Weekly Summary: August 9 – 13, 2021

Key Observations from the Past Week:

- Vaccination rates and government policies in reaction to increases in Delta variant infection rates should produce “uneven” effects on economies’ “reopenings.”

- We believe that uneven Delta effects will produce investment opportunities and advantageous entry points for Value and Cyclical stocks. We expect Energy stocks to be especially volatile.

- Although we anticipate that the Delta variant impact will be rather short lived as it proves to be manageable, we still believe that it will play a more prominent role in future CPI, PPI and employment data.

- The preliminary University of Michigan consumer sentiment index for August fell dramatically as consumers worried about the Delta variant and inflation.

The Upshot: We continue to believe that the Delta variant will be manageable and rather short-lived. We believe that Value and Cyclical type stocks continue to present the best risk/reward opportunities given today’s market prices. In our opinion, Delta’s uneven effects on economic growth rates, employment and inflation will provide attractive future entry points to add to desired positions. Consumer sentiment appears to be very fragile as it reacts to the Delta variant.

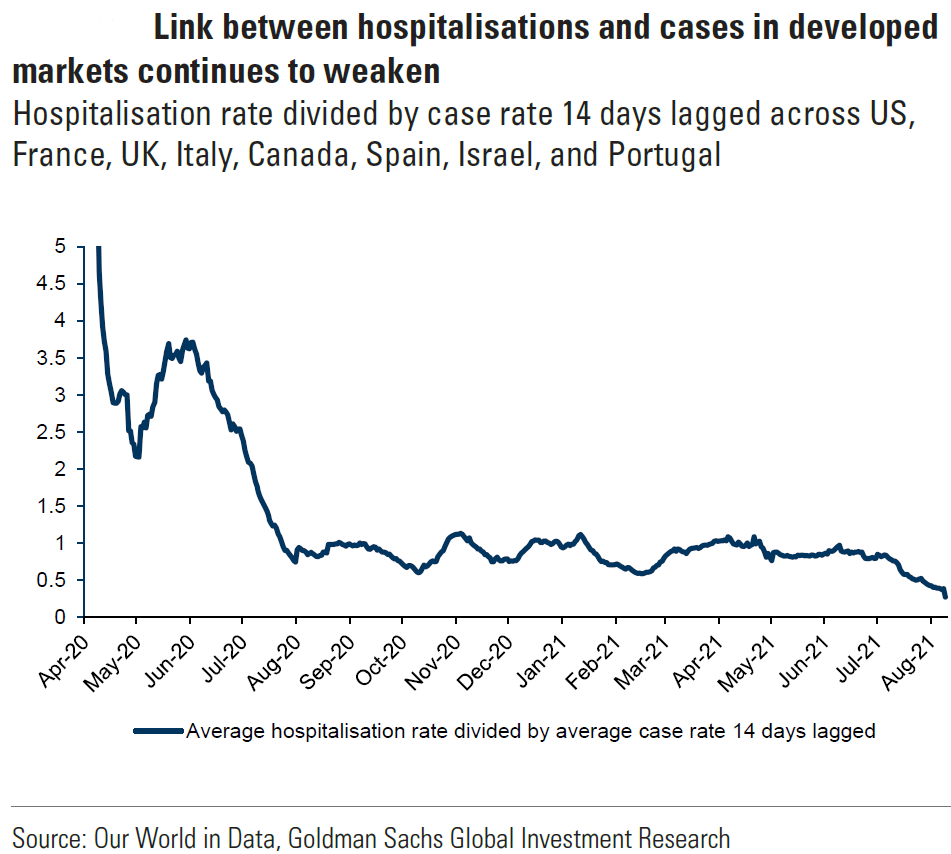

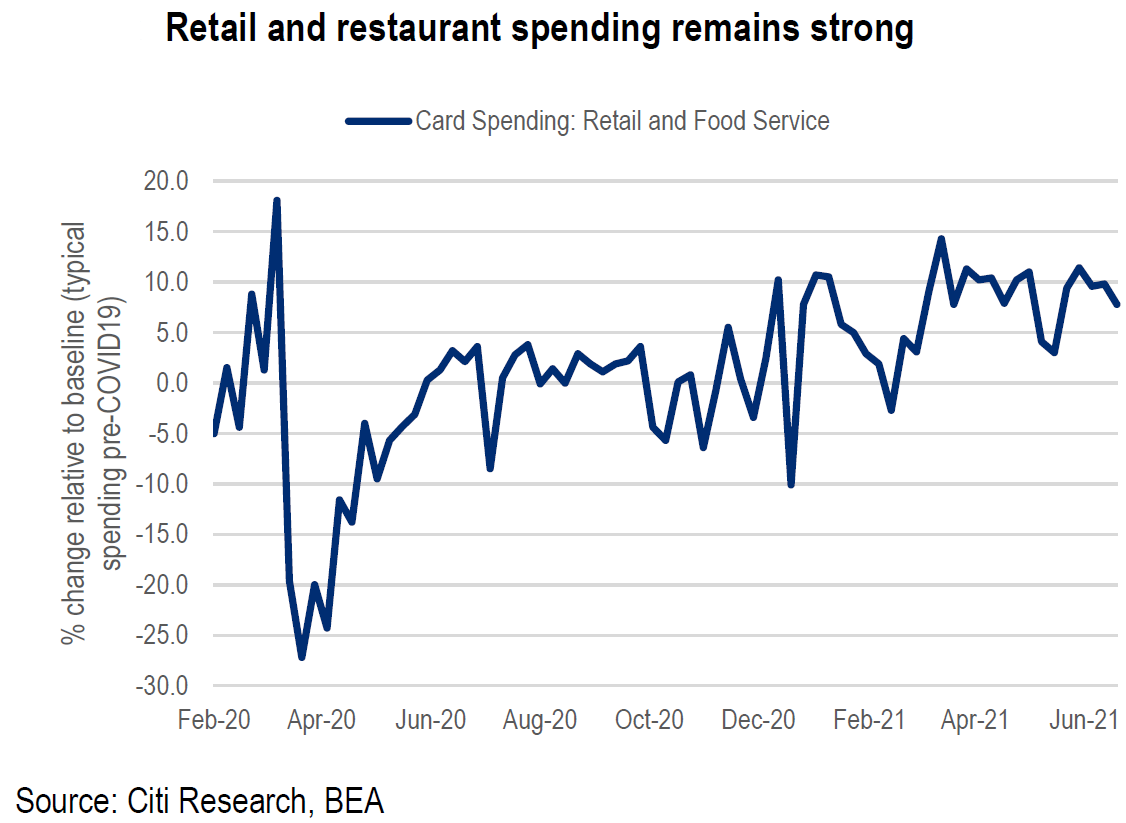

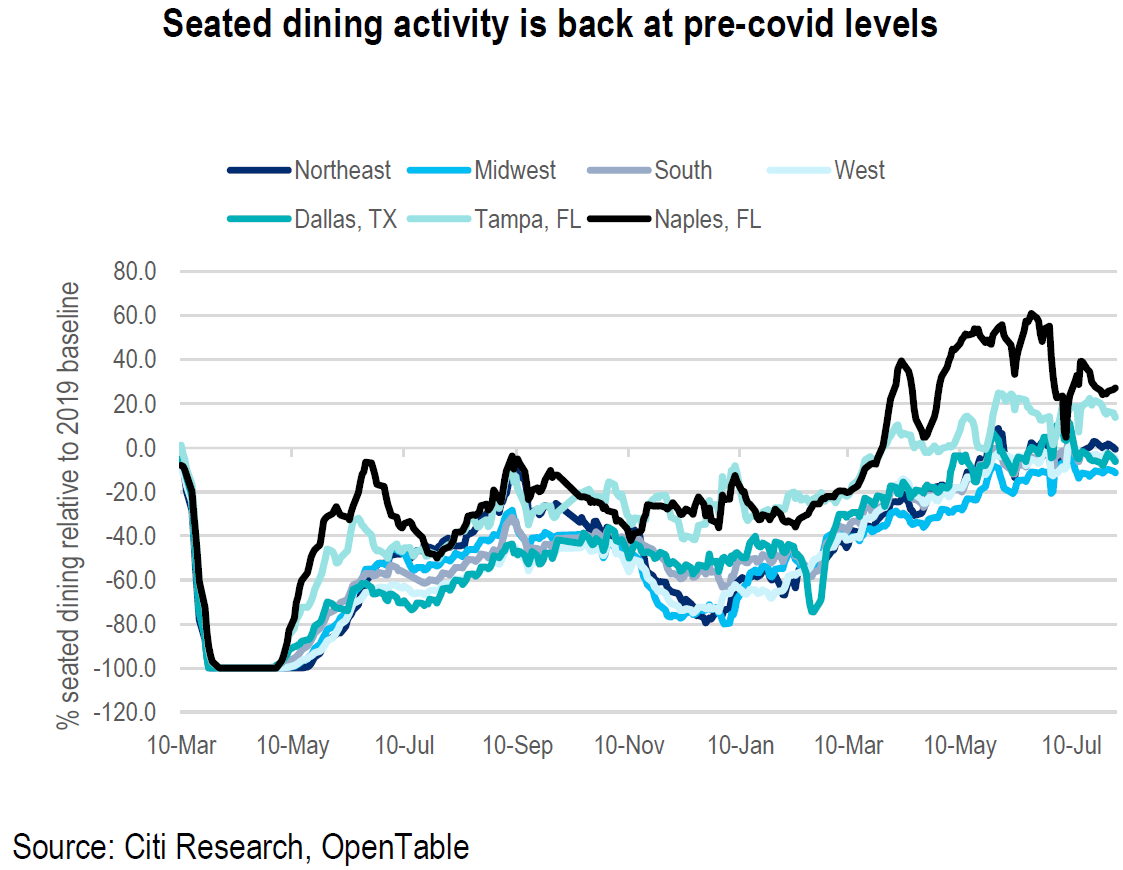

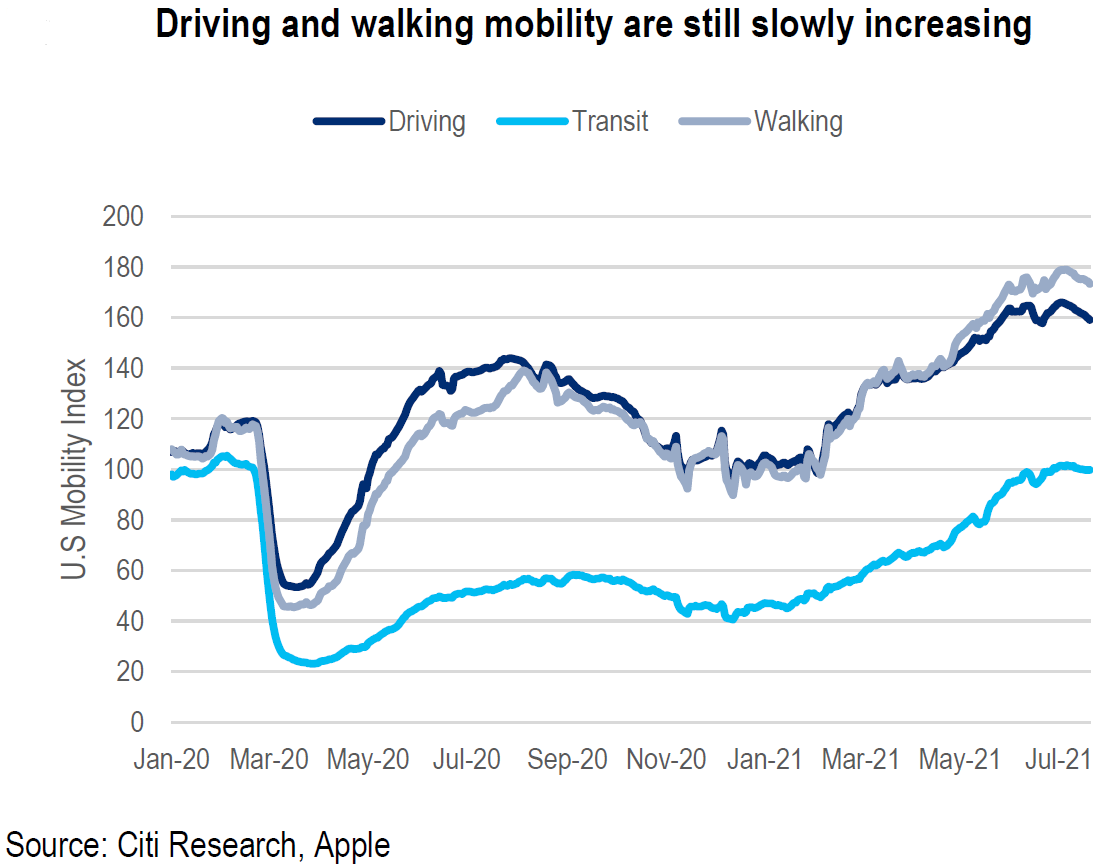

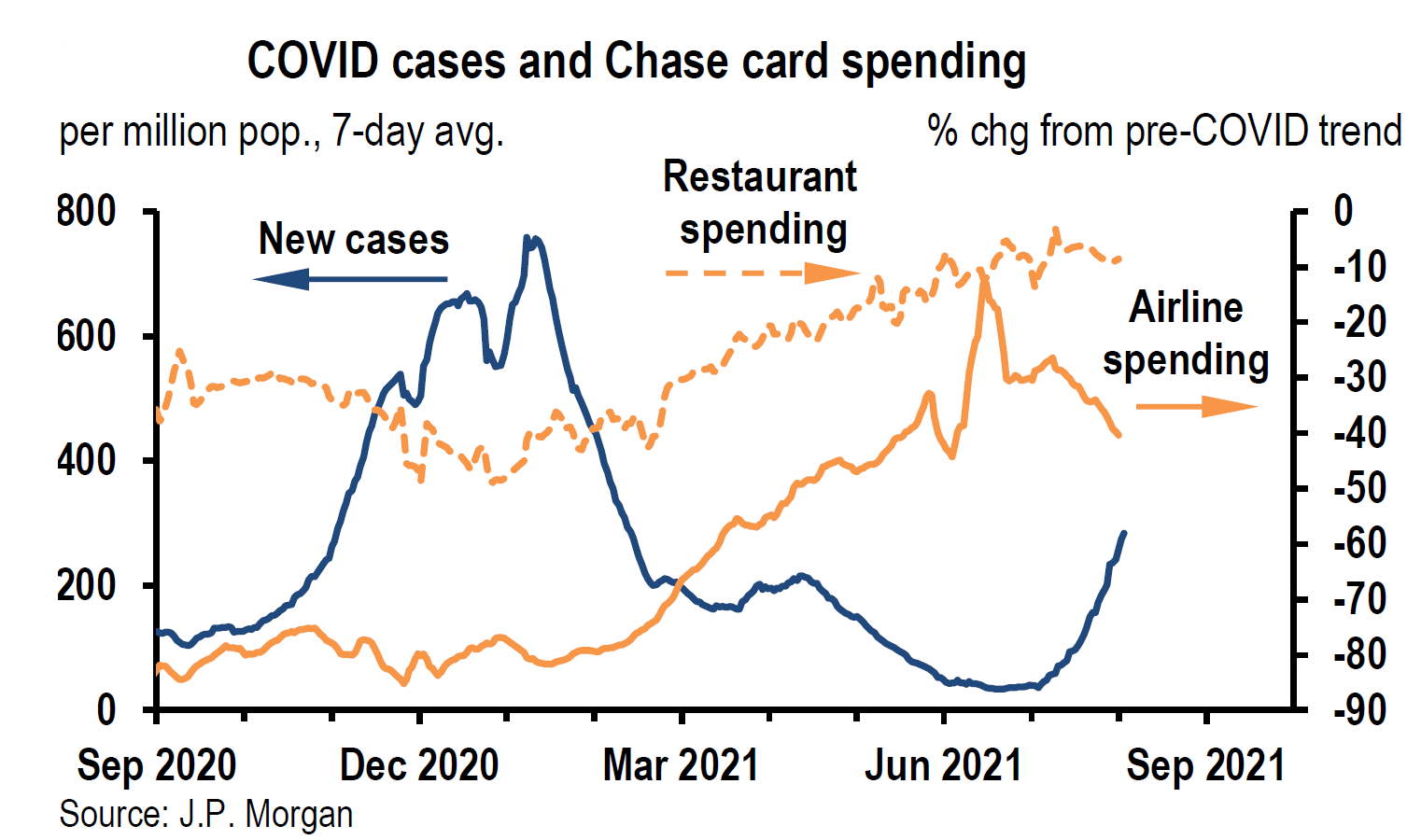

The Delta variant experience of India, which has a very low vaccination rate and the U.K., which has a relatively high vaccination rate, both show that Delta variant infections tend to rise quickly but also seem to dissipate rather quickly. Higher vaccination countries like the U.S. should see only a relatively slight delay in its economy more fully reopening. Continued low hospitalization rates will be critical in keeping the U.S. reopening on track. Perhaps the most worrisome concern is that children seem to be more prone to getting infected and more severely impacted by the Delta variant. Delays in school reopenings could negatively impact U.S. economic growth more than is currently expected. Delta variant concerns can appear very suddenly. A few weeks ago, Southwest Airlines (SA) executives were bullish about their business. According to a WSJ August 11 story, SA executives now are saying that the recent surge in Delta variant infections is causing bookings to slow and cancellations to rise. Rising infection rates are prompting cancellations of festivals and trade events such as the New York International Auto Show planned for August. Similarly, the reservation platform OpenTable showed dining reservations were 8% lower from 2019 levels for the week ended August 10, compared to late June when dining reservations exceeded 2019 levels. Credit card spending on airlines and dining confirmed these new trends. In our opinion, these new trends should prove to be only temporary setbacks to the U.S. economy reopening.

