Weekly Summary: January 10 – 14, 2021

Key Observations:

- Our expectation of market volatility and rotation into Value/Cyclical types of stocks was realized in the first few trading days of 2022.

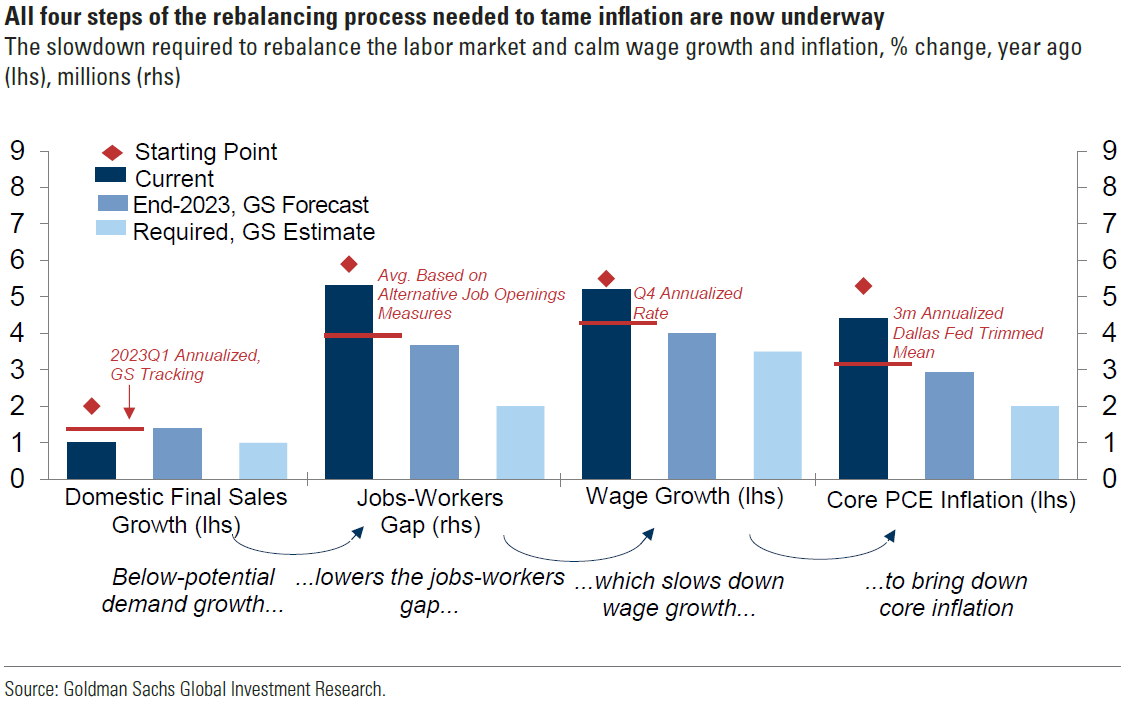

- Increasing inflation, accompanied by a tight labor market and increasing wages, could easily lead to higher inflation expectations and eventually to actual elevated inflation.

- The Federal Reserve (Fed) has realized that the best way to ensure a stable economy and continued full employment at present is through a stable price environment. It therefore does not have to choose between its goals of controlling inflation and achieving and maintaining full employment.

- Financial markets seem to react forcefully to changes in the perceived Fed policy, even if they perceive only a nuanced change. An example of this was the perception that Fed chair Powell was less “hawkish” in his confirmation testimony than was shown in the minutes of the December 14-15 Federal Open Market Committee (FOMC) meeting.

The Upshot: The longer inflation is allowed to persist, the more likely will such expectations become more “entrenched.” The Fed is concerned that wage gains above worker productivity gains could possibly lead to a wage-price spiral type of inflation. Such an inflation would tend to be more persistent. Expectations of wage gains, along with a tight labor market, are manifestations of the beginning expectations of continued elevated inflation. The latest University of Michigan survey of consumer sentiment confirms the appropriateness of the Fed’s concerns and focus on inflation.

