Weekly Summary: May 23 – May 27, 2022

Key Observations:

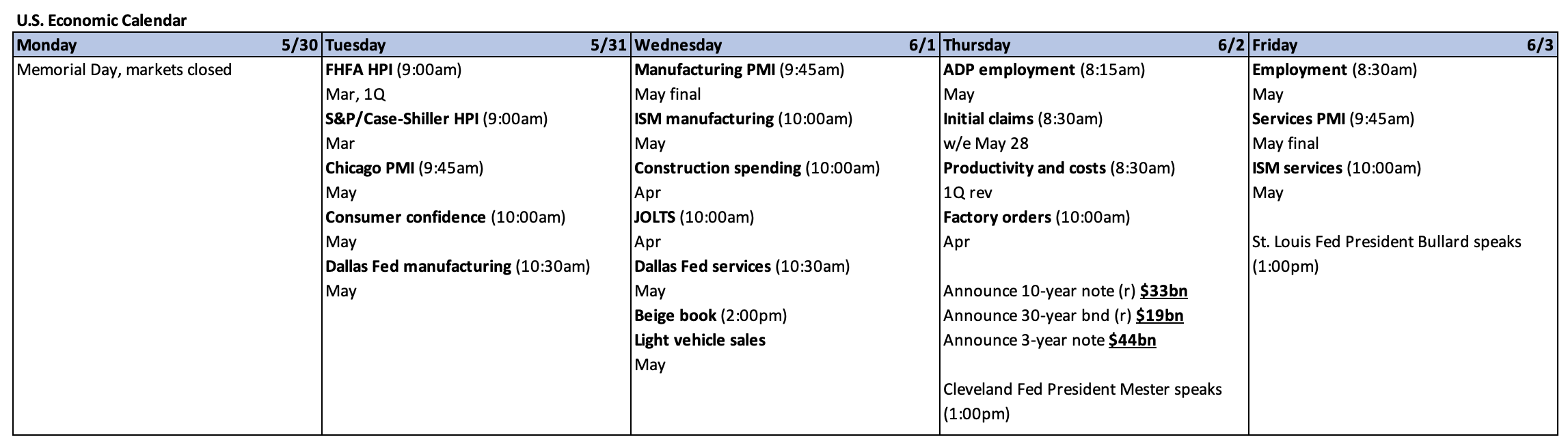

- The minutes of the Federal Reserve’s (Fed) May 3-4, 2022 meeting reiterated its preference for “front-loading” its monetary tightening policies and that the Fed would be “data dependent” in implementing those policies. The Fed wanted to avoid telling the wrong “story” as it did when it characterized inflation as “transitory.”

- Since the Fed’s last meeting, much of the incoming economic data could be characterized as disappointing — particularly housing data — relative to expectations, but inflation has remained very elevated. We doubt that any of this additional data will dissuade the Fed from continuing to tighten its monetary policies aggressively.

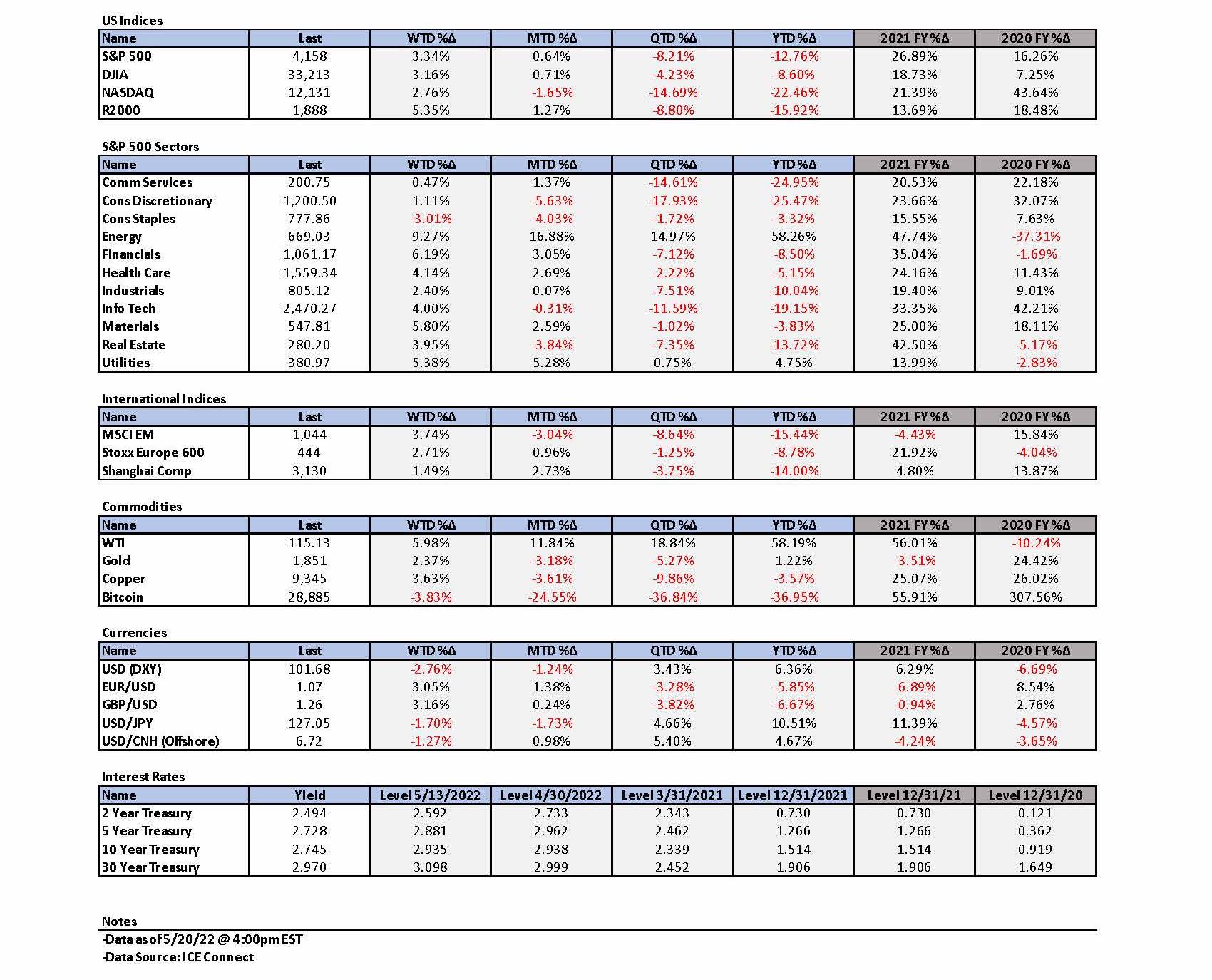

- There were many encouraging signs in U.S. equity markets this week. While this latest upturn in equities might continue, we maintain our assumption that a decline will resume once again. There are too many unresolved uncertainties regarding recession probabilities, inflation trajectories and Fed policies. We also understand that analysts’ downward revisions of earnings and margins could be a prerequisite for a more sustainable bottom.

