Weekly Summary: July 25 – July 29, 2022

Key Observations:

- We characterize the Federal Reserve’s (Fed) latest policy stance as relatively dovish, and we label this stance as a “soft” pivot. Given our assumption of peak headline inflation and our observations of a slowing U.S. economy, we foresee any future hikes in the federal funds rate as not to exceed 50 basis points (bps).

- Fed chair Powell stressed the Fed’s data dependency in decision making at upcoming meetings. Powell did not provide any guidance for the next meeting. Decisions will be made on a meeting-by-meeting basis. But Powell maintained general guidance of “restrictive” interest rate levels by year end.

- We agree with Powell that the U.S. is not in a recession currently in spite of consecutive quarters of negative U.S. GDP growth.

- Selected high-quality tech and growth stocks continued to outperform since mid-June. Recently, lower real interest rates have supported this outperformance. We suppose that high-quality growth stocks should command a premium valuation in a slowing economy.

The Upshot: We have refined our outlook for financial markets given our assumption that the Fed has provided financial markets with a “soft” data-dependent pivot, our assessment that the U.S. economy will continue to slow, and that headline inflation has more than likely peaked in the U.S. Additionally, we have stressed repeatedly that the rapidity of change since the onset of the pandemic has continued to surprise. Even though Fed policy works its way through financial conditions tightening with a lag, we have observed along with Powell a moderation in demand throughout the economy. Additionally, we suppose that the economic slowdown in the U.S. will begin to accelerate and that it will help rein in inflation. Although we anticipate that the slowing of inflation to acceptable levels for the Fed will take some time, we suppose that a more predictable level of interest rate hikes could serve as an enhancement for equity valuations – particularly for the benefit of high-quality growth stocks.

We foresee continued financial market volatility and we maintain our conviction that equities should only be purchased on downturns. However, many uncertainties remain. As outlined in our prior week’s commentary, our latest focus is on the natural gas flow from Russia to Europe through the Nord Stream 1 (NS1) pipeline. We imagine continued headline risk with respect to the flow rates of this pipeline. Furthermore, we have highlighted for quite some time the relative illiquidity and low volumes of many financial markets. Such conditions should exacerbate market volatility. In our opinion, the reduction of natural gas flows into Europe will only serve to enhance recession probabilities worldwide and increase inflationary pressures on a global scale. In general, we continue to favor big-cap high-quality stocks with strong balance sheets, as well as relatively stable cash flows and margins. We continue to favor high tech and growth stocks within this group. We also continue to favor selective energy stocks. We will otherwise search across all sectors to find stocks that meet these characteristics. Furthermore, we continue to favor at least some commodity exposure as well.

Given the Fed’s soft pivot and the myriad of variables that continue to affect economic data and financial markets, we foresee increasingly that a “capitulation” day for the overall equity market is increasingly unlikely. We are focused more on anticipating and recognizing bottoms of individual stocks and sectors. This is one of the reasons why we have been recommending buying at tradable bottoms for long-term investors. One can never be sure that any particular bottom for a stock or sector was the “ultimate” bottom for this cycle. Our base case assumes that we will escape a severe recession. A severe recession would almost certainly push virtually all equity valuations lower.

The Fed’s Latest Monetary Policy Stance

In our opinion, the Fed adopted at its latest meeting mid-week a more “dovish” stance towards its monetary tightening policy to rein in inflation. On that day, the financial markets seemed to agree with our characterization. U.S. equities rallied, Treasury yields traded lower as the yield curve steepened and the U.S. Dollar (USD) traded lower as well. In a statement announcing its latest decision, the Federal Open Market Committee (FOMC) acknowledged a slowing U.S. economy that was evident in comparing its current statement to its prior one. The new statement deleted a reference to a pickup in economic activity and replaced it with “recent indications of spending and production have softened.” Fed chair Powell referenced many examples of a slowing U.S. economy in the press conference after the release of the Fed’s decision to raise the federal funds rate by 75 bps, as generally expected. We have referenced many such examples in our recent commentaries as well and we will provide more such references this week. Even though Powell continued to characterize the U.S. labor market as “extremely tight,” he alluded to the household survey of employment we highlighted in last week’s commentary. Powel pointed out that the household survey showed a much lower level of job creation over the past three months when compared to the Bureau of Labor Statistics (BLS) payroll survey that showed an average number of 375,000 jobs added.

More Details on Fed’s Monetary Policy

The 75-bps hike raised the federal funds rate target range to between 2.25% and 2.50%, which the Fed considers to be in “neutral” territory – not a stimulant to the economy, and not a depressant to economic growth. The other notable deletion from the FOMC’s prior statement was any reference to China’s COVID-19 related lockdowns that “are likely to exacerbate supply chain disruptions.” We admit that we no longer expect that Chinese lockdowns will be as severe as the recent ones, but we do think that the length and severity of any future lockdowns could continue to surprise. Even mass testing requirements in lieu of lockdowns could be disruptive to China’s supply chains and economy. This still could slow global economic growth and raise inflationary pressures. Powell reiterated the Fed’s data dependency going forward in its upcoming decisions, and he stressed that interest rate hikes will be determined on a meeting-by-meeting basis. Much like the European Central Bank (ECB), there was no specific guidance on possible rate hikes at any one meeting. However, Powell did provide a “general” guidance by indicating he wanted to achieve by year end a more restrictive interest rate level – in the 3.0% to 3.5% range.

“The Scientist” – Not the Fed

Some of the lyrics in Coldplay’s song “The Scientist” coincided with our assessment of the Fed’s prior attempts at guidance and its often inaccurate assessment of inflation. It was as if the Fed “was just guessing at numbers and figures; Pulling the puzzles apart; Running in circles, coming up tails; Nobody said it was easy; No one ever said it would be this hard.” We have characterized the Fed as being behind the curve in deciding to tighten finally its monetary policy to rein in inflation. We did not share the Fed’s belief that inflation was “transitory.” Recently, the Fed often has stressed that it could not let inflation and inflation expectations become “entrenched” because it would be more costly to eventually rein in inflation. But, due to its assumption of transitory inflation that did not require any immediate action, that is precisely what the Fed did. We can only guess that Powell must have wished often: “Oh, take me back to the start” when inflation first became an issue so that the Fed could have acted more “expeditiously” than they did.

The Fed’s “Soft” Pivot

We will now examine why we believe the Fed is now more dovish and why this new “non-guidance” at a meeting-by-meeting approach might even be assumed to be the much-anticipated Fed “pivot.” We label this as a “soft” pivot. Many investors and analysts have been waiting for the Fed to pivot as a necessary prelude to a more sustainable equity “bottom” and/or rally. We have been looking also for such a pivot. We understand that the required pivot is an actual cut in interest rates by the Fed and we do not anticipate any such cut in the near-to-medium term. But we do believe that this current soft pivot could be sufficient to achieve the effects of a more classic pivot. Given Powell’s notion that the U.S. economy is slowing and our similar notion accompanied by a slowing headline inflation rate, we agree with Powell that it “likely will be appropriate to slow the rate increases” in the federal funds rate. “Whether another large increase could be appropriate depends on the data.” Powell noted that 75 bps hikes were “unusually large.” We do not anticipate any more hikes as large as 75 bps for the duration of this tightening cycle. The Fed needed to catch up to at least a neutral rate as expeditiously as possible. There is less need to get to a slightly more restrictive rate in an expeditious manner. We presume that the Fed will “handle with care” the present economic environment.