Source: Goldman Sachs, Oil: Cyclical demand headwinds, structural supply tailwinds, (August 2021)

Source: Citi, U.S. Economics: The Daily Update, (8/9/21)

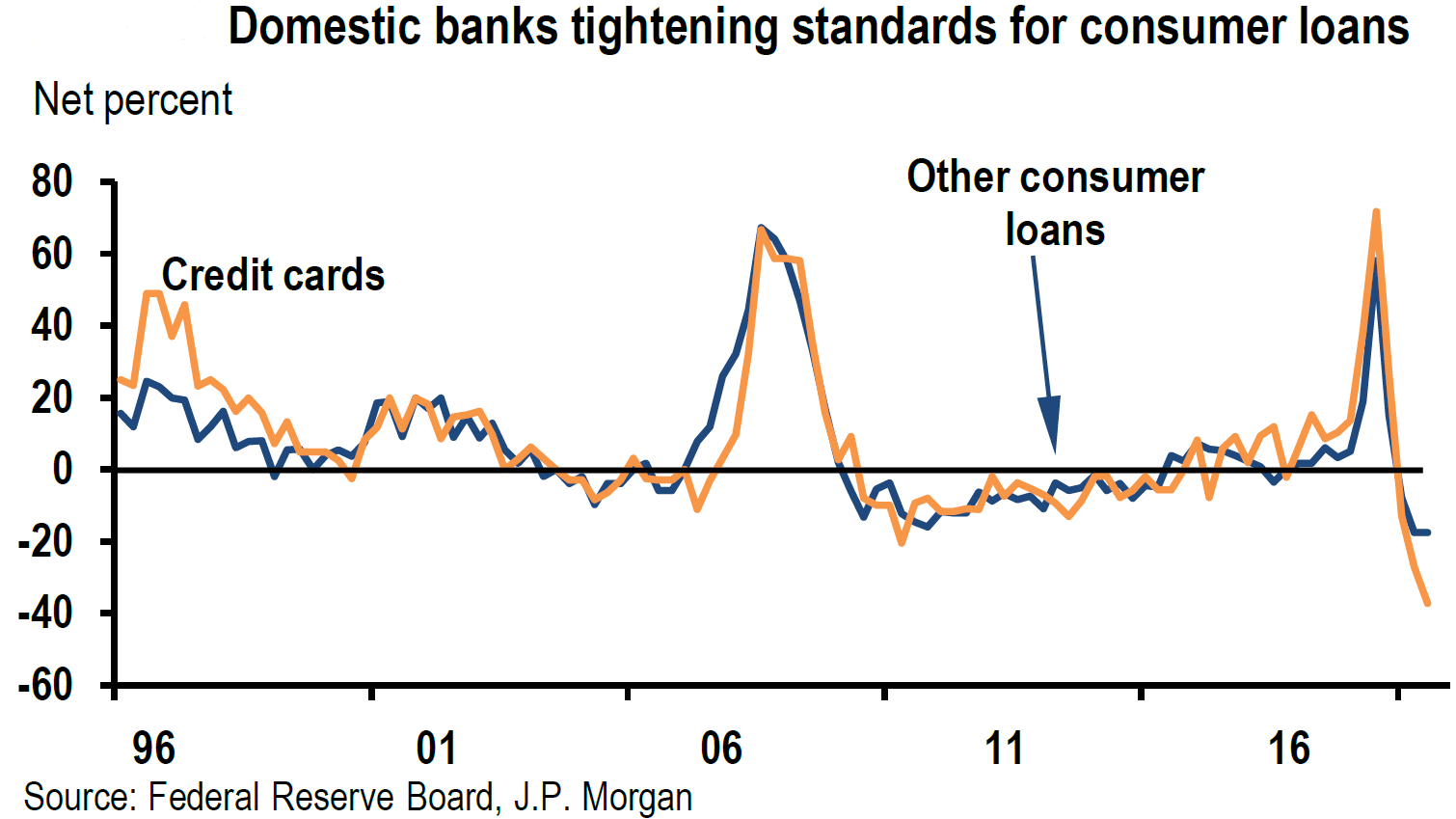

Source: J.P. Morgan, U.S. Weekly Prospects, (8/6/21)

Asia’s Aggressive Delta Variant Containment Approach

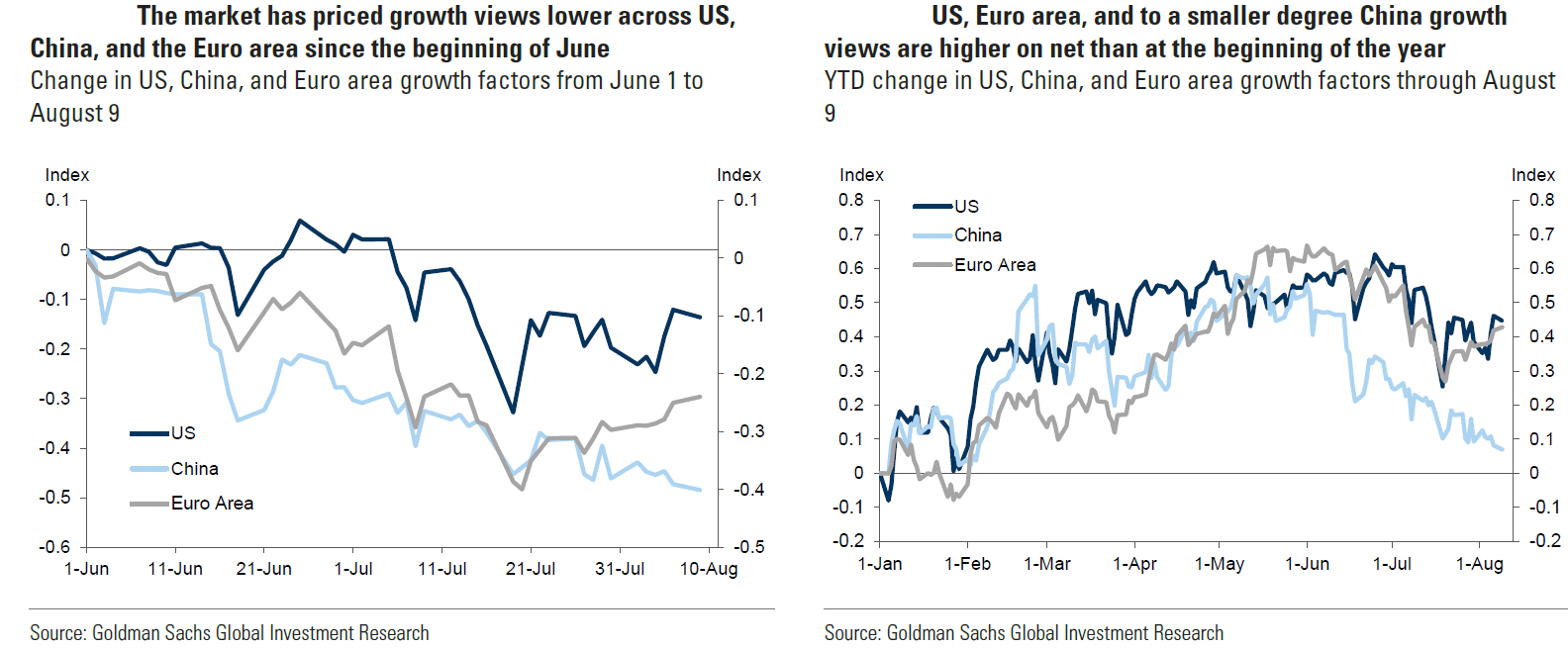

In general, Asian countries, such as China, continue to take a very aggressive and quick approach to dealing with increases in coronavirus infections. Due to the recent outbreak of Delta variant cases across 17 provinces in China, the Chinese government has tightened quarantine and social distancing measures, including new lockdown measures. According to a Citi Research August 11 report, China’s Ministry of Education called for a delay in opening schools for the next semester in the medium-to-high risk areas for infections. These high- and medium-risk areas account for 22% of China’s nominal GDP. We now believe that China’s Services sector will not fully recover until at least Q4. A current assessment of economic conditions in China showed a dramatic drop in August, but was still higher than that of the U.S. or Europe. In its August 10 report on the oil markets, Goldman Sachs, believing that Delta’s effects will be short-lived, cut its estimate for China’s oil demand for only the next two months by 1 million barrels/day. We agree that the Delta variant’s impact will not be long lasting in China.

Source: Goldman Sachs, Global Markets Analyst: Is the Market Overpricing Growth Risk?, (8/11/21)

