Seeing the Bigger Picture

A thoughtfully constructed wealth strategy takes a holistic approach to wealth management and understands how each piece interacts with the others. As your wealth increases, so do the complexities, potential risks, and unique opportunities available to you and your family.

The new year provides a great opportunity to evaluate where updates may be needed and to assess your financial wellness. Our guide below summarizes some key areas to review in 2023. We encourage you to speak to your NewEdge Wealth team regarding any changes in your personal or financial circumstances that may require a course correction.

Notable Legislative Updates for 2023

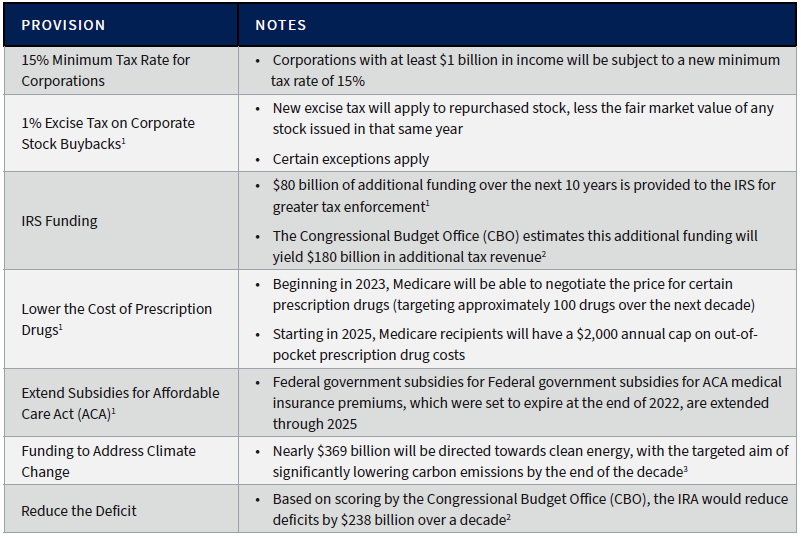

Build Back Better Act (BBBA) Becomes the Inflation Reduction Act (IRA)

The Biden Administration was unable to advance the $1.75 trillion Build Back Better Act (“BBBA”) through both houses of Congress, in large part due to objections from Senators Manchin of West Virginia and Sinema of Arizona. While BBBA had initially targeted raising income tax rates for high earners and lowering the estate exemption, such tax proposals were left out of the Inflation Reduction Act, aside from the IRA incorporating an additional $80 billion of funding to the IRS.

The larger legislative package was ultimately scaled back to the Inflation Reduction Act ($430 billion) and was signed into law by President Biden on August 16, 2022. The $430 billion bill aims to combat climate change, lower healthcare costs, and reduce the deficit.

² Source: CFRB: “CBO Scores IRA with $238 Billion of Deficit Reduction” (September 2022).

³ Source: CNBC: “The U.S. passed a historic climate deal this year — here’s a recap of what’s in the bill“ (December 2022).

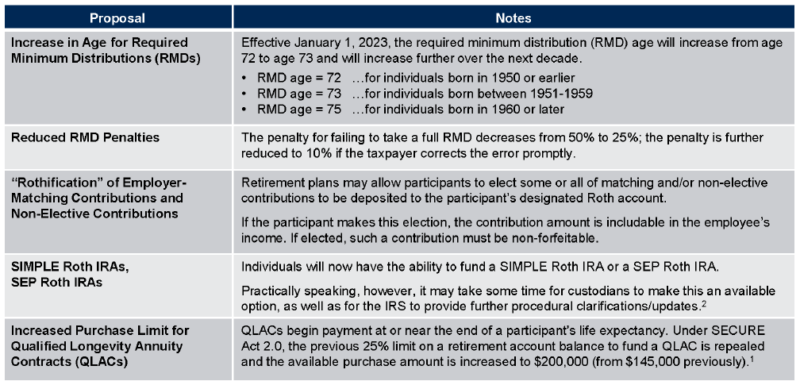

Secure Act 2.0

Building on retirement enhancements made under SECURE Act 1.0 (which became law in 2020), Congress passed SECURE Act 2.0 on December 23, 2022, as part of the $1.7 trillion omnibus spending bill. Among the many changes, the Required Minimum Distribution (RMD) age will increase to age 73 and eventually to age 75, and individuals will have expanded opportunities to save for retirement including potentially utilizing Roth accounts. Changes from SECURE 2.0 will be phased in between 2023, 2024, and future years.

