Weekly Summary – June 5 – 9

Key Observations:

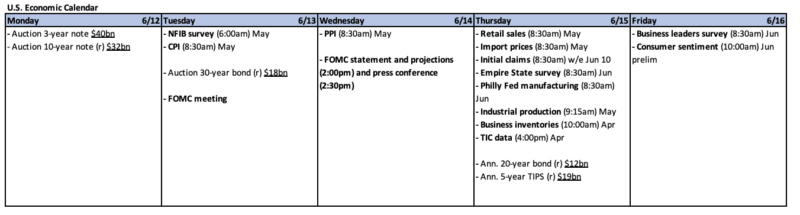

- As we approach the Federal Reserve’s (Fed) meeting next week, it has become increasingly clear that many investors and analysts are “anticipating” a myriad of factors in regard to the Fed’s decision, financial market developments and economic developments. It has become somewhat difficult to discern the consensus of many of these factors. The “consensus” appears to be that the Fed will “skip” a hike of the federal funds rate and then most likely hike in July. This has become our opinion as well. But we wish to emphasize that the Fed could change its mind depending on the latest CPI and PPI data announced during its two-day meeting next week.

- We are maintaining our inclination that the recent “broadening” of the equity rally could continue. However, we are not completely convinced of this stance and we could be very quick to change our opinion on this matter. We reiterate our opinion stated in our May 26 commentary that the sudden change in the NVDIA Corporation’s (NVDA) fundamentals and its stock reaction was a “game changer.“ We believe that holders of AI related stocks will be less willing to sell and that investors might now be more willing to buy. We view the risk-reward analysis in regard to stocks as having changed.

- We continue to characterize recent economic data as “mixed,” but acknowledge the possibility of a U.S. recession over the next twelve months. The recent further inversion of the two to 10 -year Treasury yield curve would tend to support this possibility. We believe that the U.S. economy will slow in the second d half of this year.

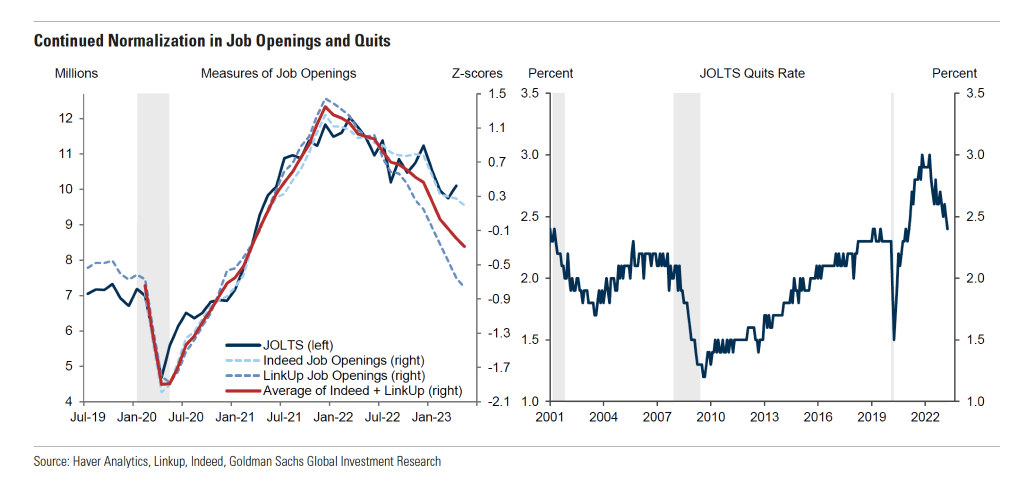

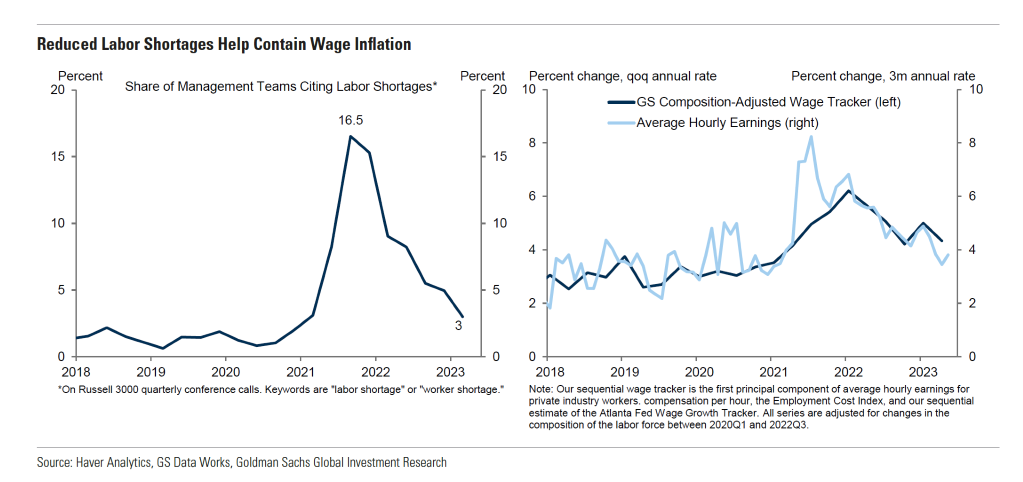

- We are encouraged by the recent progress that has been made on suppressing U.S. wage growth. We see the “cooling” of the U.S. labor market continuing and possibly accelerating. This could enable the stubborn and “sticky” inflation that is more typical of the services sectors to dissipate more quickly.

The Upshot: Our general investment approach remains the same as depicted in last week’s commentary. We maintain our preference for quality stocks with good balance sheets, relatively stable cash flows with stable margins. Volatility across sectors continues to be supportive of a diversified portfolio for long term investors. We continue to stress that stock selectivity is of paramount importance.

The Russell 2000 (RTY), a U.S. small cap index, has begun to outperform relative to other U.S. stock averages recently. This has been one aspect of the more-broad nature of the recent rally in U.S. stocks. RTY comprises many unprofitable companies. In our search for new stock ideas in RTY, we would maintain our preference for quality. We would avoid unprofitable companies in general and would try to avoid companies that might need outside financing over the next year.

