Weekly Summary – May 22 – May 26

Key Observations:

- In general, we are encouraged by the latest news reports that a resolution to increase the U.S. debt ceiling will be reached in a “timely manner” so that the U.S. will not default on its debt obligations. Although we are maintaining our stance that the Federal Reserve (Fed) will “pause” at its next meeting in June, it has become a “close” call as to whether the Fed will hike the federal funds rate after all. We maintain our view that the Fed will not cut rates this year.

- In our opinion, uncertainty permeates financial markets and economic forecasts. Lack of conviction mostly closely follows great uncertainty. Diversity of opinions increases along with uncertainties. This was shown in the Fed’s minutes of its May meeting as “some” Fed officials thought that an additional hike under certain scenarios would likely be warranted, whereas “several” participants thought it likely that further hikes might not be necessary given their assumptions. Equity markets’ poor market breadth reflects relatively more “conviction” about a few select stocks relative to most other stocks.

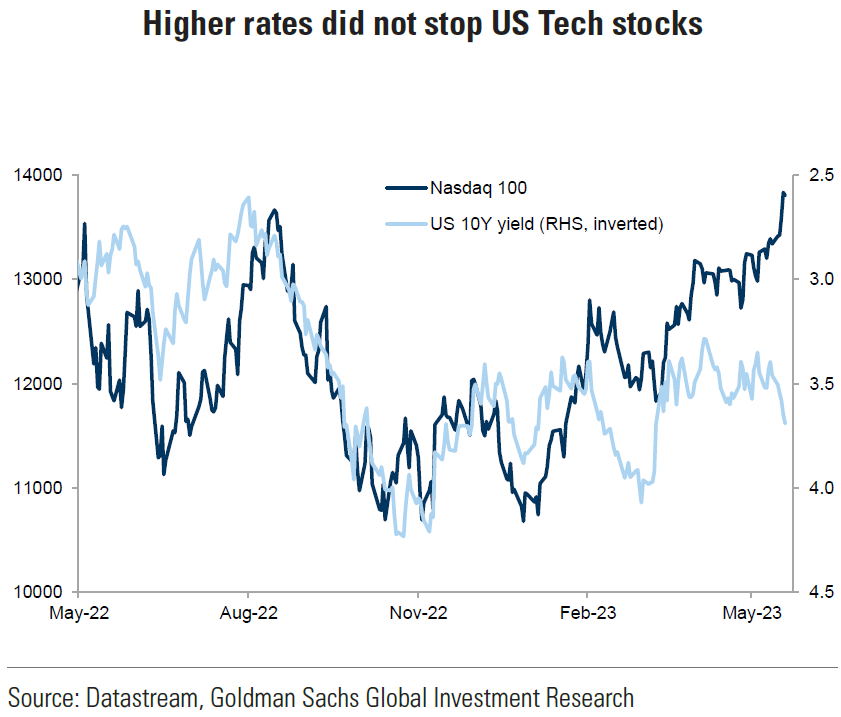

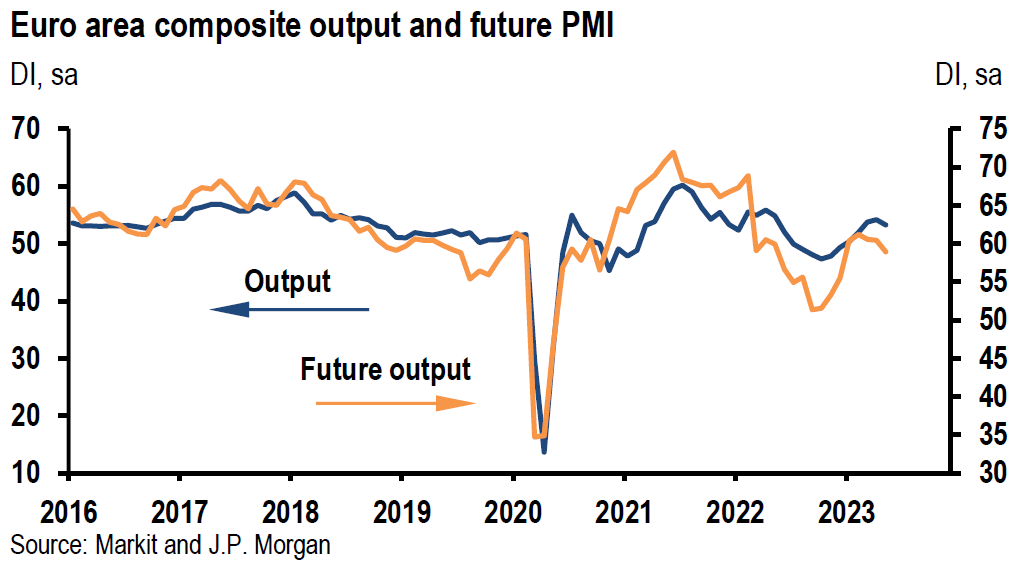

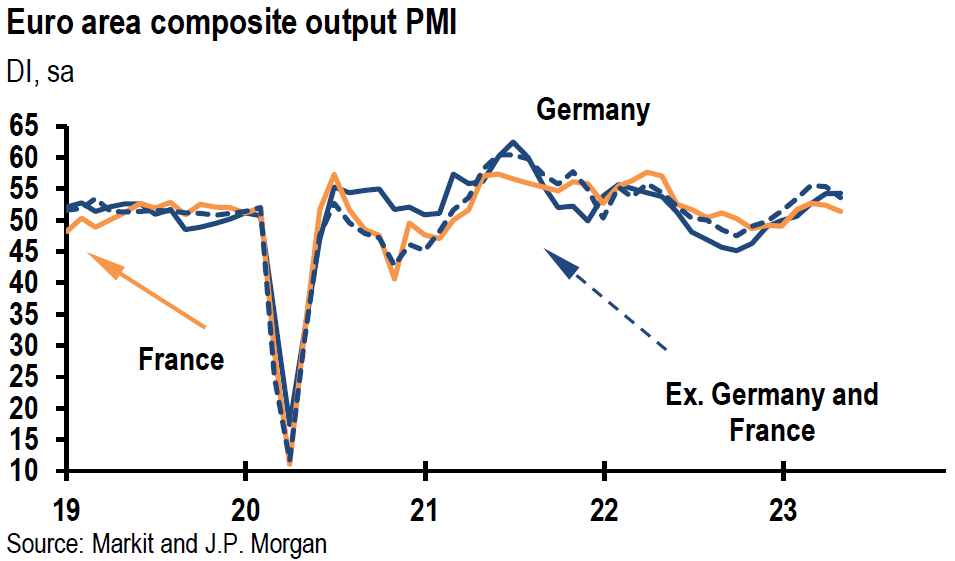

- We continue to observe many examples of divergent trends. A prime example is the increasing outperformance of services sectors relative to manufacturing sectors in many countries. The data analyzed this week has shown that these divergent trends are particularly acute in Europe. The services sectors continue to be characterized by “sticky” inflation where the impact of high wage growth rates have been mentioned often. We would also characterize the recent outperformance of stocks related to Artificial Intelligence (AI) as divergent from most other stocks.