Germany’s Approach: Similar to Asia

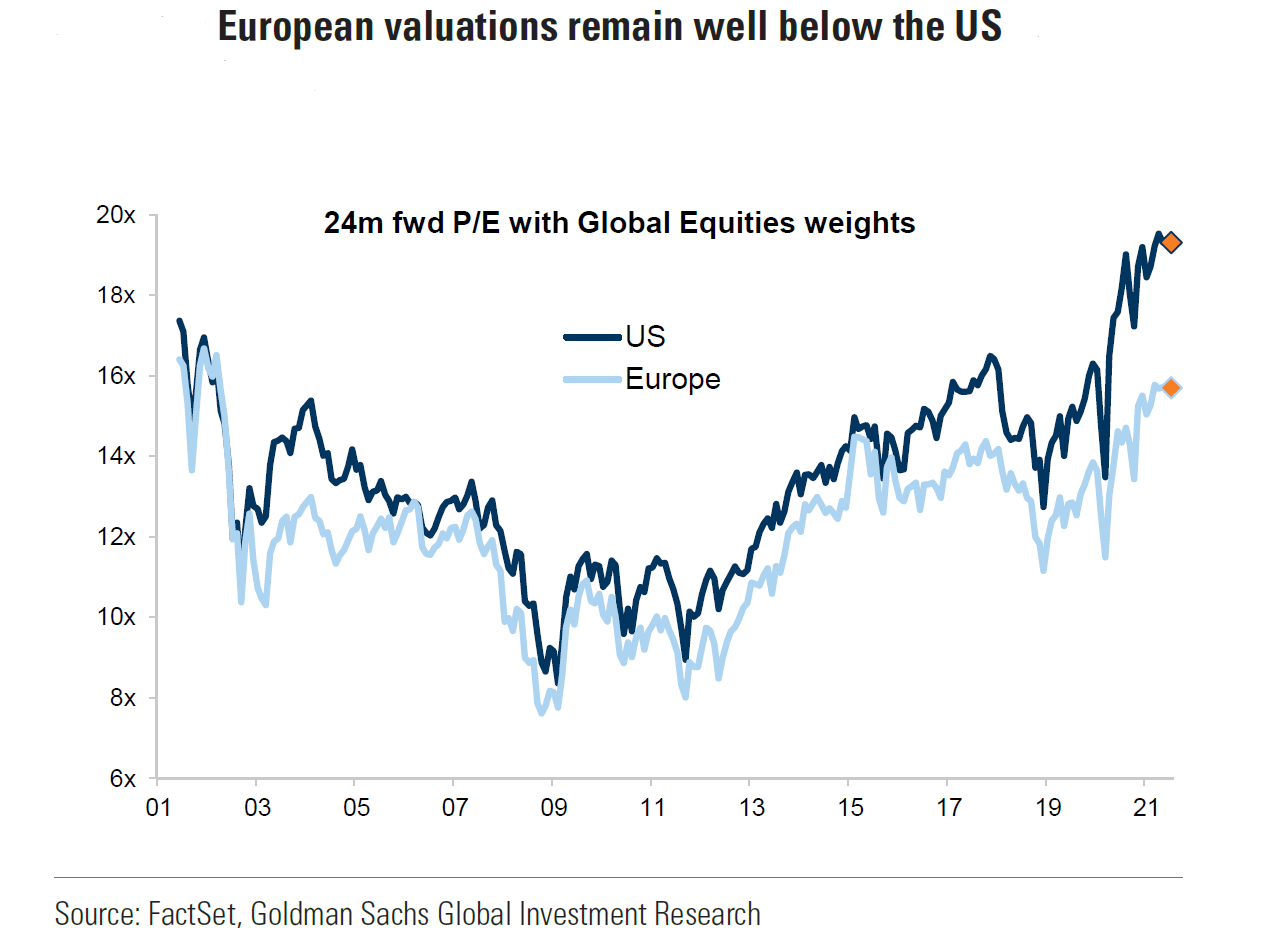

Germany has also taken an aggressive approach with restrictions when confronted with spikes in infection rates. The German authorities recently decided to keep coronavirus restrictions in place into the autumn as the Delta variant has become more prominent. Germany’s ZEW Institute’s indicator of economic sentiment showed much larger-than-expected declines in its expectations for Germany and the Eurozone, even as the assessment of current conditions improved. It was notable that the German economy is highly dependent on exports to China, whose economy is feared to be slowing. The ZEW surveys for August released this week warned of increasing risks for the German economy from a possible fourth coronavirus wave in the autumn or a slowdown in China’s economic growth. Perhaps it is Europe’s, and in particular Germany’s, lagging vaccination rates as compared to the U.S. and its more aggressive restrictions that account for European equities underperforming U.S. equities. The ZEW indicators are compiled from interviews of up to 300 experts from banks, insurance companies and from financial departments of various companies. It is international in scope.

Source: Goldman Sachs, More to go: Raising targets and earnings forecast (8/10/21)

Governments’ Reactions to Delta Affecting Confidence

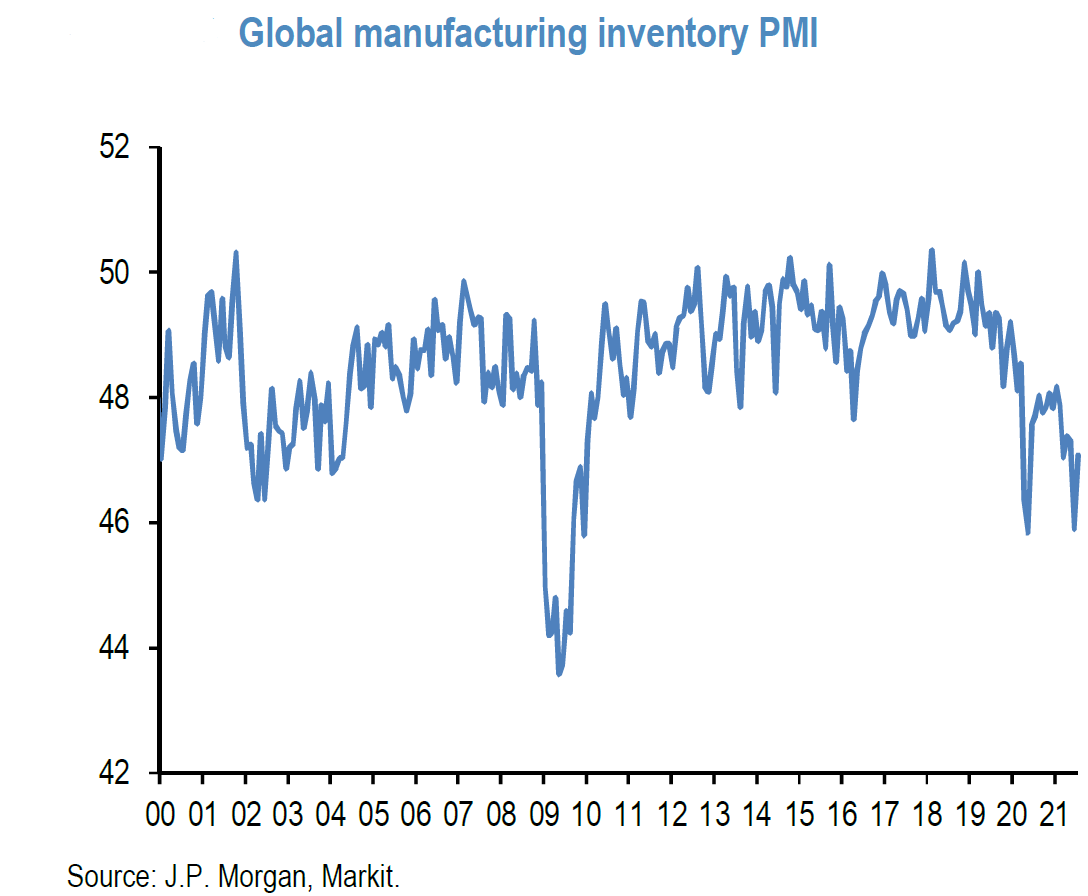

The examples of China and Germany show how governments’ reactions to increases in Delta variant-related infections can greatly affect business executives’ confidence about the future, and in China’s case, even about the current environment. The great dependence of Germany’s export oriented economy is also greatly influenced by the Chinese government’s handling of the Delta variant. Obviously, the uneven effects of the Delta variant on reopenings of various economies are not just based on vaccination rates and hospitalization rates relative to infections, but on government policies as well. The interrelationships of various economies also matter a great deal. To the extent that Delta variant related infections increase, we expect a temporary slowdown in economic growth rates and an increase in inflation as supply chains are further disrupted and labor shortages are more persistent due to the Delta variant.

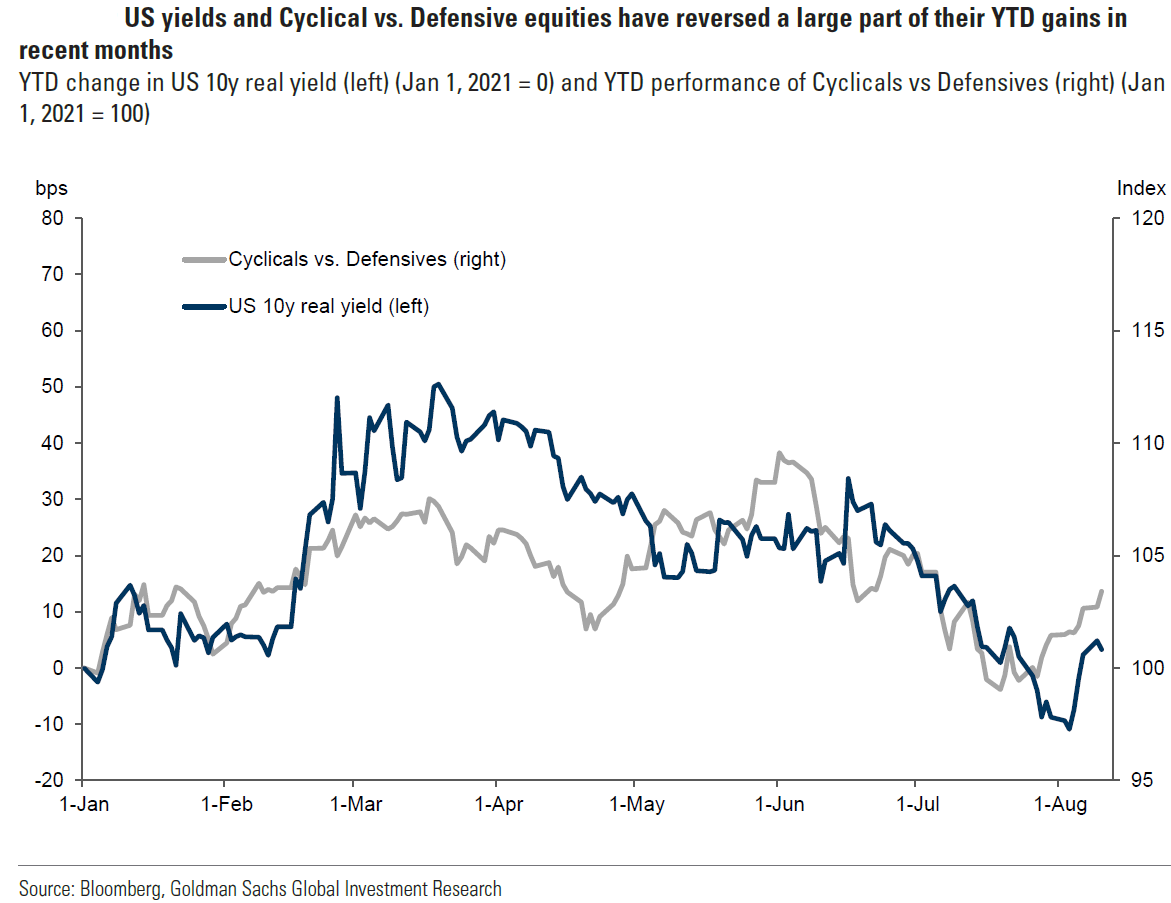

Uneven Effects of Delta Providing Investment Opportunities

We expect that the uneven effects of the Delta variant will continue to provide attractive entry and/or trading opportunities. Last week’s better-than-expected U.S. nonfarm payroll data for July helped propel interest rates higher and continued a rotation into more Value and Cyclical type stocks over the more defensive and high-quality mega-cap growth stocks. To the extent that the Delta variant makes investors question the sustainability of economic growth and continued growth in U.S. employment, better entry points should then occur. We continue to recommend that investors should only add to desired positions on market and/or sector price downdrafts. Patience is needed.