Changes Effective for 2023

2 Source: SECURE Act 2.0 Paves the Way for Big Changes as of January 2023

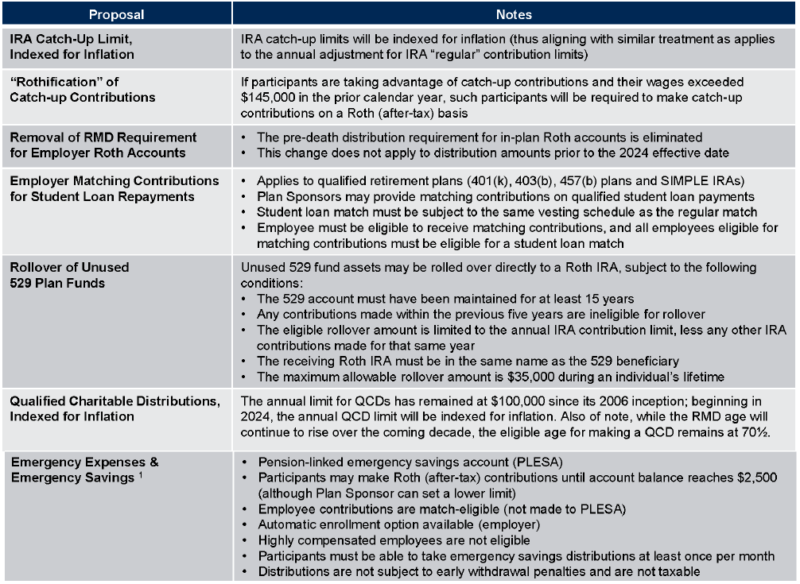

Changes Effective for 2024

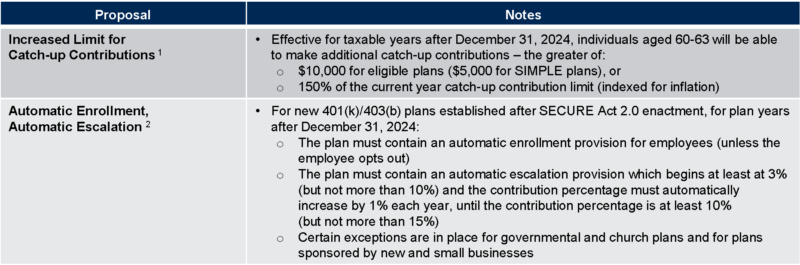

Changes Effective for 2025 or Later

² Source: Morgan Lewis – “SECURE Act 2.0: Congress Deliver Retirement Plan Legislation and Holiday Cheer as Part of Year-End Spending Bill” (December 27, 2022)