- We viewed the unexpected dramatic rise in the NVDIA Corporation’s (NVDA) estimate of its Q2 revenue and its stock’s reaction to that news as a “game changer” for assessing the risk-reward calculus for certain types of growth stocks. We surmise that if investors are “convinced” of a growth stock’s long-term potential but believe that such a stock might be “overvalued” based on its expected price earnings ratio or some other metric, that NVDA’s sudden change in its fundamentals might make investors hesitate in selling what might appear to be an overvalued stock. This might be especially true for AI related stocks that could have a sudden favorable change in their fundamental outlooks but at a time uncertain. NVDA has shown that an investor might “miss out” on dramatic revaluations of a particular stock due to their “impatience.” In our opinion, this reasoning probably applies only to certain types of growth stocks and could have only a negligible effect on changing the equity markets’ narrow breadth. But since many such growth stocks have a large capitalization and have a correspondingly large impact on equity weighted averages, those averages downside could be more well contained than would otherwise be the case. The NVDA experience also highlights the importance of stock selection.

The Upshot: Our general investment approach remains the same as depicted in last week’s commentary. We maintain our preference for quality stocks with good balance sheets, relatively stable cash flows with stable margins. Volatility across sectors continues to be supportive of a diversified portfolio for long term investors. We continue to stress that stock selectivity is of paramount importance.

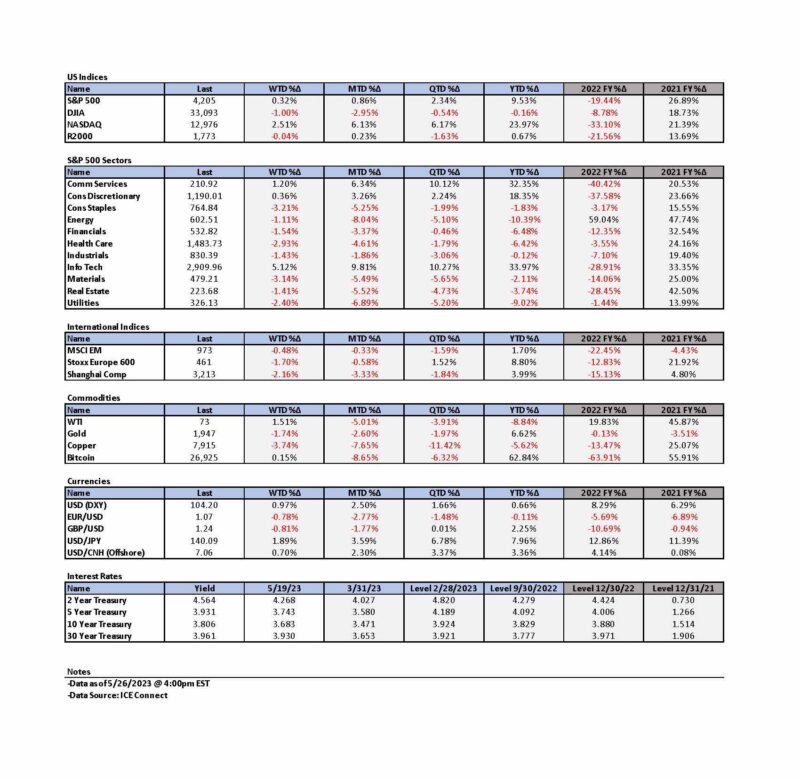

As of early Friday afternoon, the two-to-10-year Treasury yield became more inverted by about 17 basis points (bps) relative to last week’s close as interest rates rose across the yield curve. We interpret this further inversion as an indication of an increased probability of a U.S. recession. This coincides with our belief that further Fed hikes of the federal funds rate should raise the recession odds. We also postulate that increasing divergencies, such as the outperformance of services sectors relative to manufacturing sectors could be indicative of increasing recession probabilities as well.

Should We Worry?

