Weekly Summary: March 21 – March 25, 2022

Key Observations:

- As the Fed sets its monetary policy each month, Federal Reserve (Fed) chair Powell stated that the Fed “will be looking at actual progress” on inflation-related data and “not assume significant near-term supply-side relief.” We interpret this to mean that Powell is determined not to make the same mistake as when the Fed “looked through” what they deemed to be “transitory” inflation. If Powell stays true to his word, the Fed will be “backward looking” while implementing its monetary tightening policies.

- While listening to Powell’s Monday speech, we realized immediately that we needed to revise our prior week’s expectation that the 10-year Treasury yield might have hit a short-term peak of 2.24%. Compared to last week, Powell’s much more hawkish stance this week meant that there would not be even a short term “pause” in the yield’s continued ascent. We expect the 10-year Treasury yield to continue higher to a level above 2.50% this year, although it could possibly be in an irregular pattern. At this point, we don’t have a specific target on the 10-year yield. But we would not be surprised to see a higher yield substantially above 2.50%.

- Following the announcement of the Fed’s decision last week, Powell declared that the Fed had not yet decided whether or not to “front-load” its monetary tightening policies. After Powell’s speech this week and the subsequent Q&A, we are convinced that the Fed has decided to front-load its tightening schedule.

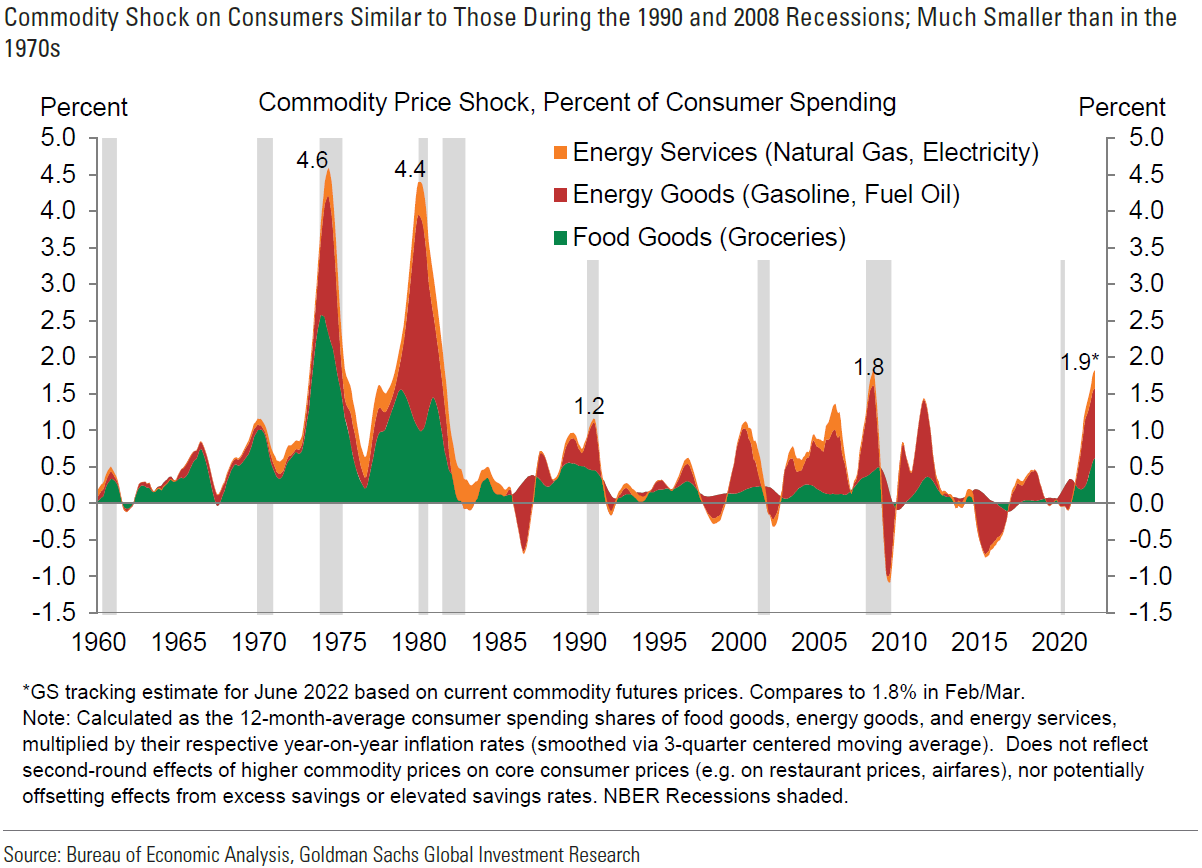

The Upshot: We assume under the current circumstances that backward looking means that the Fed will continue to tighten even if it expects inflationary pressures to diminish in the future. Given the consensus view of slowing inflation at some point this year, we conclude that a backward-looking approach makes this stance even more hawkish. In other words, the Fed will be making policy decisions based on actual data, and not on expected data. We postulate that the Fed’s front-loading of the tightening monetary policy could take the form of a 50 bps hike in the federal funds rate at the May meeting. Furthermore, we surmise that an announcement and implementation of the beginning of its balance sheet reduction plan might also occur at that same meeting. We expect yet another 50 bps hike at the June meeting. Powell made it clear that the Fed must act “expeditiously” – promptly – to rein in inflation due to the increasing likelihood of inflation expectations becoming “unanchored” and “entrenched” at “uncomfortably” high levels. We understand that the timing and the nature of how the Russia-Ukraine war and associated sanctions (war) will end is “unknowable.” The many outcome possibilities could range from an agreement to end the war on terms acceptable to Ukraine to horrible possibilities, including the use of nuclear weapons, chemical and biological warfare, as well as cyberattacks. A March 24 Bloomberg headline best describes one of our greatest concerns: “Putin stirs U.S. concern that he feels cornered and may lash out.” Our approach remains the same as last week. Many long-term investors could strive to maintain a diversified portfolio of high quality stocks of companies with strong balance sheets, somewhat predictable cash flows and an ability to maintain strong profit margins, with at least some exposure to commodities.