Divergence of What’s “Anticipated”

For quite some time, the Fed focus has been on the U.S. labor market and the rate of wage growth. As we have indicated in prior commentaries, the Fed officials are “anticipating” wage growth closer to 3%, which they deem compatible with their 2% inflation rate target. Services inflation, which seems to be very closely aligned with wage growth that continues to be too elevated, has proven to be very persistent and “sticky.” We trust that evidence of slowing wage growth and a “cooling” U.S. labor market has begun to emerge. In last week’s commentary, we highlighted the reasons why we thought that the Fed most likely would “skip” hiking the federal funds at its June 13-14 meeting. Financial markets mostly have priced in now this probability, and the consensus now is that a July hike is most likely. Nevertheless, a lack of conviction has fostered many divergent opinions. The minutes of the Fed’s last meeting continue to show that the Fed’s staff continues to “anticipate” a mild U.S. recession. Many analysts and investors seem to agree. Others – including Fed chair Powell – think a recession can still be averted. We trust that Carly Simon’s song “Anticipation” captures the essence of the many divergent views about the economic future. “We can never know about the days to come; But we think about them anyway … Anticipation, anticipation; Is makin’ me late; Is keepin’ me waitin’.” The very state of “anticipation” has kept many investors in a state of abeyance and apparently is about to make the Fed’s next decision “late” and will keep us all “waitin.”

AI’s Possible Effects on the Economy and Financial Markets

Another very strong focus of markets and the Fed recently has been on Artificial Intelligence (AI) and its potential effects on companies’ growth prospects and profitability, as well as on the potential increases in labor productivity. Who will be the winners and losers? Who will lose their job and who will become more productive? We assume that increased productivity will help increase output and reduce inflationary pressures. In our May 26 commentary, we characterized the NVDIA Corporation (NVDA) as the “poster child” for AI. NVDA showed that the timing of when increased revenues and profitability would become evident and realized could be very unpredictable. We surmise that NVDA’s example could make investors more willing to invest in and hold what might appear to be an overvalued stock because the fundamentals could change very abruptly for certain growth companies. This highlights again the importance of stock selection. We view the task of trying to quantify the timing and productivity enhancements from AI as a very difficult exercise that in the end inevitably must be a “best guess.” The translation of productivity gains most likely will be only one of many factors that affect stock prices. Short-term concerns could overwhelm longer-term goals. We believe that NVDA’s example has raised the bar so that long-run goals now could be more likely to overcome shorter term negative developments.