This week, House Speaker Kevin McCarthy said that Americans should not “worry” about hitting the debt ceiling even as we approach the critical June 1 deadline when Treasury Secretary Janet Yellen believes that the U.S. will no longer be able to meet all of its obligations unless the ceiling is raised. On May 24, Fitch Ratings put the U.S. credit on “rating watch negative” under its classification for a possible downgrade. In 2013, Fitch put America’s credit on a “negative” watch but never dropped its top credit rating. But in 2011, another rating agency, Standard and Poor’s, dropped the U.S. debt rating from its AAA rating, pointing to “partisan divisions that made it difficult … to control spending or raise taxes enough to reduce its debts.” A downgrade would increase America’s borrowing costs. This week, Fitch said that the failure to reach a deal on the debt ceiling “would be a negative signal of the broader governance and willingness of the U.S. to honor its obligation in a timely fashion,” and likely would be inconsistent with a “AAA” rating. In a statement released Wednesday, Fitch also stated: “The brinkmanship over the debt ceiling, failure of the U.S. authorities to meaningfully tackle medium term fiscal challenges that will lead to rising budget deficits and a growing debt burden signal, downside risks to U.S. creditworthiness.”

U.S. Debt Ceiling in Focus

McCarthy has expressed his confidence that a “debt deal” will be done in a “timely manner.” But the worries by Fitch Ratings belies this attitude. It is as if McCarthy was saying “I Ain’t Worried” as expressed in OneRepublic’s song. “I don’t know what you’ve been told; But time is running out, no need to take it slow … so spend it [time] like gold … But I ain’t worried ‘bout it right now … No stressing, just obsessin’ with sealin’ the deal.” The ability to raise the U.S. debt ceiling is but one of many uncertainties that have been plaguing financial markets currently.

FOMC Minutes Highlight Uncertainties and Divergent Opinions

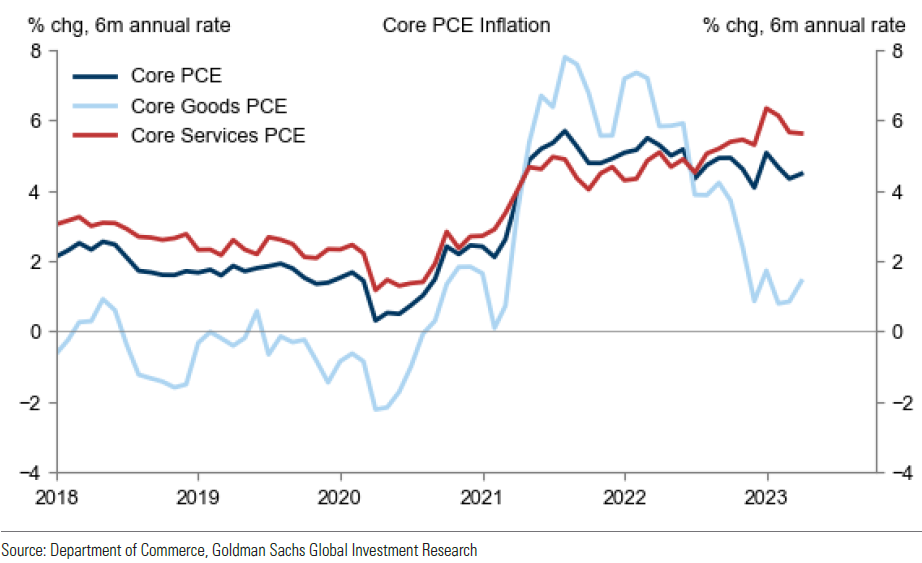

The minutes of the Federal Open Market Committee’s (FOMC or Committee) May 2-3 meeting highlighted many uncertainties that the Fed was grappling with in an effort to determine its monetary policies. “Participants generally expressed uncertainty about how much more policy tightening may be appropriate.” A divergence of opinions seemed to be forming at the Fed. “Some participants commented that, based on their expectations that progress in returning inflation to 2% could continue to be unacceptably slow, additional policy tightening would likely be warranted at future meetings.” Others at the meeting expressed another set of opinions. ”Several participants noted that if the economy evolved along the lines of their current outlooks, then further policy firming after this meeting may not be necessary.” The Fed staff continued to expect a “mild” recession later this year. Given the many uncertainties confronting the Fed, “many” participants agreed that the Committee should retain “optionality” in regard to its future monetary policies. Participants agreed that the degree to which tighter credit conditions on households and businesses resulting from the regional banking crisis would “weigh” on activity and reduce inflation remained “very uncertain” or “highly uncertain.” Other uncertainties included the “pace at which labor market conditions softened and economic growth slowed.” Participant continued to characterize inflation as “unacceptably high” and noted that reductions in core inflation measures were slower than anticipated.

“Hawkish” Fed Officials

On Wednesday, Fed Governor Christopher Waller made his stance very clear. “I do not support stopping rate hikes unless we get clear evidence that inflation is moving down towards our 2% objective … But whether we should hike or skip at the June meeting will depend on how the data come in over the next three weeks.” After Waller’s comments, many analysts interpret a “pause” as no more hikes, whereas a “skip” anticipates at least one more hike in the federal funds rate. St. Louis Fed president James Bullard expressed his opinion this week that two more Fed hikes might be appropriate. According to Reuters on Wednesday, the futures markets were pricing a one-in-three chance of a June hike and a one-in-two chance of another hike by the end of July. Moreover, futures were pricing in a federal funds rate cut of less-than 25 basis points (bps) by year end, which is significantly less than pricing almost 100 bps worth of cuts earlier this month. We retain our stance of no Fed cuts this year.