- In a widely distributed videoconference, China’s Premier Li Keqiang stressed the need to get China’s economy back on track and called on government officials to “strike a better balance between economic growth and coronavirus measures.” Many onlookers took this as a possible challenge to President Xi Jinping’s authority. Stay tuned.

The Upshot: In last week’s commentary, we thought on Thursday, May 19, 2022, that U.S. equities were trying to put in a short-term bottom, which was realized this week. But we do not think that this will be a sustainable bottom. Given our assumptions, we continue to anticipate that global economic growth forecasts will be lowered and that inflation forecasts will be raised. We assume that upward revisions in inflation forecasts will be due primarily to higher energy and other commodity prices, mostly due to the persistence of the Russia-Ukraine war (war). We believe that financial market volatility will continue for at least as long as this war lasts. Therefore, we still favor diversified portfolios for long-term investors that consist of high-quality stocks as well as some commodity exposure. We will continue to look for opportunities to take advantage of market volatility.

Maintaining a Narrative for too Long

As an investor, analyst and writer, I am always trying to develop a narrative to try and make sense of incoming economic and financial market data. Over the past two years, since the onset of COVID-19 infections and the uncertainties surrounding this virus, many narratives and “stories” emerged that attempted to provide a framework that was consistent with incoming data:

- How virulent was this virus?

- What sort of disruptions would develop?

- How infectious was it?

- How long would it take to develop effective vaccines?

- How long to inoculate a large portion of the populations of various countries?

- What sort of restrictions would be imposed?

- What would be the effects of these variables on economic growth and inflation, etc.?

The Fed took a relatively early stance that most inflationary pressures caused by the coronavirus would prove to be “temporary.” Unfortunately, the Fed continued to maintain its transitory stance on inflation despite the many data points that were not supportive of their story. To paraphrase the lyrics of Tracy Chapman’s “Telling Stories” song, “There [was] fiction in the space between [the Fed’s narrative] and reality.” To further paraphrase from this song, the Fed wrote the words and made believe that “there is truth in the space between.” In other words, it was “a fabrication of a grand scheme.” Maybe they might have even thought that “sometimes a lie is the best thing.”

We disputed this narrative almost from the very beginning. Although some portion of inflationary pressures could be thought of as transitory depending on one’s definition of transitory, we also thought, as expressed in many of our earlier commentaries, that structural changes were taking place, leading to very persistent high rates of inflation. The Fed finally dropped this narrative when it became untenable. Inflation was not only lasting too long, but it was also getting worse, and it was becoming more evident that it was not transitory.

Why did the Fed adopt this stance and why did it “overstay” with the transitory inflation narrative? Our contention is that the Fed was initially much more concerned with ensuring that the U.S. achieve sustainable economic growth, and that the unemployment rate should be drastically reduced as quickly as possible. It is quite possible that the Fed even believed in their narrative initially and for quite some time. But, in the end, the Fed finally realized that they were “behind the curve” in reining in inflation that kept accelerating.

Data Dependency Helps Avoid Stale Narratives

The Fed has now put itself in a very difficult position where it is “forced” to adopt an aggressive monetary tightening policy to rein in inflation. We suppose that inflation has already become somewhat entrenched, especially with regard to inflation expectations. In an attempt to avoid adopting the wrong “storyline,” the Fed has made it quite clear that it will be much more data dependent. But as discussed in our prior commentaries, the Fed has strongly indicated that it will hike the federal funds rate by 50 bps at its next two meetings in June and July. In our opinion, the Fed believed that it needed to get closer to a neutral stance in its monetary policy in an “expeditious” manner and not be so far behind the curve. The Fed would then have time to reassess the impact of tightening financial conditions on the economy and inflation. We wish to remind the reader that financial markets do a large part of the Fed’s work indirectly through lower equity prices, higher interest rates (including higher mortgage rates), lowering of consumer and business confidence that leads to lower demand, as well as other factors.

Fed Minutes

The Fed minutes of its meeting earlier this month on May 3-4 confirmed our description above as they emphasized the many uncertainties and the need to reassess the Fed’s policies: “At present, the participants judged that it was important to move expeditiously to a more neutral monetary policy stance. They also added that a restrictive stance of policy may well become appropriate depending on the evolving economic outlook and the risks to that outlook.” The FOMC then stated that “risk management considerations would be important in deliberations over time regarding the appropriate policy stance.”

The Fed envisioned a constant state of reassessment depending on incoming data. We thought that the FOMC made its preference quite clear for the “front-loading” of tighter monetary policies so that it could more properly assess the effects of tighter monetary policies, given that such policies have a “lagged” effect. The Fed meeting minutes mention that “Many participants judged that expediting the removal of policy accommodation would leave the Committee well positioned later this year to assess the effects of policy firming and the extent to which economic developments warranted policy adjustments.”

The participants noted an increase in credit card balances and auto loans in the first quarter of 2021, but that credit quality of firms, municipalities and households remained “strong” overall: “Several participants who commented on issues related to financial stability noted that the tightening of monetary policy could interact with vulnerabilities related to the liquidity of markets for Treasury securities and to the private sector’s intermediation capacity.”

Concerns were also expressed regarding increased risks related to the volatility in commodities markets after Russia’s invasion of Ukraine. The Fed’s Financial Stability Report, released recently and summarized in a prior commentary, also expressed these liquidity and volatility concerns. The Fed reiterated its view on the strength of the U.S. economy and the tightness of the U.S. labor market. The reduction of the Fed’s balance sheet should begin on June 1. However, the Fed continues to surprise us with its uncertainty concerning the effects of its balance sheet reduction. “Regarding risks related to the balance sheet reduction, several participants noted the potential for unanticipated effects on financial market conditions.”

Change Narrative when Facts Change

We have observed that many analysts and investors tend to “overstay” whatever narrative and “storyline” they adopt. I have always striven to avoid this mindset. If the facts change, I try to change my narrative. For this reason, I immediately changed my narrative when Russia invaded Ukraine on February 24. The war only accentuated my conviction for continued elevated inflation. China’s zero COVID-19 policies and their accompanying lockdowns disrupted supply chains sporadically and added even more to the current inflationary pressures. The Goldman Sachs measure of supply constraints continued to ease this week and some companies even reported having sufficient and excess inventories. Unfortunately, as Walmart and Target showed recently, maybe the wrong inventory.