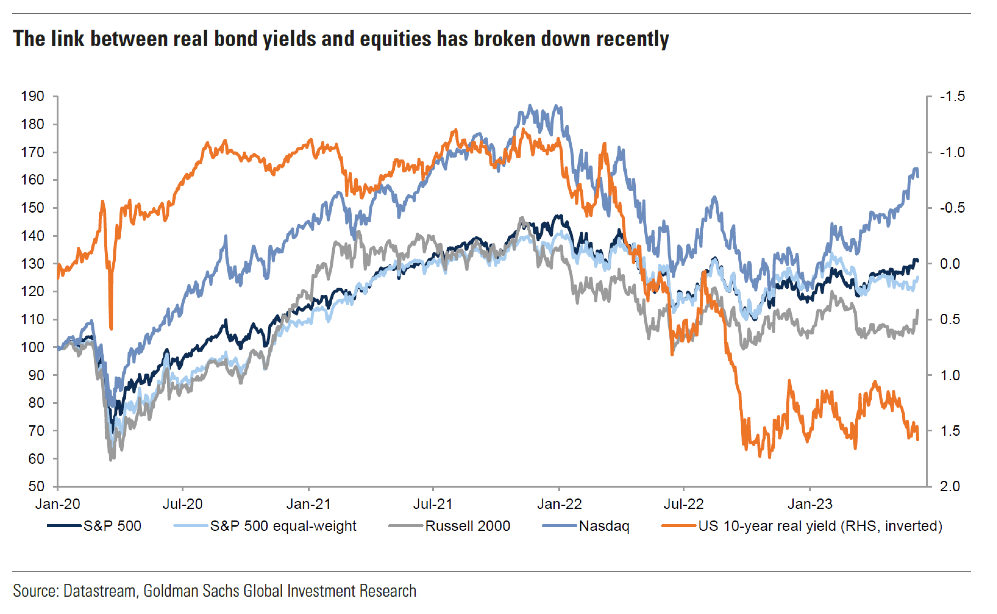

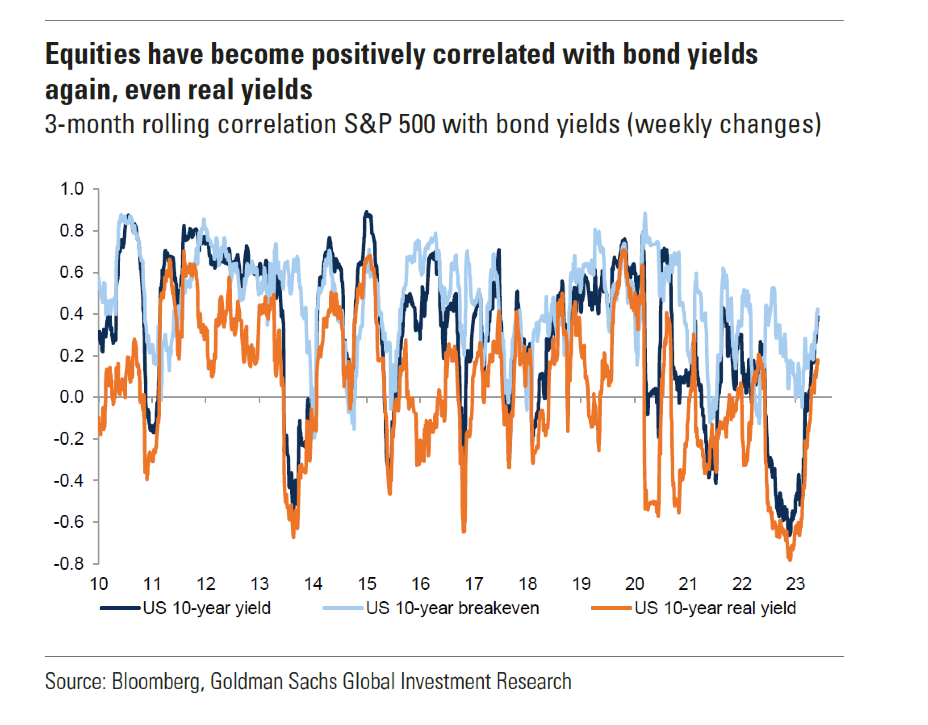

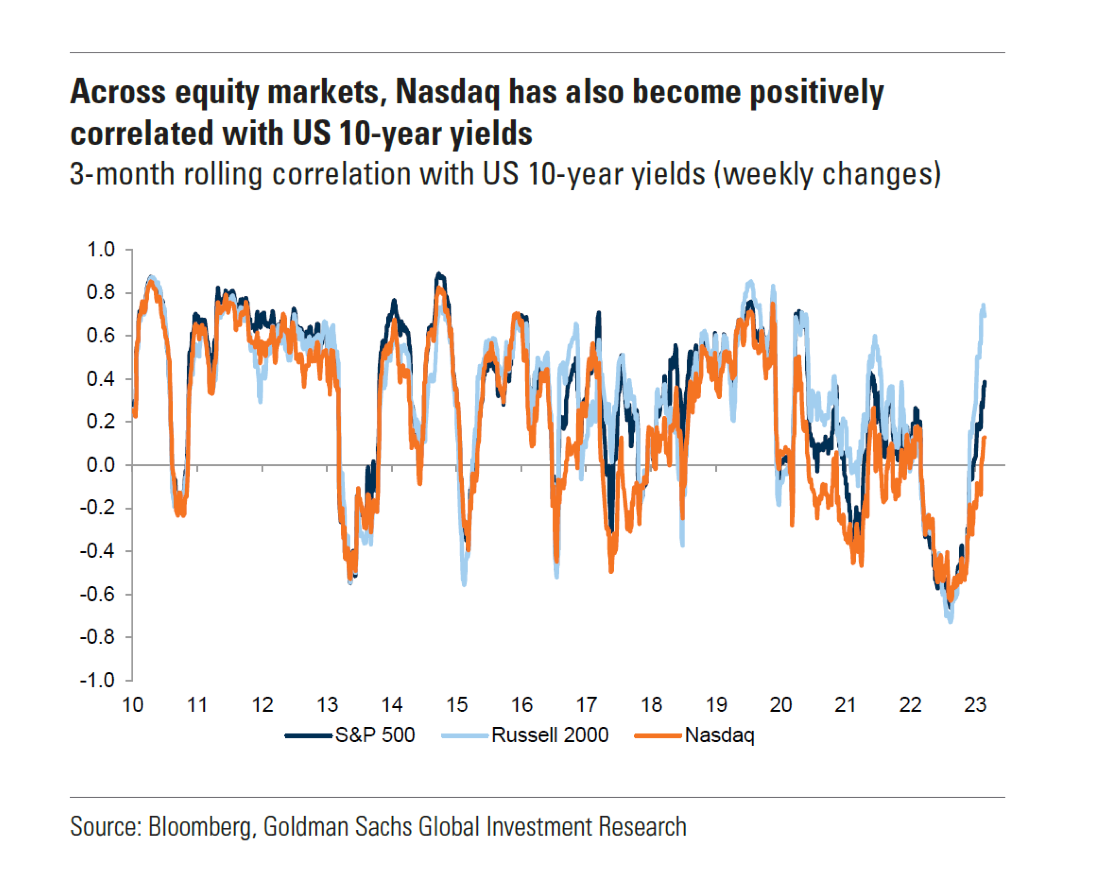

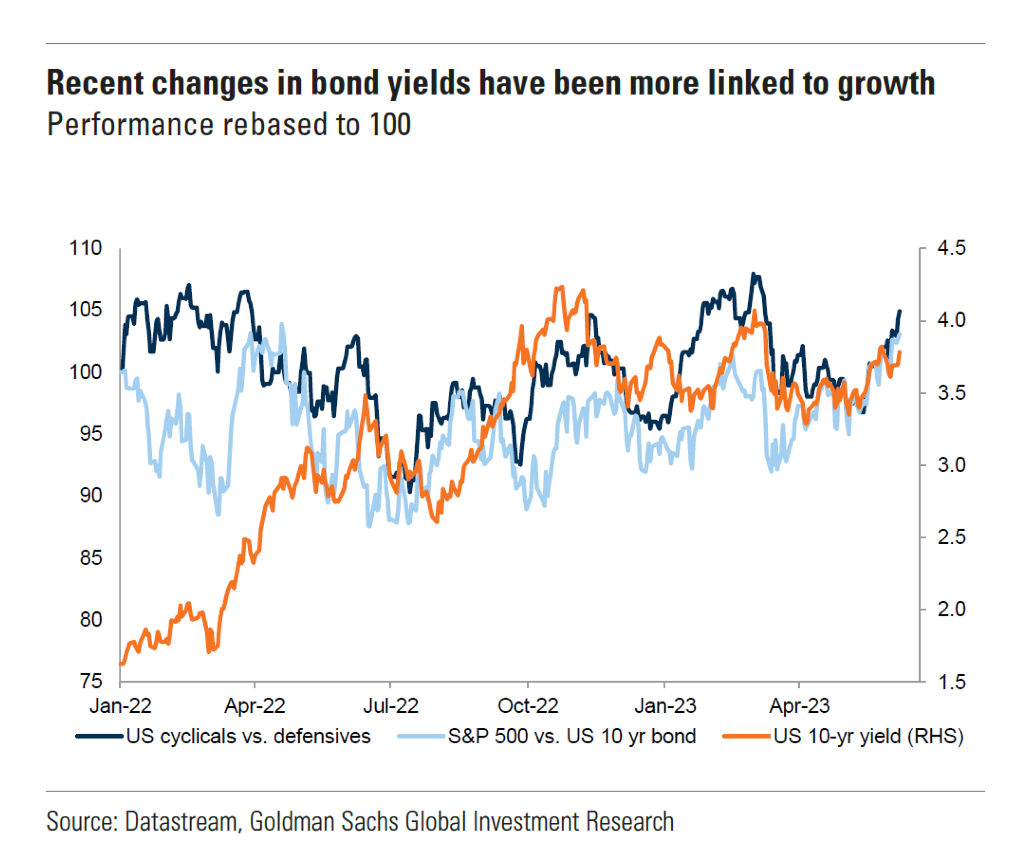

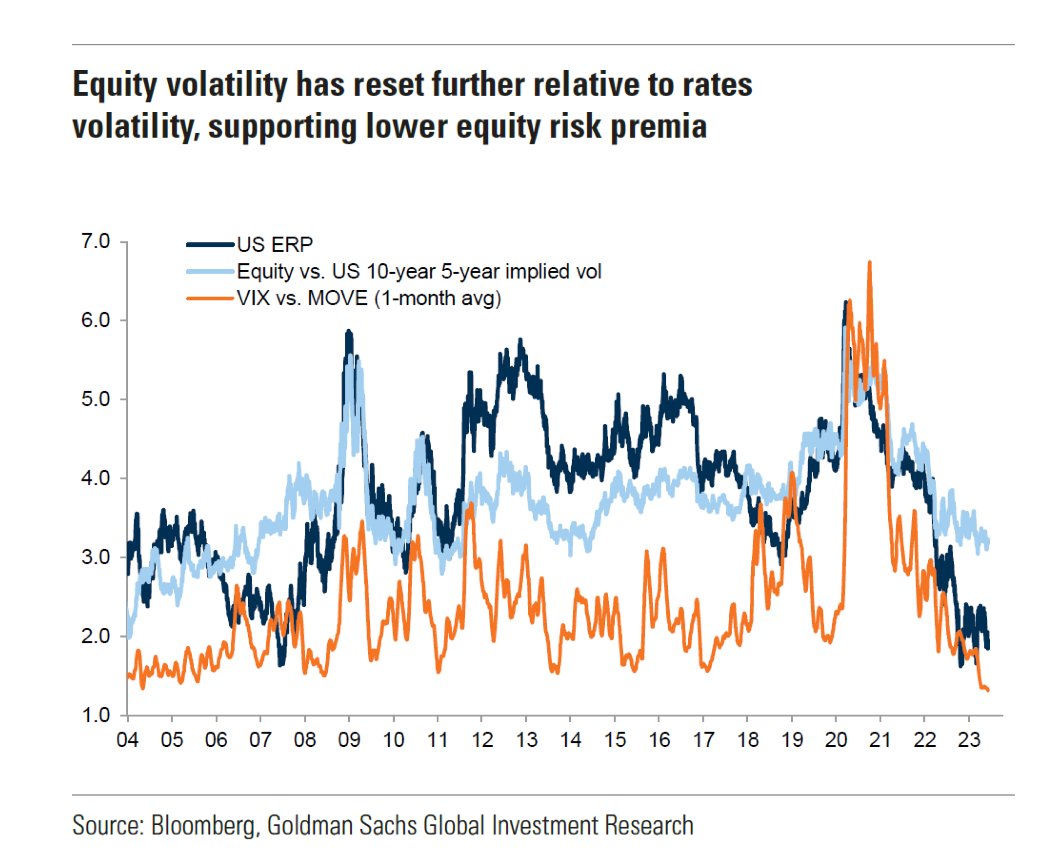

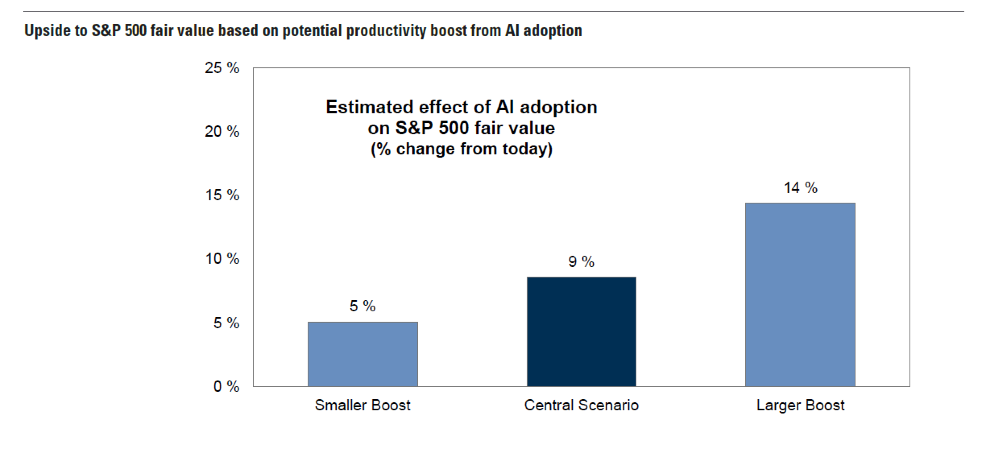

On June 6, Goldman Sachs (Goldman) attempted to quantify the potential impact of AI on companies and their stock prices. In our May 26 weekly, we shared our opinion that the sudden and abrupt large increase in NVDA’s revenues and profitability most likely changed the risk-reward analysis of certain individual stocks, as well as major U.S. stock averages. We therefore agree with Goldman that “the timing and ability of S&P 500 companies to generate incremental profits from AI is uncertain and therefore is unlikely to be fully priced by investors in the near term.” But we do believe that the probability of a better risk-reward scenario should make stocks a more enticing investment in general. Using various assumptions, Goldman calculated that widespread AI adoption could boost “productivity growth by 1.5 pp per year over a 10-year period.” We agree with Goldman as well that, all else being equal, widespread adoption of AI could lead to bigger earnings per share of the S&P 500 index and increase its fair value. But given the suddenness of NVDA’s change in fundamentals, we are not willing to quantify AI’s effects on stock valuations and changes in a company’s profitability. We suspect that there will be great variations on the “anticipated” effects of AI. In last week’s commentary, we also surmised that many AI-related stocks were now somewhat impervious to higher interest rates after the NVDA “effect.”