Stock Selection Matters

The spotlight was especially bright this week on stock selectivity. While retailers such as American Eagle Outfitters, Inc. had big one-day losses, retailers such as Urban Outfitters, Inc. and Abercrombie & Fitch, Co. saw big one-day gains. But the most notable earnings announcement came from NVDA after U.S. financial markets closed for the day on Wednesday. NVDA is the “poster child” for AI and is the world’s most valuable semiconductor company. The company designs and sells graphics processing unit (GPU) chips used in data centers and ultimately to power AI applications. Data centers provide vast computing resources and storage, which enables AI to process massive data sets for training and inference. An increasing amount of data centers to store and process information will be needed for AI applications. NVDA is the biggest maker of the advanced chips required to train a new generation of AI services. In other words, NVDA provides the “nuts and bolts” required for AI. NVDA’s CEO Jensen Huang said that “we’re seeing incredible orders to retool the world’s data centers … The budget of a data center will shift very strongly to accelerated computing.” For Q2 ending in July, NVDA increased its revenue estimates from expectations of approximately $7.2 billion to $11 billion. The company’s stock surged more than 24% higher on the day, increasing NVDA’s market capitalization more than $180 billion in one single day. This was close to the largest single day stock gain of about $191 billion by Apple in November 2022. Amazon’s one day gain in February 2022 was slightly smaller than Apple’s one day gain. Many semiconductor stocks registered big gains “on the back” of NVDA’s gains.

NVDA Changes Risk-Reward Calculus for Certain Growth Stocks

NVDA has been a stock we’ve followed for quite some time, but its “high valuation” did not fit into our firm’s more conservative valuation metrics. So why are we spending so much time on NVDA? We view the massive and unexpected change in NVDA’s fundamentals as changing our risk-and-reward approach in evaluating stocks that exhibit long-term potential. This will be particularly true for anything related to AI. We surmise that the NVDA experience will make investors less willing to sell certain stocks that could be seen as “overvalued,” and in particular any AI-type of stocks, for fear of “losing out” from unexpected positive surprises. In our opinion, this should limit the downside of some stocks that fit this description. But we still would look for quality, big-cap stocks with good balance sheets and relatively stable margins. NVDA is also a prime example of a high P/E (price-earnings ratio) stock that might not be as overvalued as thought because of a possible abrupt change in the “E” (earnings) component of the ratio.

Another favored stock for us is Microsoft (MSFT), which also has had large gains from the October market bottom. Investors also consider MSFT as an AI-type of stock. After the NVDA experience this week, our current assessment and our view is that the downside of MSFT is more limited than before, but after the large recent gains, we see limited upside in the short term.

Source: Goldman Sachs, Improving growth optimism boosts growth stocks despite higher rates (5-22-2023)

Possible Strategies for Taking Positions in “Missed” Stocks

We have been advising against chasing any stocks and waiting for pullbacks to add to or to initiate positions in any stocks. We still prefer this approach. If any investors believe that they “missed out” on owning or adding to a particular stock, there are potential strategies for those long-term investors who are willing to take a risk of purchasing what could look like an overvalued security and are intending to hold the position for quite some time. Additionally, we would expect that most investors should wait for a downturn to purchase any particular stock.

A possible investment approach to initiate or add to a position is a “buy-write” options strategy only for those investors who have decided to buy a stock and have the “appropriate” risk tolerance. This would entail buying the stock and selling calls against the stock. A riskier approach would be to sell puts as well assuming that the stock trades lower and that investors were “put” the stock, ultimately owning more of the position. Given the many uncertainties and volatility in the current market environment, one may consider limiting this strategy to short term positions. Such a strategy should be employed only after close consultation with an advisor will vary depending on each investor’s goals and risk tolerance.

Possible Long-Term Opportunities From AI

We expect to see large productivity gains from AI over the next few years and beyond. Furthermore, we also expect to see many security-type issues unfold, including creation of false images and information. We postulate that a possible scenario over the years could be a reversal of what most people would consider entrenched trends. We can envision a time when working less remotely – including in-person meetings in the office and business trips – could stage a comeback in part due to security concerns. There might come a time when we must meet someone face-to-face to verify certain information and characteristics about a person. This might include observing a person to see how they think on their feet without much assistance from AI. For those who have at least a five-year investment time horizon, we suggest investments that might benefit from more personal interaction. As certain types of real estate come under pressure, interesting and perhaps even compelling investment opportunities might arise. We hope that these thoughts will lead to discussions about which trends might be enhanced or reversed and to considerations of long-term investment types that might be able to take advantage of potential changes due to AI. This process should hopefully reveal more clearly what specific type of companies could be “hurt” by AI developments.