Selective Stock Picking Still Matters, Some Encouraging Signs for Equities – At Least in Short-Term

Adept stock selectivity appeared to be particularly rewarded this week in the retail sector. For example, the stock prices of Williams-Sonoma (WSI), Nordstrom (JWM), Macy’s (M), Dollar Tree (DLTR) and Dollar General (DG) had big gains on the announcement of their positive Q1 results and positive guidance. Conversely, the stock prices of retailers such as American Eagle Outfitters (AEO) and The Gap (GPS) were severely punished when they announced disappointing results and guidance. Stock selectivity does matter after all, which is an encouraging sign that we may be entering into at least some level of stock market stability.

Merchandise focused on “higher-end” consumers or discounters focused on “lower-end” (lower income) consumers seemed to do best. Retailers such as Macy’s commented that they could see signs of stress in lower-income consumers. Analysts downgraded Kraft-Heinz because of its susceptibility to inflationary pressures due to its low margins.

Another positive sign for equities was when some stocks recovered initial losses after disappointing earnings or guidance. A prime example of this was the relatively high multiple tech stock NVIDIA which initially traded over 10% lower in after-hours trading midweek before rebounding to close over 5% higher during regular trading the next day. We took this as another good sign for equities generally, and particularly for the technology sector – at least for those companies with relatively solid balance sheets and positive cash flows.