Powell’s Assessment of U.S. Economy

Powell did not deviate from his commitment to reduce inflation to the Fed’s 2% target. The Fed will continue to watch for “compelling” evidence that inflationary pressures are diminishing. This should take at least a number of months. Powell commented that an economic growth slowdown will be “necessary” to rein in inflation and that he thinks there “will be some softening in labor market conditions.” An economic slowdown will allow the supply side to “catch up” to a moderating demand due somewhat to increasing interest rates. Powell also noted a “marked” slowdown in consumer demand in the second quarter, a decline in job creation, some indication that wages moderated, and a “feeling” that the labor market was moving back into balance as employers were having “less difficulty” in finding workers. Powell noted that “broader financial conditions have tightened a good bit.” This is what is supposed to happen as the Fed raises interest rates. In answering a question, Powell denied that we were currently in a recession since we were not in a “broad based decline.” Furthermore, Powell stated that we don’t need a recession to rein in inflation but that the path to avoid a recession has narrowed. Powell continued to stress that the Fed needed to be “nimble” while adhering to a data dependent approach.

Two Consecutive Quarters of Negative U.S. GDP Growth

The preliminary data of U.S. real GDP growth for Q2 was released the day after the FOMC meeting. We were struck by the observation that the Fed’s statement and much of Powell’s statements of the day before were as if they knew the contents of this report. We assume that the Fed was in fact aware of this data. The real U.S. GDP contracted 0.9% quarter-over-quarter (q/q) versus an expected increase of 0.3%. This was the second consecutive quarter of negative GDP growth. First-quarter GDP contracted 1.6%. The smaller decrease in Q2 reflected an upturn in exports and a smaller decrease in federal government spending. Many people believe that two consecutive quarters of negative growth constitutes a recession. We do not subscribe to this definition. Powell made it abundantly clear the day before that he thought we were not in a recession since “too many areas of the economy are doing well now,” especially the labor market. Our commentary of July 15 explains in detail why we believe that the two consecutive quarters of negative GDP growth this year will generally not be considered a recession. Nevertheless, as disclosed in our prior commentary, there was only one time in the post-World War II era when two consecutive negative economic growth quarters were not labeled a recession. That time sounds similar to the present circumstances when trade deficits and inventory adjustments detracted from economic growth while consumption growth remained positive. The slow growth of private inventory accumulation, which slowed to an annual rate of only $82 billion, was the biggest contributor to the negative GDP growth in Q2 as it subtracted 2.0% from the headline number. General merchandise stores and motor vehicle dealers contributed greatly to this inventory shortfall, along with a sharp drop in agriculture inventories. We would not be surprised to see an increase in inventory accumulation in Q3 to replenish depleted inventory levels. Inventory data could then be additive to GDP growth. Higher interest rates appeared to have their desired effect on slowing economic growth as many interest-rate-sensitive categories of final demand contracted in Q2. These included housing, consumer durables, and business spending on equipment and structures. Consumption growth slowed to 1.0%, the slowest pace of the expansion when compared to a 2017-19 average pace of 2.6%. Government spending was a negative contributor.