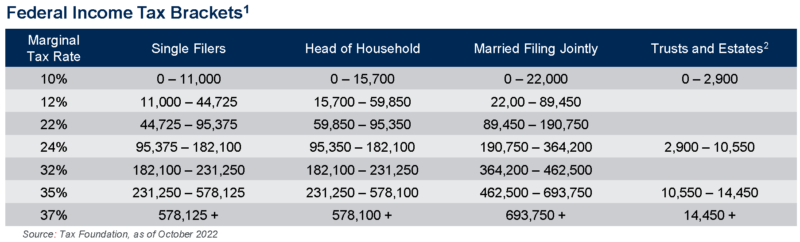

Income Tax Planning

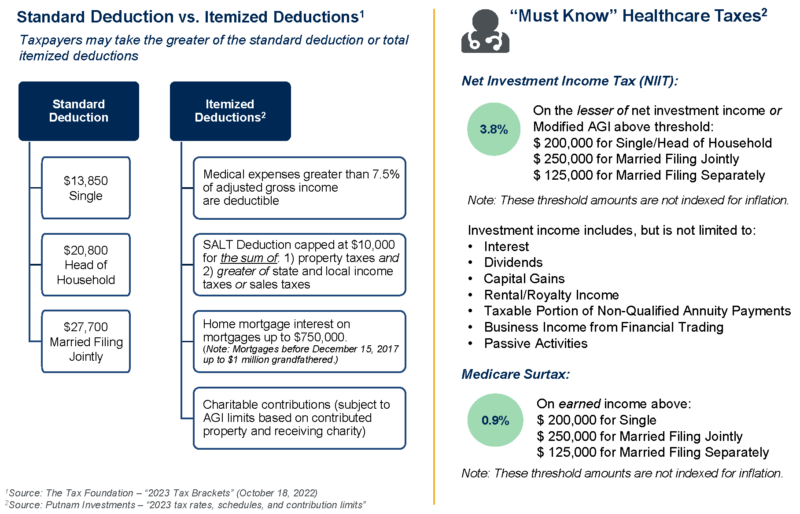

Taxpayers may take the greater of the standard deduction or total itemized deductions.

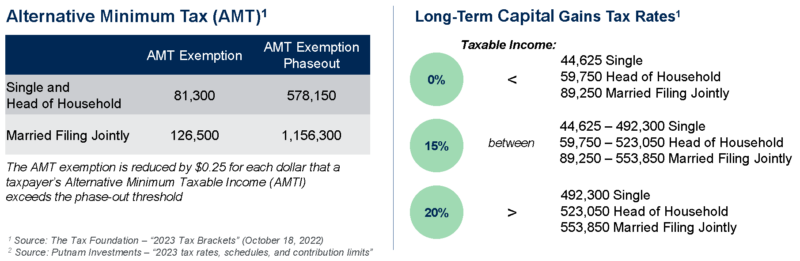

Net Investment Tax (NIIT)

3.8% on the lesser of net investment income or Modified AGI above threshold:

- $200,000 for Single/Head of Household

- $250,000 for Married Filing Jointly

- $125,000 for Married Filing Separately

Note: These threshold amounts are not indexed for inflation.

Investment income includes, but is not limited, to interest, dividends, capital gains, rental/royalty income, the taxable portion of non-qualified annuity payments, business income from financial trading, and passive activities.

Medicare Surtax

0.9% on earned income above:

- $200,000 for Single/Head of Household

- $250,000 for Married Filing Jointly

- $125,000 for Married Filing Separately

Note: These threshold amounts are not indexed for inflation.

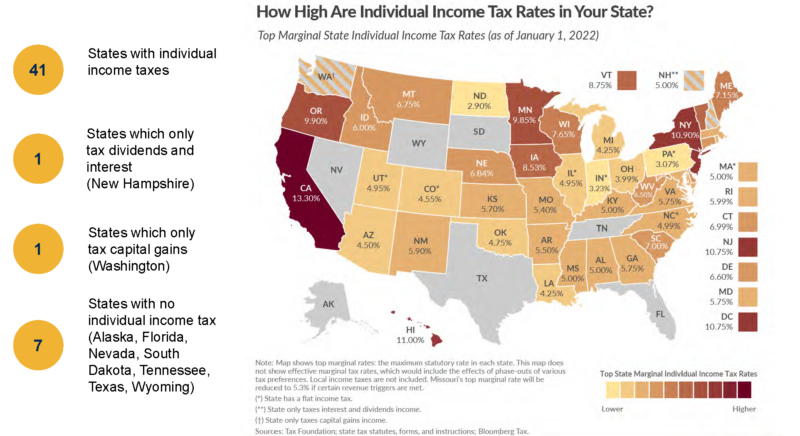

State Tax Provisions

Charitable Planning

Accelerated Charitable Giving

The charitable giving landscape changed substantially in 2018, as the Tax Cut and Jobs Act nearly doubled the standard deduction but capped the state and local tax (SALT) deduction at $10,000 and eliminated “miscellaneous two percent itemized deductions.” Due to the new changes, taxpayers should evaluate whether or not a portion of charitable giving would produce a tax benefit. Taxpayers may benefit from accelerating (“bunching”) charitable gifts to maximize itemized deductions in a single tax year while taking the standard deduction in other years. This planning strategy can be particularly effective for charitably inclined taxpayers without deductible medical expenses ( >7.5% of Adjusted Gross Income) and with no/minimal mortgage interest.