Weaker Housing Indicators

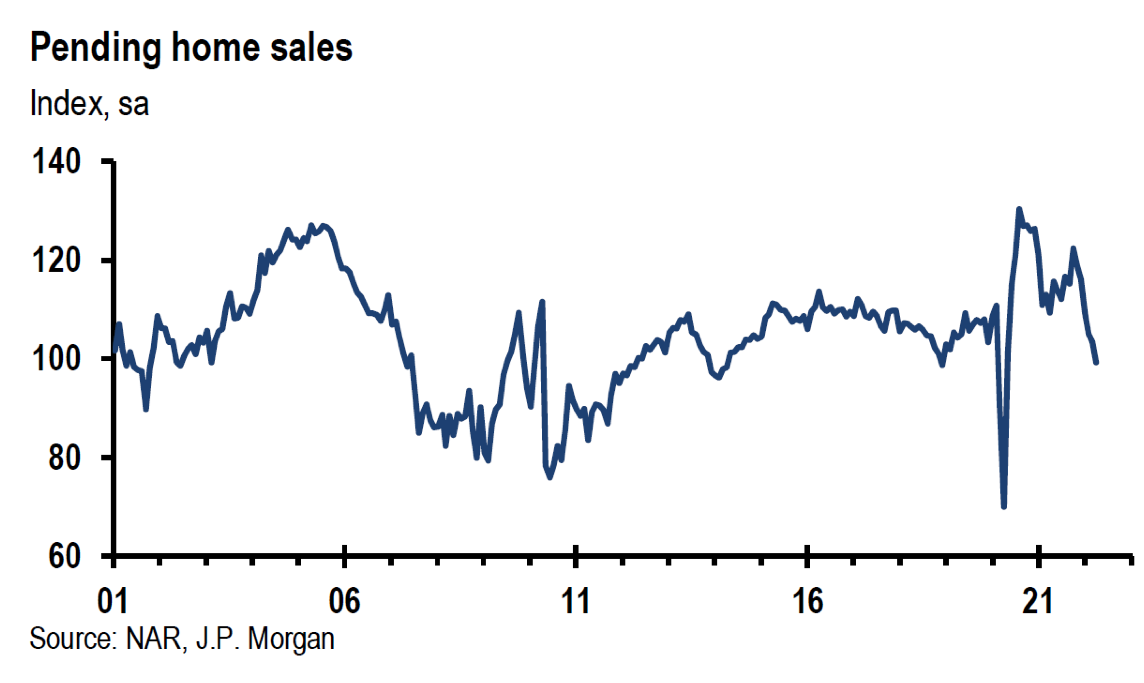

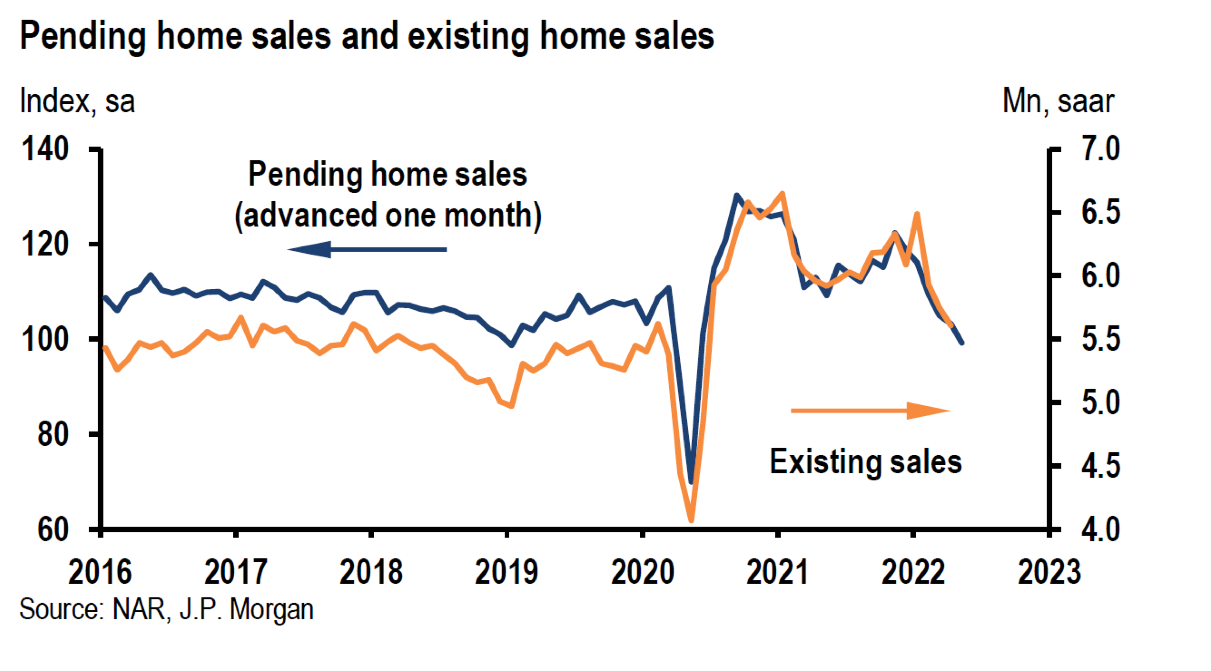

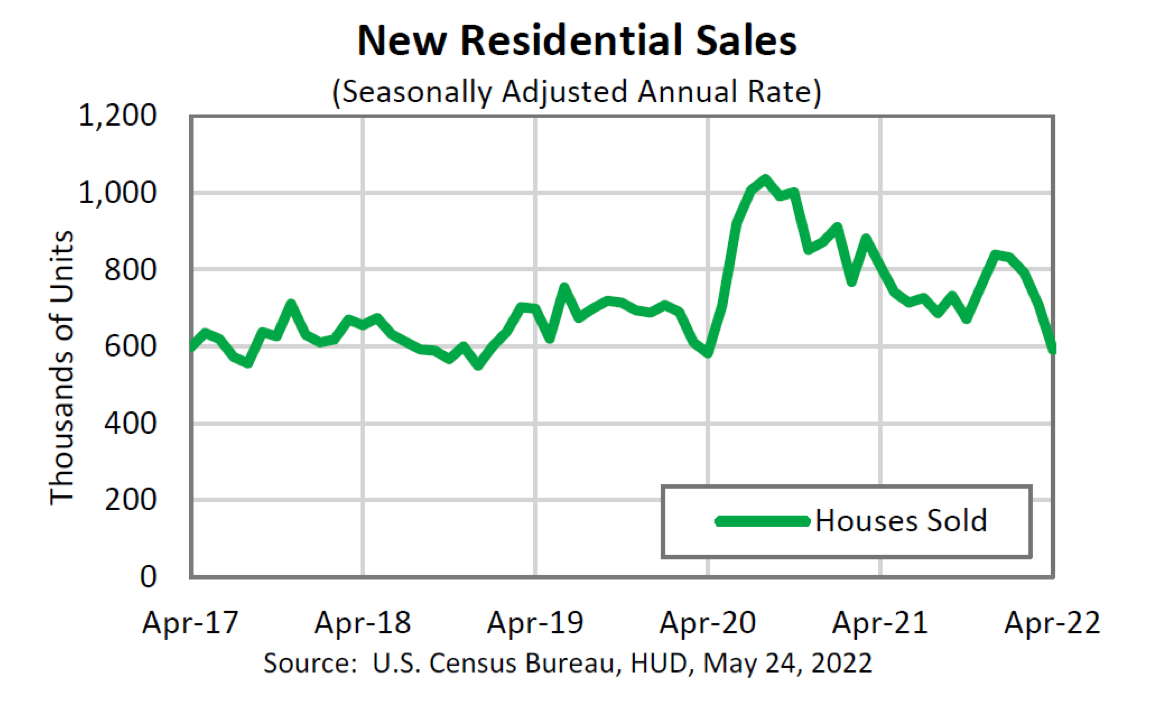

Housing indicators released this week continued to weaken in the U.S. New single family home sales in April dropped 16.5% month-over-month (m/m) to an annualized rate of 591,000, which was the weakest level since April 2020. Evidently, high home prices and high mortgage rates significantly affected home sales, which led to the fourth consecutive month of declining sales. Pending home sales for April were released this past Thursday and were disappointing as well, down 3.9% m/m (versus down 2.1% expected) for the sixth consecutive monthly decline and were over 9% lower year-over-year (y/y). The signing of a contract to buy a home constitutes a “pending” home sale.

Homebuyers were not the only ones changing their proclivities. According to CNBC on May 26, the supply of homes for sale “jumped” by 9% last week when compared to the same week one year ago and new home listings for the previous four weeks ending May 15 were almost twice as many as when compared to the same period a year ago. We assume this change in home sellers was due to their perception that the housing market may be “cooling off.” This is yet another example of the rapidity of the change in consumer behavior. The rapid change in the behaviors of potential home buyers and sellers is also an example of how tightening of financial conditions has been doing part of the Fed’s task to rein in inflation as the 30-year fixed rate mortgage started the year at around 3% and is now over 5%.

Source: J.P. Morgan US: Six straight declines for pending home sales into April (5/26/2022)

Source: Monthly New Residential Sales, April 2022 (5/24/2022)