Source: Goldman Sachs Global Markets Daily: Equity Duration Relaxation – Less Drag from Higher Rates (Mueller-Glissmann/Mariotti) (6/8/2023)

Source: Goldman Sachs US Equity Views: US equities and Artificial Intelligence: Quantifying the potential impact on the S&P 500 Index (Hammond, Kostin, Snider, Conners, Calcagnini, Ma, Chavez) (6/6/2023)

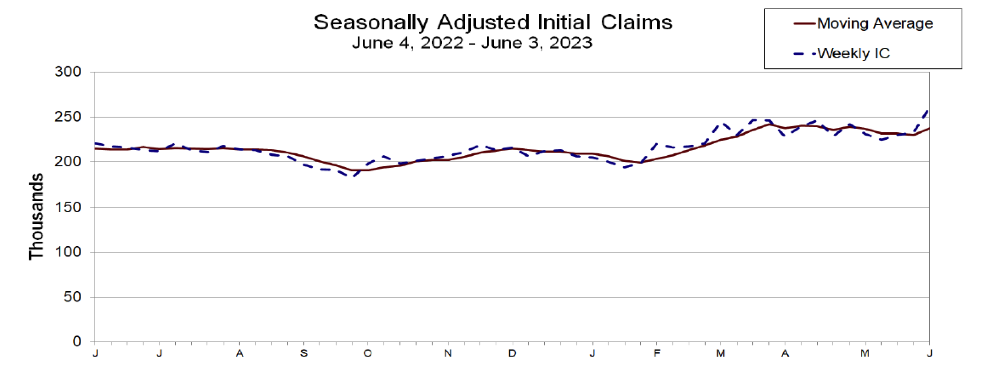

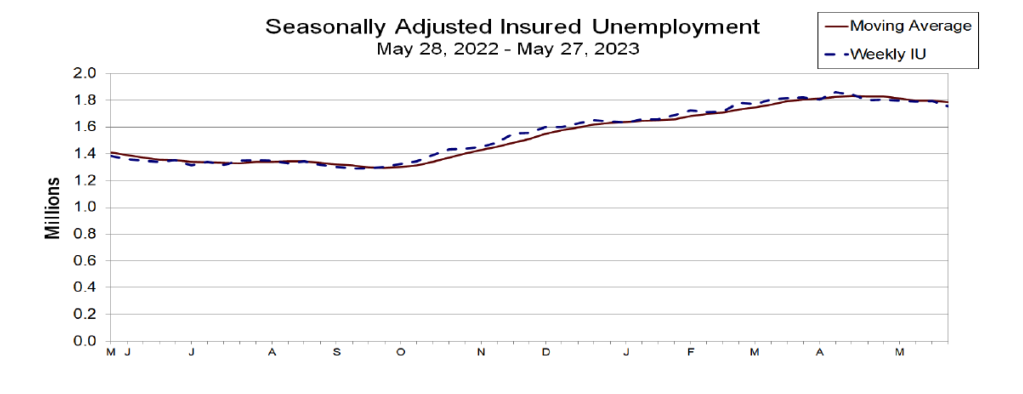

Initial Jobless Claims Increase Much More than Expected

Initial claims for U.S. unemployment insurance benefits for the week that ended June 3 increased to 261,000 which was 28,000 above the previous week’s slightly upwardly revised level and much higher than the expected 235,000 level. This latest level of initial claims was the highest since October 2021, and was the largest weekly increase since July 2021. This was also the third consecutive week of initial jobless claims increases. Continuing claims declined 37,000 to 1.757 million for the week that ended May 27, versus an expected 1.80 million. Taken at face value, the jump in initial claims indicates an acceleration of a softening labor market. But as we have learned many times since the onset of the pandemic, the economic data is very rarely “clear cut.” The initial claims data include a holiday, and sometimes holidays could lead to unpredictable seasonal adjustments. Initial claims on a non-seasonally adjusted basis rose only 11,000 to 219,000.

Source: News Release: Unemployment Insurance Weekly Clains (Department of Labor) (6/8/2023)

Wage Growth Slowing

According to Indeed Hiring Lab on June 7, “wage growth is slowing sharply in Indeed’s U.S. Job postings.” Indeed indicated wage growth in their job postings have been decelerating for over a year and could return to 2019 levels by early 2024. Advertised wages increased 5.3% year-over-year (y/y) in May, down from a peak of 9.3% y/y in January 2022. The slowdown in wage postings was broad based, but was particularly harsh for low wage earners, which previously had shown large increased wages. Software jobs also saw large decreases in wage levels.