Divergent Trends

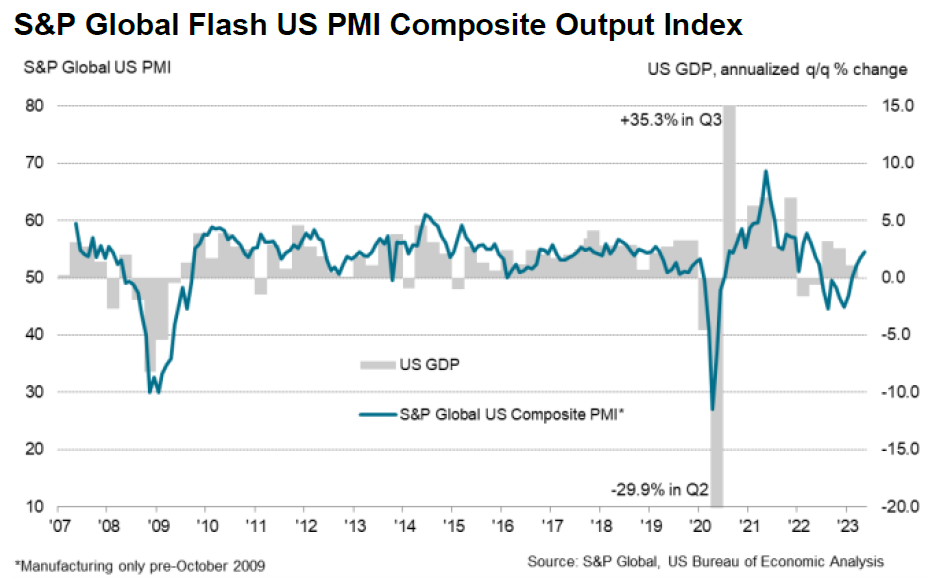

As economic data continues to be “mixed,” we continue to observe many “divergences” in financial markets and economic trends. We believe that selectivity of investments will continue to play a prominent role in investment returns. The narrow “market breadth” of many stock markets is emblematic of divergences. The ascendence of AI fits into this narrative as well. The Purchasing Managers Indexes (PMIs) of Europe, the U.S. and China all seem to show increasing divergences between services and manufacturing sectors. Perhaps demand for goods was mostly satiated due to COVID-19 restrictions. It appears that most people continue to seek out personal experiences that are much more service oriented. We will examine the latest PMI data released this week in an effort to detect any visible trends.

S&P Global Flash U.S. May PMIs – 13-Month High for Output Growth but Divergence Widens Between Manufacturing and Services

U.S. flash PMI composite output index rose to a 13-month high of 54.5 from April’s reading of 53.4. U.S. flash services business activity index also hit a 13-month high of 55.1 compared to 53.6 in April. U.S. manufacturing output fell to 51.0 from 52.4 in April. The expansion was led by services as U.S. manufacturing PMI fell into contractionary territory after two months of expansion to 48.5 from April’s 50.2 level. Total employment levels rose at the fastest pace since July 2022. Total new export orders continued to decline for the twelfth consecutive month. Input prices for manufacturers fell for the first time in three years. The prices received for manufacturers increase only marginally and the pace of increase was the softest since July 2020. In contrast input prices for service providers showed “marked” increases in their input costs although the pace of increase slowed to the slowest pace in five months. These input price rises were often linked to wage increases. Prices received for service providers continued to show “resilient” strong increases.

Source: S&P Global, S&P Global Flash US Composite PMI (5-23-2023)