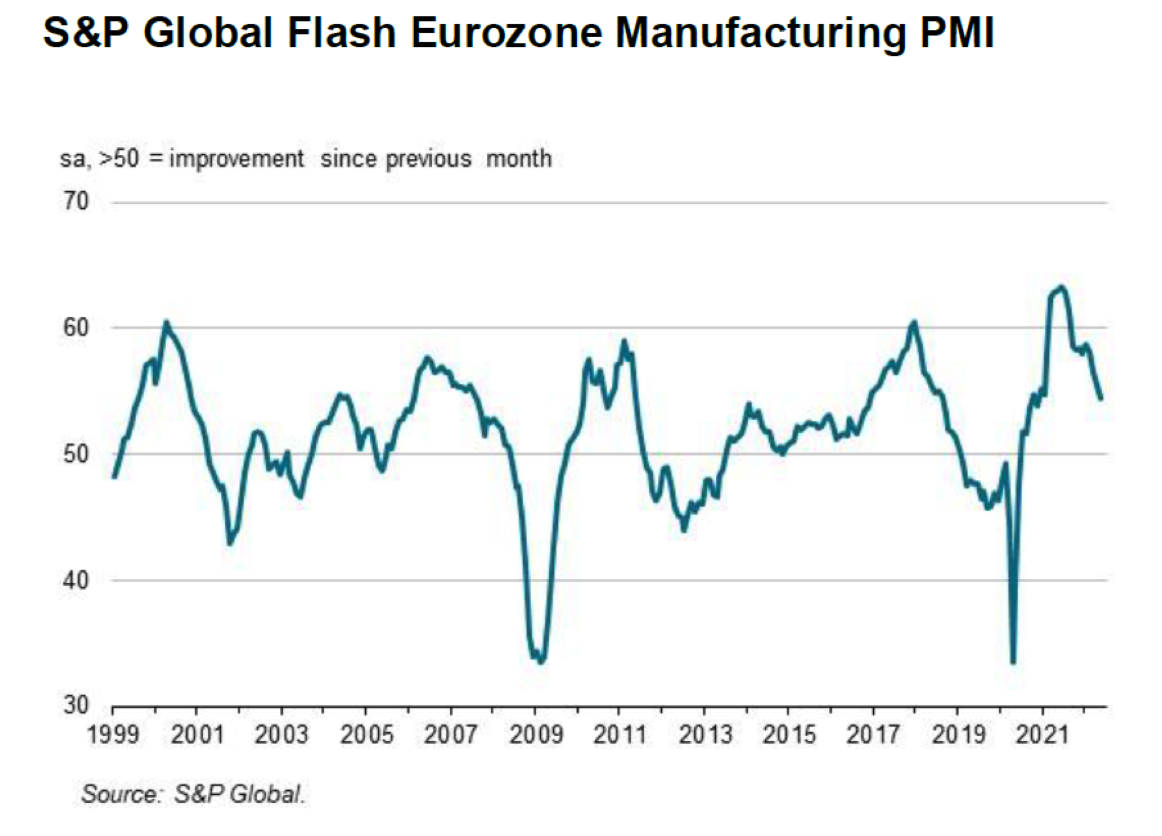

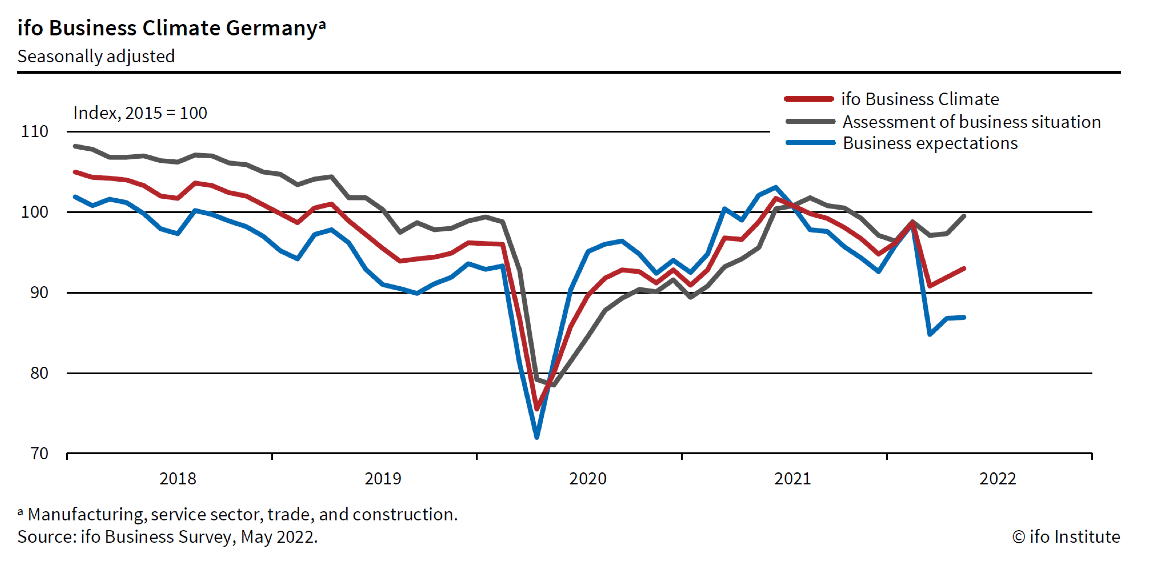

European PMIs

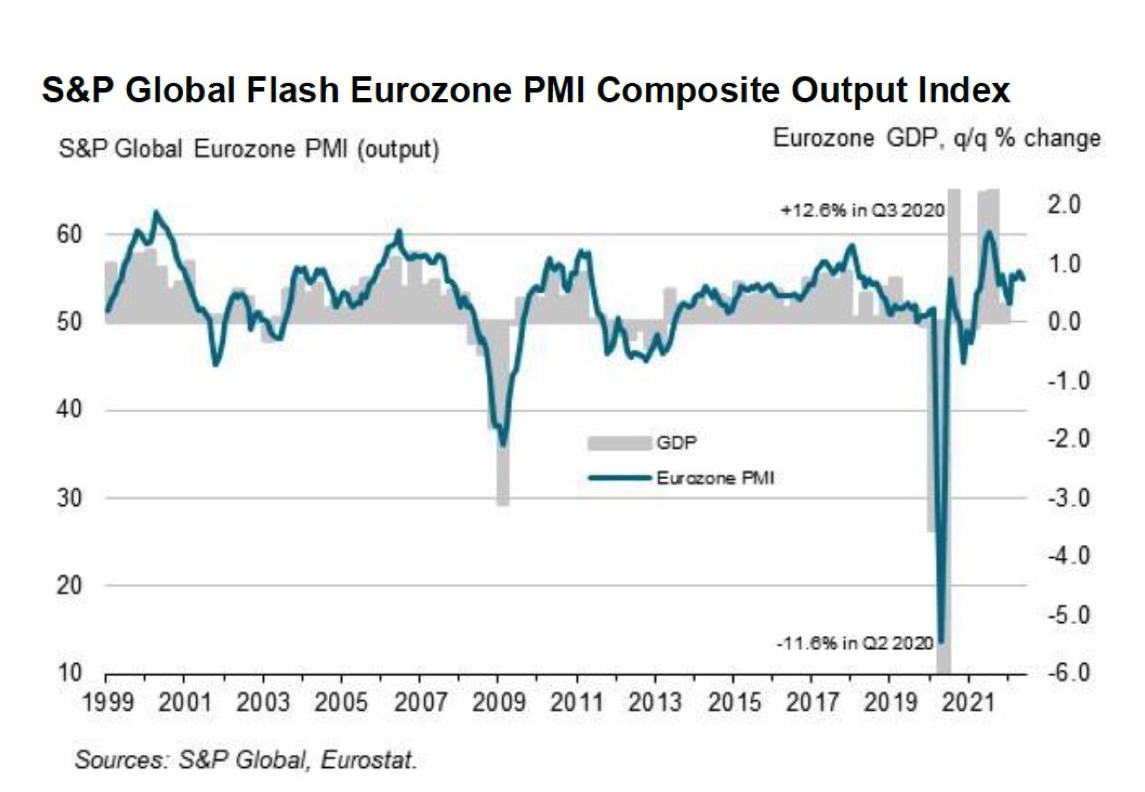

The strength of Europe’s May S&P Global Purchasing Managers’ Index (PMI) relative the U.S. and the U.K. surprised us. We have been assuming that Europe’s economic growth was much more at risk relative to the U.S. because of its reliance on Russia’s energy and other commodities. Even though Europe’s energy prices exceed those of the U.S., its PMIs continue to show a robust economy primarily due to its service sector, which had its strongest job gains in about fifteen years and its second strongest expansion in eight months. The manufacturing sector showed only modest gains for the second month in a row. Confidence in the manufacturing sector fell to its lowest level since the pandemic’s start. Although supply constraints remained a problem, there were signs that supply issues were starting to ease. The factory “malaise” was already starting to “spill over” into some parts of the services sector. Europe’s composite May flash PMI was 54.9 versus 55.8 in April. Services PMI was 56.3 versus 57.7 in April and manufacturing output was 51.2 versus 50.7 in April.