Powell’s Hawkish Monday Speech

Other than issues relating to the Russia-Ukraine war, we paid particular attention to when certain “adults are talking” – Fed officials and especially Fed chair Powell. Only last week and just after the Fed’s March meeting, Powell stated in his press conference that the Fed had not yet decided whether it was going to “front-load” its newly-adopted tightening monetary policy.

At the time of Powell’s press conference last week, most financial market observers interpreted Powell’s presentation as more hawkish than expected. Front-loading was interpreted generally to mean that the Fed might quicken the pace of raising rates to achieve a higher funds rate – i.e. 50 bps in lieu of 25 bps increases – at future Fed meetings. On Monday of this week Powell spoke at the Annual Economic Policy Conference National Association for Business Economics in Washington, D.C. He entitled his speech “Restoring Price Stability.” Along with many other analysts, we interpreted Powell’s speech as much more hawkish than even his statements of last week. “There is an obvious need to move expeditiously to return the stance of monetary policy to a more neutral level, and then to move to more restrictive levels if that is required to restore price stability.” Powell used the word expeditiously again later to describe the Fed’s need for prompt action. Later that same evening, Goldman Sachs focused on this word to change its forecast of 25 bps increases in the federal rate at the Fed’s May and June meetings to 50 bps at each of those meetings. Financial market indicators were quick to assign a 73% probability of a 50 bps hike at the May meeting and a 63% chance of such a hike at the June meeting. Cleveland Fed president Loretta Mester and St. Louis president Jim Bullard were also rather outspoken this week in their preference for the Fed to front-load its tightening policies. Moreover, Bullard was the sole dissenter to the Fed’s decision last week to raise the federal funds rate by 25 bps, expressing his preference for a 50 bps hike.

Likelihood of 50 bps Hikes

Given Powell’s statements on Monday, we now agree that the Fed most likely will announce a more aggressive hiking cycle. We also expected the Fed to announce the shrinking of its balance sheet at the May meeting and to begin implementing the shrinkage at that time as well. But since Powell had suggested that the beginning of the Fed’s balance sheet reduction – quantitative tightening (QT) – “might be the equivalent of another rate increase,” we thought that the Fed would only hike by 25 bps in May alongside QT. After listening to Powell on Monday, we now anticipate a 50 bps increase in the federal funds rate in May along with QT. In the Q&A period after his speech, Powell was asked what could prevent the Fed increasing by 50 bps. His answer: “nothing.” He then paused before adding that his answer was also his “executive summary.”

Fed’s Dual Mandate

Powell never lost sight of the Fed’s dual mandate: to promote maximum employment and stable prices. Powell described the labor market as ”very strong” and “very tight.” He described inflation as “much too high.” Powell believes that the best way to sustain a strong labor market is by reining in inflation. “If you want a strong labor market you have to have price stability.” We agree.

“Actual” Information and Progress – Fed NOT Assuming Supply-Side Relief

Powell readily admitted his assumption that inflation was “transitory” proved to be wrong. “The rise in inflation has been much greater and more persistent than forecasters generally expected.” In essence, the Fed could label inflation as “transitory” because it was “looking through” the causes of inflation. The Fed was convinced at that time that supply chain issues were temporary and concluded that inflation was transitory. Throughout this time, we thought that inflation was not transitory and that it would be greater and more persistent than the Fed believed. In our opinion, Powell showed clearly on Monday that he was determined not to make that mistake again. “As we set policy, we will be looking to actual progress on these issues and not assuming significant near-term supply side relief.” Powell seemed ready to accept the incoming economic data at face value. We think that the lyrics of The Strokes song “The Adults are Talking“ are apropos. “No more askin’ questions or excuses; Information’s here; Here and everywhere.”