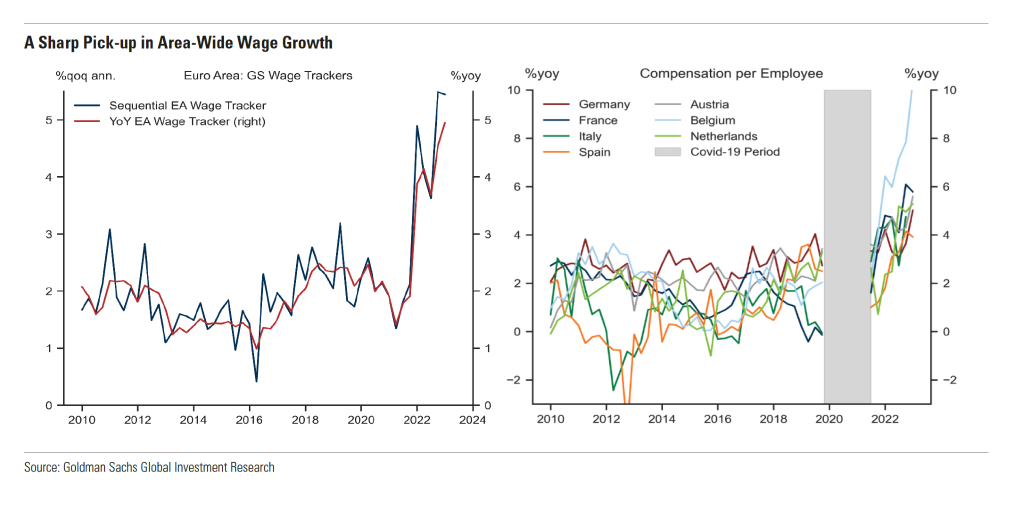

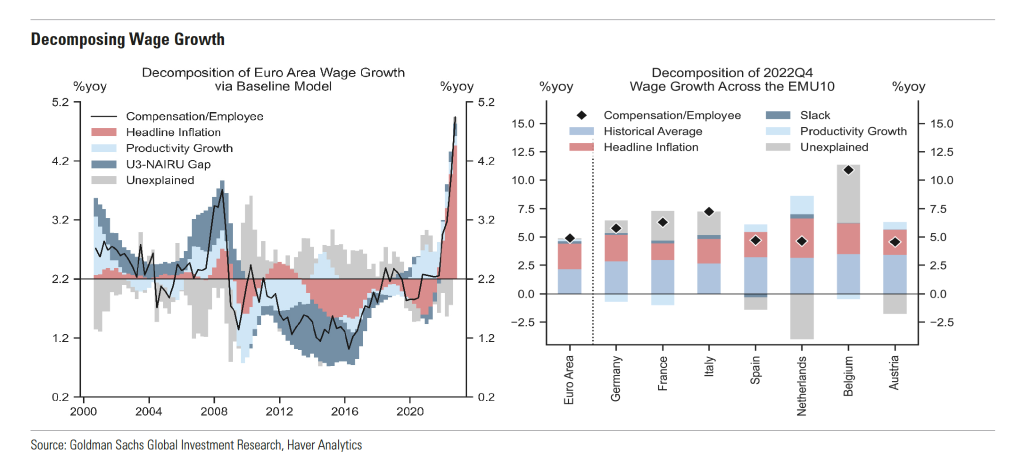

On June 7, Goldman found that “last year’s high headline inflation had played the key role in pushing up wage growth across the Euro area.” Labor market tightness also played a ”significant” role but with less of an impact. A number of Governing Council members of the European Central Bank (ECB) thought that much of Europe’s wage growth could be attributed to a “catch-up” with high headline inflation, while some other members ascribed wage growth mostly to labor market tightness. Wage growth due to

“catch-up” should fall rapidly along with a fall in headline inflation. The ECB released its latest survey (April) of consumer inflation expectations on Tuesday. We were encouraged to see inflation expectations fell to 4.1% for the next twelve months from a 5% expectation in the Mach survey. Similarly, three year ahead inflation expectations fell to 2.5% from 2.9%. More aggressive monetary policies seem to be needed in the U.S. and the UK, where high wage growth rates are aligned more closely with tight labor markets. On June 9, Goldman estimated that U.S. wage growth was running at a 4.3% annual rate in Q2 while that of Europe was still near its cycle high of 5% annualized in Q1.

Source: Goldman Sachs Global Views: Lower Risks, Higher Rates (Hatzius) (6/6/2023)

Source: Goldman Sachs European Economics Analyst: Euro Area Wage Growth – Catch-Up Trumps Overheating (Stehn/Scott) (6/7/2023)

Lower than Expected but Still Expanding ISM Services as Employment Fell into Contractionary Territory in May

The U.S. Institute for Supply Management (ISM) services index declined from 51.9 in April to 50.3 in May versus an expected increase to 52.2. The key components of this index were weak. Business activity declined -0.5 points to 51.5, the lowest level since May 2020 and new orders fell -3.2 points to 52.9, as both of these sub-indexes remained in expansionary territories. But the employment index fell -1.6 points to 49.2 into contractionary territory (under 50 is considered contractionary). The inflation news in this survey was more upbeat as the prices paid index declined by 3.4 points to 56.2. We viewed this report as supportive of a “cooling” U.S. labor market. The Fed and investors have been focusing recently on the U.S. services sector since the services sector appears to be the repository of the most stubborn and sticky U.S. inflation. We are hopeful that a contraction in employment could soon lead to a further weakening of U.S. wage growth that could help contain the most-stubborn inflationary pressures.

Reserve Bank of Australia (RBA) and Bank of Canada (BOC) Unexpectedly Hiked Key Interest Rates this Week

The central banks (CBs) of Australia and Canada surprised financial markets this week as they raised their key rates after previous pauses to their rate hiking cycles. RBA was the first surprise hike on Tuesday. BOC surprised on Wednesday and had an even more dramatic effect on raising many interest rates globally, including in the U.S. RBA indicated that more hikes might be forthcoming but that it would be data dependent. BOC also indicated that further rate hikes may be necessary as well. BOC declared that “monetary policy was not sufficiently restrictive to bring supply and demand into balance and return inflation sustainability to the 2% target.” BOC cited the “accumulation of evidence” that included stronger than expected Q1 output growth, an uptick in inflation and a rebound in housing activity. Typically, the Fed leads other major CBs in their monetary policies, but these two CBs have shown both the appropriateness of pausing and then resuming their rate hiking policies. They have helped to pave the way for the Fed to meet “consensus” expectations for a pause or a skip in June to be followed by a July hike in the federal funds rate.