Source: S&P Global Flash Eurozone PMI: Eurozone growth remains robust in May thanks to buoyant service sector. Cost pressures ease for second month but remain elevated (5/24/2022)

Source: ifo Business Climate Germany, Results of the ifo Business Survey for May 2022: ifo Business Climate Index Rises (5/23/2022)

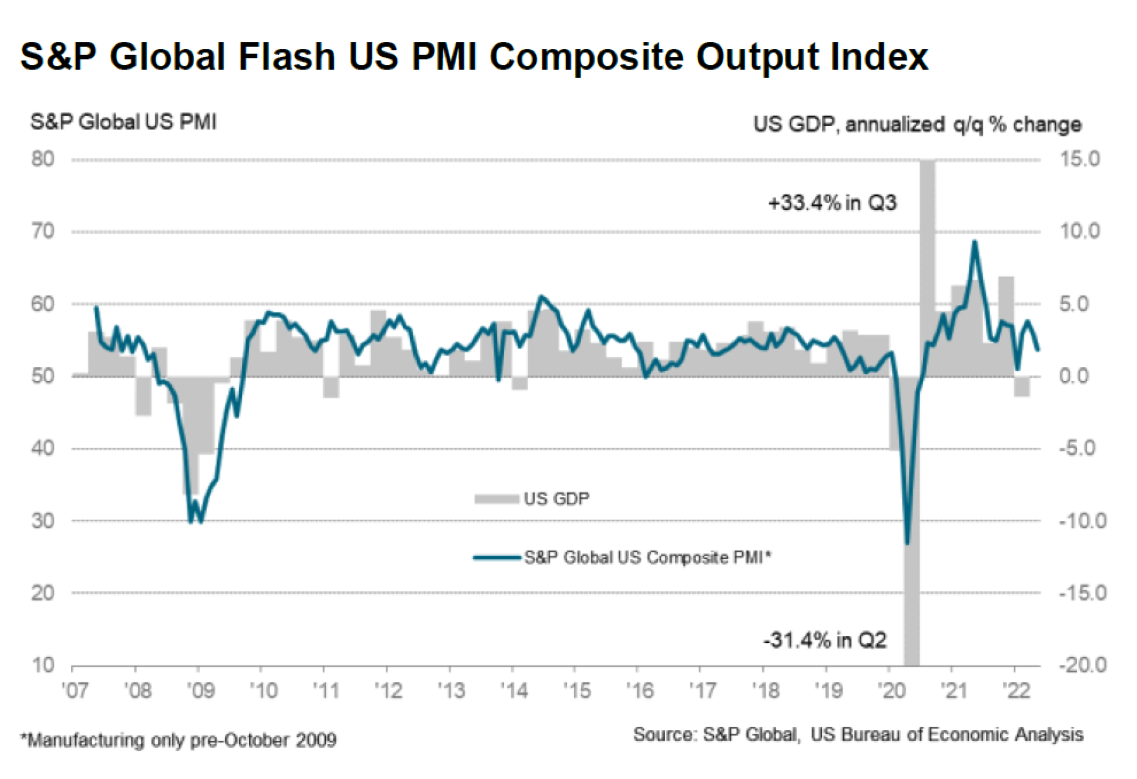

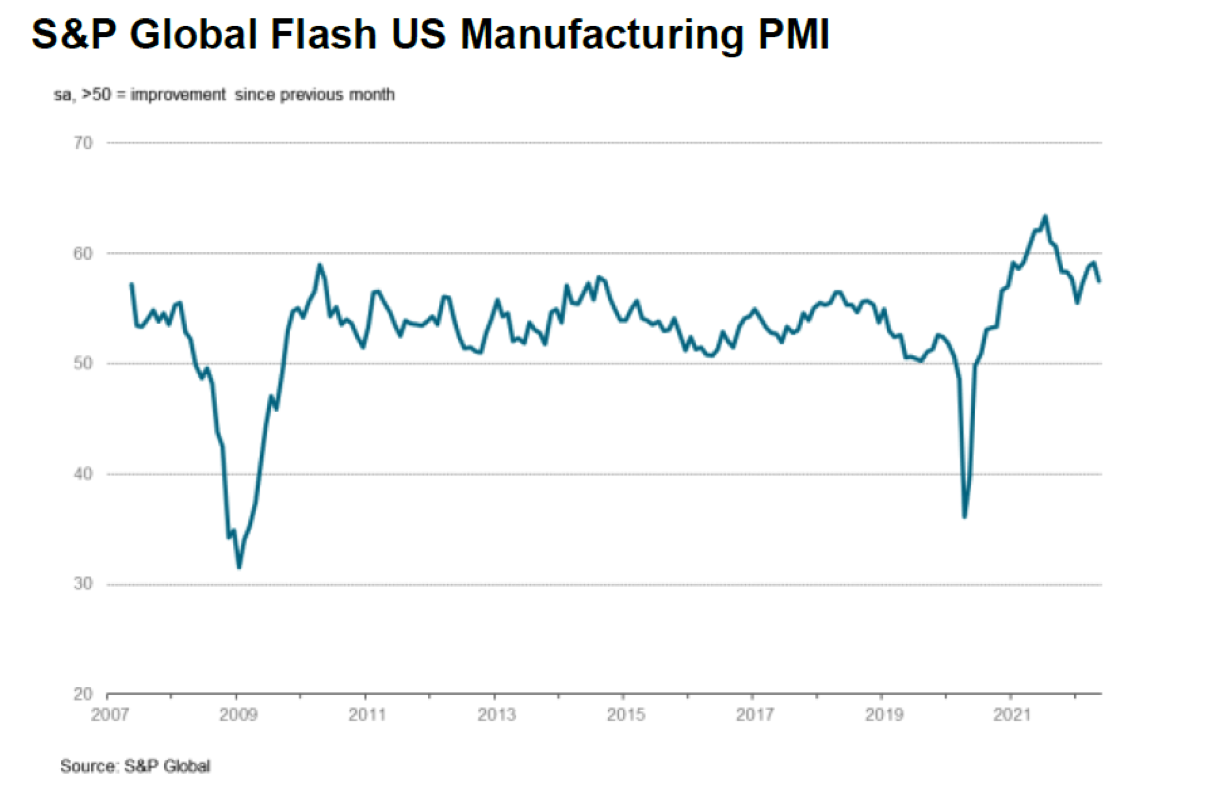

U.S. PMIs

The composite flash May composite PMI for the U.S. came in at 53.8 (four month low) versus 56.0 in April. The flash services reading also hit a four month low of 53.5 versus 55.5 in April. Manufacturing output PMI was 55.2 versus 57 in April. The U.S. data revealed further deterioration in supplier delivery times and composite new orders increased at the slowest rate since August 2020. Service providers signaled the slowest upturn in business for almost two years as hikes in selling prices weighed on demand and positive effects from the U.S. economy re-opening already showed signs of fading. The pace of input price rises reached record high levels. The composite increase in input prices was driven mainly by record breaking rises in service sector inputs. But cost inflation for manufacturers’ input prices were among the fastest recorded as well. Some manufacturers indicated it was becoming more “challenging” to pass along input price hikes to their customers, indicating margin pressures were increasing. As a result, manufacturers expressed the lowest degree of optimism in seven months for the next year’s business outlook.