Charitable Giving Vehicles

There are numerous considerations to evaluate whether a donor-advised fund (DAF), private foundation, or a combination of such paired with other vehicles might be an effective charitable giving strategy.

Retirement Planning

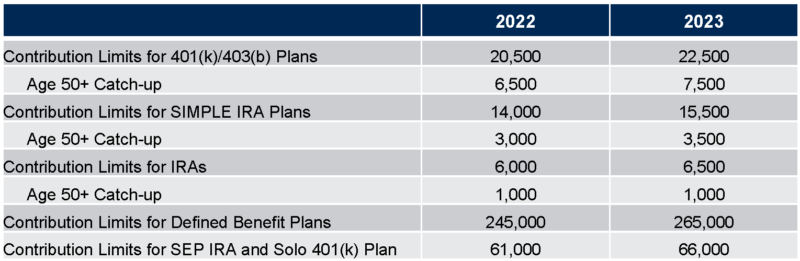

Retirement Contribution Limits

Modified Adjusted Gross Income (MAGI) Limitations for IRA Contributions

Beware of the Five-Year Rule: Converted Funds must remain in your Roth IRA for at least five years, regardless of an individual’s age. Failure to do so may result in a 10% early withdrawal penalty.

Ways to Maximize Retirement Savings Beyond Your 401(k) Plan

After maximizing contributions to retirement plans (401(k), 403(b)) and deferring at least your company’s match, investors can look to take advantage of the following:

- Maximize after-tax assets in your portfolio:

- Maximize contributions to after-tax accounts

- Consider Backdoor Roth IRA contributions (if allowable)

- Consider a Roth IRA conversion

- Consider establishing a Spousal IRA

- If self-employed, maximize retirement savings by contributing to a Solo 401(k), SEP-IRA, or Defined Benefit Plan

The “Stretch IRA” Replaced by 10-Year Rule

SECURE Act 1.0 largely eliminated the “stretch IRA.” Most non-spouse beneficiaries can no longer ‘stretch’ IRA withdrawals out over their lifetime and are instead required to fully withdraw inherited retirement account assets by December 31 of the tenth calendar year following the account owner’s death. Importantly, beneficiaries do not need to make withdrawals each year over the 10-year period. Instead, consider deferring withdrawals into tax year(s) when taxable income will be lower.

Who is Still Eligible for the Extended Payout Period?

- Heirs of IRAs whose original owners died before 2020

- Surviving spouses

- Chronically ill or disabled heirs

- Heirs within 10 years of age of the original owner

- Minor children of the account owner, up to the age of majority or age 26 if the child is still in school; at that point, the 10-year payout begins

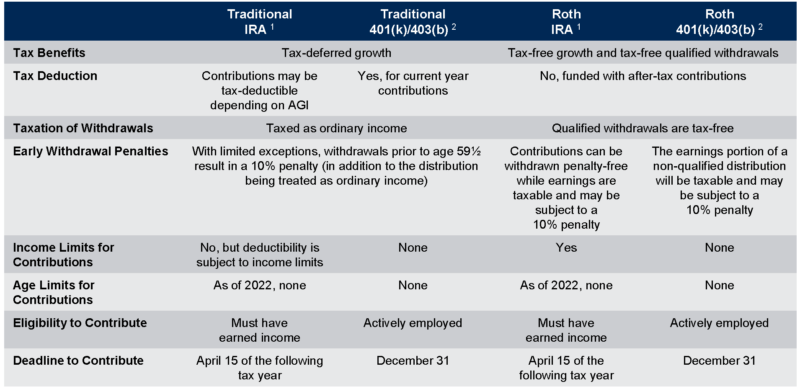

Traditional vs. Roth IRA

Review objectives and marginal income tax brackets to evaluate whether to contribute to a Traditional retirement account, a Roth retirement account, or a combination of both. As a form of tax diversification, individuals may consider utilizing a combination of both Traditional and Roth retirement plan accounts as a ‘tax hedge’ given the uncertainty over future income tax rates.