Regional Fed Surveys

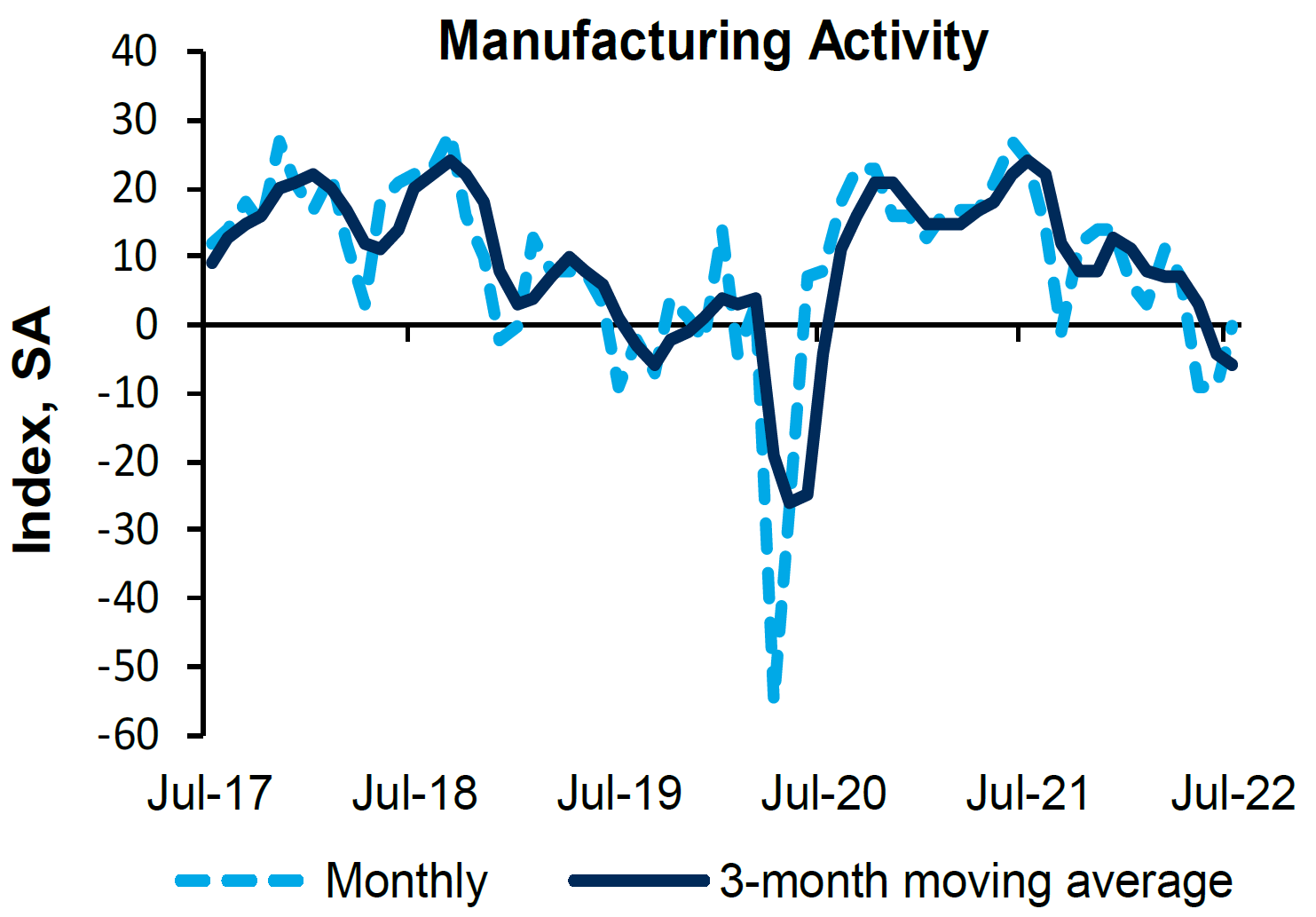

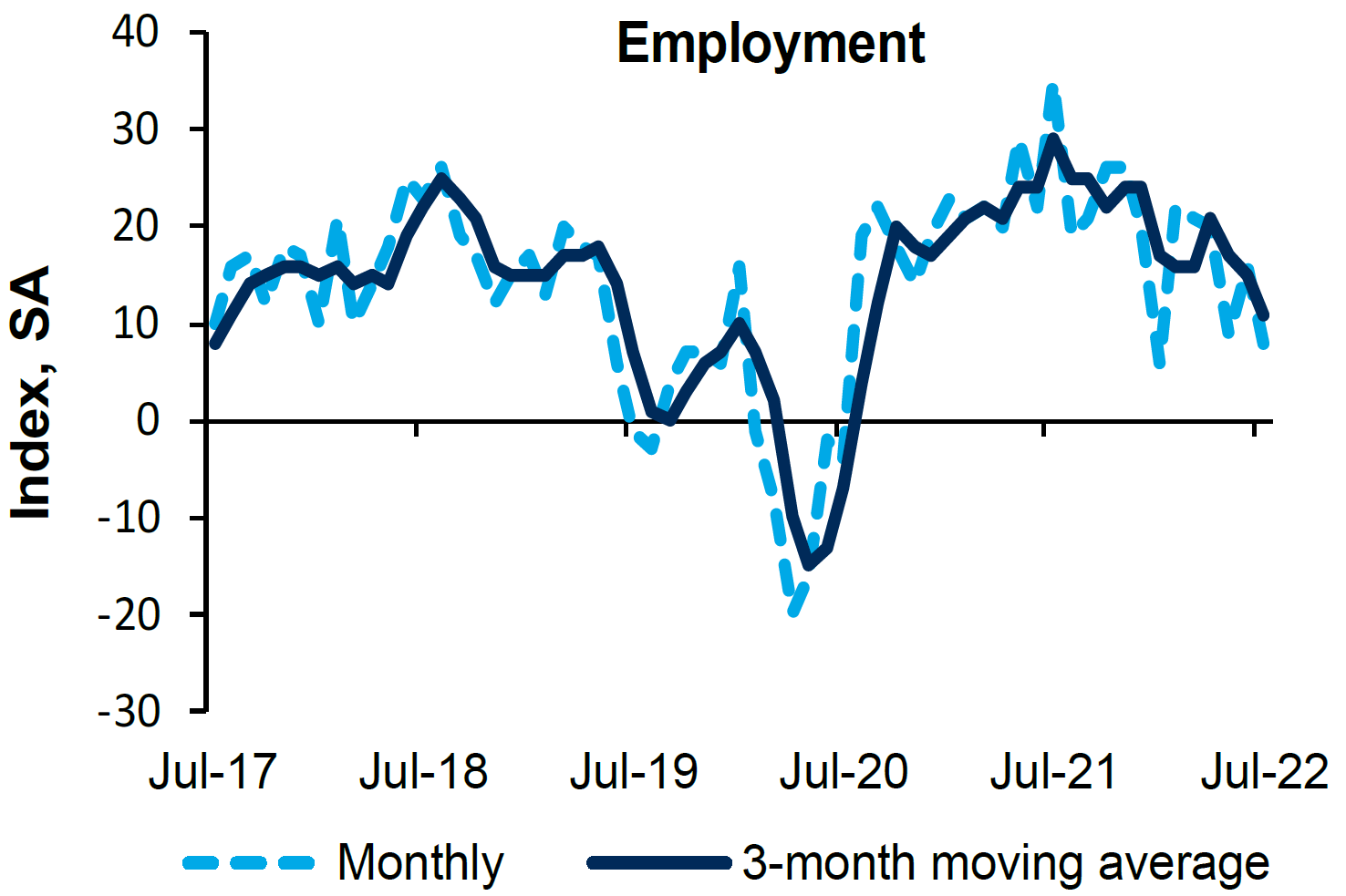

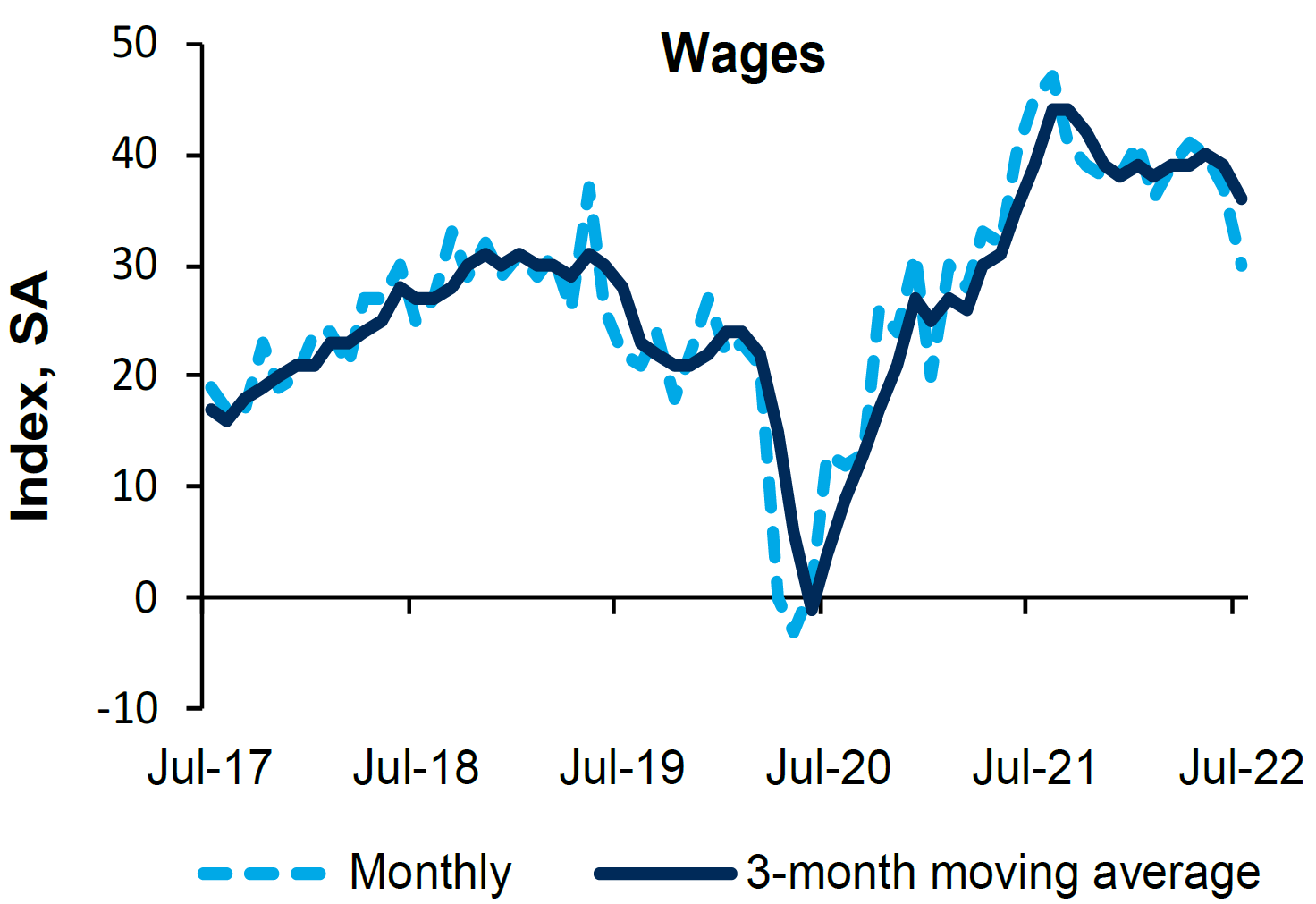

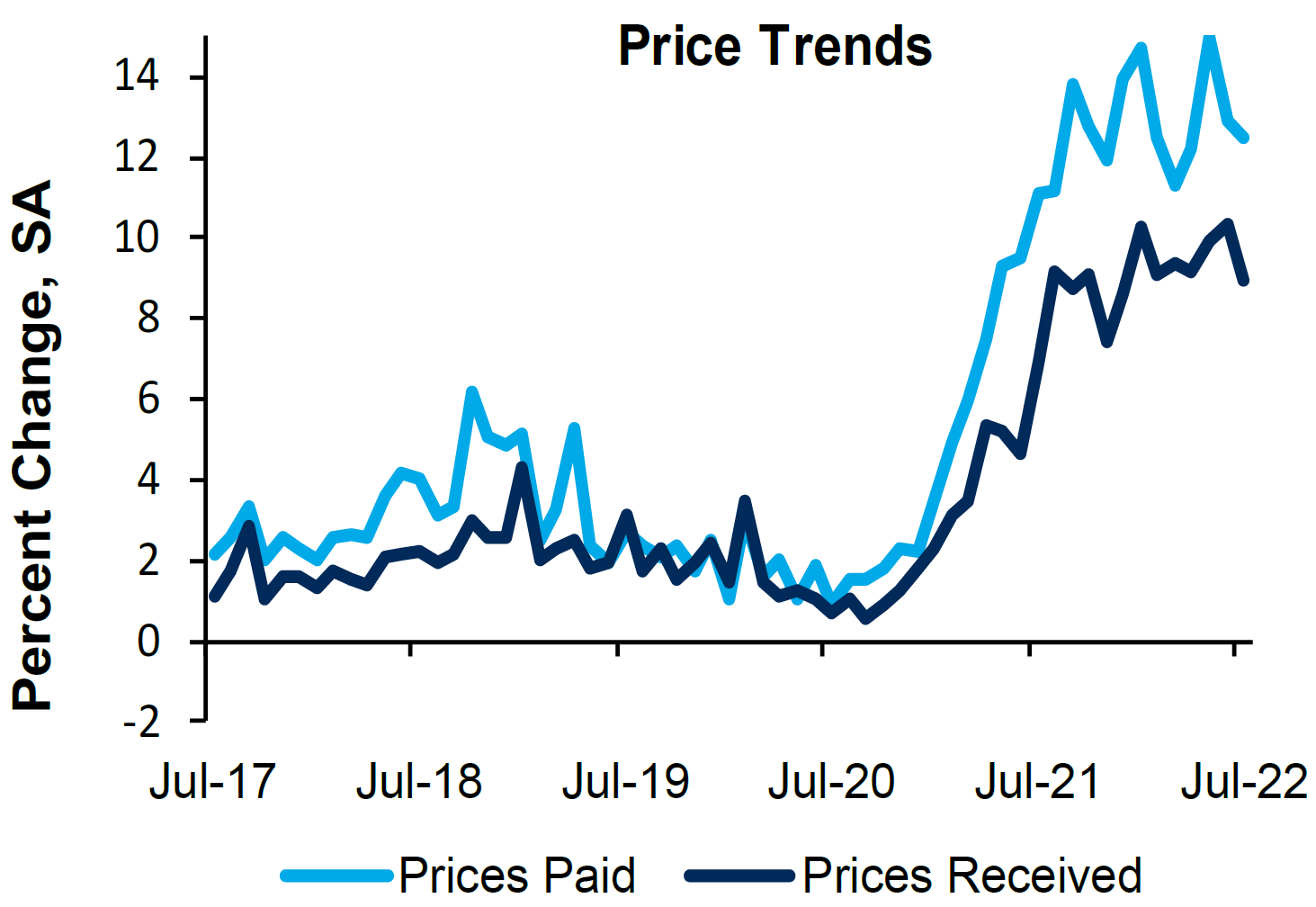

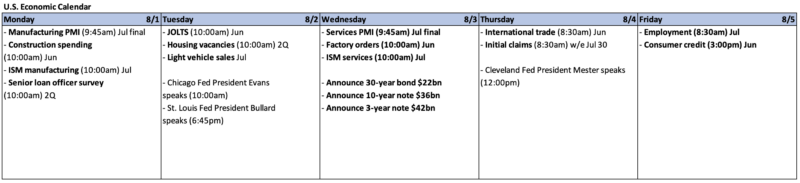

Most of the economic data released this week was consistent with a slowing U.S. economy. Additionally, most of the various surveys by the Federal District Banks of Dallas, Richmond, Philadelphia and Kanas City showed modest economic growth but with diminished expectations and lowered new order growth. The Dallas Fed’s general business activity index for manufacturing hit its lowest level since May 2020. Its retail sales index descended to its lowest level since July 2020. The Kansas City Fed’s manufacturing index monthly and annual survey price indexes fell to their lowest levels in over a year.

Source: Federal Reserve Bank of Richmond Manufacturing Activity Survey, Regional Surveys of Business Activity (7-26-2022)