Source: S&P Global Flash US Composite PMI: Inflationary pressures weigh further on US private sector expansion (5/24/2022)

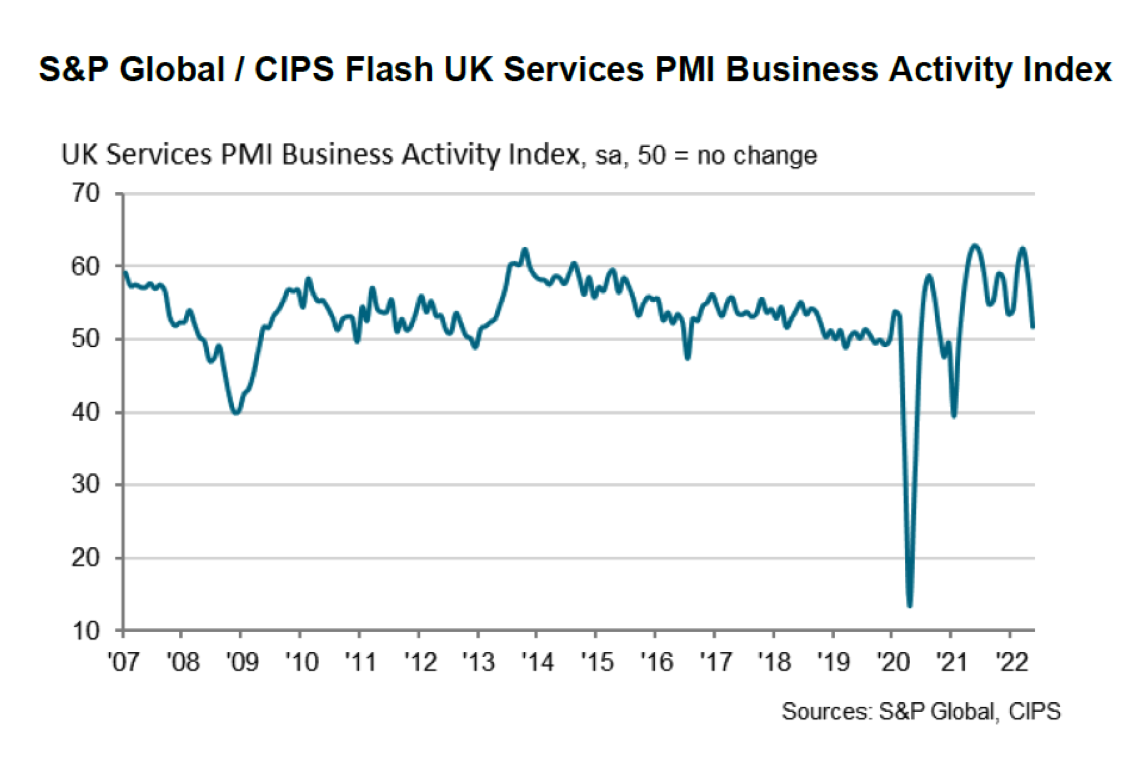

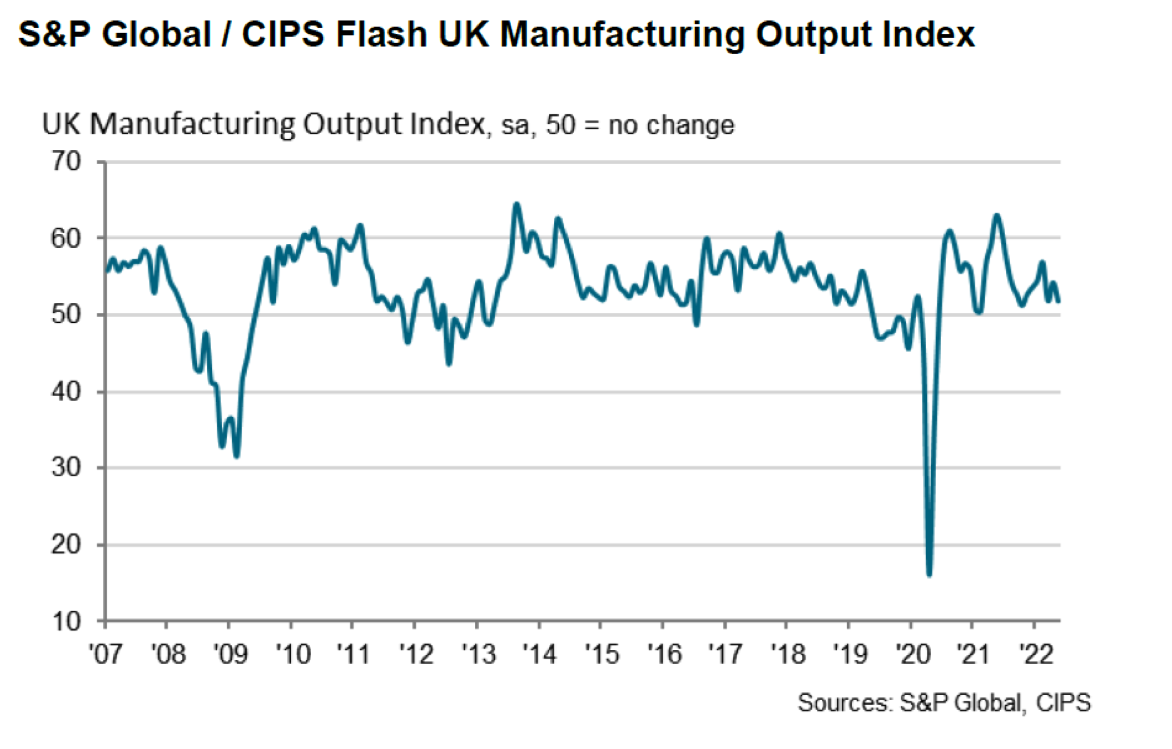

UK PMIs

The U.K. flash composite PMI was the dourest of all three of these PMIs as it fell to a fifteen month low of 51.8 in May from 58.2 in April. The chief economist for S&P Global characterized the UK PMI survey as signaling a “severe slowdown in the rate of economic growth in May, with forward looking indicators hinting that the worst was yet to come.” The survey data also “pointed to an economy almost grinding to a halt as inflationary pressures rise to unprecedented levels.” We surmise that a principal reason why Europe’s composite PMIS continue to outperform the U.S. and the U.K. is that the ECB has been much slower in adopting and implementing a monetary tightening policy. Our impression is that Europe has also lagged the U.S. in the reopening of its economies. Brexit-related issues may have also exacerbated the U.K.’s economic growth and inflationary issues.

Source: S&P Global / CIPS Flash United Kingdom PMI: UK private sector growth slumps to its weakest since the inter 2021 lockdown as cost of living crisis hits customer demand in May (5/24/2022)

Higher Energy Prices

We interpret the above information and data as generally supportive of a narrative that depicts slowing economic growth in the U.S. and perhaps slowing core inflation. But the problem of high energy costs remains, which could keep headline inflation measures significantly elevated and further slow economic growth.