² Source: Nerdwallet – “Roth 401(k) vs. 401(k): Which Is Best for You?” (January 2023)

Backdoor Roth Contributions

If a taxpayer’s income is higher than the noted thresholds for contributing to a Roth IRA, a taxpayer may fund a Traditional IRA with a “non-deductible” contribution. This contribution may, in turn, be converted to a Roth IRA tax-free, provided the taxpayer does not have any other holdings in a Traditional IRA. If a taxpayer has an outstanding Traditional, SEP, or SIMPLE IRA balance, a portion of the conversion will be treated as taxable income.

Roth Conversions

Unlike income limits for Roth IRA contributions, there are no such income limitations for completing a Roth conversion. Taxpayers should recognize that converting a Traditional IRA to a Roth IRA typically produces taxable income. Individuals should evaluate their income tax picture to compare how their current tax bracket might compare to a future tax bracket:

Individuals might consider a partial conversation where income is recognized up to a certain tax bracket.

For ultra-high net worth individuals that will otherwise have a taxable estate, a Roth conversion may be beneficial as it reduces the size of the taxable estate by the amount of taxes paid on conversion while leaving a favorable asset to heirs. Inheriting a Roth IRA is preferable to inheriting a Traditional IRA as beneficiaries’ withdrawals are income tax-free.

Increase to the Social Security Cost of Living Adjustment (COLA)

The Social Security Administration (SSA) announced the 2022 cost of living adjustment (COLA) of 8.7%. The adjustment for 2023 represents the fourth largest since automatic adjustments began in 1975 and marks the largest annual increase since 1981.

A common misconception is that Social Security is going broke. Without any changes, the Social Security trust fund is estimated to be depleted by 2035; however, Social Security is a pay-as-you-go system and, as such, will continue to collect revenue from payroll taxes. Even if Congress were to enact no changes based on incoming payroll tax collections, Social Security would still be able to pay an estimated 80% of benefits.