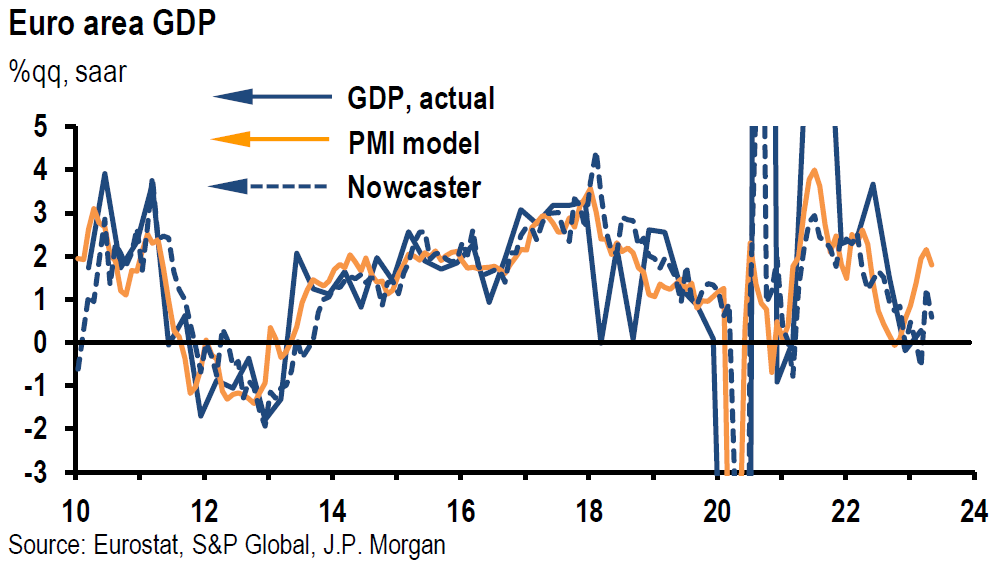

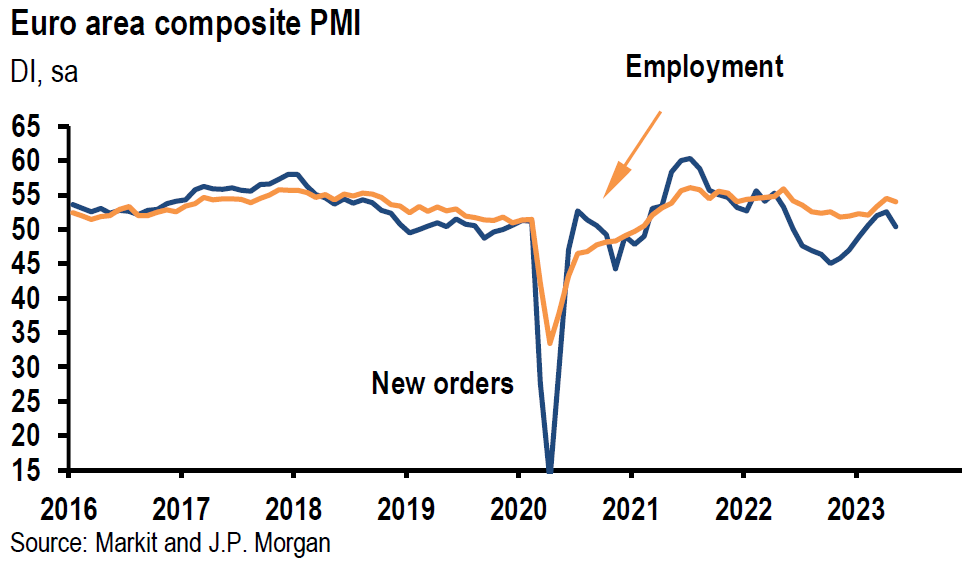

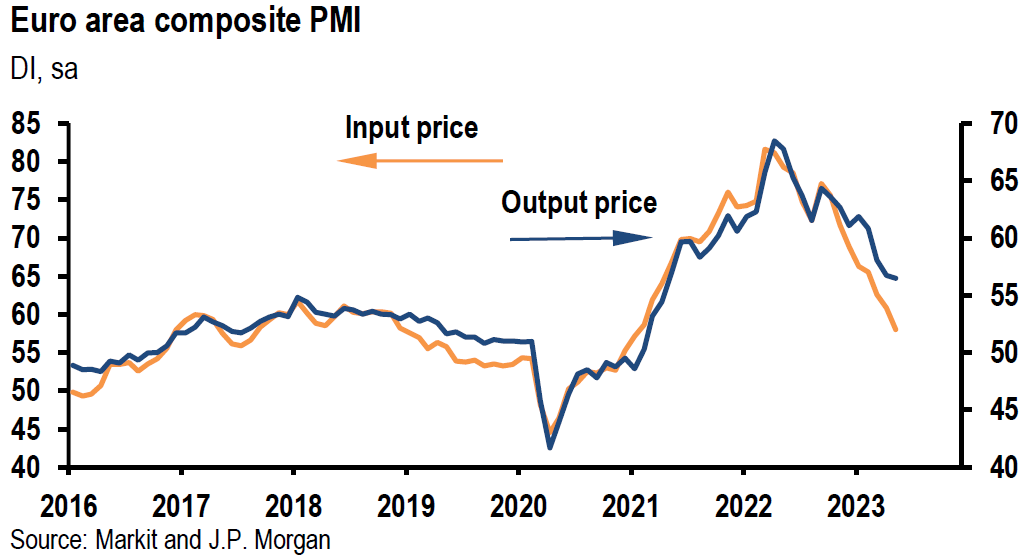

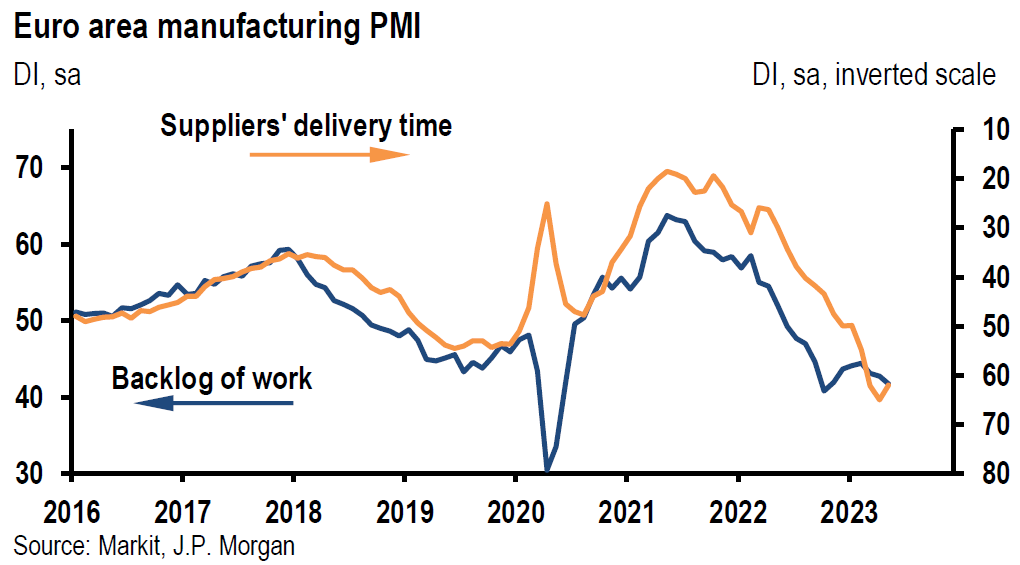

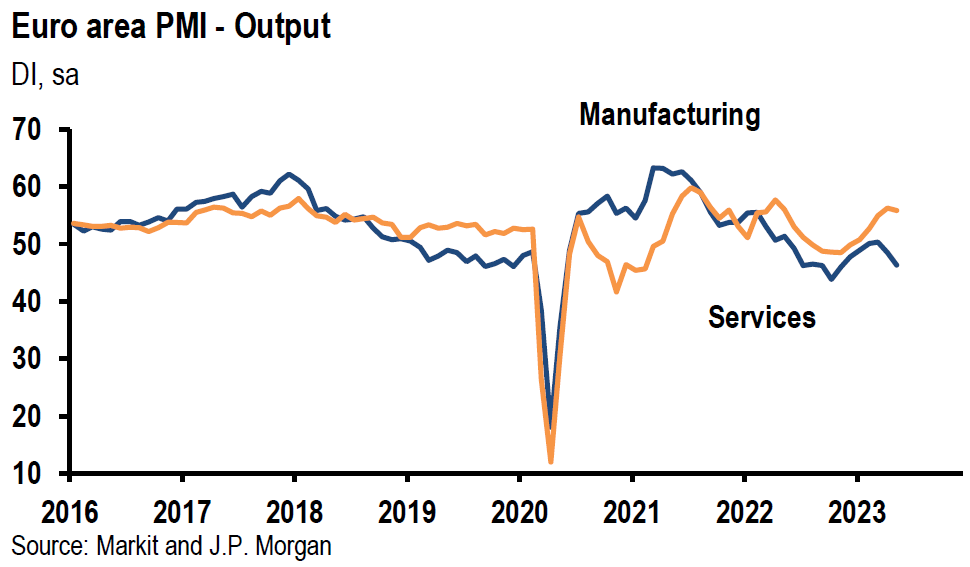

Euro Area Flash May Composite PMI Declined After Six Consecutive Increases – Service Performance Continued to Widen Relative to Manufacturing

Euro area composite PMI fell 0.9 points to 53.3 in May to a three-month low as a steepening factory downturn offset a services “revival.” The outperformance of services relative to manufacturing was the widest since January 2009. It appears that European growth is being driven mostly by the services sector as manufacturing continued to deteriorate. Eurozone services remained strong in May