level. Stronger manufacturing levels were helped by the easing of supply bottlenecks. Many companies thought that increased output levels for manufacturers and services were attributable to new business, employees returning from sick leave, increased travel and greater availability of raw materials. New business among private sector companies grew at the fastest pace in seven months. Customers reportedly made additional purchases to avoid future price hikes. The pace of job growth at service firms reached a nine month high. The diminishing Omicron variant infections were clearly helping.

Source: IHS Markit Ltd, IHS Markit Flash US Composite PMI (2/22/2022)

February Economic Resiliency was Encouraging

The resiliency and rebound in economic growth in February was very encouraging in regard to future global economic growth. Given this economic data, we are assuming that global economies will show a similar resiliency and will rebound from any slowdown of economic growth due to either direct or indirect repercussions of the Russia-Ukraine conflict. But on the margin, we do expect higher inflation rates and slower economic growth for as long the conflict continues.

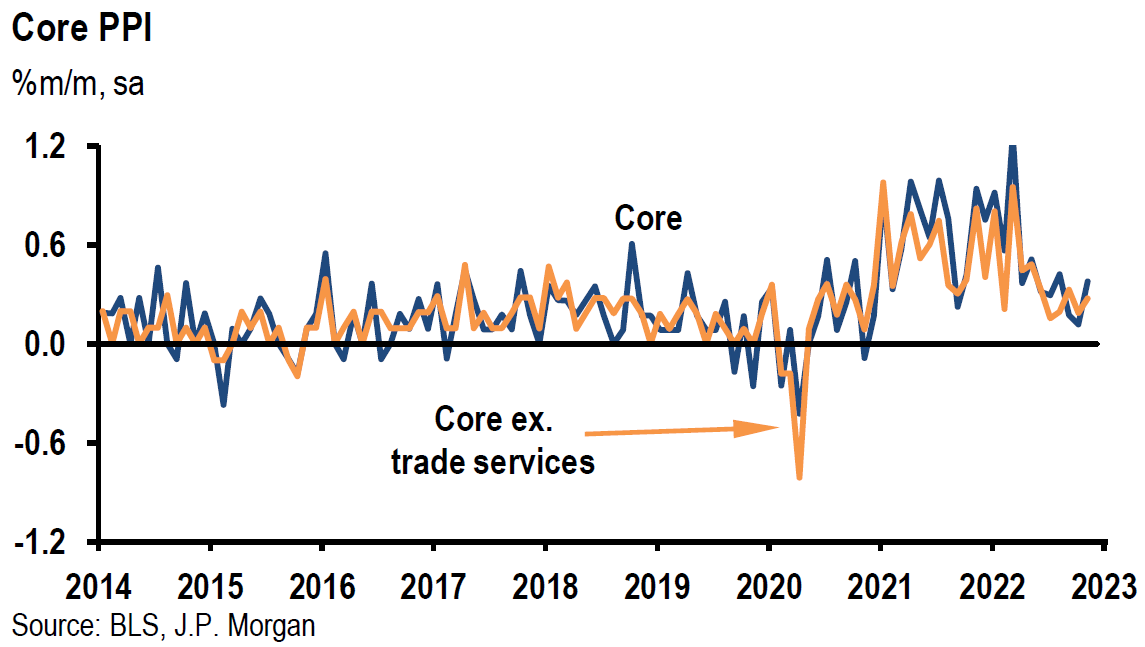