Housing Data

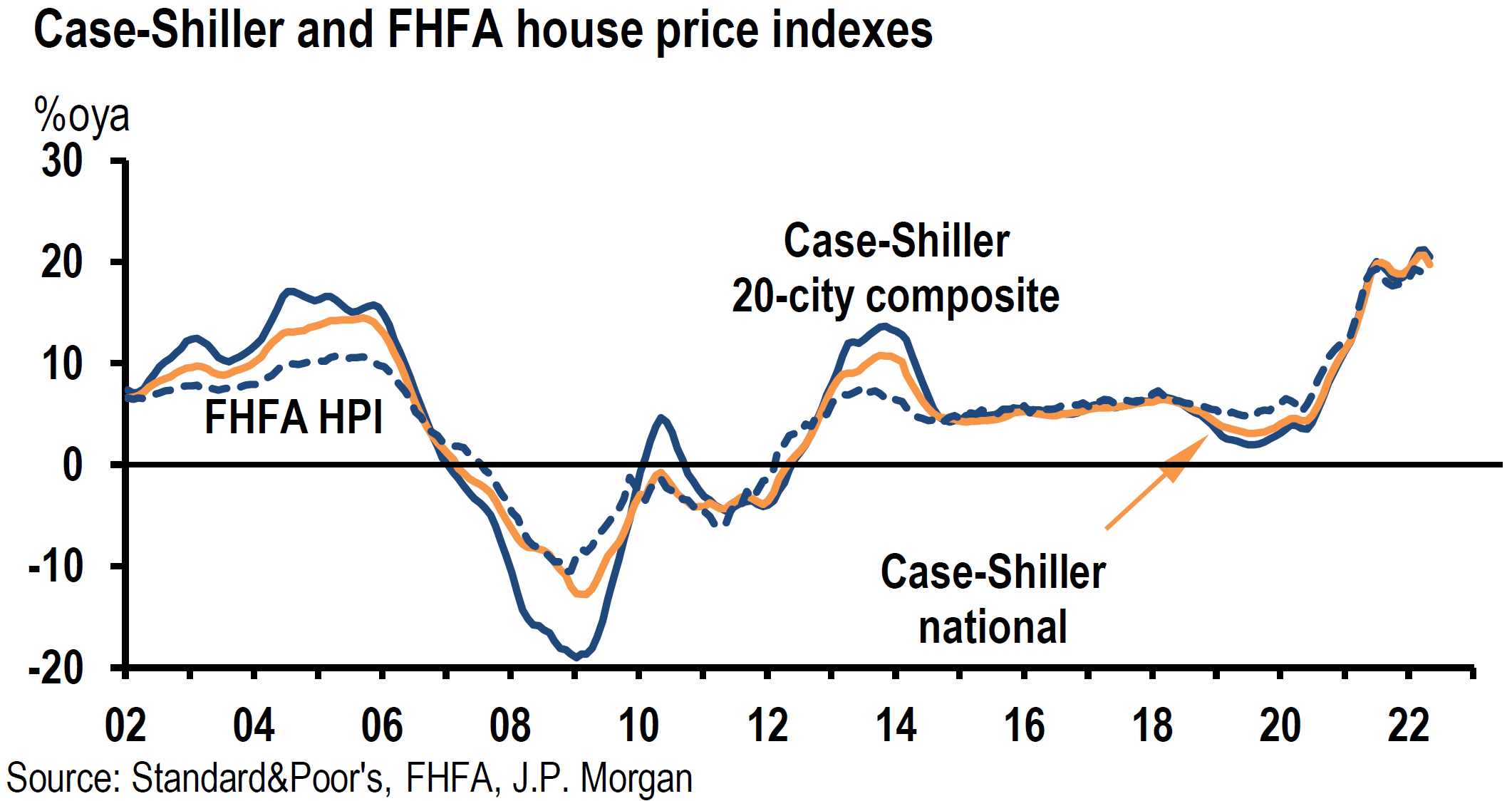

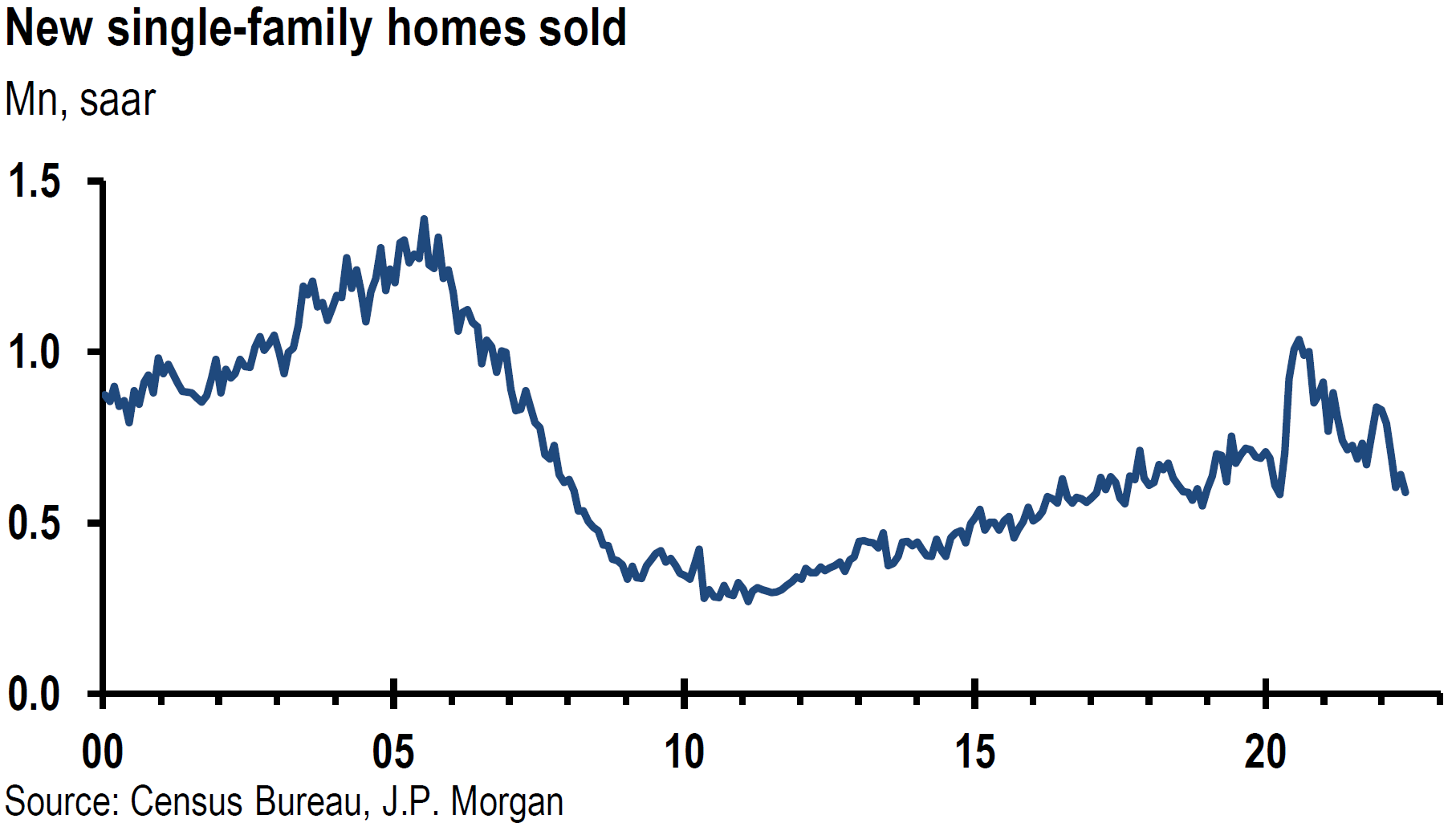

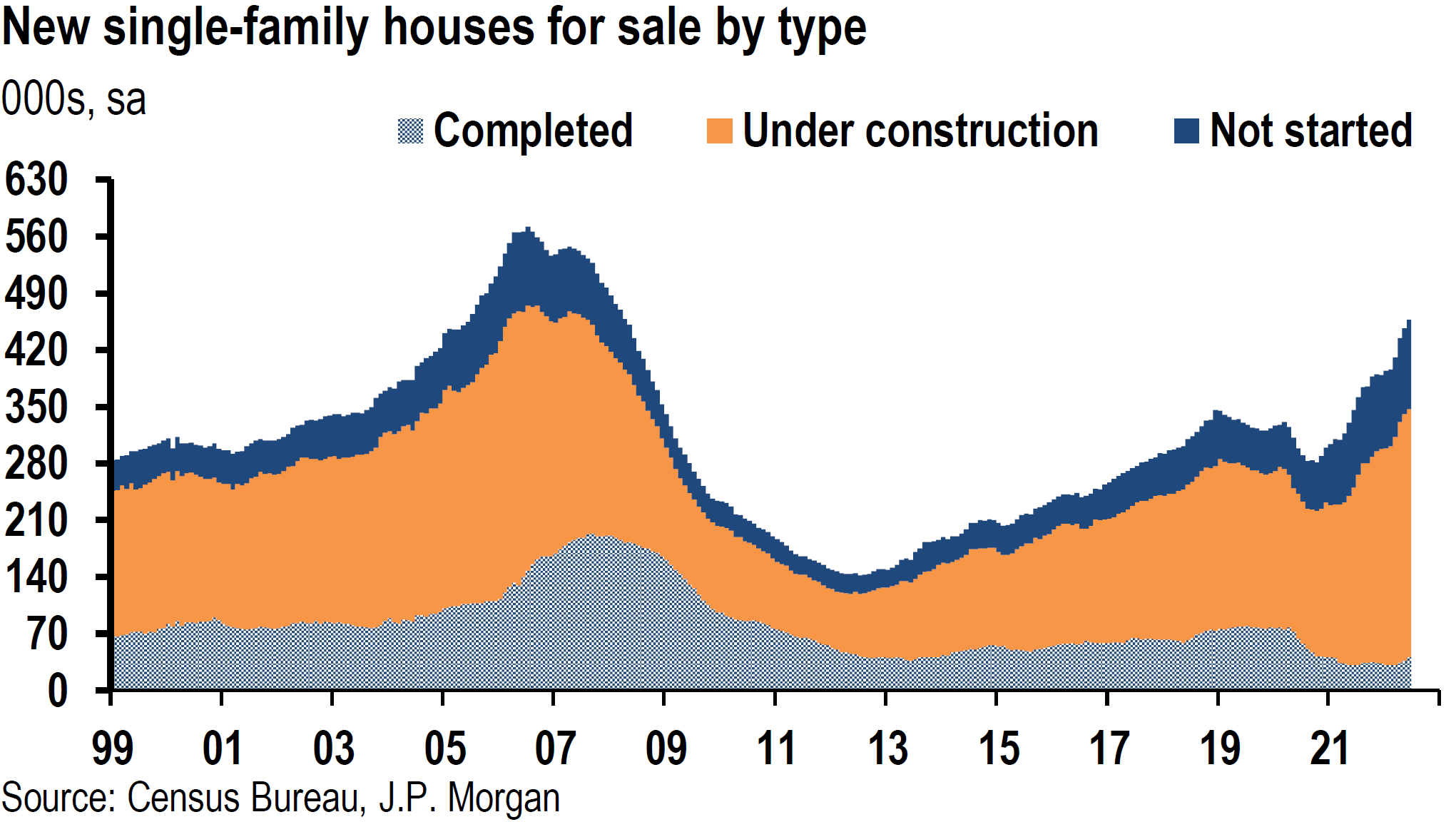

Housing data continued to weaken, The Federal Housing Finance Agency (FHFA) and Case-Shiller home price indexes both showed a moderation of home price appreciations. New home sales fell 8.1% month-over-month (m/m) in June to their lowest sales pace since April 2020 and were 17.4% lower year-over-year (y/y). Mortgage applications for residential mortgages retreated for the fourth consecutive week for the week ended July 22. Pending home sales were 8.6% lower in June m/m and 20% lower y/y.