at 55.9 versus a 56.2 reading in April. Manufacturing output fell to 46.3 – a six month low – from 48.5. Manufacturing PMI decreased to 44.6 from 45.8, also a six-month low. Input prices continued to moderate across both services and manufacturers but prices received by manufacturers declined for the first time since September 2020, even as prices received by service firms continued to edge higher. The manufacturing sector showed weak demand but resilient employment.

Source: JP Morgan, Euro area PMI: First decline since November (5-23-2023)

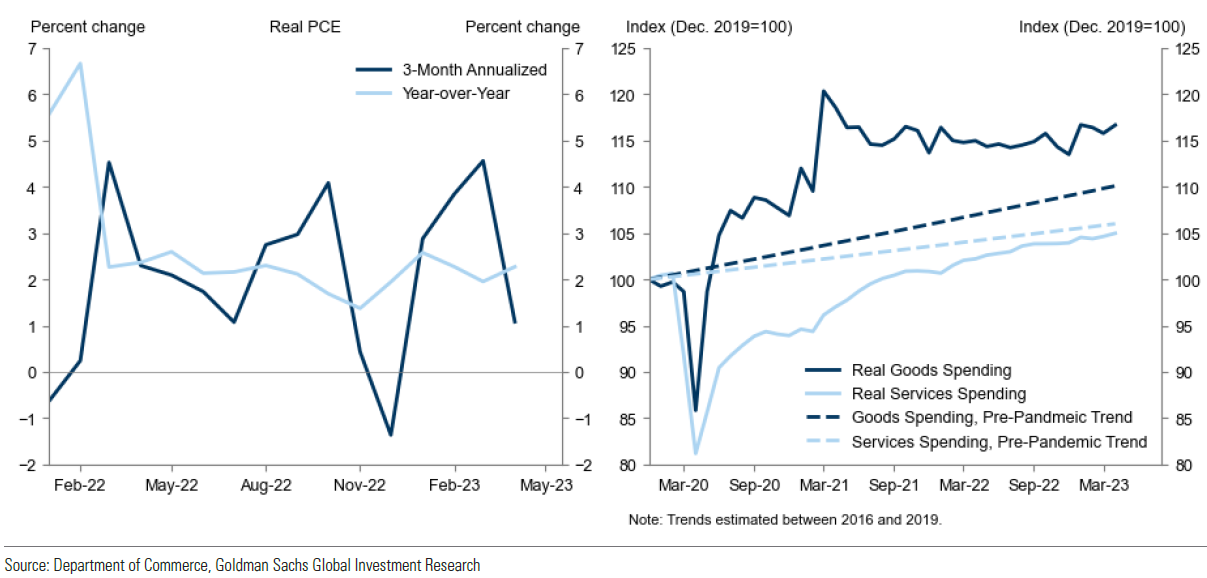

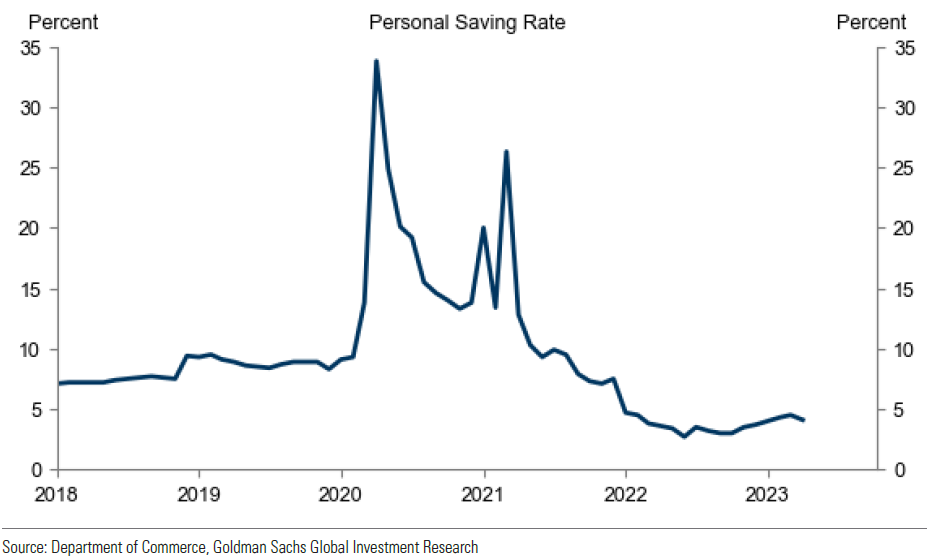

U.S. April Core PCE Prices and Personal Spending Rose More than Expected, Personal Income Increased as Expected