Tight U.S. Labor Markets

The refrain from Bob Dylan’s “Maggie’s Farm” song, “I ain’t gonna work on Maggie’s farm no more,” is probably a good description of some workers’ attitudes today with respect to their willingness for working at certain jobs. Given all of the media attention on the tightness of the U.S. labor market and wage increases in general, workers have become very discerning on their job selections – very often demanding higher wages and benefits. Alternatively, as Bob Dylan seemingly concluded, some workers just haven’t found any satisfactory jobs. As we have discussed in many of our prior commentaries, there are many indications of a tight labor market. On January 4, 2022, CNBC cited the Labor Department’s Job Openings and Labor Turnover Survey (JOLTS), which indicated that a record 4.53 million U.S. workers quit their jobs in November, 2021. That number represented 3% of the U.S. workforce, which was equal to September’s record percentage. Although U.S. job openings decreased from October’s level, there were still over 1.5 times the number of job openings for each person out of work and looking for jobs.

Real Wages Also Matter

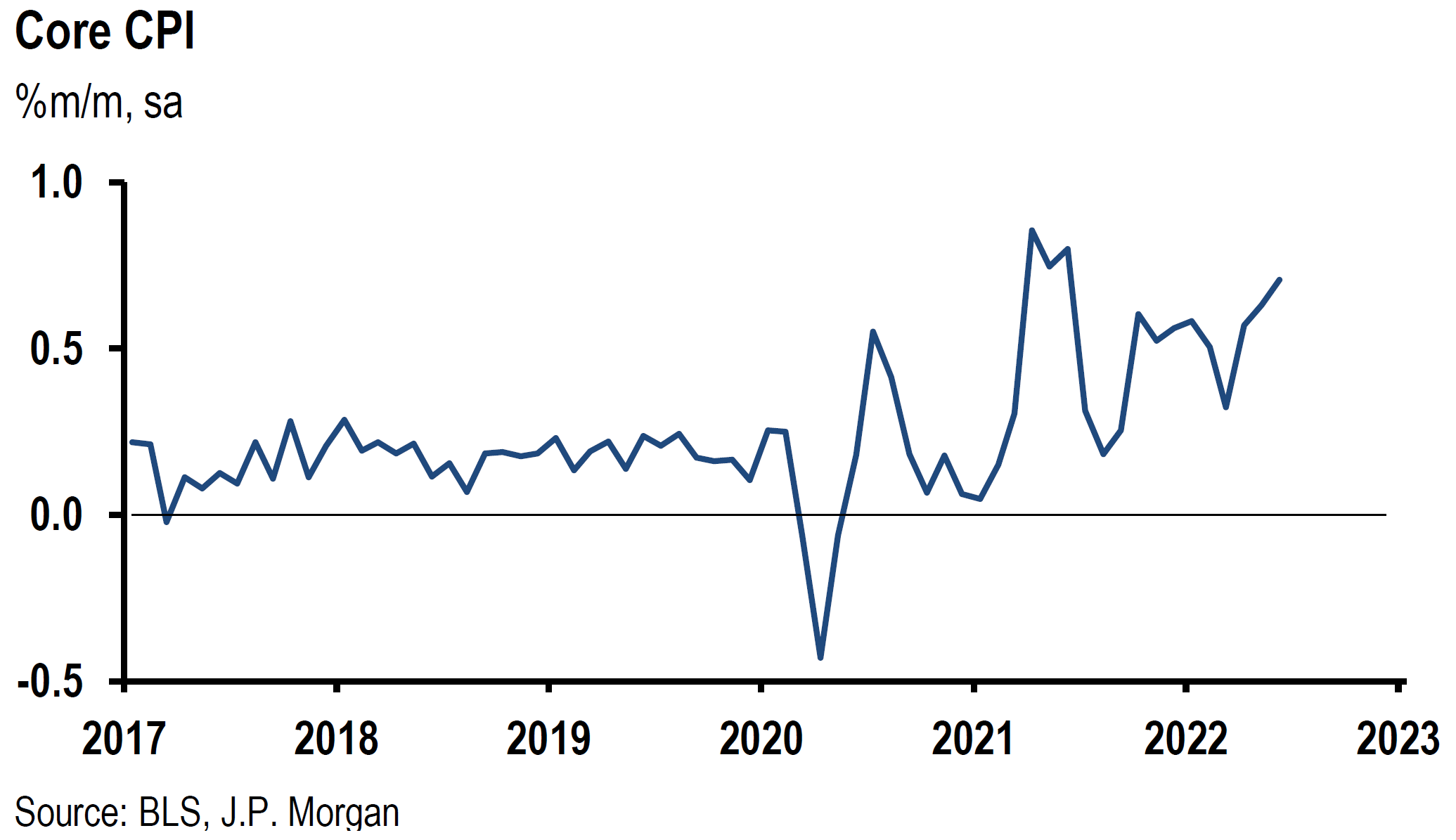

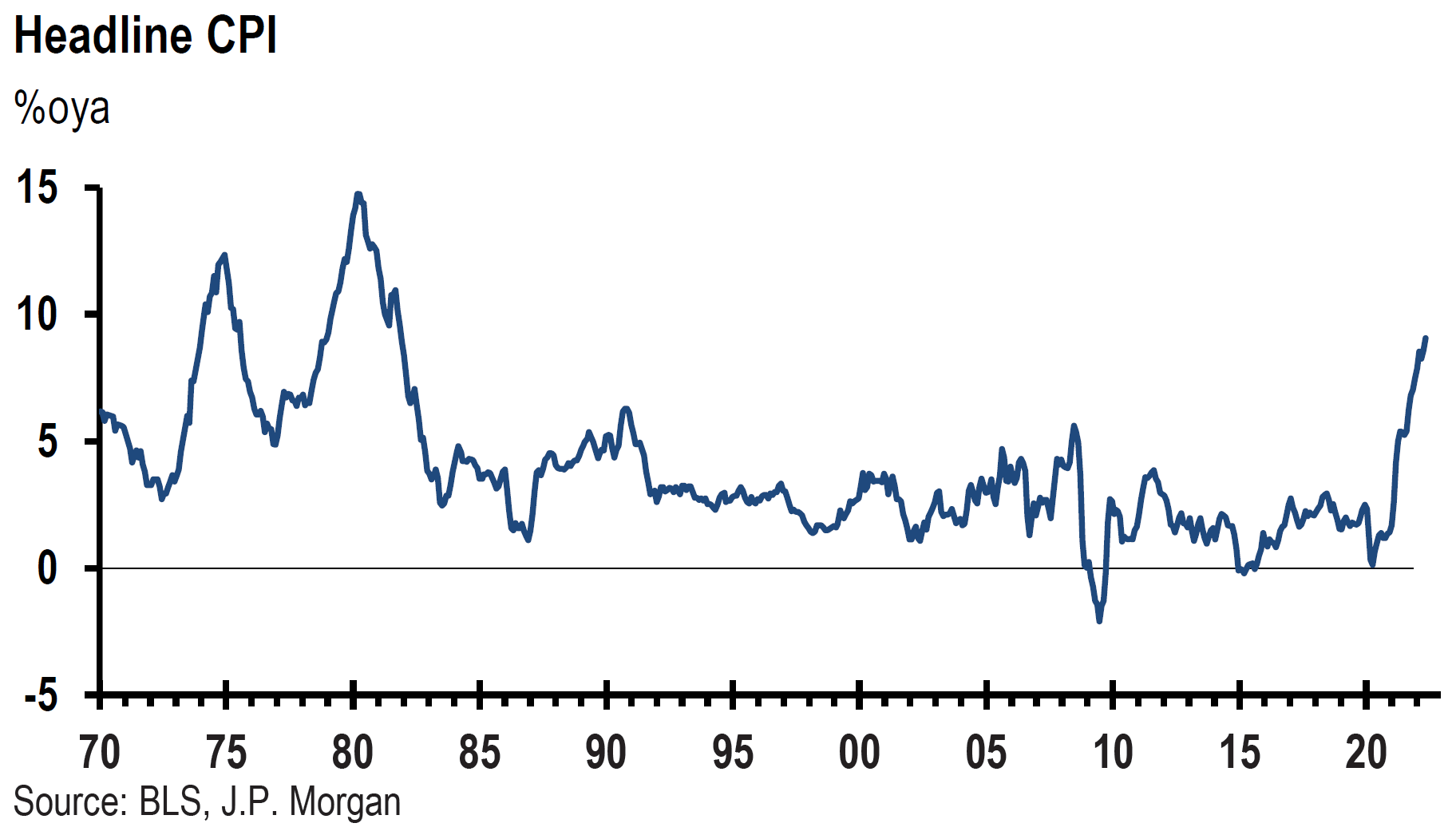

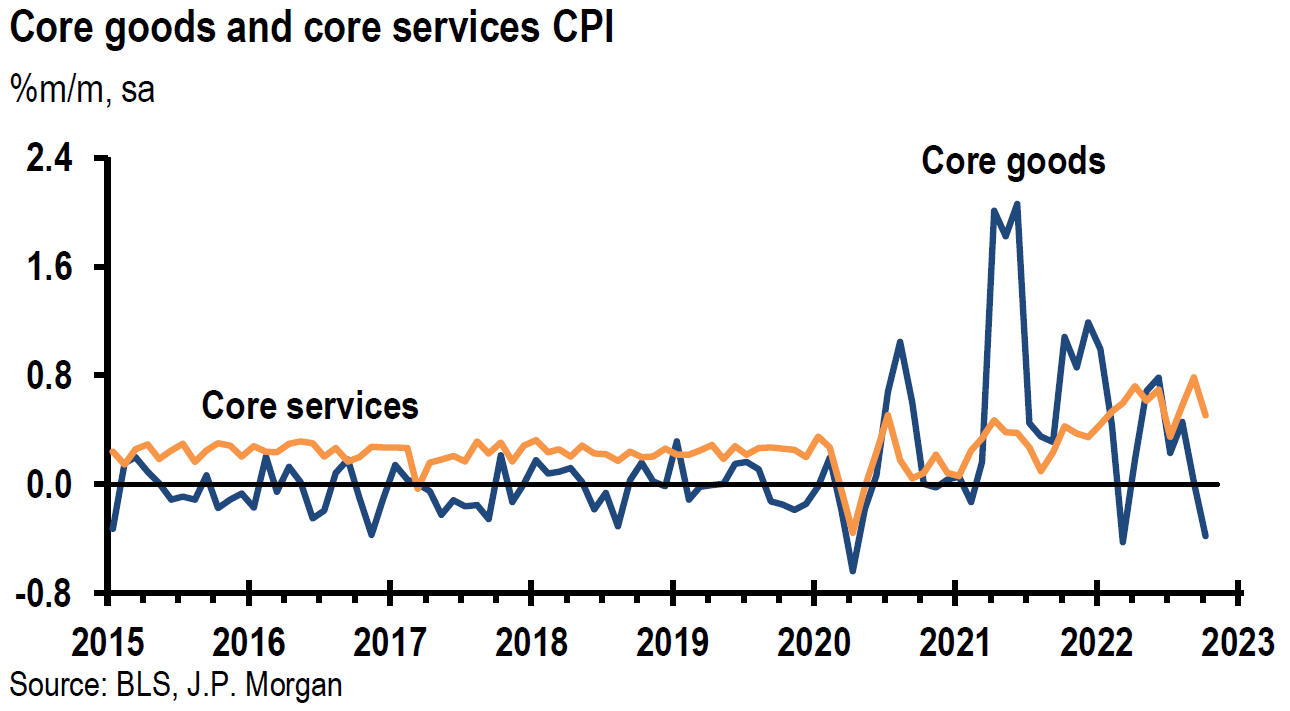

December’s unexpectedly low 3.9% unemployment rate was another indicator of labor market tightness. December’s average hourly earnings increase of 4.7% year-over-year exceeded consensus expectations of 4.2%. The unwillingness of many people to rejoin the workforce was typified by the labor force participation rate remaining stubbornly 1.5% below the pre-pandemic level from February 2020. December 2021 saw the highest year-over-year Consumer Price Index (CPI) increase since 1982. After taking into account that record CPI increase, a CNBC report from January 12, 2022 highlighted that real wages actually decreased 2.4% year-over-year. Our prior commentaries have also mentioned that the wage picture is complicated further by lagging worker productivity. Diminishing worker productivity increasingly could become a problem for companies maintaining and growing their profit margins. These concerns should enhance the attractiveness of investing in companies whose wage costs account for a relatively small portion of their revenues.