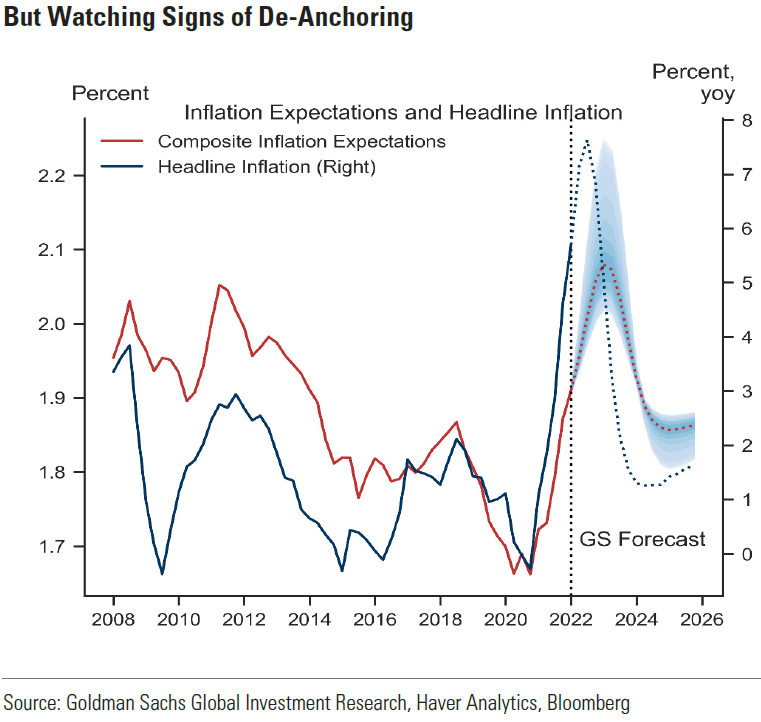

Inflation Expectations Rising

As long as Powell stays true to his word, accepts that the “information’s here” and that he will not make any “excuses” or attempt to provide explanations that would suit his agenda, we accept that the Fed will be very aggressive as long as elevated inflation persists as reflected by incoming economic data/information. We then suppose that the Fed will maintain an aggressive tightening stance irrespective of their belief that the rate of increasing inflation will slow later this year. As we have highlighted in many of our prior commentaries, the Fed is very concerned that expectations of continued elevated inflation do not become “entrenched” and that longer-term inflation expectations remain “well anchored” close to the Fed’s 2% inflation target. Powell stated that the “risk is rising that an extended period of high inflation could push longer term expectations uncomfortably higher, which underscores the need for the Committee to move expeditiously.”

Source: European Daily: ECB—A Difficult Trade-off (3/23/2022)

Summary of Economic Data Examined this Week

The “actual” economic data we examined this week continued to show rather buoyant economies in both Europe and the U.S. The re-opening of economies appeared to offset most of the negative effects stemming from the war. The war’s “ill-effects” most likely were reflected by very elevated input prices and prices received, as well as diminishing margins and declining optimism about future business activity – typically considered six months into the future. The data reflected in these surveys were all collected sometime during March. Therefore, we assume that all respondents were well aware of the war and were evaluating the possible effects of the war on their businesses. The nonmanufacturing survey conducted by the Federal Reserve Bank of Philadelphia and the manufacturing surveys of the Richmond Fed and the Kansas City Fed all showed expansionary economies in March.