Investors and Analysts “Anticipate” Economic and Financial Market Developments but Views Diverge

Three very well-known and prominent investors are anticipating a U.S. recession. Jeffrey Gundlach, Stanley Druckenmiller and Ray Dalio are all rather downbeat on the prospects for the U.S. economy. This week, Dalio stated that “things are going to get worse for the [U.S.] economy” as he foresaw a U.S. “balance sheet recession.” Dalio was concerned that there might be an insufficient number of buyers for the planned issuance of as much as $1.6 trillion of Treasury securities through the balance of 2023. We have expressed previously our concern that this massive issuance of Treasury securities might “drain” liquidity from the U.S. economy and financial markets. This week, Goldman took down their assessment of the probability of a U.S. recession over the next twelve months back to 25%. This was the probability assigned to a recession possibility prior to the regional banking crisis in March when Goldman increased that probability to 35%. The consensus probability of a U.S. recession appears to remain over 50%.

This week, the World Bank released its Global Economic Prospects report, which indicated that the greater than expected resilience of the global economy of early 2023 was projected to fade into a “more enduring weakness.” The World Bank increased its 2023 global GDP forecast to 2.1% from its January forecast of 1.7% and compared to a 3.1% 2022 growth rate. The growth rate for 2024 was cut to 2.4% from the previous 2.7% estimate, with risks tilted to the downside. The World Bank noted that the ”drag” from higher borrowing costs were becoming “increasingly apparent” and predicted that more “lagged” effects would surface as credit conditions became more restrictive. The Bank characterized the outlook for emerging markets and developing economies as “worrisome” and estimates that about one in four emerging economies has effectively lost access to bond markets due to restrictive credit conditions. We are of the opinion that attractive long term investment opportunities are available on a selective basis.

The Organization for Economic Cooperation and Development (OECD) also this week released its rather subdued global economic forecast for this year and next. It projects a 2.7% global growth for fiscal 2023 and 2.9% for fiscal 2024. These projected global growth rates are significantly lower than the seven year average growth rate of 3.4% that preceded COVID-19.

As can be seen from these various “anticipations,” a sluggish global economic growth environment seems to be the best-case scenario. Slower future economic growth is often projected as well as recession possibilities. Perhaps the advent and implementation of AI can enhance the global economic outlook. We remain hopeful on this possibility over the longer term.