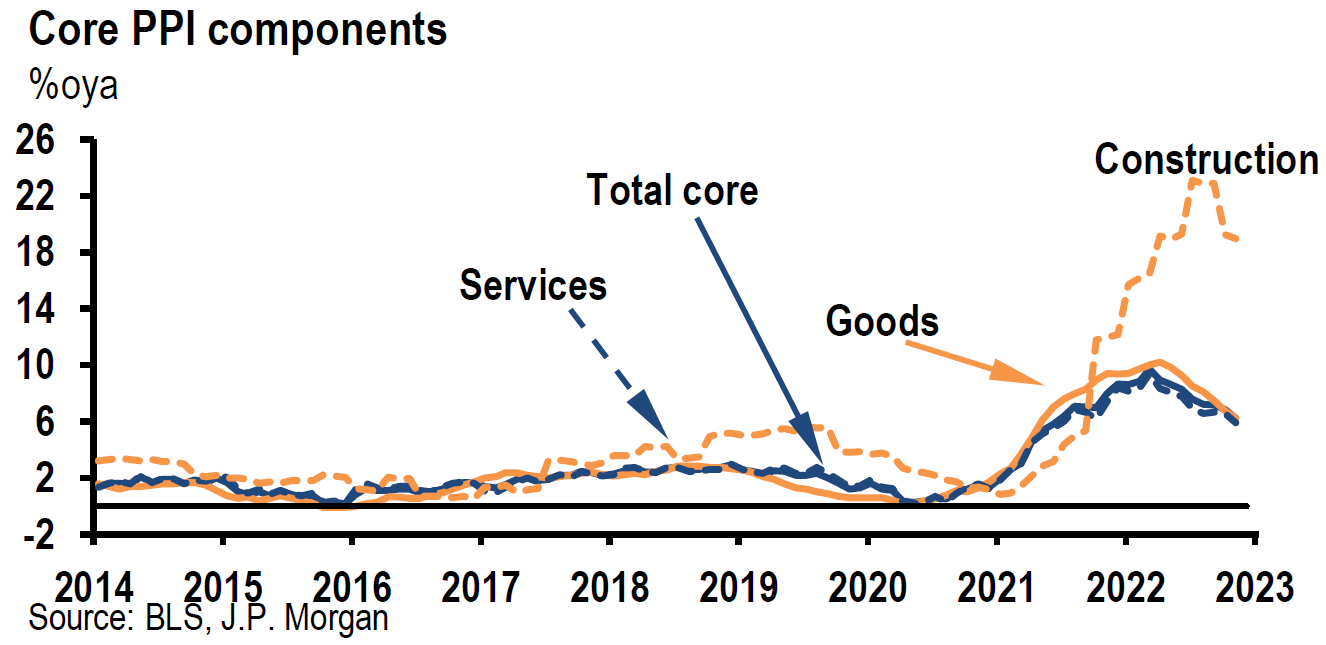

Source: J.P. Morgan, US Weekly Prospects (2/18/2022)

Fed Tightening Policies Remain On Track

We maintain our conviction that the Fed will adopt a very aggressive stance in tightening its monetary policies. Additionally, we continue to look forward to the Fed raising the federal funds rate by 25 bps at its mid-March meeting. Furthermore, we agree with the Fed’s assumption that the best way to ensure a steady and sustainable path for economic growth under current circumstances is to restrain inflation and ensure the “anchoring” of inflation expectations. Hopefully, the Russian-Ukraine conflict will prove to be short-lived. The longer that conflict persists, the better the chance that global economies will slow with higher inflation rates.

Considering that monetary policies operate with an average lag of roughly nine months, we do not foresee the Fed slowing the implementation of its tightening policies unless global economic growth slows substantially. We do not forecast such a scenario. However, we contemplate that financial markets will remain volatile and that it will be difficult to sustain equity rallies prior to the Fed’s mid-March meeting.