Source: JP Morgan, US: New home sales disappoint in June (7-26-2022)

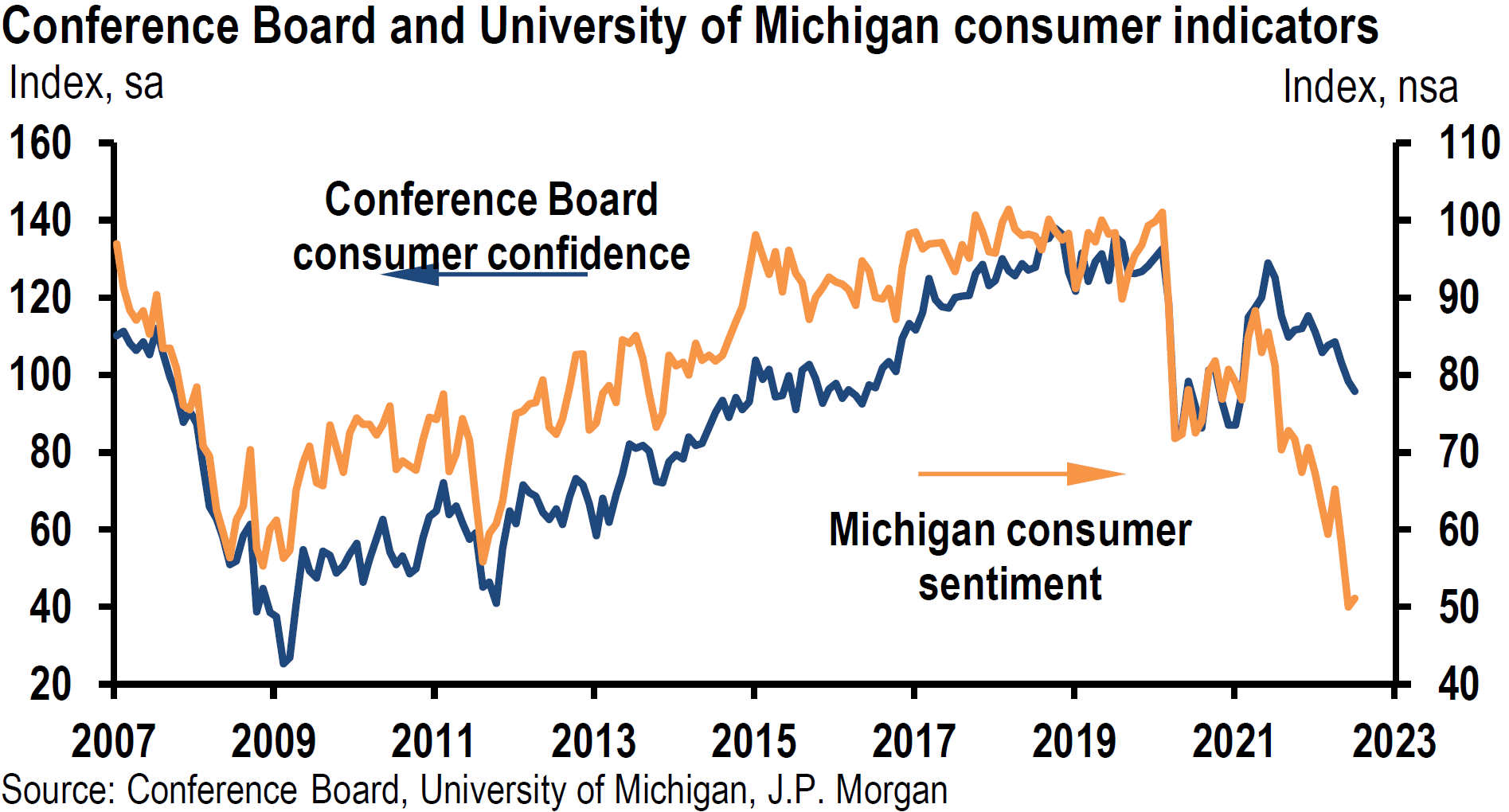

Conference Board’s Consumer Confidence Index

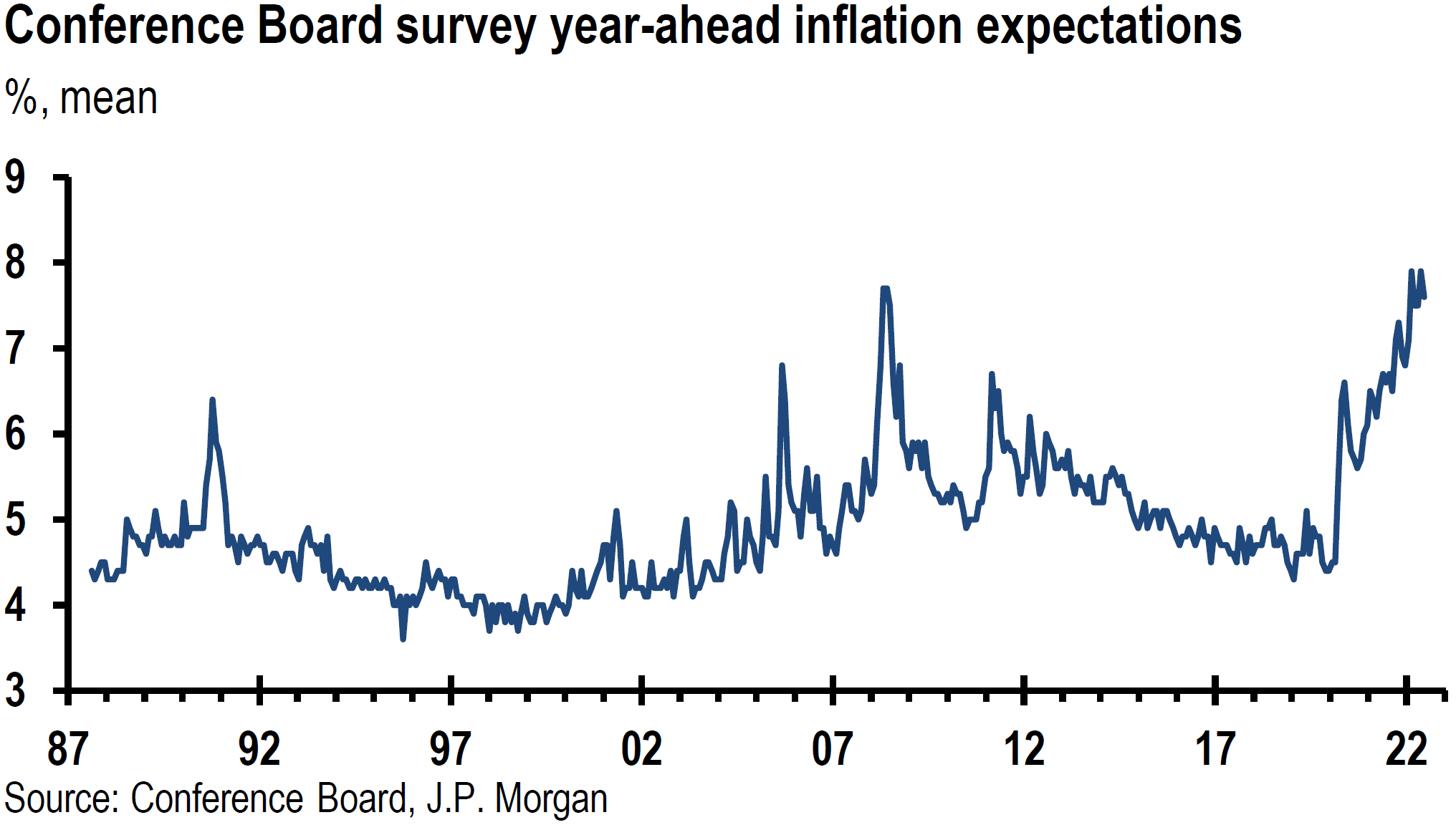

The Conference Board’s consumer confidence index fell for the third consecutive month in July to its lowest level since February 2021. However, unlike last month when the expectations index accounted for most of the decline, the July decline was mostly due to a drop in the present situation index. This drop was attributed to rising gasoline and food prices.