Source: J.P. Morgan, US: Another solid month for CPI inflation (1/12/2022)

Fed Determined to Rein In Inflation

Both the minutes of the FOMC’s December 14-15 meeting released on January 5, 2022 and Fed chair Powell’s testimony on January 11 in his confirmation hearings before the Senate Banking Committee, underscored the Fed’s focus on reining in inflation. The minutes noted that “inflation readings remained high, and various indicators suggested that inflationary pressures had broadened in recent months.” Participants at the meeting stressed that supply chain bottlenecks and labor shortages prevented many businesses from meeting strong demand for their products and/or services, while also contributing to elevated levels of inflation. The meeting’s participants generally expected global supply bottlenecks to persist well into next year. Powell agreed with the assessment in his testimony this week, while stating that supply bottlenecks should diminish by mid-2022.

Inflation Expectations and Wage Increases – Closely Linked

But no one seemed willing even to guess when labor force tightness will dissipate. Instead, many participants were very concerned that the “risk of wage growth above productivity growth could trigger inflation wage-price dynamics.” Powell also reiterated the concern expressed in the minutes that the longer inflation persists, the higher the risk that inflation expectations will become entrenched, which would lead to further inflation. In fact, Powell now expressed his belief that the best way to sustain full employment is to achieve price stability. In other words, the Fed was not sacrificing full employment to control inflation. Some of the surveys portrayed in our prior commentaries supported this view. These surveys generally indicated that the very high inflation rates of the past few months were beginning to affect consumer and business sentiment. Increasing prices were even beginning to meet with some resistance.

Consumer Sentiment – University of Michigan Preliminary Survey for January

The preliminary consumer sentiment data for January was released by the University of Michigan on Friday. This data confirmed our view that inflation was the principal concern of consumers and that these concerns were continuing to weigh on consumer sentiment. The Index of Consumer Sentiment dropped to 68.8, which was the second lowest reading in a decade, from 70.6 in December and was below expectations of 70.0 as indicated by polls of economists by Bloomberg and Reuters. The economic conditions subindex and the expectations gauge also showed declines from December levels. The Michigan report stated that “three-quarters of consumers in early January ranked inflation, compared with unemployment, as the more serious problem facing the nation. Given that inflation’s impact is regressive, the Sentiment Index fell 9.4% among households with incomes below $100,000 in early January but rose by 5.7% among households with incomes over that amount.” In general, consumers were more likely to assume “bad” economic times in the year ahead. Confidence in government economic policies was at its lowest since 2014.

The University of Michigan seemed to agree with the Fed: “The most crucial and difficult task will be defusing the developing wage-price spiral.” We agree. The lower their incomes, the more likely that consumers were to comment on their worsening finances. The most common explanation was the inflationary erosion of their living standards. “Nearly half of all consumers (48%) anticipated that the inflation rate would outdistance income increases to produce real income declines. Just 17% anticipated real income gains in 2022.” Consumers’ inflation expectations also rose for both the year ahead (4.9% vs. 4.8%) and for the next five years (3.1% vs. 2.9%).

This survey confirms the importance of the Fed’s focus on inflation and a possible wage-price spiral.

Beige Book – Supply-Chain Disruptions and Tight Labor Markets Continue to Affect Growth and Inflation

The Fed’s Beige Book summary of comments, received from nation-wide contacts outside the Federal Reserve System on or before January 3, reiterated that supply-chain disruptions and a tight labor market were hampering economic growth and exacerbating inflationary pressures. Although consumption trends remained robust, growth expectations were diminishing. In our opinion, the tight U.S. labor market will continue to exert upward pressure on inflation rates for the foreseeable future.

Why Focus on Tight Labor Market and Rising Wages?