Estate Planning

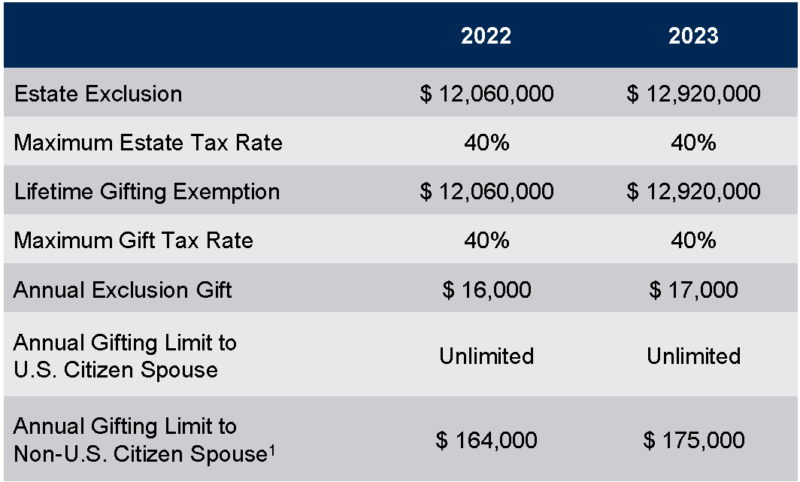

Increased Federal Estate Planning Limits

Additional Gifting Opportunities

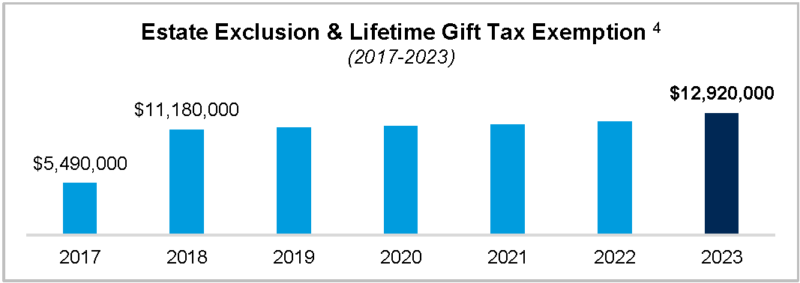

The estate and lifetime gift tax exemption increased substantially to $12.92 million per person (from $12.06 million as of 2022). Given the notable increase, high net worth individuals who may have previously exhausted the lifetime gift tax exemption may now have flexibility to gift additional assets out of an otherwise taxable estate. Under present federal legislation, this limit is set to decrease to $5.0 million (adjusted for inflation) in 2026. In November 2019, the Treasury Department and IRS issued final regulations indicating individuals utilizing the increased gift and estate tax exclusion amounts (scheduled for 2018 to 2025) would not be adversely impacted by a clawback should the exclusion revert to pre-2018 levels.

The annual gift tax exclusion also increased to $17,000 (from $16,000 as of 2022).

Be Mindful of State Estate or Inheritance Tax

Does your state have an estate or inheritance tax? Seventeen states and the District of Columbia have an estate or inheritance tax. Older estate plans should be reviewed to ensure trust provisions incorporate current federal and state estate tax limits.

⁴ Source: Evans Estate Law Resources – “Federal Estate and Gift Tax Rates And Exclusions”

Key Takeaways: The federal estate exemption has increased significantly (+$860,000) in 2023 due to the inflation adjustment, providing additional gifting opportunities to those who had previously exhausted the lifetime gift tax exemption.4 With the scheduled decrease in exemption amounts in 2026, individuals who have – or are likely to have – a taxable estate and who have sufficient assets for retirement may want to consider gifting additional assets. Your NewEdge Wealth team will work to evaluate and analyze your personal situation to determine the optimal wealth transfer strategies.

Changes to the 529 College Savings Plan in 2023

SECURE Act 2.0 provides a new allowance of tax-and penalty-free rollovers from unused 529 funds directly to a Roth IRA, subject to certain provisions.

FAFSA changes will benefit grandparent-owned 529 Plan accounts. Effective October 1, 2023 (for the 2024-25 academic year), students will no longer be required to disclose cash distributions from grandparent-owned 529 Plans.

Given the value of an individual’s taxable estate, it may be more efficient to pay tuition directly from your estate and make annual exclusion gifts to another wealth transfer vehicle. When it comes to education, is also important to make sure you’re coordinating your estate plan with the older generations.

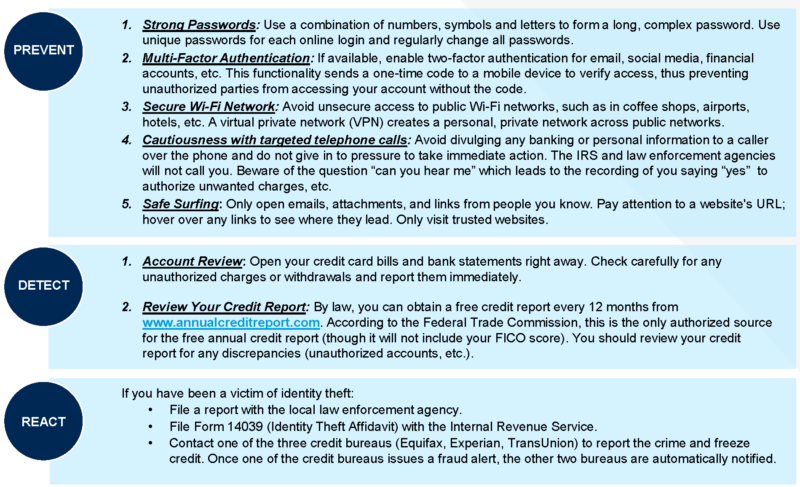

Cybersecurity

SOURCES

Fiducient Advisors 2023 Financial Planning Guide

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/answers/indices.htm.

All data is subject to change without notice.

© 2025 NewEdge Capital Group, LLC