Source: Goldman Sachs, Global Markets Analyst: Is the Market Overpricing Growth Risk?, (8/11/21)

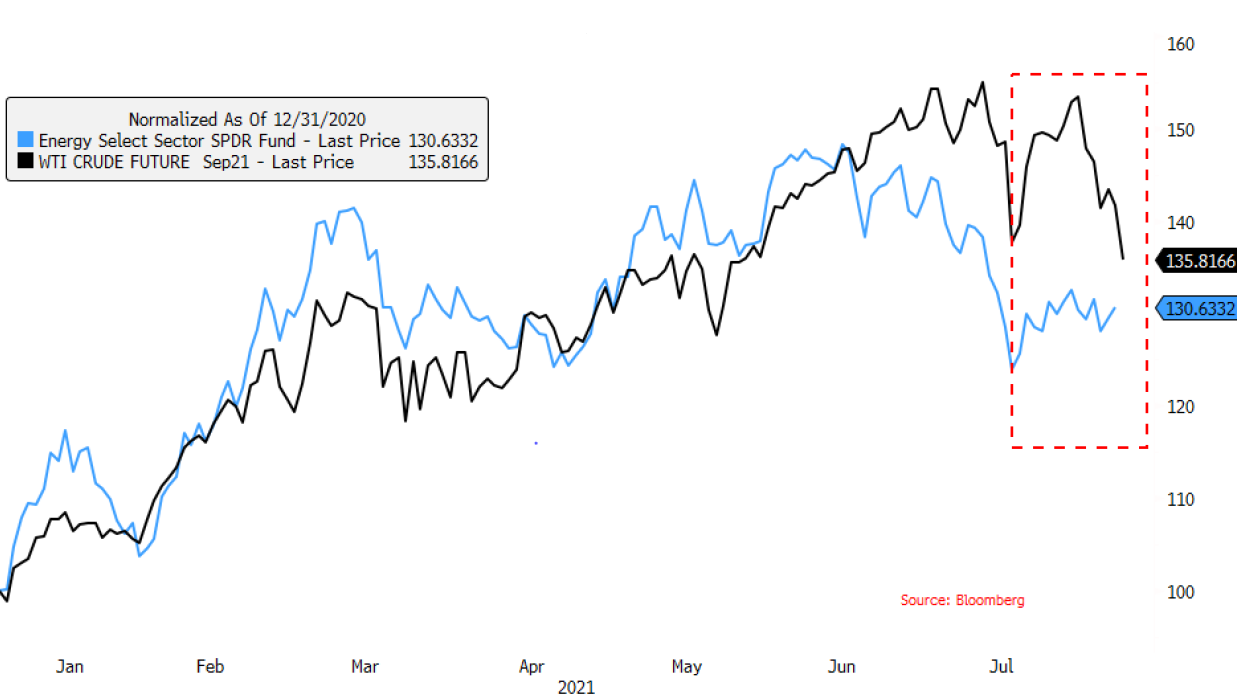

A “Classic” Buying Opportunity in Energy

We have been overweight energy in both our tactical opportunity portfolio (Thematic) and our outsourced CIO portfolio (OCIO) for quite some time. But for those looking to add to energy positions, Monday provided a “classic” buying opportunity. The gap between the WTI oil price and XLE (energy ETF) was 11% YTD as of August 9, and 13.7% over the past three months. WTI traded over 4% lower at one point on Monday due to Delta variant concerns to the mid-$60’s price per barrel, down from the mid-$70’s in early July. XLE was down less in percentage terms on Monday. The sudden severe one-day drop in WTI’s price after a steady decline over a month’s period and the corresponding outperformance of XLE on that day was a “classic” opportune time to buy. We expect that other buying opportunities will emerge in Energy stocks. The Biden administration has been increasingly concerned about high gasoline prices which have risen over 40% y/y. On August 11, the U.S. National Security Advisor Jake Sullivan called on OPEC+ to “do more to support the [economic] recovery.” Perhaps a deal with Iran could even be forthcoming sooner than expected. Any substantial increase in oil supplies would no doubt provide additional buying opportunities in energy-related securities. According to a WSJ August 12 article, the International Energy Agency (IEA) in its monthly oil report issued that day, cut its global oil demand forecast by 100,000 barrels/day for 2H 2021 due to the rise of Delta variant infections, but increased its 2022 outlook of oil demand growth by 200,000 barrels/day for 2022. The IEA now expects global oil demand to return to pre-pandemic levels by 2H 2022.

XLE (Energy Select ETF) vs. WTI (West Texas Intermediate Crude Oil Price)

Source: J.P. Morgan, U.S. Market Intelligence: Morning Briefing, (8/9/21)

Delta’s Economic Effects

The Delta variant has the potential to greatly affect employment growth, economic growth and inflation. We believe that these effects will be temporary. We recommend that investors take advantage of negative Delta variant effects on these economic statistics and the accompanying market volatility. We believe that the latest U.S. employment and inflation statistics mostly show no deleterious effects due to the Delta variant. We expect that next month’s economic statistics will probably show some Delta variant effects. We continue to believe that global economic growth will proceed on a rolling economic growth trajectory as we have discussed in prior market commentary. We believe that many components of inflation will persist.