Core Personal Consumption Expenditures (PCE) price index increased 0.4% month-over-month (m/m) versus an expected increase of 0.3%. This is the Fed’s preferred measure of inflation. The year-over-year (y/y) increase was 4.7% versus an expected 4.6% gain. Personal spending was 0.8% higher m/m compared to an expected 0.4%. Real personal spending increased 0.5%, reflecting a 0.8% increase in goods spending and a 0.3% increase in services spending. Personal income was 0.4% higher, as expected. The saving rate declined to 4.1% from a downwardly revised 4.5% and was 0.5% lower than expected. Solid consumer spending that offset sluggish business and residential investment spending characterized the year to date. After this stronger than expected economic data on Friday, the CME FedWatch Tool was indicating a probability of as high as 64.2% for a June hike in the federal funds rate.

Source: Goldman Sachs, USA: Core PCE Inflation Above Consensus Expectations; June Pause Still Our Baseline but a Close Call; Raising Q2 GDP Tracking to 2.1% (5-26-2023)

University of Michigan Final May Results for Consumer Sentiment Revised Higher from Preliminary Readings, Inflation Expectations Revised Lower

Consumer sentiment was revised higher to 59.2 from an initial estimate of 57.7, as it remained the lowest reading in six months. The expectations gauge was revised to 55.4 from 53.4 and the current economic conditions index was increased slightly to 64.9 from 64.5. One year ahead inflation expectations were revised lower to 4.2% from 4.5% and the five-year outlook dropped to 3.1% from the preliminary May estimate of 3.2%. Uncertainty in regard to one year inflation expectations fell to the lowest level of uncertainty in almost two years. The report states that “this suggests that consumer views over short-run inflation may be stabilizing following four months of vacillation.”

Bottom Line

For the time being we are maintaining our basic investment approach as expressed in last week’s commentary. We continue to prefer high quality stocks that offer good balance sheets, as well as relatively stable cash flow and profit margins. We prefer a global diversified portfolio for long term investors. We continue to stress that stock selectivity in this current environment is of paramount importance. We foresee continued financial market volatility.

We view NVDA’s narrative this week as a “game changer” in respect to a risk-reward analysis in evaluating growth stocks. This is especially true for AI related stocks. This could make many investors less willing to sell such stocks and more willing to buy such securities. This could also limit the downside to such stocks. Given the large capitalization of many of these securities, this could also limit the downside of many “cap weighted” stock averages.

Definitions:

Federal Open Market Committee (FOMC) – The Federal Open Market Committee (FOMC) is the branch of the Federal Reserve System that determines the direction of monetary policy specifically by directing open market operations. The committee is made up of 12 members: the seven members of the Board of Governors; the president of the Federal Reserve Bank of New York; and four of the remaining 11 Reserve Bank presidents on a rotating basis.

FOMC Minutes – The Minutes are a detailed record of the Federal Open Market Committee (FOMC) meetings and are released three weeks after every meeting. The minutes offer more concise insights on the monetary policy stances of all members of the committee and how individual members see the value of the USD and other securities.

Inverted Yield Curve – An inverted yield curve describes the unusual drop of yields on longer-term debt below yields on short-term debt of the same credit quality. Sometimes referred to as a negative yield curve, the inverted curve has proven in the past to be a relatively reliable lead indicator of a recession.

Basis Points (bps) – A basis point is one hundredth of one percent, used chiefly in expressing differences of interest rates.

Headline PCE Inflation – A measure of the prices that people living in the United States, or those buying on their behalf, pay for goods and services. The PCE price index is known for capturing inflation (or deflation) across a wide range of consumer expenses and reflecting changes in consumer behavior.

Core PCE Inflation – A measure of the prices that people living in the United States, or those buying on their behalf, pay for goods and services that excludes food and energy prices. The core PCE gives a more accurate reading of inflation because food and energy are very volatile parts of the economy.

US Debt Ceiling – The debt ceiling is the maximum amount that the U.S. government can borrow by issuing bonds. The Treasury Department must find other ways to pay expenses when the debt ceiling is reached otherwise, there is a risk the U.S. will default on its debt.

Flash Composite PMI – The flash Composite Purchasing Managers’ Index (PMI) provides an early estimate of current private sector business activity by combining information obtained from surveys of the manufacturing and service sectors of the economy.

Flash Services PMI – Flash services PMI is an early estimate of the Services Purchasing Managers’ Index (PMI) for a country, designed to provide an accurate advance indication of the final services PMI data.

Flash Manufacturing PMI – Flash Manufacturing PMI is an estimate of manufacturing for a country, based on about 85% to 90% of total Purchasing Managers’ Index (PMI) survey responses each month.

Artificial Intelligence (AI) – AI refers to the simulation of human intelligence by software-coded heuristics. Nowadays this code is prevalent in everything from cloud-based, enterprise applications to consumer apps and even embedded firmware.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/fast-answers/answersindiceshtm.html or http://www.nasdaq.com/reference/index-descriptions.aspx.

All data is subject to change without notice.

© 2024 NewEdge Capital Group, LLC