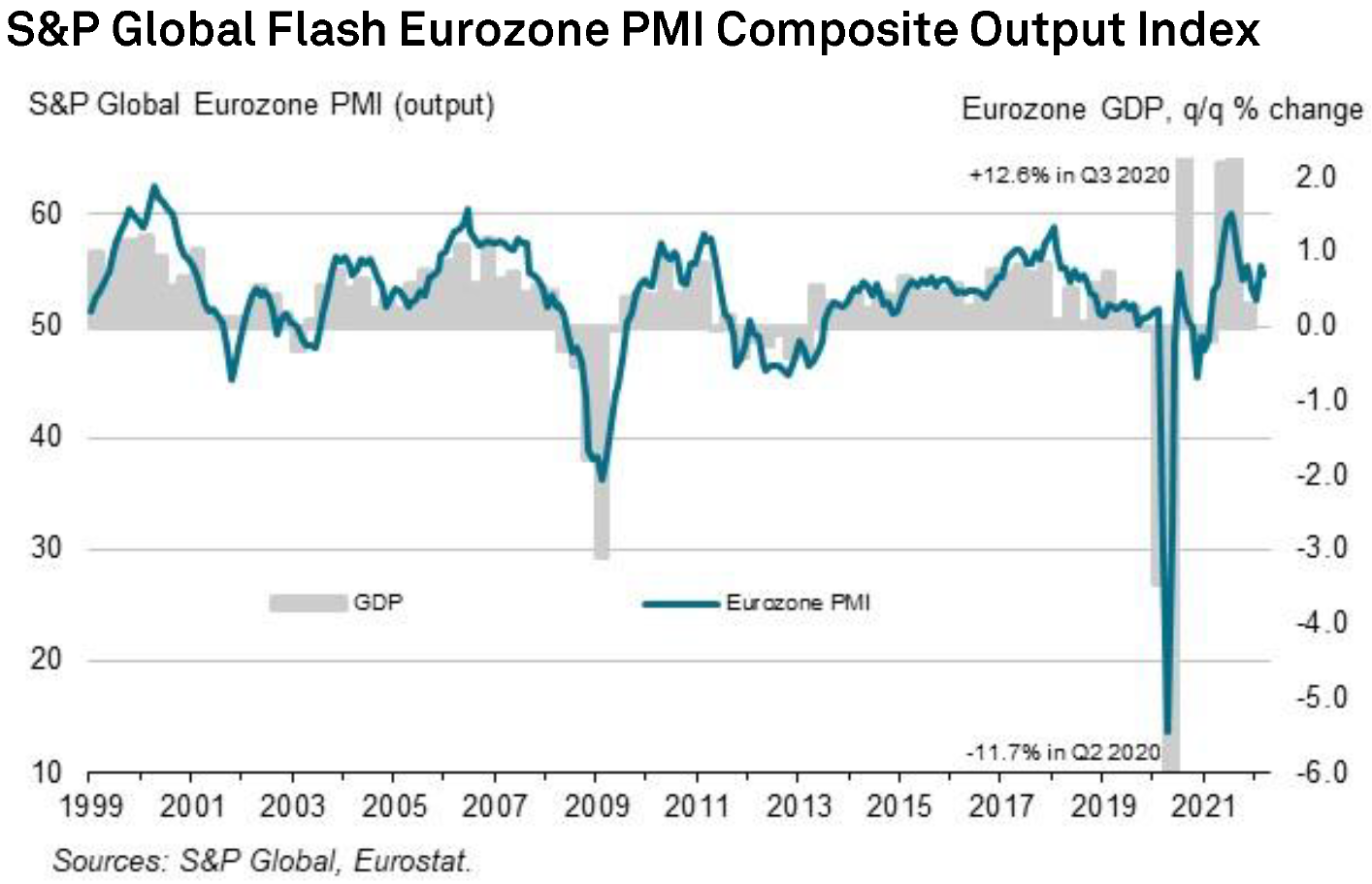

Eurozone PMIs

Other than Russia or Ukraine, it appears that there is a very cohesive consensus opinion of analysts that European economic growth would be the most adversely affected by the war. Although the war did have negative effects on Europe’s economies, those negative effects were obscured largely by the fortuitous coincident timing of the re-opening of Europe’s economies due to drastically lessened COVID-19 restrictions. According to S&P Global (formerly IHS Markit), the headline Flash Eurozone Composite Purchasing Managers’ Index (PMI) fell from a five-month high of 55.5 in February to 54.5 in March. February’s growth was the second strongest expansion since November 2021. Flash PMIs are preliminary PMIs based on about 85% of the final number of respondents. Manufacturing output growth slowed at a faster pace than the slowdown in services sector expansion. Additionally, manufacturing output was hurt especially by new export orders, which fell for the first time in 21 months. This orders reduction included a decline for auto makers’ exports. The war’s effects could be seen most clearly through its effects on prices. “Average input prices across both manufacturing and services rose at a rate far in excess of any previous increase recorded since comparable data were first available in 1998.” The higher input costs along with further wage increases led to an “unprecedented” rise to record high levels in average prices received for goods and services. Nevertheless, we were surprised that the Eurozone PMIs held roughly at the mid 50’s level. Any reading above 50 is considered expansionary. We conjecture that Eurozone PMIs will continue to deteriorate in future months. Chris Williamson, Chief Business Economist at S&P Global agreed with us: “had it not been for the easing of COVID-19 containment measures to the lowest since the start of the pandemic, business activity would have weakened far more sharply in March. This short-term boost from the rebound will fade in the coming months.” Business optimism was hit hard this month, “with expectations of future output collapsing in March.” We agree with Williamson that the “detail [of this PMI report] reveals a significantly darker economic outlook compared to February.” We trust that the longer the war persists, the worse for Europe’s economic outlook in the months ahead.

Source: S&P Global, S&P Global Flash Eurozone PMI (3/24/2022)