CPI and Employment Data: Market Impacts

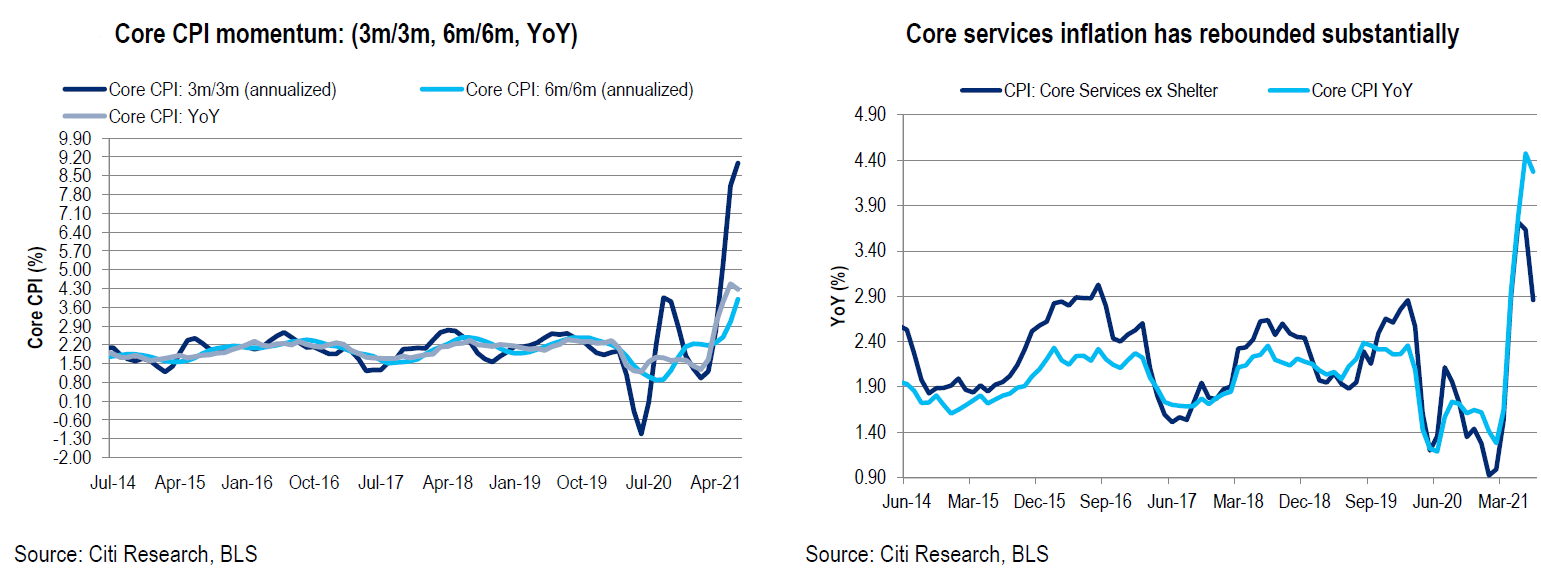

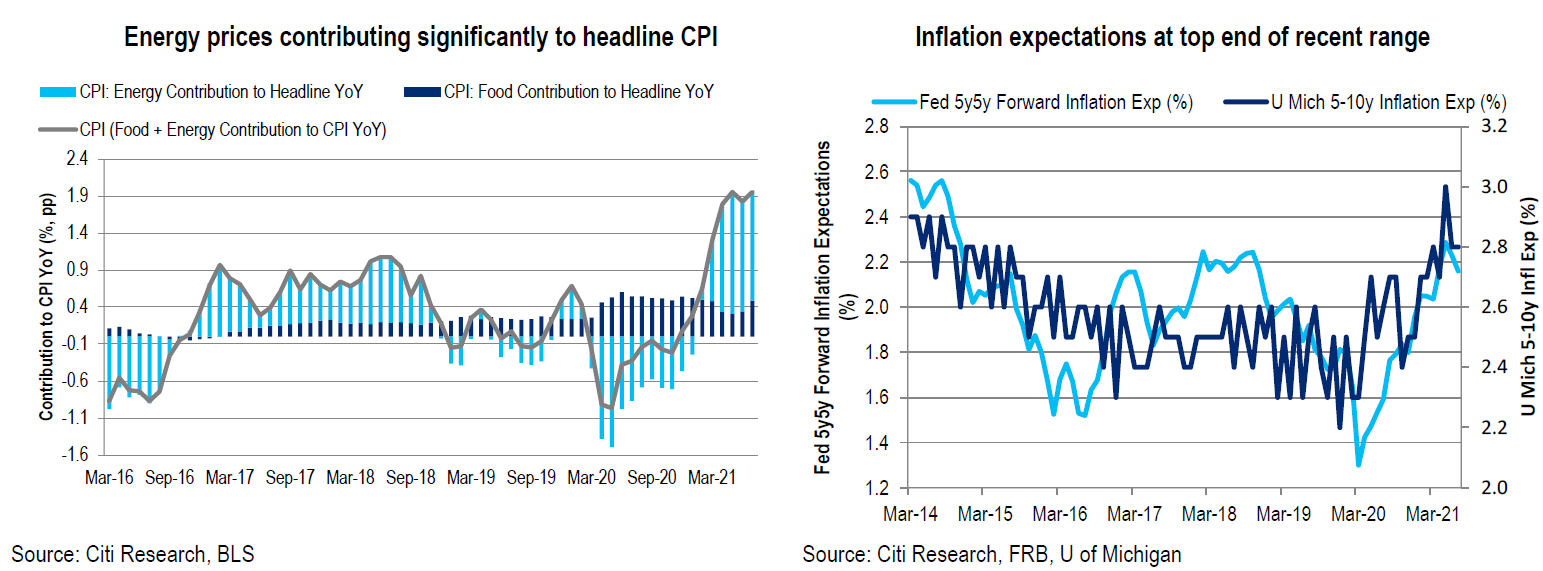

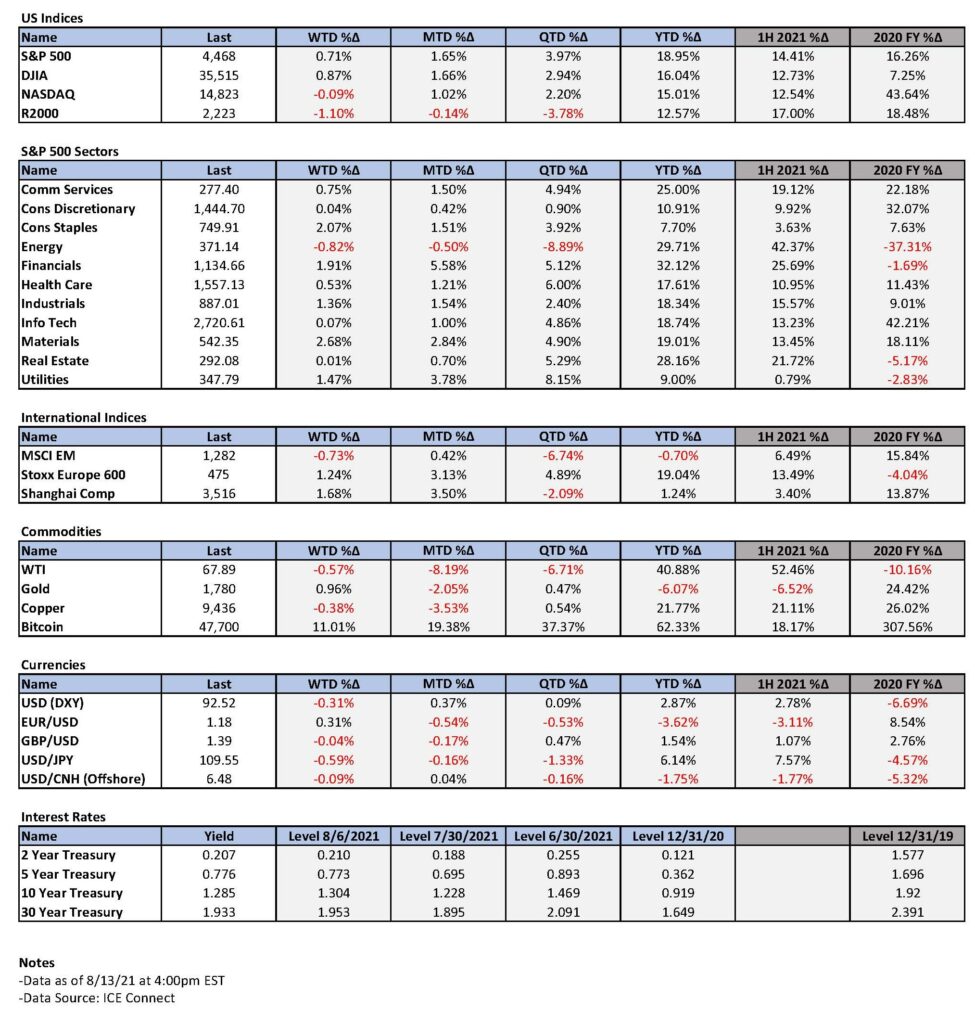

Headline U.S. consumer price index (CPI)) was as expected, but core CPI (excluding energy and food prices) was below expectations: 0.33% m/m vs. 0.4% expected. Although interest rates and USD eventually traded lower after the CPI was announced, the lower than expected CPI core was not enough to reverse the USD gains and higher interest rates from the better-than-expected employment data of last week. The Value/Cyclical stocks added to their outperformance from the employment announcement day. The rise in employment and hopes for continued economic growth were obviously more impactful than current levels of inflation. We believe that Value and Cyclical type stocks should continue to be bought on dips. In our opinion, better opportunities will arise to add to our core holdings of high quality large cap growth stocks at some later date.

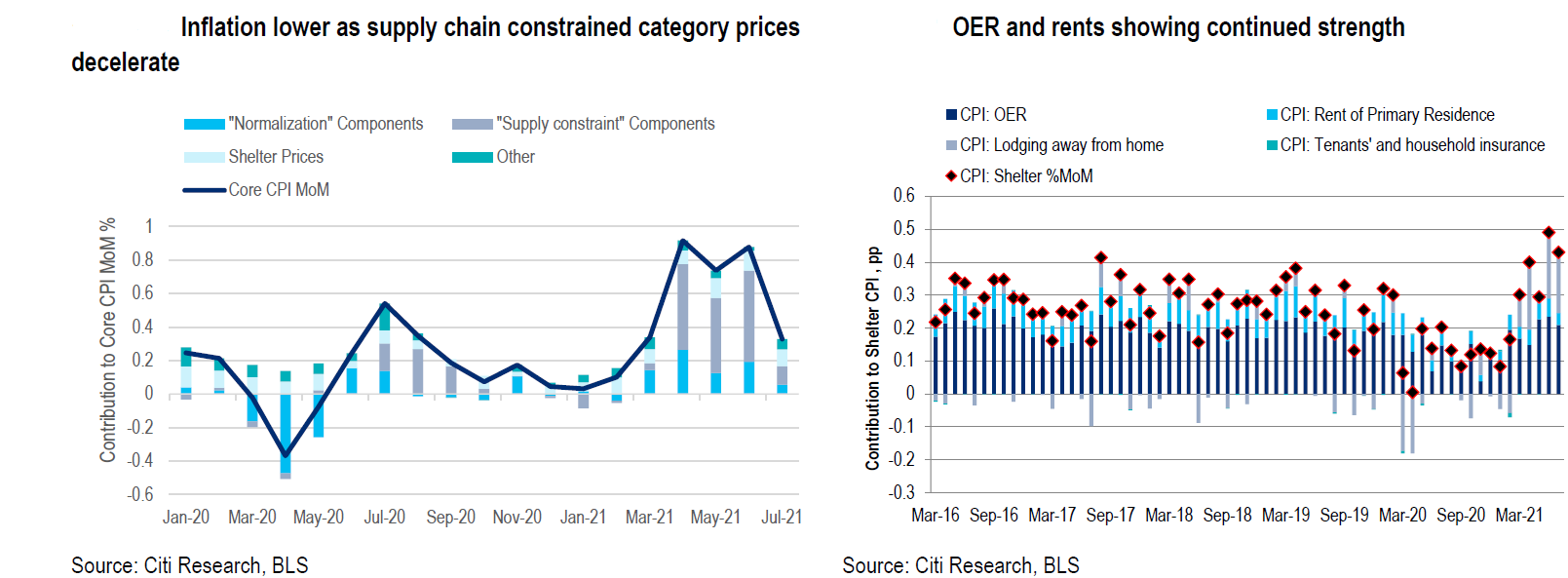

Composition of CPI

Although price declines in temporary categories, such as used car prices from a monthly increase of over 10% m/m in June to a +0.2% m/m increase in July, had a great impact on reducing core CPI to +0.33% m/m in July from the prior three month average of +0.8% per month, we still believe that inflationary pressures should continue for quite some time. In our opinion, these pressures should include such factors as materials shortages, shipping bottlenecks, hiring difficulties and further supply chain disruptions to Delta variant infections. New car prices, on the other hand rose 1.7% m/m as semiconductor chip shortages continued to negatively impact auto production, thereby keeping new car inventories at historically low levels. We also expect continuing price increases in the Services sectors as the reopening of economies gathers momentum. Costs of food away from home increased at 0.8% m/m in July, which was the biggest monthly advance since 1981. We expect shelter costs to continue to increase due to continued low inventories of homes for sale, as well as workers moving back to cities as companies require the presence of employees in their offices. Headline CPI increases remain highly sensitive to energy prices and food costs which continue to show appreciable increases. Gasoline prices rose 2.4% m/m in July and grocery prices increased by 0.7%.