Source: JP Morgan, US: Consumer confidence declines in July (7-26-22)

University of Michigan Consumer Sentiment Index and Inflation Expectations

The index of consumer sentiment for the end of July remained near record lows. The expectations gauge was unchanged at its lowest level since 2009. The median expected year ahead inflation rate was 5.2%, little changed from the prior two months. Long run (five years) inflation expectations came in at 2.9%. Commentary from the University of Michigan noted that “inflation continued to dominate consumers’ attention, and labor market expectations continued to soften.”

Source: JP Morgan, US: Consumer confidence declines in July (7-26-22)

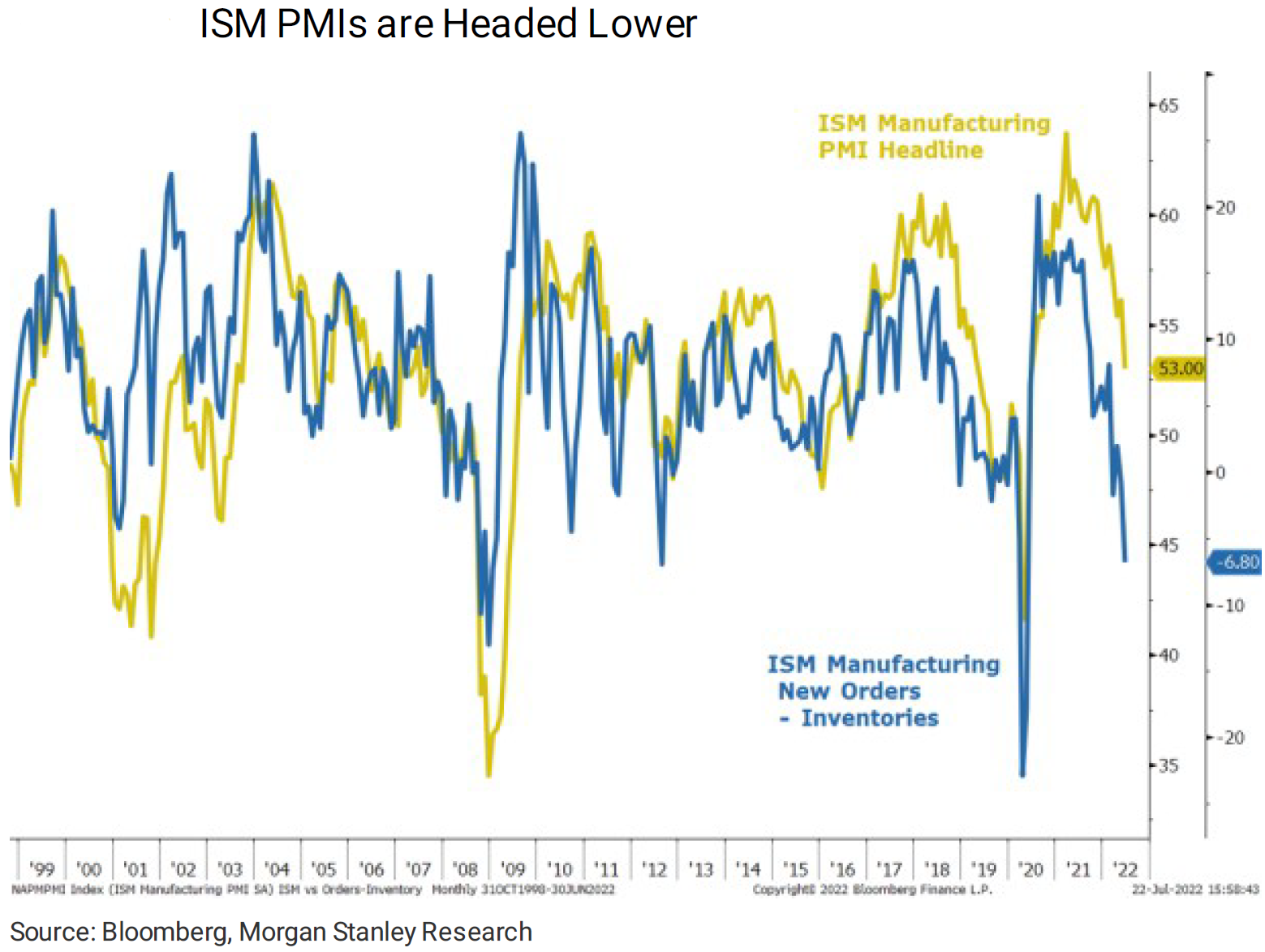

Chicago PMI

Chicago’s PMI decreased to 52.1 points in July from 56.1 points in June and was below expectations of 55. This was its lowest level since August 2020. The Chicago PMI is reflective of factory activity in the Chicago region.

Source: Morgan Stanley, Weekly Warm-up: Is the Market Trying to Price a Fed Pause? (7-25-22)

U.S. Trade Deficit and Wholesale Inventories

The U.S. trade balance data for June was released mid-week. The U.S. trade deficit in June shrank to its lowest level of 2022 as U.S. exports surged and imports shrank. Wholesale inventories rose more than expected. Mostly due to this data, Goldman Sachs raised its estimate for Q2 real GDP growth to 1.0% and J.P. Morgan raised its estimate to 1.4%. Both were disappointed the very next day.

To What Extent Are Financial Markets Already Reflecting Recession Probabilities?