J.P. Morgan (JPM) forecasts gasoline prices in the U.S. to exceed $6/gallon by sometime this summer. According to CNN, on May 23, average diesel prices in the U.S. recently hit a record high of $5.58/gallon, a 75% y/y increase. The diesel prices in the Northeast exceeded the national average, reaching $6.52/gallon recently and 102% higher y/y. Diesel is critical for the U.S. economy as it powers farm and construction equipment, trucks, trains and ships that transport needed goods. Therefore, higher diesel prices can be expected to increase costs for food and many other types of goods. Inventories of diesel fuel in the Northeast are now at record lows. In an article that was updated on May 26, the Boston Globe reminded us that Target’s Q1 profits declined by $1 Billion due to higher diesel costs in transporting goods.

We expect high energy and high prices for many other commodities to persist as long as the war lasts. We anticipate further increases in these prices as China’s economy begins to improve following the ending of shutdowns related to China’s “dynamic zero-COVID-19 policy.” Increased China demand for energy and other commodities will inevitably push these prices higher, everything else remaining equal.

Potential Turmoil in China’s Leadership

Further complicating any efforts to forecast economic and inflation trends is the apparent developing controversy of China’s President Xi Jinping’s zero-COVID-19 policy. According to a Goldman Sachs May 16 report, Xi Jinping reiterated the appropriateness of “embracing” this policy and he pledged to fight any attempt to “distort, question and challenge” this policy. On May 26, CNBC cited a “high profile state media article” early on Wednesday describing how Xi Jinping “led the country to success with its dynamic zero-Covid policy, and noted China’s bright economic prospects.”

Later that very same day, China’s Premier Li Keqiang held a very rare nationwide videoconference. This videoconference was described as one with “provincial, city-level and county-level local government officials across the country.” Li warned how China’s economy was at a “critical point” for determining its full year trajectory and called on officials to “work hard” for Q2 growth and to reduce unemployment. Li said, “the difficulties, in some areas and to a certain degree, are even greater than the severe shock of the pandemic in 2020.” Li said that China’s economy faced “grim challenges.” According to the Washington Post on May 26, Li said his chief goal was to ensure that China’s economy expands in Q2. LI said that this growth target was low but “based on reality.” The Washington Post estimated that over 100,000 government officials listened to Li’s conference. Li, who is considered second in ranking after Xi Jinping, traditionally would be expected to lead the economy. Although silent for much of his tenure, Li has urged changes to return the economy to a better economic growth trajectory in the past few months. “Li called on governments to strike a better balance between economic growth and coronavirus measures.”

We speculate that this could be a challenge to Xi Jinping as he prepares to take on a controversial third term. Perhaps opposition is growing. We will try to monitor this developing story closely. The variables continue to grow exponentially.

Need for the Most Appropriate “Story”

Much like Premier Li Keqiang felt that he was at a critical juncture to help ensure a satisfactory economic growth rate for China, we also feel like we are at a critical juncture as to determining what narrative or “story” makes the most sense given our current knowledge of the latest economic data. We would like to stress that we feel the need for more data before we can become more confident of the appropriate story that can properly encompass the incoming economic data. In our most recent commentaries, we thought that financial markets were pricing in the increasing probability of a U.S. recessionary outcome within the next twelve months. We agree that this probability has increased, but we are still reluctant to make a recession our base case at this time. We also acknowledge that at least some measures of core inflation might be diminishing, and that supply chain constraints and disruptions could continue to abate. But once again, we have difficulty escaping our conclusion that high headline inflation will persist as long as the war persists. That will only be exacerbated further to the extent China has fewer lockdowns and a better functioning economy.

We are very data dependent, just as the Fed has portrayed itself. We forecast that the rapidity of changes that we have witnessed in the past few weeks in regard to consumer and business behaviors will continue. We must remain vigilant so as to be able to grasp and understand whatever rapid changes transpire. We will not hesitate to change our narrative when and if appropriate. Will the Fed “pivot” if it sees inflationary pressures diminish if recession probabilities increase substantially? Will a commitment to raise the federal funds rate by only 25 bps at its September meeting be seen as enough of a pivot by the Fed so as to put in a sustainable bottom in U.S. stocks? An August/September timeframe for a more sustainable bottom in U.S. equities would also coincide with typical bottoms for U.S. stocks during mid-term elections. We also doubt a sustainable bottom until earnings and margins are revised lower. Stocks can also be expected to trade lower to the extent the probability of a recession within the next twelve months becomes more accepted by the markets.

Bottom Line

We assume continued volatility across virtually all financial markets for at least as long as the war persists. There were many encouraging signs in U.S. equity trading this week that lead us to believe that this week’s rally might continue at least into next week. But we do not think that this will be a sustainable “bottom.” Ideally, we would like to see a sector other than the energy sector assume a leadership role. Financial market uncertainty continues to be reflected in the daily variability of different sectors being the outperformers. The stock prices of many U.S. banks and other financials were catapulted higher after JPM’s CEO Jamie Dimon made positive comments about JPM and the banking sector at JPM’s investor day held on Monday. Perhaps the financial sector, and banks in particular are ready to assume a leadership role. We view that analysts’ revisions of their margins and earnings estimates might need to be revised lower as a prerequisite. We maintain our conviction that predictable margins should become increasingly important in evaluating appropriate investments.

Our fundamental investment approach remains the same as our most recent commentaries expressed. We maintain our preference for high-quality stocks in a diversified portfolio with at least some commodity exposure.

Definitions:

Flash PMI – The Flash Manufacturing PMI is an early indicator of where the final PMI figure may settle. The flash reading of PMI is an estimate of the Manufacturing Purchasing Managers’ Index (PMI) for a country, based on about 85% to 90% of the total PMI survey responses each month. Its purpose is to provide an accurate advance indication of the final PMI data.

The Purchasing Managers’ Index (PMI) – The Purchasing Managers’ Index (PMI) is an index of the prevailing direction of economic trends in the manufacturing and service sectors. It consists of a diffusion index that summarizes whether market conditions, as viewed by purchasing managers, are expanding, staying the same, or contracting. The purpose of the PMI is to provide information about current and future business conditions to company decision makers, analysts, and investors.

Federal Open Market Committee (FOMC) – The Federal Open Market Committee (FOMC) is the branch of the Federal Reserve System that determines the direction of monetary policy specifically by directing open market operations. The committee is made up of 12 members: the seven members of the Board of Governors; the president of the Federal Reserve Bank of New York; and four of the remaining 11 Reserve Bank presidents on a rotating basis.

Ifo Business Climate Germany – The Ifo Business Climate Index is a highly-regarded early indicator of economic developments in Germany published on a monthly basis.

European Central Bank (ECB) – The European Central Bank is the prime component of the Eurosystem and the European System of Central Banks as well as one f seven institutions of the European Union

Federal Funds Rate – The term federal funds rate refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

Basis Points (bps) – A basis point is one hundredth of one percent, used chiefly in expressing differences of interest rates.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/fast-answers/answersindiceshtm.html or http://www.nasdaq.com/reference/index-descriptions.aspx.

All data is subject to change without notice.

© 2024 NewEdge Capital Group, LLC