OER: Owners’ Equivalent Rent

Source: Citi, U.S. Economics: Softer July core CPI but details unsurprising, (8/11/21)

Source: J.P. Morgan, The J.P. Morgan View : Global Asset Allocation Increase bond underweights, (8/9/21)

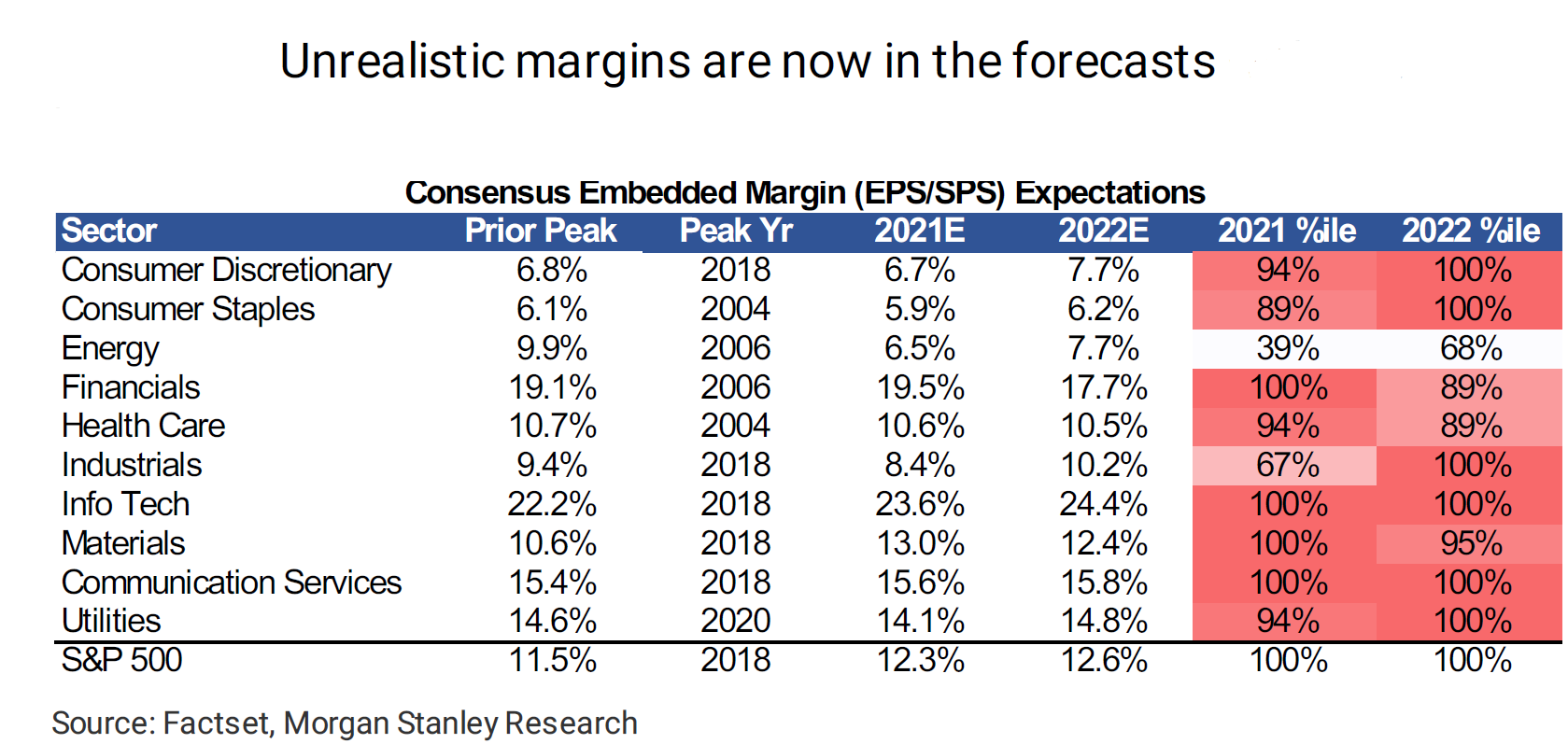

PPI and Net Profit Margins

The producer price index (PPI) for July, also announced this week, was much better than expected: 1.0% m/m for both the headline and core numbers. According to the Bureau of Labor Statistics, three -fourths of the July increase was attributable to the 1.1% advance for Services prices. The final demand for goods registered a 0.6% increase. We believe that much of the increase in future inflation statistics will be attributable to the Services sectors, in spite of Services being most vulnerable to the Delta variant upward trajectory of infections. The most obvious question is to what extent will increases in PPI flow through to the CPI. This should become more evident in the next 1-3 months. There could be margin compression to the extent companies do not pass on price increases at the wholesale level. According to FactSet’s August 6 report, with 89% of S&P 500 companies reporting Q2 earnings, the projected net profit margins of the S&P 500 would be a record 13.0% on average, above the record average net profit margin of 12.8% for Q1. This compares to the five-year average of 10.6%. We believe that these net margins are not sustainable in the medium-to-long term. This could partly account for the generally muted stock price reactions in both Q1 and Q2 when the S&P 500 companies continued to substantially beat revenue and earnings estimates.

Source: Morgan Stanley, Weekly Warm-up: Strong Jobs Puts Equity Valuations on Notice, (8/9/21)

Market Reactions, Inflation Expectations and Declining Confidence Among Business Owners

The initial financial markets reactions to the stronger than expected PPI numbers was a 4 bps increase in 10-year Treasury yields to 1.37%, a slight increase in USD and slight changes in the major U.S. equity indexes. The best performing S&P sectors relative to other sectors reverted to a more defensive and growth tilt (such as Healthcare and Info Tech) in contrast to the first three days this week when the Value/Cyclical stocks in Materials, Financials and Industrials clearly outperformed. These latter three sectors retained their top spots after the fourth day, as well. The initial financial market’s reaction is consistent with increasing concerns about the Delta variant’s possible negative (and we believe temporary) effect on economic growth and increasing inflation risks, given the increase in interest rates.

The New York Fed’s July nationwide survey, released on August 9, confirmed the continued high inflation expectations as exemplified by the latest PPI data. Median one-year inflation expectations remained at 4.8% and three-year expectations slightly increased to 3.7% (highest since August of 2013) from 3.6% in June.

The NFIB July survey of small business economic trends released on August 10, showed a dip in small business optimism for the next 3-6 months as labor shortages continued to be a major problem. According to the NFIB report, “small business owners are losing confidence in the strength of the economy and expect a slowdown in job creation.” We believe that the Delta variant’s effects probably will exacerbate this negative trend, but we believe that it will be relatively short-lived. We believe that trading opportunities will be forthcoming as volatility increases among sectors, if not the overall market.