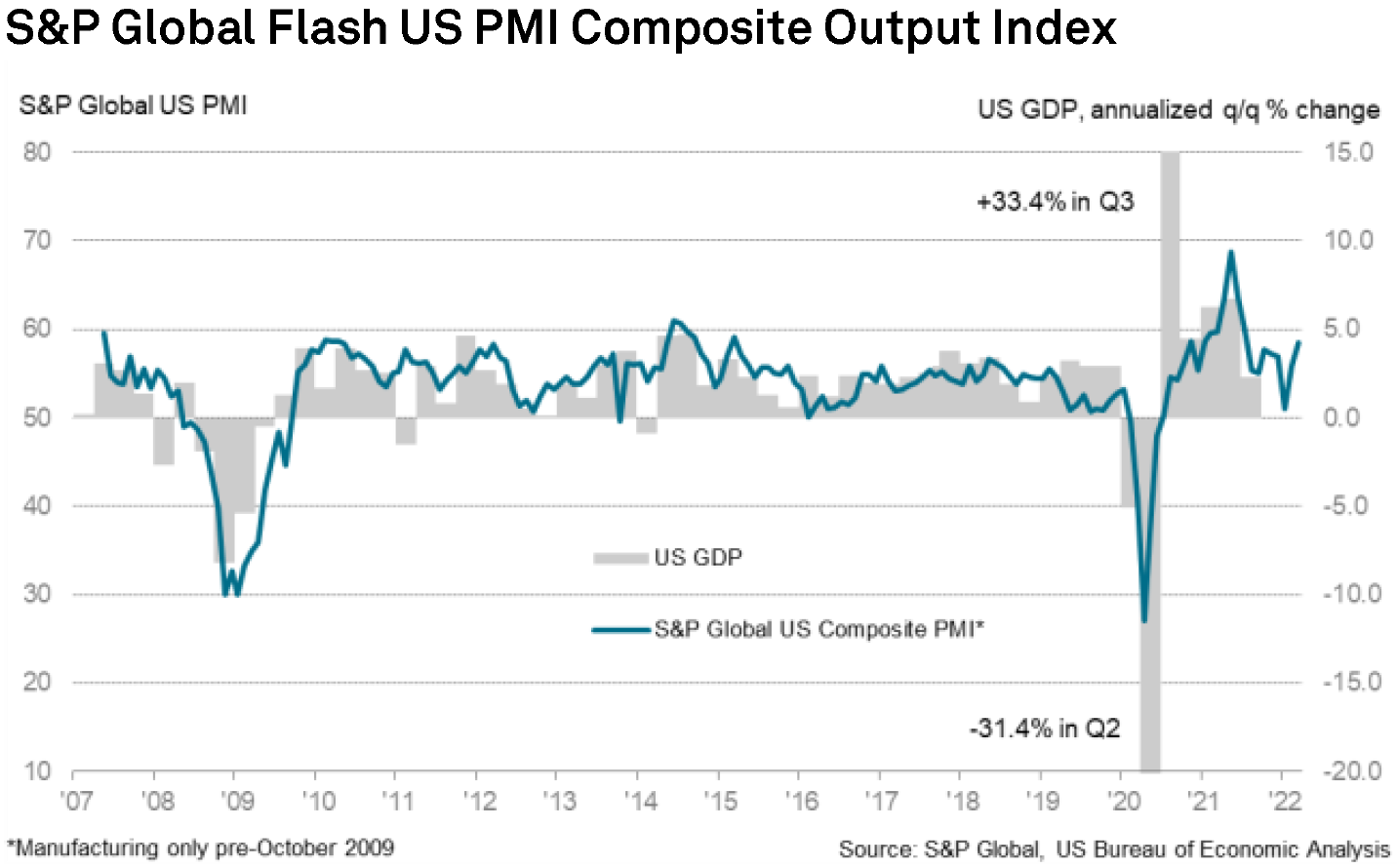

U.S. PMIs

As expected, U.S. Flash PMIs were much stronger than those of Europe. Even so, they showed a surprising resilience in the face of increasing inflationary pressures that were exacerbated by the war. The headline Flash U.S. PMI Composite Output index rose from February’s reading of 55.9 to 58.5 in March. The March reading indicated the fastest rise in private sector output since July 2021. The sharp increase in activity was described in the report as “broad-based” and that it “signaled a further recovery from January’s Omicron-induced slowdown.” Input costs increased in March at near-record rates for manufacturing and services sectors. Raw material, fuel and energy costs were particularly troublesome. Many firms in the survey also highlighted supply chain issues that were exacerbated by the war in Ukraine and lockdowns in China. New order growth was thought to be behind the record rise in backlogs. But as with Europe, “the degree of confidence [for future business activity] slipped to a five-month low amid concerns regarding soaring input costs and the war…” The services sectors in particular were concerned about the potential impact of customers’ reduced disposable incomes due to rising inflationary pressures. Up from February’s level of 56.5, the U.S. Services PMI March reading of 58.9 signaled the strongest output rise in eight months. Once again, the positive re-opening economic effects overwhelmed the negative effects from the war. The U.S. Manufacturing PMI also rose from 57.3 in February and reached 58.5 in March, “to indicate a sharp improvement in operating conditions across the manufacturing sector.” There was some evidence of stockpiling to protect against future price increases. Williamson perhaps best described this survey: “Services led the upturn as the hospitality sector in particular benefitted from loosened pandemic restrictions, though manufacturing output growth also accelerated, buoyed by rising demand and fewer supply constraints. Supply bottlenecks fell to the lowest level for 14 months.” The strength of the PMIs of the U.S. as compared to Europe appears to confirm the relative isolation of the U.S. from the Ukraine war’s ill effects.

Source: S&P Global, S&P Global Flash US PMI (3/24/2022)

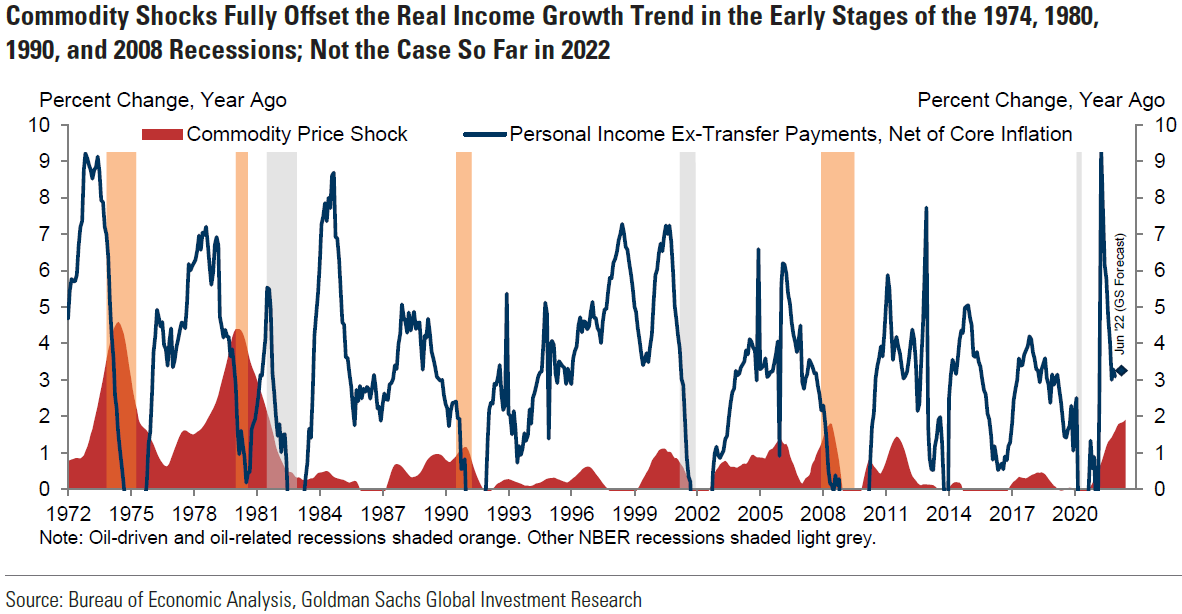

Source: Goldman Sachs, US Daily: Commodity Price Shocks and Recession Risk: Lessons from the Gulf War (3/23/2022)