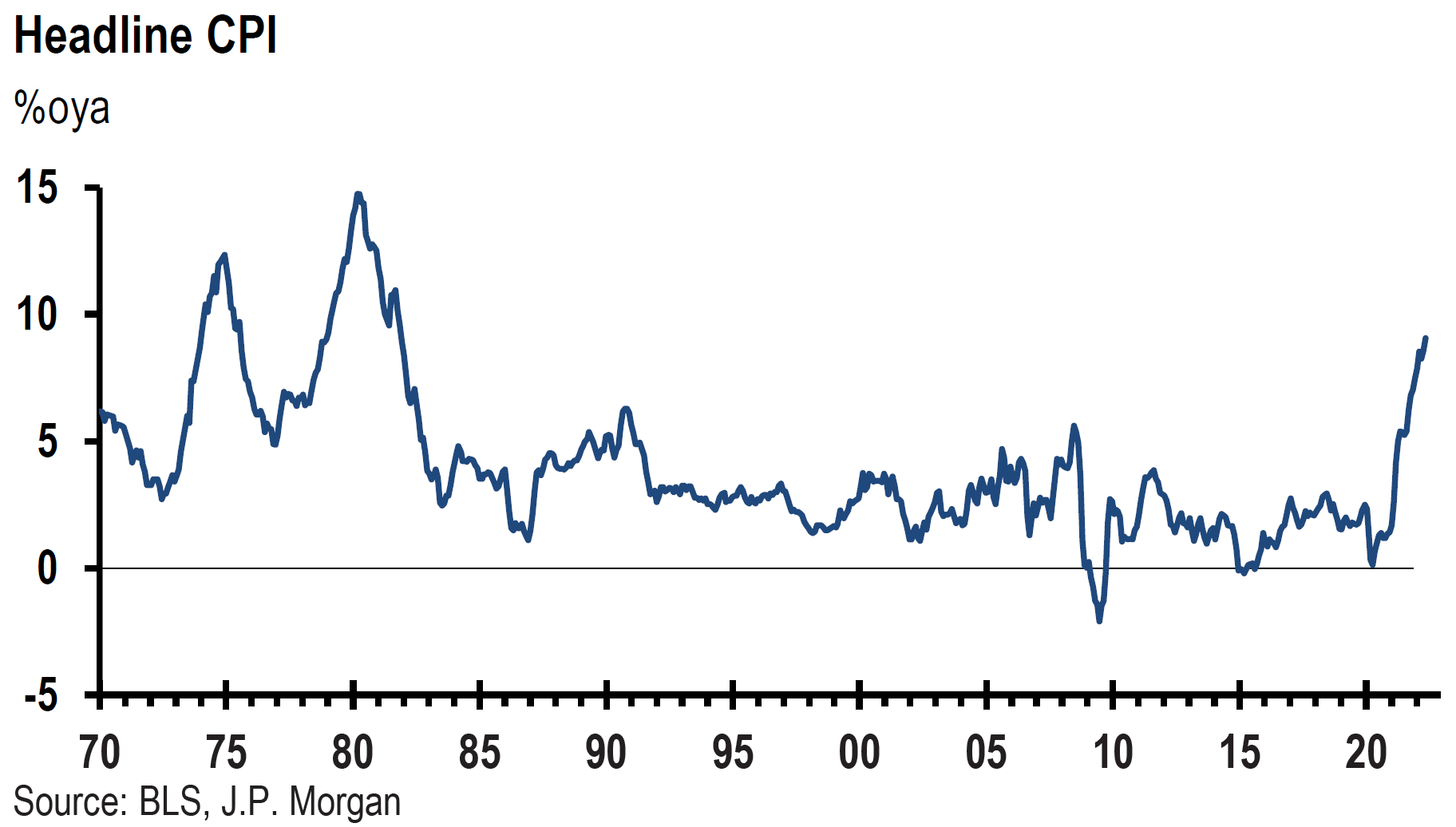

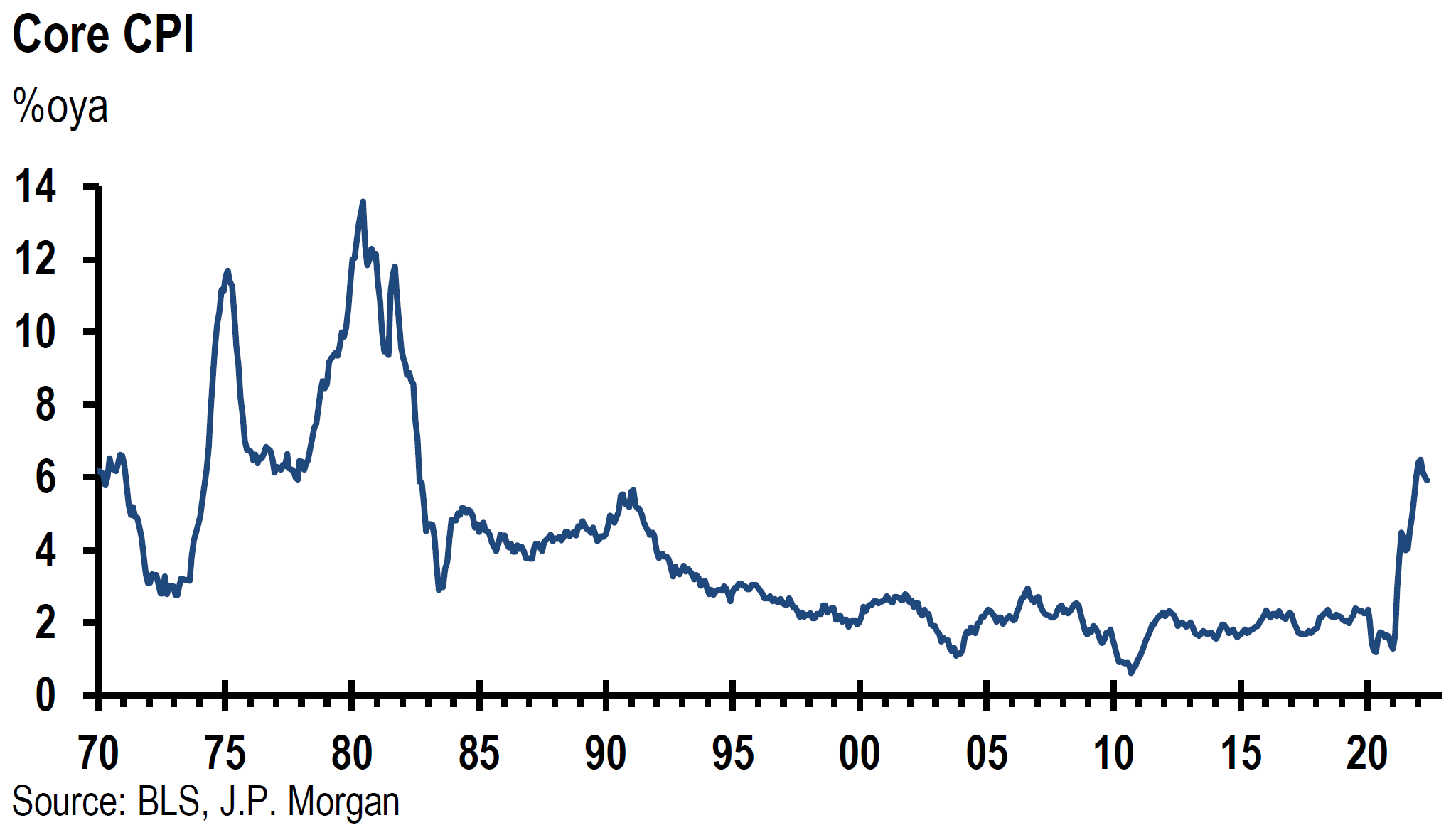

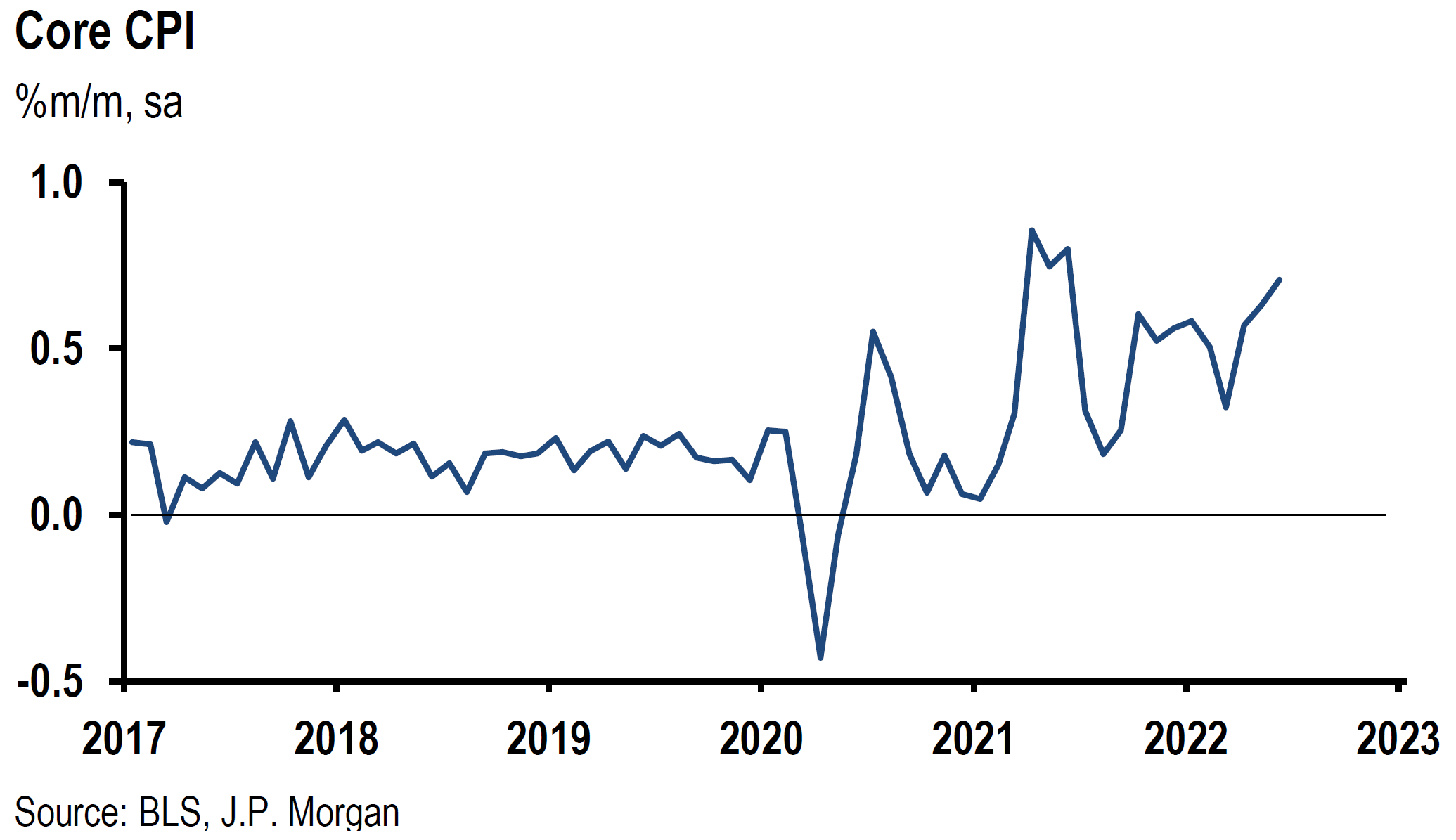

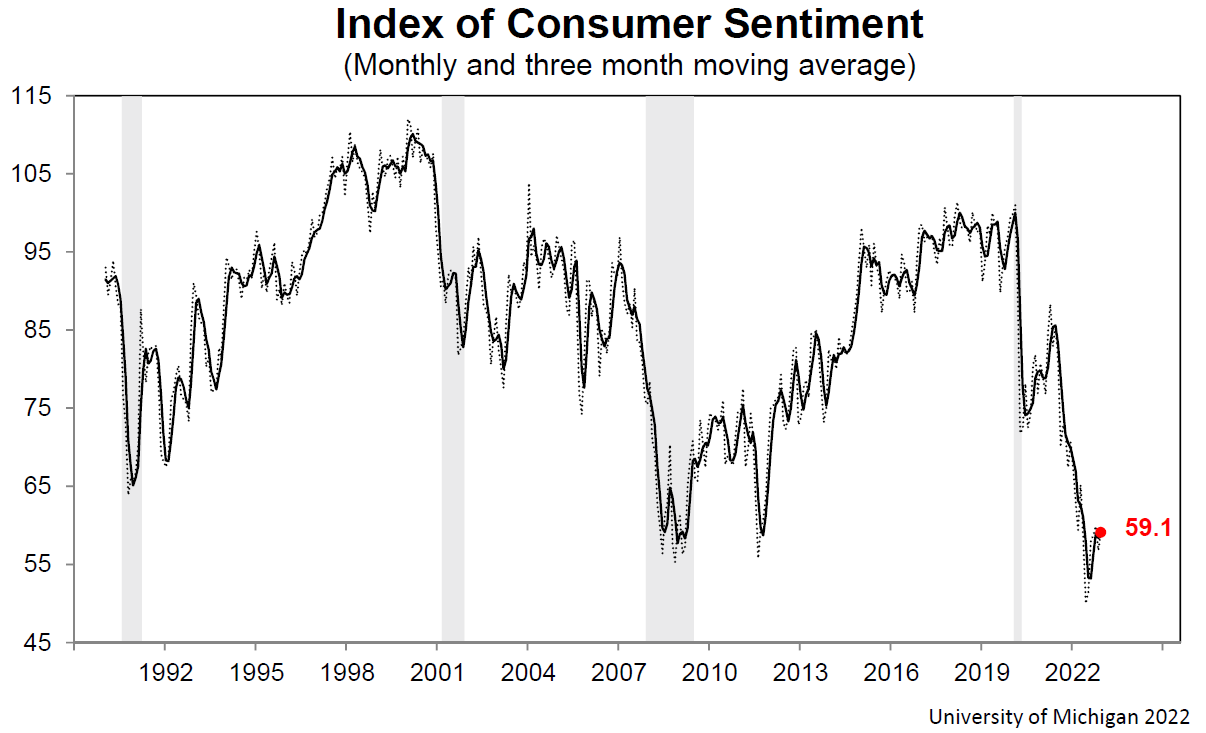

Source: Goldman Sachs, US Daily: The Distribution of Inflation (Another Thing to Worry About) (2/22/2022)

Bottom Line

Given the increased level of uncertainties due to the invasion of Ukraine on top of uncertainties in regard to inflation, global economic growth rates and Fed policies, we retain our outlook that equity rallies will not be sustainable until at least the Fed’s mid-March meeting. We suppose continued volatility across all financial markets. These increased uncertainties have led us to consider ALL sectors in our search for the most attractively priced stocks. As uncertainties have increased, so has the need for stock selectivity as well. We contemplate a more difficult period of investing in commodity-linked equities relative to their underlying commodity prices.