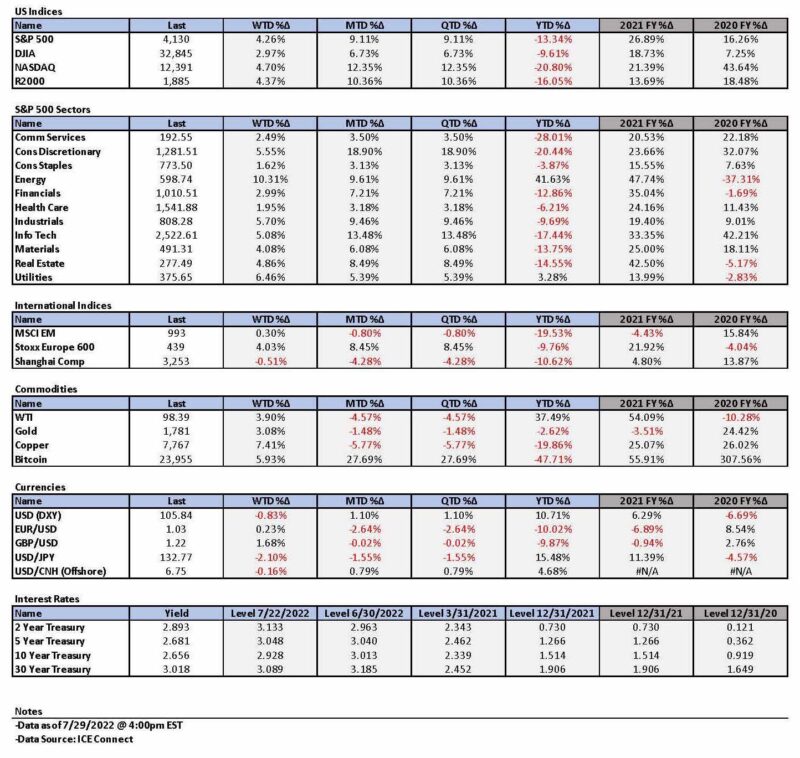

We have been highlighting for quite some time that the “financial markets … continue to price in an increased probability of a U.S. recession, and possibly a global one as well.” We also have been waiting for downward revisions of earnings, sales and margin estimates. We have seen many downward revisions recently during this reporting season of Q2 results, as well as lowered guidance of their future financial results as delineated by company managements. Many stocks have traded down precipitously on “negative” results relative to consensus expectations. But others have traded surprisingly well on “disappointing” results. Our attention is focused particularly on this latter group as indicative that maybe too much “bad” news was priced into their share prices. Microsoft (MSFT) and Alphabet (GOOGL) were prime examples of this latter group. Both of these companies reported their Q2 results after the close of trading on Tuesday. They both reported that they “missed” consensus expectations for both top line – revenues – and bottom line – earnings. They both eventually traded substantially higher in after-hours trading. We found this to be an encouraging sign for these individual stocks, as well as an encouraging sign for U.S. equities in general. We were not surprised at all when stocks traded higher the next day. This was true particularly with respect to quality high tech and growth stocks as typified by the Nasdaq index, which had its best day of appreciation since November 2020. The major U.S. stock averages continued their ascent on Thursday after the surprising negative Q2 GDP print. Interest rates continued their descent as well. Following the disclosure of their Q2 results, both Amazon (AMZN) and Apple (AAPL) traded higher after the close of trading on Thursday. This was especially true of Amazon’s share price, which rose as much as 13.63% in after-hours trading.

The Appeal of Selected High Quality Tech and Growth Stocks

On June 16, we thought that high quality tech stocks, including selected mega-cap quality tech stocks and semiconductor stocks, had “bottomed” and presented very attractive entry points to purchase. We forecast that in a slow-growth environment selected growth stocks could command a premium valuation since growth would become an increasingly rare commodity. We accepted that most of the “bad” news was already “priced-in” at those mid-June levels. The principal missing ingredient was a Fed pivot of some kind so that we could at least anticipate an upper level of interest rates. We suppose that the Fed and Powell provided the necessary “soft” pivot to increase our confidence as to the longevity of the appreciation of such securities. But we still foresee volatility going forward. We assume lower U.S. economic growth along with elevated inflation continuing. Furthermore, we project that headline inflation should diminish somewhat as energy prices and some grain prices have dropped recently. However, we still expect that these commodities will remain volatile. Therefore, we expect a rather erratic pattern to decreasing headline inflation measures.

Myriad of Variables = More Problematic Forecasting

We have been highlighting for quite some time that the many variables associated with economic growth rates and elevated inflation have increased the difficulty in forecasting trends of financial markets. Russia’s invasion of Ukraine on February 24 exponentially increased the number of variables that must be considered in any forecast. It has been our contention that the proliferation of variables would make “calling the bottom” of equities in general particularly difficult. If China-related supply chain issues are solved, we are left still with elevated commodity prices due mostly to the Russia-Ukraine war. To what extent will Russia deny natural gas to Europe, leading to a recession that would have global repercussions? How and when will the war end? We have also highlighted the rapidity of change due to all of these variables. What will be the extent and virulence of new COVID-19 mutations? We have found that most general financial market bottoms have been relatively easy to “call.” In our opinion, this has been mostly because we could focus on one principal issue or crisis and a government entity or entities typically would come to the “rescue.” Our current situation is quite different. We also don’t anticipate any government entities coming to rescue financial markets unless there was a very severe market “dislocation” of some kind. Perhaps as one set of variables can be ascertained and predicted to some degree, particular sectors or individual stocks that are sensitive to such variables could bottom at different times. We have already seen examples of this phenomenon throughout this year.

Capitulation? Is It Really Needed?

For all of the reasons enumerated above, we think that it is quite possible that there will be no “capitulation” day where equity markets generally bottom. Perhaps individual securities or sectors will bottom on a much more idiosyncratic basis. In this context, it is quite possible that selected equities have already seen their “bottom.” Nevertheless, we still assume financial market volatility and maintain our conviction only to buy on market downturns. There are still plenty of unknowns. In particular, we expect market volatility around headlines of natural gas flows into Europe, the resulting further economic downturns, and rising inflationary pressures due to diminished flow of natural gas flows into Europe. Given our assumptions of slowing economic growth and possibly a foreseeable top in Fed rate hikes, we continue to prefer high-quality tech and growth stocks with good balance sheets, relatively predictable cash flows and sustainable margins. We would continue to include other high quality stocks in a diversified portfolio along with some commodity exposure. We also continue to favor selective energy stocks. Of course, we assume that a severe recession would result in further downside for most equities. That is not our base case.

Bottom Line

We assume that the Fed has provided financial markets with a “soft” pivot that is data dependent. Given our observations of a slowing U.S. economy with a more-than-likely peaking of headline inflation, we have refined our outlook for financial markets. We suppose that a more predictable level of interest rate hikes could serve as an enhancement for equity valuations, and in particular for the benefit of selected high-quality tech and other growth stocks. In general, we continue to favor big cap high-quality stocks with strong balance sheets as well as relatively stable cash flows and margins.

We assume continued volatility across virtually all financial markets. Many uncertainties remain. Our latest focus is on the natural gas flow rates from Russia to Europe through the NS1 pipeline. We imagine continued headline risk with respect to the flow rates of this pipeline.

We foresee increasingly that a “capitulation” day for the overall equity market is increasingly unlikely given the Fed’s soft pivot and the myriad of variables that continue to affect economic data and financial markets. We are focused more on anticipating and recognizing bottoms on individual stocks or sectors.

Definitions

Federal Open Market Committee (FOMC) – The Federal Open Market Committee (FOMC) is the branch of the Federal Reserve System that determines the direction of monetary policy specifically by directing open market operations. The committee is made up of 12 members: the seven members of the Board of Governors; the president of the Federal Reserve Bank of New York; and four of the remaining 11 Reserve Bank presidents on a rotating basis.

Federal Funds Rate – The term federal funds rate refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

Real Gross Domestic Product – Real gross domestic product (real GDP) is an inflation-adjusted measure that reflects the value of all goods and services produced by an economy in a given year (expressed in base-year prices) and is often referred to as constant-price GDP, inflation-corrected GDP, or constant dollar GDP.

Real Interest Rate – A real interest rate is an interest rate that has been adjusted to remove the effects of inflation. Once adjusted, it reflects the real cost of funds to a borrower and the real yield to a lender or to an investor.

ISM Manufacturing Index (PMI) – The ISM manufacturing index, also known as the purchasing managers’ index (PMI), is a monthly indicator of U.S. economic activity based on a survey of purchasing managers at more than 300 manufacturing firms. It is considered to be a key indicator of the state of the U.S. economy.

Growth Stock – A growth stock is any share in a company that is anticipated to grow at a rate significantly above the average growth for the market. These companies generally do not pay dividends, instead growth stocks tend to reinvest any earnings they accrue in order to accelerate growth in the short term.

NASDAQ – The Nasdaq Composite Index is the market capitalization-weighted index of over 2,500 common equities listed on the Nasdaq stock exchange.

Federal Housing Finance Agency (FHFA) – The FHFA was established by the Housing and Economic Recovery Act of 2008 (HERA) and is responsible for the effective supervision, regulation, and housing mission oversight of Fannie Mae, Freddie Mac (the Enterprises) and the Federal Home Loan Bank System, which includes the 11 Federal Home Loan Banks (FHLBanks) and the Office of Finance. Since 2008, FHFA has also served as conservator of Fannie Mae and Freddie Mac.

Case-Shiller Home Price Index – The S&P CoreLogic Case-Shiller U.S. National Home Price Index (“the U.S. national index”) measures the value of single-family housing within the United States. The index is a composite of single-family home price indices for the nine U.S. Census divisions and is calculated monthly.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/fast-answers/answersindiceshtm.html or http://www.nasdaq.com/reference/index-descriptions.aspx.

All data is subject to change without notice.

© 2024 NewEdge Capital Group, LLC