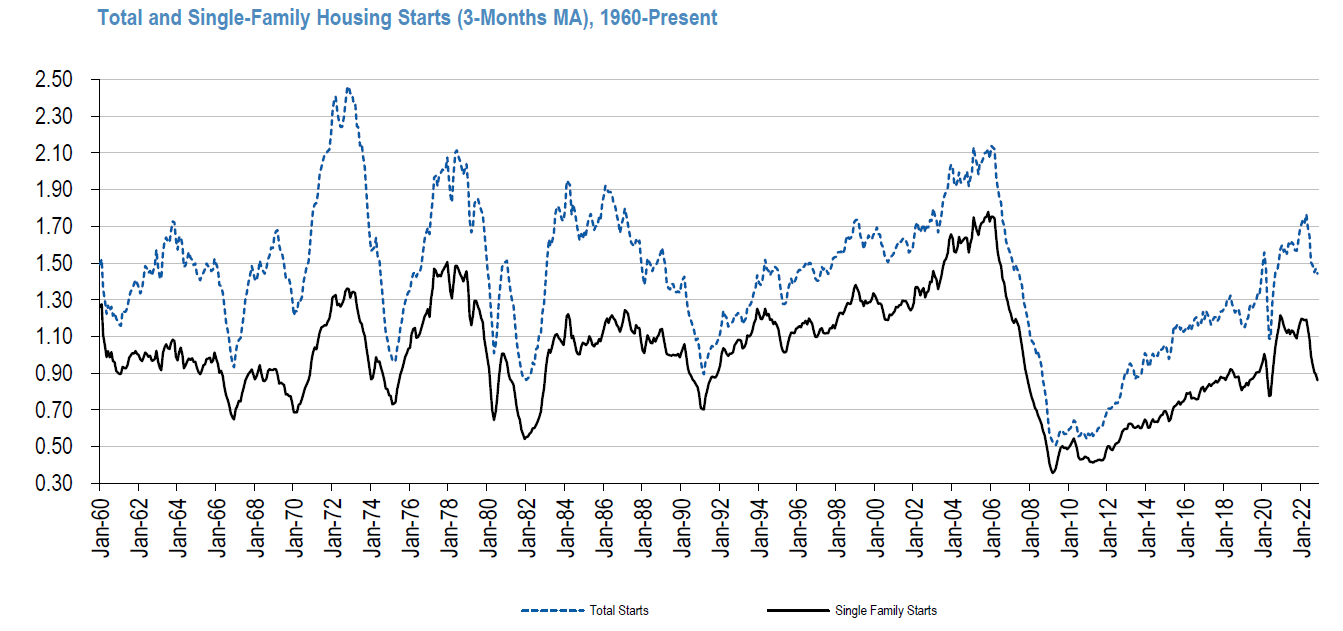

Although there are many factors that contribute to increasing rates of inflation, which we have enumerated many times, we chose to focus on the U.S. labor market and increasing wages because we view this area as the best direct expression of inflation expectations. The Fed is now similarly focused on trying to ensure that inflation expectations do not become “entrenched.” Wage increases are also one of the more “persistent” types of inflation components. Once achieved, wage increases are typically very difficult to roll back. Another type of a more “sticky” inflation tailwind is shelter costs. Shelter costs account for almost one-third of the Consumer Price Index (CPI). In December, shelter costs grew at the rate of 4.1% year-over-year. Although as Goldman Sachs’ January 11 report reflects, there was a slight deceleration of rental costs and owners-equivalent rent when compared to their last three-month averages, we still expect solid shelter cost increases in the months ahead.