We continue to favor diversified portfolios that include selected European and EM equities for long-term investors. Companies with strong balance sheets and strong cash-generating attributes could become increasingly attractive. We continue to foresee higher interest rates, higher-than-consensus inflation rates, robust global economic growth, a weaker USD and strong but volatile commodity prices.

Definitions

Eurozone – The eurozone, officially called the euro area, is a monetary union of 19 member states of the European Union that have adopted the euro as their primary currency and sole legal tender.

The STOXX Europe 600 Index (SXXP) – The STOXX Europe 600 Index is derived from the STOXX Europe Total Market Index (TMI) and is a subset of the STOXX Global 1800 Index. With a fixed number of 600 components, the STOXX Europe 600 Index represents large, mid and small capitalization companies across 17 countries of the European region: Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Norway, Poland, Portugal, Spain, Sweden, Switzerland and the United Kingdom.

NASDAQ – The Nasdaq Composite Index is the market capitalization-weighted index of over 2,500 common equities listed on the Nasdaq stock exchange.

Associated Press (AP) – The Associated Press is an American non-profit news agency headquartered in New York City. Founded in 1846, it operates as a cooperative, unincorporated association. Its members are U.S. newspapers and broadcasters.

West Texas Intermediate (WTI) Crude – West Texas Intermediate can refer to a grade or a mix of crude oil, and/or the spot price, the futures price, or the assessed price for that oil; colloquially WTI usually refers to the price of the New York Mercantile Exchange WTI Crude Oil futures contract or the contract itself.

Brent Crude – Brent Crude may refer to any or all of the components of the Brent Complex, a physically and financially traded oil market based around the North Sea of Northwest Europe; colloquially, Brent Crude usually refers to the price of the ICE Brent Crude Oil futures contract or the contract itself.

The Purchasing Managers’ Index (PMI) – The Purchasing Managers’ Index (PMI) is an index of the prevailing direction of economic trends in the manufacturing and service sectors. It consists of a diffusion index that summarizes whether market conditions, as viewed by purchasing managers, are expanding, staying the same, or contracting. The purpose of the PMI is to provide information about current and future business conditions to company decision makers, analysts, and investors.

Eurozone Composite – In the Euro Area, the Markit Eurozone PMI Composite Output Index tracks business trends across both the manufacturing and service sectors, based on data collected from a representative panel of over 5,000 companies (60 percent from the manufacturing sector and 40 percent from the services sector). The index tracks variables such as sales, new orders, employment, inventories and prices. National data are included for Germany, France, Italy, Spain, Austria, the Netherlands, Greece and the Republic of Ireland. A reading above 50 indicates expansion in business activity and below 50 indicates that it is generally declining.

bbl – An abbreviation for oilfield barrel, a volume of 42 galUS [0.16 m3].

Cyberattack – An attempt by hackers to damage or destroy a computer network or system.

Re-opening trade – The reopening trade means buying stocks that will benefit from an open economy, domestically and globally.

Kremlin – the Russian or (formerly) Soviet government.

NATO – The North Atlantic Treaty Organization (NATO), also called the North Atlantic Alliance, is an intergovernmental military alliance between 28 European countries, 2 North American countries. The organization implements the North Atlantic Treaty that was signed on 4 April 1949.

Emerging Market Economy (EM) – An emerging market economy is the economy of a developing nation that is becoming more engaged with global markets as it grows. Countries classified as emerging market economies are those with some, but not all, of the characteristics of a developed market.

Federal Funds Rate – The term federal funds rate refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

U.S. Dollar Index (DXY) – The U.S. Dollar Index is an index of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners’ currencies. The Index goes up when the U.S. dollar gains “strength” when compared to other currencies.

The Energy Select Sector SPDR Fund (XLE) – XLE seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the Energy Select Sector Index (the “Index”). The Index seeks to provide an effective representation of the energy sector of the S&P 500 Index.

Basis Points (bps) – A basis point is one hundredth of one percent, used chiefly in expressing differences of interest rates.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/fast-answers/answersindiceshtm.html or http://www.nasdaq.com/reference/index-descriptions.aspx.

All data is subject to change without notice.

© 2024 NewEdge Capital Group, LLC