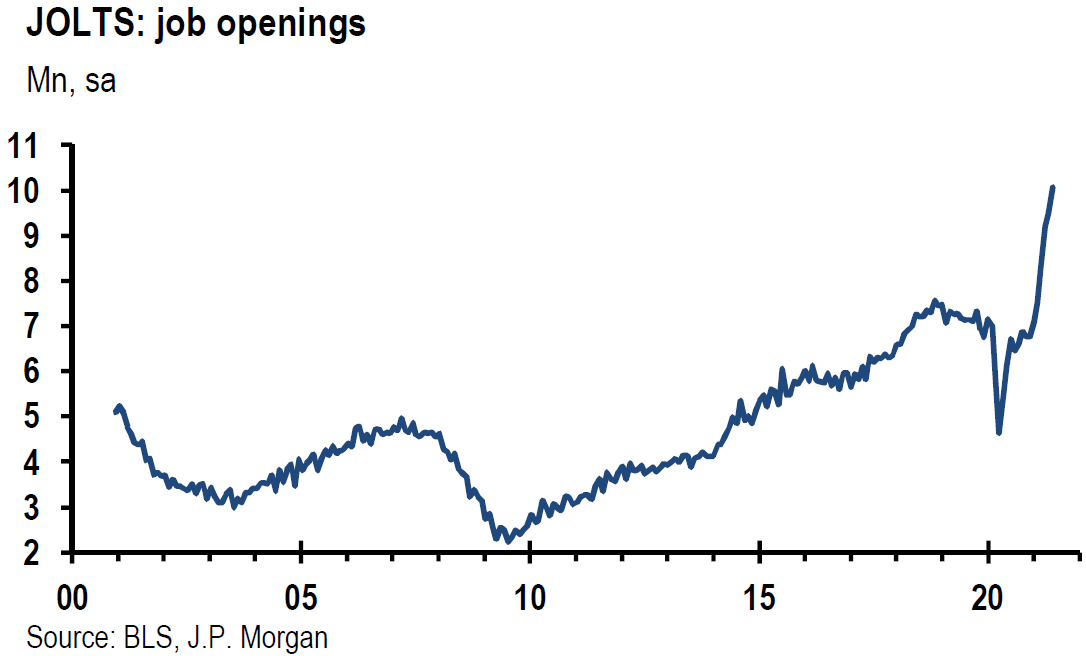

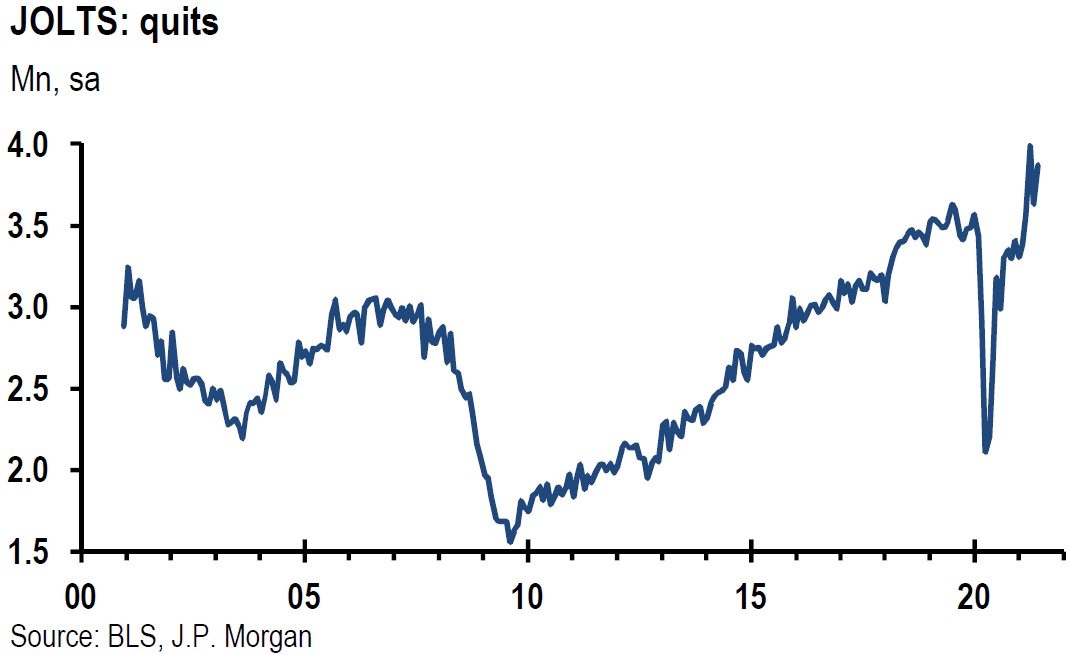

Source: J.P. Morgan, U.S.: Jump in job openings and hires eases labor market tightness, (8/9/21)

JOLTS: Job Openings and Labor Turnover Survey

Dramatic Fall in Consumer Sentiment

The dip in small business optimism for the next 3-6 months indicated by the NBFIB survey was displayed in a much more dramatic fashion by the University of Michigan preliminary consumer sentiment index for August, which plummeted to 70.2 (lowest since 2011 and well below market expectations) from 81.2 in July. The expectations gauge plummeted even more – down 14 points to 65.2 (lowest since October 2013). Only 36% of respondents, down from 52% in July, now expect a decline in the jobless rate, despite record job openings. Consumers now expect inflation to rise by 3% over the next 5-10 years, up from 2.9% in July. The inflation rate over the next year is now expected to be 4.6% vs. 4.7% in July.

The loss of confidence was widespread across incomes, age, education levels and regions. Expectations were more downbeat about all aspects of the economy, including unemployment and inflation.

This survey clearly displays the current fragility of consumer confidence. Perhaps the director of the survey said it best: “the extraordinary surge in negative economic assessments also reflects an emotional response, mainly for the dashed hopes that the pandemic would soon end.” We expect consumer confidence to rebound once the manageability of the Delta variant has become more clear.

Notable financial market reactions to the drop in consumer confidence: 10-year Treasury yield traded back down to the 1.30% level, USD dropped about 0.5% and the best performing S&P 500 sectors rotated back to a more defensive, growth stock orientation.

Bottom Line

We believe that the Delta variant will only slow, but not derail, economies’ reopenings around the world. Vaccination rates, hospitalization rates and government policies with regard to controlling this virus, will all be of great importance. The dramatic decline in the University of Michigan preliminary survey of consumer sentiment for August clearly shows the fragility of consumer sentiment. Uncertainty about future inflation rates and especially with regard to the Delta variant’s impact on the economy, could impact consumer spending and businesses hiring behaviors. We expect that these effects will be temporary.

In general, we continue to favor Value and Cyclical stocks at current prices. But we advise patience in deciding when to add to desired positions. We expect that more favorable risk/reward opportunities will materialize later this year and early next year when it will be more advantageous to add to our core high quality, big cap growth stocks.

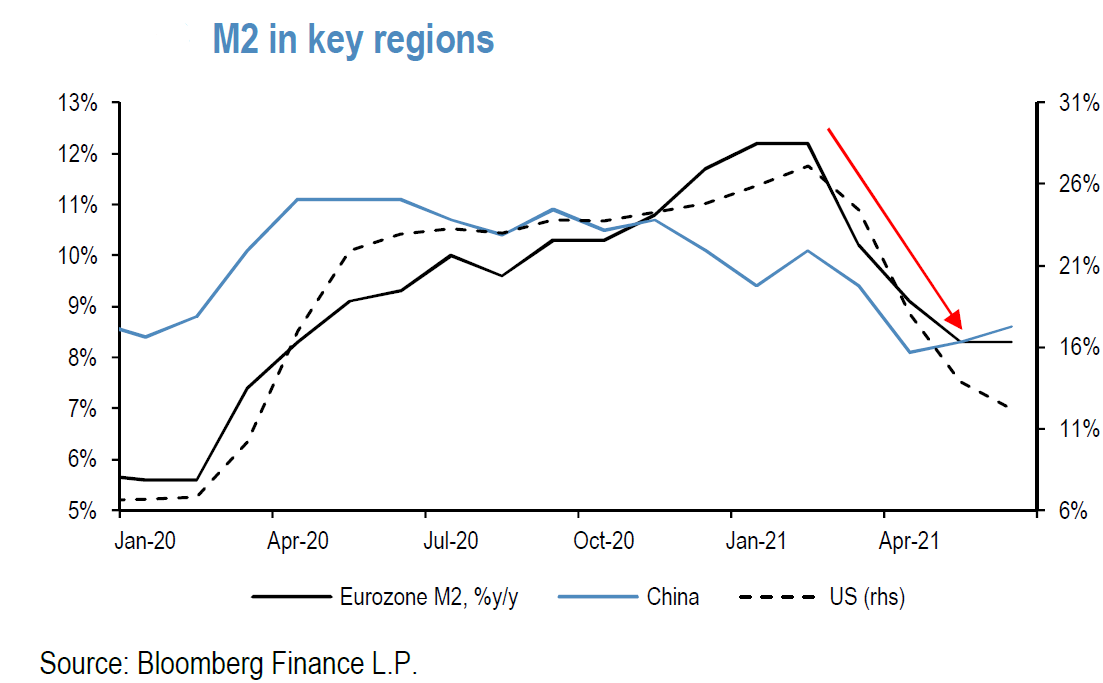

It is our opinion that interest rates are headed higher and that pressure on net profit margins will begin to intensify. Counterbalancing possible headwinds from margin pressures will be liquidity which has continued to sustain elevated equity prices and low interest rates. We expect that the recent USD strength should dissipate as the Delta variant is brought under control in foreign countries. A lower USD should help commodities, foreign companies and U.S.-based companies with overseas operations.

The uneven economic effects from the Delta variant should continue to provide attractive investment opportunities.

M2: A measure of the money supply that includes cash, checking deposits, and easily convertible near money.

Source: J.P. Morgan, Equity Strategy: Updating on the spillover concerns for equities from certain mini-bubbles, and from the peaking liquidity/M1, (8/9/21)

INDEX DEFINITIONS

KBW Nasdaq Bank Index (BKX): The KBW Bank Index is designed to track the performance of the leading banks and thrifts that are publicly-traded in the U.S. The Index includes 24 banking stocks representing the large U.S. national money centers, regional banks and thrift institutions.

MSCI EM Value Index: The MSCI Emerging Markets Value Index captures large and mid cap securities exhibiting overall value style characteristics across 27 Emerging Markets (EM) countries.

MSCI EM Index: The MSCI Emerging Markets Index captures large and mid cap representation across 27 Emerging Markets (EM) countries.

NASDAQ: The Nasdaq Composite Index is the market capitalization-weighted index of over 2,500 common equities listed on the Nasdaq stock exchange.

PCE: Personal Consumption Expenditures (PCEs) refers to a measure of imputed household expenditures defined for a period of time.

Russell 1000 Growth: The Russell 1000 Growth Index measures the performance of the large-cap growth segment of the U.S. equity universe. It includes those Russell 1000 companies with higher price-to-book ratios and higher forecasted and historical growth values.

Russell 1000 Value: The Russell 1000 Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected and historical growth rates.

S&P 500: The S&P 500 Index, or the Standard & Poor’s 500 Index, is a market-capitalization-weighted index of the 500 largest publicly-traded companies in the U.S.

VIX: The VIX Index is a calculation designed to produce a measure of constant, 30-day expected volatility of the U.S. stock market, derived from real-time, mid-quote prices of S&P 500® Index (SPX℠) call and put options.

Z-Score: A Z-score (also called a standard score) gives an idea of how far from the mean a data point is. It is a measure of how many standard deviations below or above the population mean a raw score is.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/fast-answers/answersindiceshtm.html or http://www.nasdaq.com/reference/index-descriptions.aspx.

All data is subject to change without notice.

© 2024 NewEdge Capital Group, LLC