More Factors Contribute to More Persistent Inflation

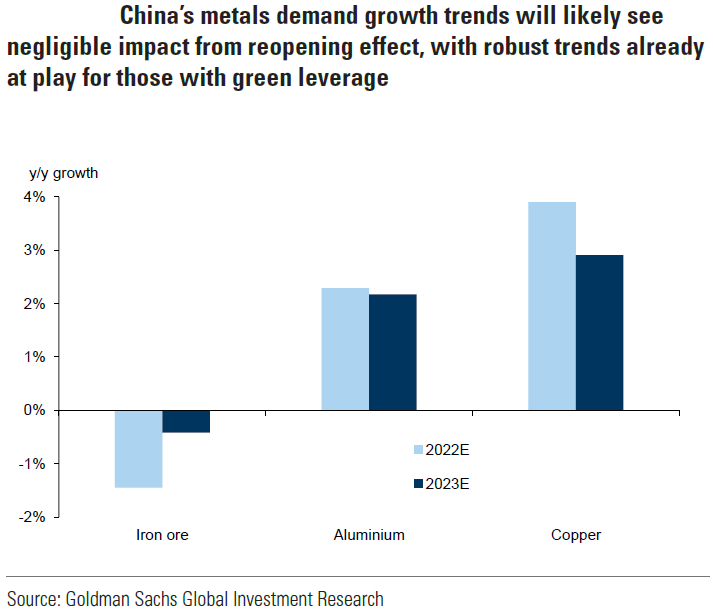

Development of more resilient supply chains, relaxing “just-in-time” inventory policies, and switching to more renewable energy sources are among the many other persistent types of inflation we have enumerated in previous commentaries . There is also a reasonable probability that supply-chain disruptions might persist for longer than anticipated given China’s current “zero-COVID-19” policies. China continues to “lockdown” areas where even minimal outbreaks of coronavirus appear. China’s vaccine used to inoculate most of its citizenry against coronavirus, appears rather ineffective against the Omicron variant. We therefore suppose that China’s strict policies will continue to be observed at least through Beijing’s Winter Olympics, which are scheduled to begin in early February this year. Perhaps, China might even relax some of its strictest policies used to contain coronavirus infections post-Olympics. Severe weather, as well as energy shortages could also disrupt supply chains at any time.

Source: Goldman Sachs, Commodity Views: Finding value in scarcity (1/13/2022)

Fed Policies as We Understand Them

We are convinced that the Fed’s asset purchase program will be concluded as of its March meeting and that the Fed will begin to hike interest rates to coincide with that meeting. We anticipate a total of at least four rate hikes in 2022. We trust that the Fed will begin the “runoff” (shrinking) of its balance sheet no later than July. However, we also admit that we would not be surprised if the runoff started in June, or even earlier. The Fed minutes released on January 5, 2022 made it clear that the Fed would be very aggressive in shrinking its balance sheet of almost $9 trillion. The Fed expressed its desire for trying to steepen the Treasury yield curve through balance sheet reduction. A steepening yield curve occurs when interest rates on longer-dated maturities rise faster than shorter maturities. The minutes stated that a steepening yield curve probably would make banks more profitable, which would make the banks be more willing to make loans and help stabilize the financial system in general.

Financial Market Reactions to Anticipated Fed Policies

The financial markets were surprised by the hawkish tone of the minutes and by the fact that the balance sheet runoff was discussed at length and in such detail. The minutes were as we expected. The market reactions were swift and rather clear. The minutes’ revelation accentuated a rotation into Value/Cyclical types of stocks and away from Growth. We have faith in the durability of this rotation. On its worst intraday low on Monday of this week, Nasdaq was 7.13% lower for the year, off approximately 8.5% from its recent peak, and down 2.72% during trading, before finally closing +0.5% for the day. All other major U.S. equity averages had similar reversals, but remained in negative territory. At their lows for the day on Monday, January 10, the S&P 500 was down 2.03% for the day and down 3.86% for the year, the Dow was off 1.63% for the day and 1.92% for the year, and the Russell 2000 was 2.14% lower for the day and down 5.0% for the year.

The rebound accelerated the following day after Powell gave his Senate testimony. We surmise that the equity rebound accelerated because the market interpreted Powell’s testimony as less “hawkish” than the minutes – especially with respect to the Fed’s balance sheet reduction plans and the timing of the runoff. Powell said that it could take two, three, or even four meetings before a decision would be made. But we assume that the first such meeting has already occurred, namely the meeting of December 14-15, 2021. Although we don’t expect the Fed to start any runoff before its anticipated first interest rate hike in March, we interpret Powell’s comments to mean that the balance sheet announcement could happen earlier – perhaps as early as at the Fed’s January 25-26 meeting.

Accompanied by lower Treasury yields, the major U.S. equity averages resumed their downturn towards the end of this week. The Nasdaq was the worst performer of the U.S. equity averages on January 12. At Thursday’s close, all major U.S. equity indexes were above their Monday intra-day low prices for the year. But the S&P 500 close on Thursday was its lowest close since December 21, 2021.