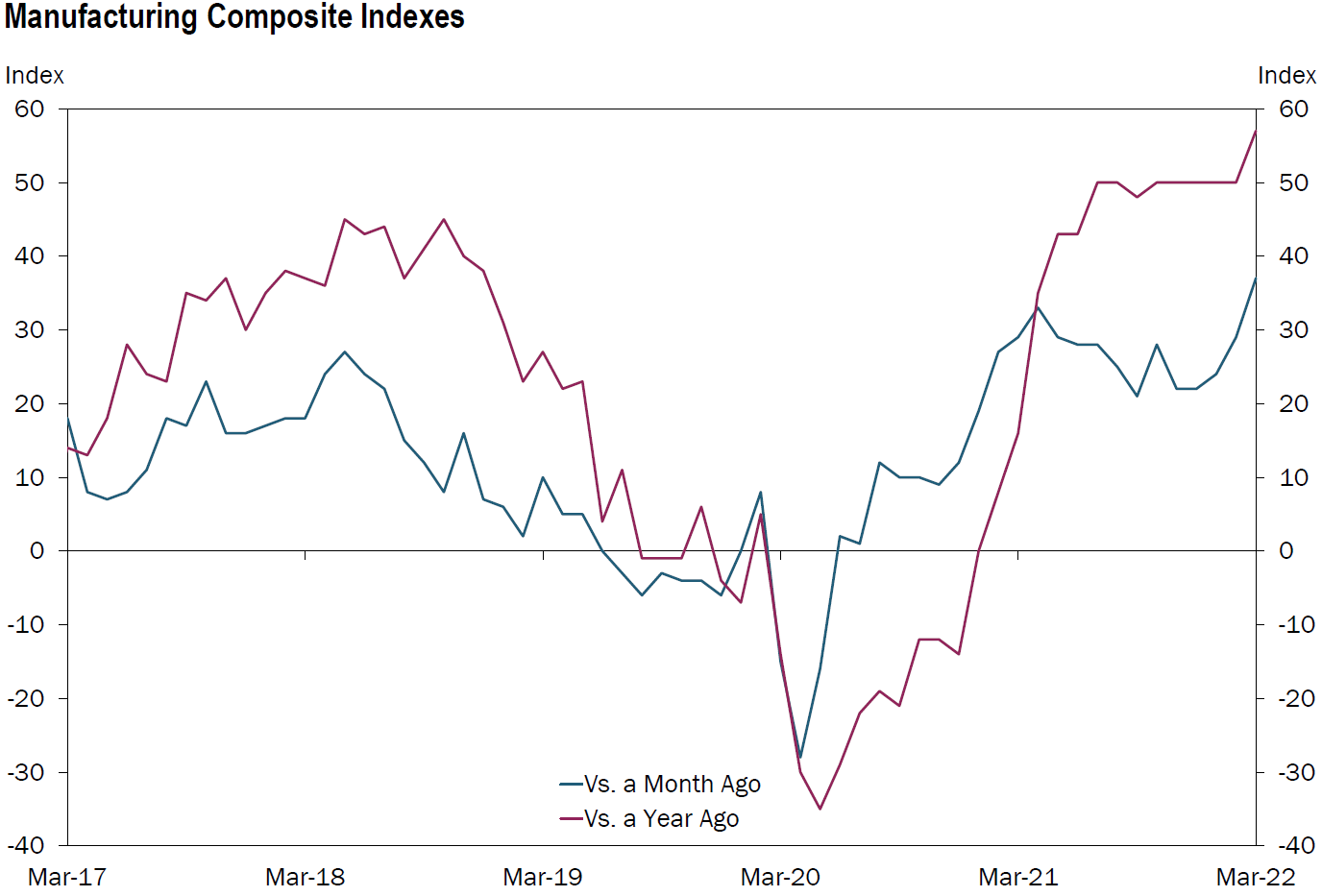

Regional Federal Reserve Bank Surveys

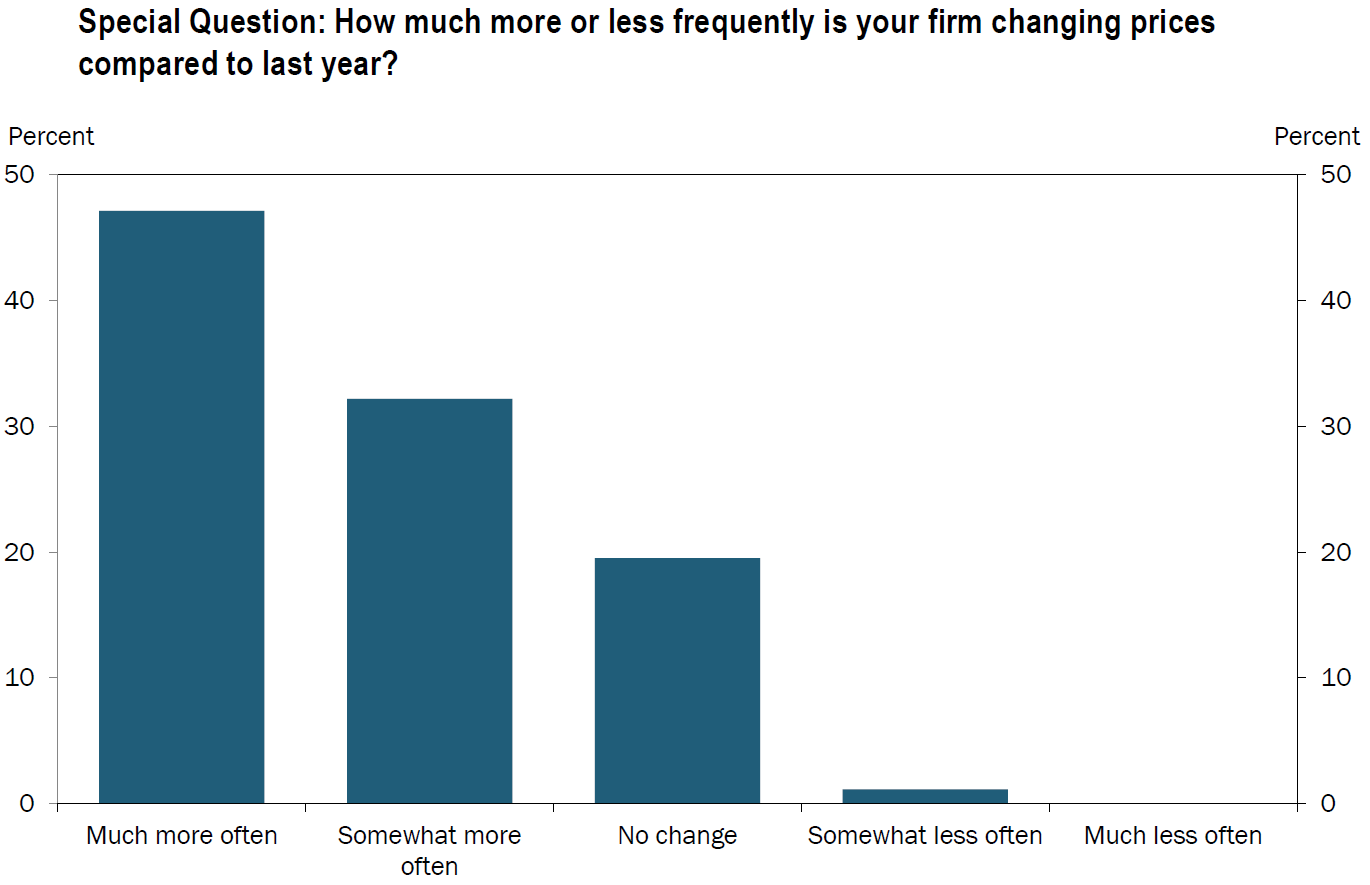

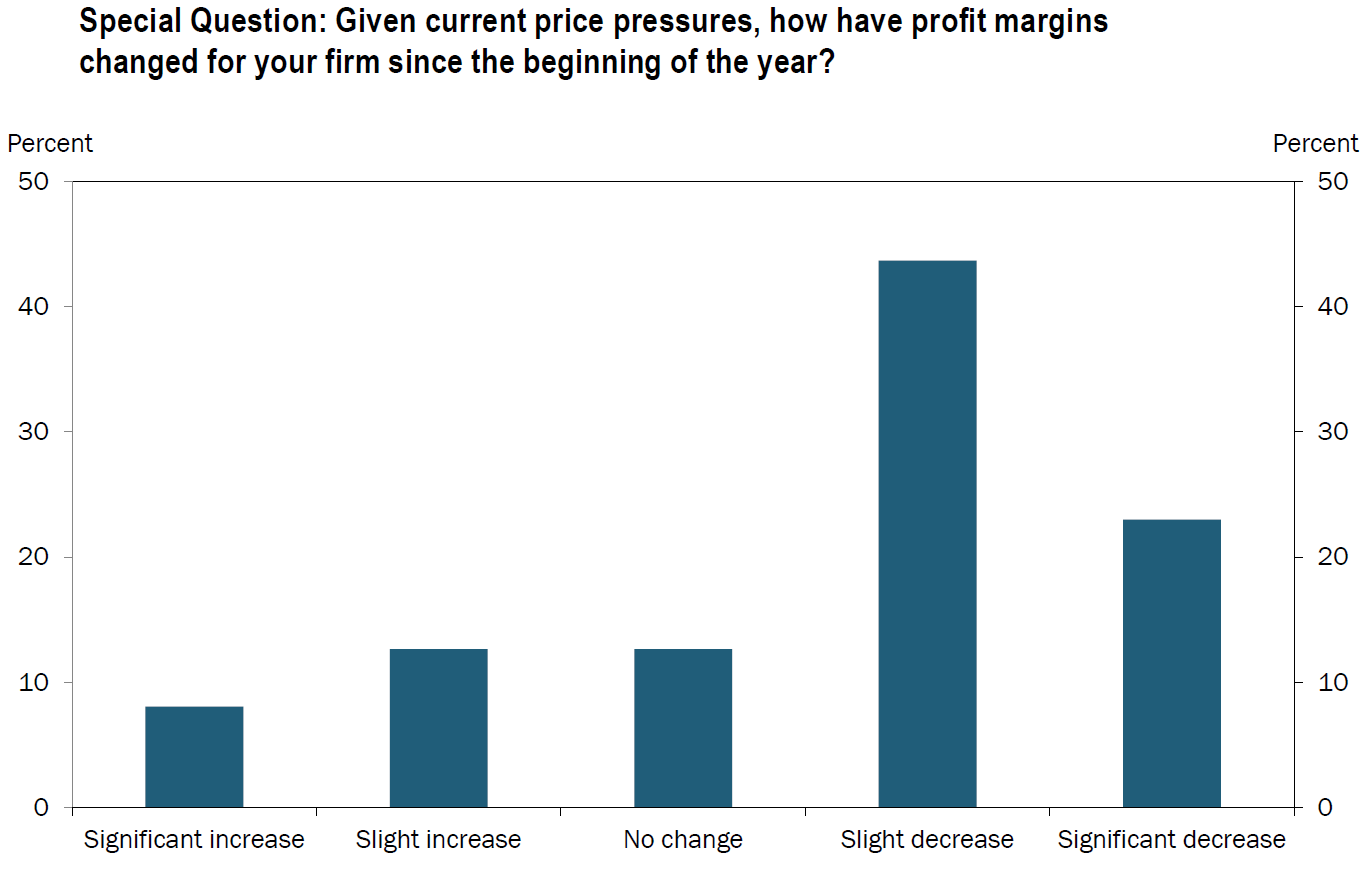

Various March surveys conducted by three Federal Reserve banks whose results were released this week showcased the strength and resilience of the U.S. economy. The nonmanufacturing survey’s index for general business activity from the Federal Reserve Bank of Philadelphia rose from 27.5 in February to 38.1 in March. Firms in the Philadelphia region continued to express optimism for business activity over the next six months. While decreasing compared to last month, prices paid and received still remained at elevated levels. The manufacturing survey conducted by the Federal Reserve Bank of Richmond showed business activity expansion in March. Shipments and volume of new orders increased. In general, firms reported increased hiring and rising wages. Low inventory levels of finished goods were expected for the foreseeable future. Prices paid were lower for the third month but remained elevated. Prices received “inched” up on average in March. The manufacturing index conducted by the Federal Reserve Bank of Kansas City grew at a record pace in March and expectations for future business activity remained “solid.” We thought it noteworthy that 23% of firms responding in this survey reported significant downturns in their profit margins this year due to rising input costs and supply chain disruptions. Another 44% of respondents conveyed slight decreases in their profit margins. One firm cited that the principal effect from the war was higher inflation due to energy and freight price increases.

Source: Federal Reserve Bank of Kansas City, Federal Reserve Bank of Kansas City Releases March Manufacturing Survey (3/24/2022)

Increasing Mortgage Rates and U.S. Housing Market