Source: Goldman Sachs, US Macroscope: Five questions and answers on interest rates and US equities (1/12/2022)

Our 2022 Expectations

The first two weeks of 2022 showed that most of our expectations expressed in the January 2, 2022 Year Ahead report were rather prescient. These first two weeks increased our confidence in our anticipation of the following: a volatile start to the year, a rotation into Value/Cyclical types of stocks and away from Growth stocks, an increase in Treasury yields, and a decrease in the USD as expressed by the U.S. Dollar Index (DXY). Furthermore, our expectations of increases in commodity prices – especially for copper, which closed above $10,000/ton during this week for the first time since October 2021, and for crude oil, were bolstered by the weaker USD.

We still maintain that a weakening dollar will increase U.S. inflation and make emerging market (EM) equities and European equities more attractive for investors. It will also enhance the attractiveness of companies with large overseas exposure in terms of their revenues and profits.

On January 10, Goldman Sachs observed that the real yield increase of 35 bps for the 10-year Treasury yield during the first week of this year was one of the largest weekly moves on record. Moreover, during that first week, the nominal yields on the 10-year sovereign bonds for both the U.S. and Germany reached their highest levels of the pandemic.

Our “forecast” of an early increase in airline stock prices as an indication of investors’ willingness to look through negative Omicron effects was substantiated by increases in Delta Air Lines’ stock price. The company’s prediction of a “meaningful” rebound in its 2022 profits even though the Omicron variant was expected to impact negatively the airline’s profitability early in 2022, only confirmed our view.

Our expectation of the Fed being more hawkish than consensus expectations was confirmed by minutes of the FOMC December 14-15 meeting. It is too early to assess the probability of many of our other expectations, such as above consensus assumptions about global economic growth, higher inflation rates, and below-consensus profit margins.

Source: Goldman Sachs, Metals Watch: Aligned for the next leg higher (1/11/2022)

Bottom Line

The Fed’s focus now is clearly on reining in inflation and on not allowing inflation expectations to become “entrenched.” The latest University of Michigan survey of consumer sentiment clearly shows why the Fed’s focus, in our opinion, is what is most needed at present.

Market uncertainty about the Fed’s anticipated policies appears to be centered on the timing of the Fed’s balance sheet shrinking. The volatility of financial markets seems to increase along with a rotation into more Value/Cyclical types of stocks, to the extent that the market perceives that the Fed will adopt a more near-term runoff of its balance sheet. The market interprets such an approach as more “hawkish.” We believe that market volatility will continue. We also expect that the rotation into Value/Cyclical type stocks will prove to be durable.

Definitions

U.S. Dollar Index (DXY) – The U.S. Dollar Index is an index of the value of the United States dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners’ currencies. The Index goes up when the U.S. dollar gains “strength” when compared to other currencies.

Federal Open Market Committee (FOMC) – The Federal Open Market Committee (FOMC) is the branch of the Federal Reserve System that determines the direction of monetary policy specifically by directing open market operations. The committee is made up of 12 members: the seven members of the Board of Governors; the president of the Federal Reserve Bank of New York; and four of the remaining 11 Reserve Bank presidents on a rotating basis.

Beige Book – The Beige Book is a report produced and published by the U.S. Federal Reserve. The report, referred to formally as the Summary of Commentary on Current Economic Conditions, is a qualitative review of economic conditions. The Beige Book is published eight times each year before meetings held by the Federal Open Market Committee (FOMC) and is considered one of the most valuable tools at the committee’s disposal for making key decisions about the economy.

Job Openings and Labor Turnover Survey (JOLTS) – The job openings and labor turnover survey (JOLTS) is a survey done by the United States Bureau of Labor Statistics (BLS) within the Department of Labor to help measure job vacancies.

Real Interest Rate (Real Yield) – A real interest rate is an interest rate that has been adjusted to remove the effects of inflation to reflect the real cost of funds to the borrower and the real yield to the lender or to an investor. The real interest rate reflects the rate of time-preference for current goods over future goods. The real interest rate of an investment is calculated as the difference between the nominal interest rate and the inflation rate.

Michigan Consumer Sentiment Index – The Michigan Consumer Sentiment Index is a monthly survey of consumer confidence levels in the United States conducted by the University of Michigan. The survey is based on telephone interviews that gather information on consumer expectations for the economy.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/fast-answers/answersindiceshtm.html or http://www.nasdaq.com/reference/index-descriptions.aspx.

All data is subject to change without notice.

© 2024 NewEdge Capital Group, LLC