As mortgage rates have risen sharply recently, we are becoming concerned increasingly about the U.S. housing market. According to CNBC on March 22, the 30-year fixed mortgage rate hit 4.72% on the day of their report. This is a 26 bps increase from the Friday before, and a 127 bps jump above the 3.45% rate from the same week in 2021. Lawrence Yun, the chief economist for National Association of Realtors expects U.S. home sales to decrease 6% to 8% this year. Home prices in January were 19% higher year-over-year. Demographics of new household formations continue to be favorable for the housing market, but affordability could become problematic especially for the first-time buyer. Housing inventory remains at historically low levels. Reuters reported on March 23, that new home sales unexpectedly fell 2% from a downwardly-revised sales figure in January. Evidently, rising home prices and mortgage rates were pricing out some first-time buyers. Reuters highlighted that mortgage payments as a share of median family income have risen above 20% for the first time since 2007. On March 23, J.P. Morgan remained optimistic that housing demand will stay “healthy” over the next several months. We consider the housing market to be a critical component of U.S. economic growth. We will continue to monitor this market very closely in evaluating the economic growth prospects of the U.S. economy.

Bottom Line

Given the myriad of uncertainties at present, we assume continued volatility across virtually all financial markets as long as the war persists. We suppose that a well-diversified portfolio of selected high-quality stocks that includes some commodity exposure could be the best strategy for many long term investors.

The economic data and surveys we analyzed this week continued to show strong resiliency in the U.S. economy and somewhat less so for Europe. We trust that this data confirms that the U.S. is somewhat isolated from the negative effects from the war.

We foresee that most global economic growth rates will be revised lower and that most inflation forecasts will be revised higher due to the war. Additionally, we assume downward earnings revisions for many companies might soon reflect those patterns. Predictable margins should become increasingly important in evaluating appropriate investments.

Definitions:

Inflation Hawk (Hawkish) – An inflation hawk, also known in monetary jargon as a hawk, is a policymaker or advisor who is predominantly concerned with the potential impact of interest rates as they relate to fiscal policy. Hawks are seen as willing to allow interest rates to rise in order to keep inflation under control.

Federal Funds Rate – The term federal funds rate refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

Recession – A recession is a macroeconomic term that refers to a significant decline in general economic activity in a designated region. It had been typically recognized as two consecutive quarters of economic decline, as reflected by GDP in conjunction with monthly indicators such as a rise in unemployment. However, the National Bureau of Economic Research (NBER), which officially declares recessions, says the two consecutive quarters of decline in real GDP are not how it is defined anymore. The NBER defines a recession as a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.

Basis Points (bps) – A basis point is one hundredth of one percent, used chiefly in expressing differences of interest rates.

Cyberattack – An attempt by hackers to damage or destroy a computer network or system.

The Purchasing Managers’ Index (PMI) – The Purchasing Managers’ Index (PMI) is an index of the prevailing direction of economic trends in the manufacturing and service sectors. It consists of a diffusion index that summarizes whether market conditions, as viewed by purchasing managers, are expanding, staying the same, or contracting. The purpose of the PMI is to provide information about current and future business conditions to company decision makers, analysts, and investors.

Eurozone – The eurozone, officially called the euro area, is a monetary union of 19 member states of the European Union that have adopted the euro as their primary currency and sole legal tender.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/fast-answers/answersindiceshtm.html or http://www.nasdaq.com/reference/index-descriptions.aspx.

All data is subject to change without notice.

© 2024 NewEdge Capital Group, LLC