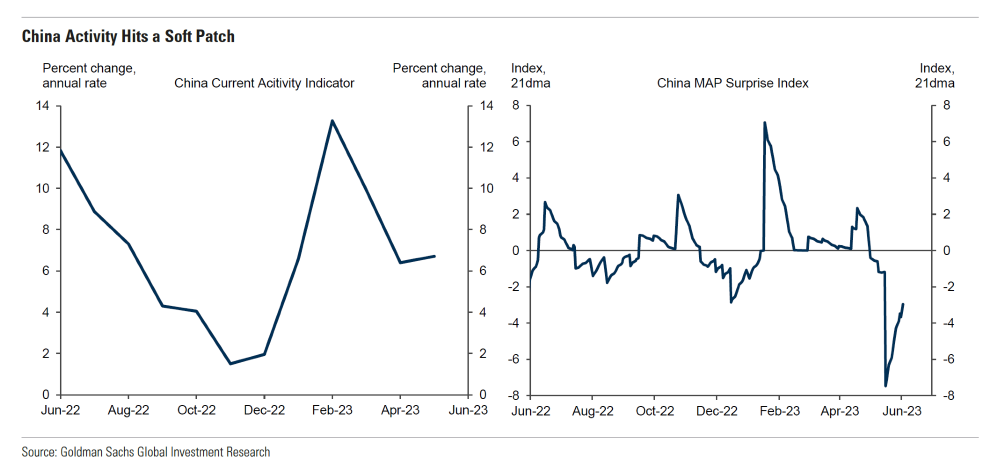

Disappointing China Economic Data Continues

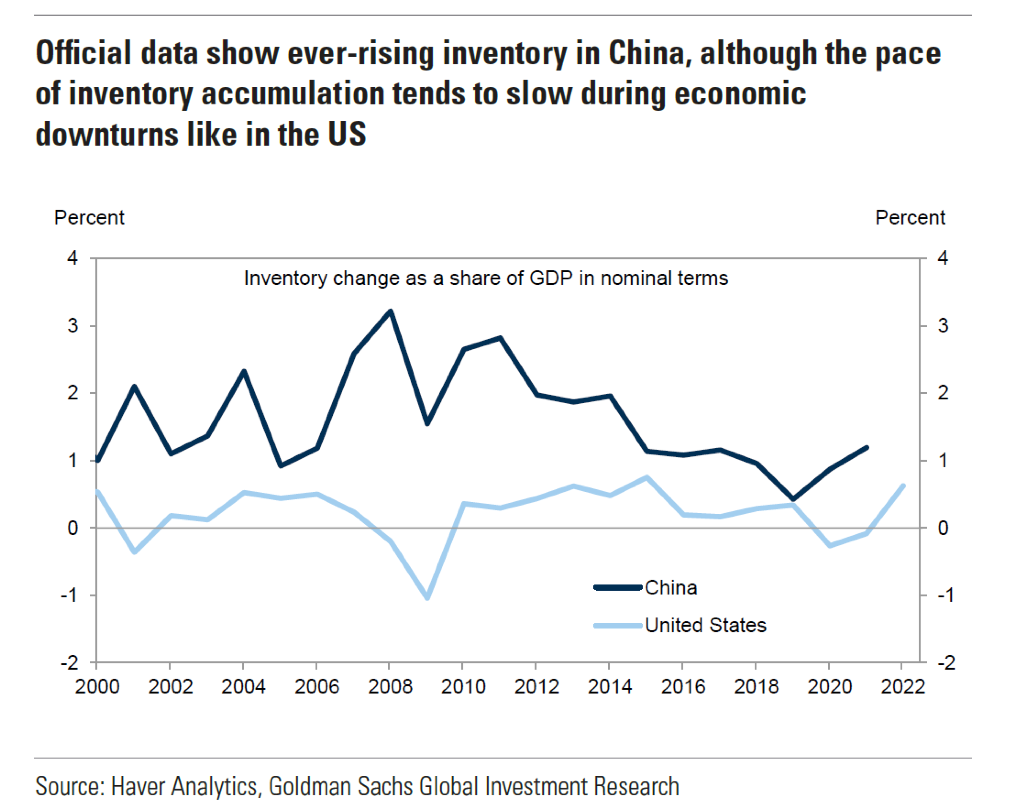

China’s May exports declined much more than expected. We view this as yet another sign of slowing global economic growth and demand. China’s May exports declined 7.5% year-over-year (y/y) versus an expected 0.4% decline and compared to an 8.5% y/y increase in April. On a seasonally adjusted basis May exports declined -10.9% m/m non-annualized in versus a m/m -5.4% decline in April. May imports declined -4.5% y/y, less than the expected -8.0% decline. Imports were only marginally lower, -0.1% seasonally adjusted non-annualized m/m in May versus a sequential -5.4% m/m decline in April. In last week’s commentary we noted that China’s Caixin manufacturing PMI exceeded expectations for May as it rose into expansionary territory. The Caixin survey is focused more on exporters. We surmise that Caixin’s strong manufacturing May PMI was probably replenishing inventories that were deleted due to April’s robust exports.

Unlike many countries, China is still struggling with deflationary pressures. Both of China’s May CPI and PPI declined sequentially. CPI declined -0.3% m/m and PPI was lower by -9.6% m/m. CPI was 0.2% higher y/y versus expectations of a 0.3% increase. PPI inflation declined 4.6% y/y in May versus an expected -4.3% decline and compared to a -3.6% y/y decline in April. The y/y PPI May decline was the steepest decline in seven years.

Source: Goldman Sachs Global Views: Lower Risks, Higher Rates (Hatzius) (6/6/2023)

Source: Goldman Sachs China Data Insights: Tracking China’s Inventory Cycle (Shan, Tilton, Wei, Wang, Chen, Yang) (6/7/2023)

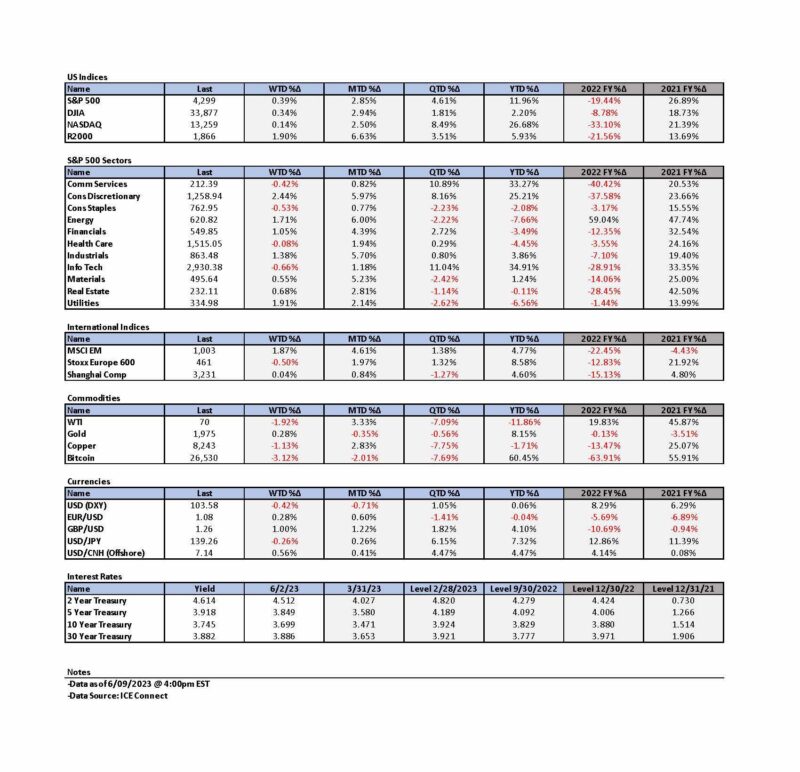

Sustainability of Recent Broader U.S. Equity Rally remains an Open Question

In last week’s commentary, we highlighted the dramatic broadening of the recent U.S. stock rally that was formerly typified by very narrow breadth. After trailing the S&P 500 (cap weighted) for four consecutive months, the Invesco S&P 500 Equal Weight ETF (RSP) has outperformed in June through Thursday. The info tech sector started to underperform last week and through Thursday was the weakest performing sector this week. We decided last week that we were inclined to give the benefit of the doubt to the sustainability of a broader U.S. stock rally. We are maintaining that inclination, but we admit that we are not completely convinced. We anticipate that the release next week of the latest CPI and PPI data for the U.S. and the Fed’s decision at its June 13-14 meeting will clarify and better identify the type of financial markets we are experiencing currently. CPI will be released on June 13 and PPI will be released on the morning of the Fed’s announcement of its decision. Through early Friday afternoon the two to 10-year-Treasury yield curve was further inverted this week as both the two-and 10-year Treasury yields were higher this week. The DXY USD index was lower this week and appeared to be range bound lately.

Bottom Line

For the time being we are maintaining our basic investment approach as expressed in last week’s commentary. We continue to prefer high quality stocks that offer good balance sheets, as well as relatively stable cash flows and profit margins. We prefer a global diversified portfolio for long term investors. We continue to stress that stock selectivity in this current environment is of paramount importance. We foresee continued financial market volatility.

We are optimistic that developments in AI will enhance labor force productivity and enhance the profitability of many companies as well. But there will also be losers. Over time, increased productivity could lead to containing inflationary pressures. The timing and extent of increased productivity will take time to discern. We “anticipate” that this process could be rather unpredictable and variable. We anticipate a non-linear function. The sudden and surprising improvements in NVDA’s fundamentals has convinced us that AI developments could remain very difficult to forecast. We are also convinced that the “anticipation” of AI developments will vary greatly across individuals and companies.

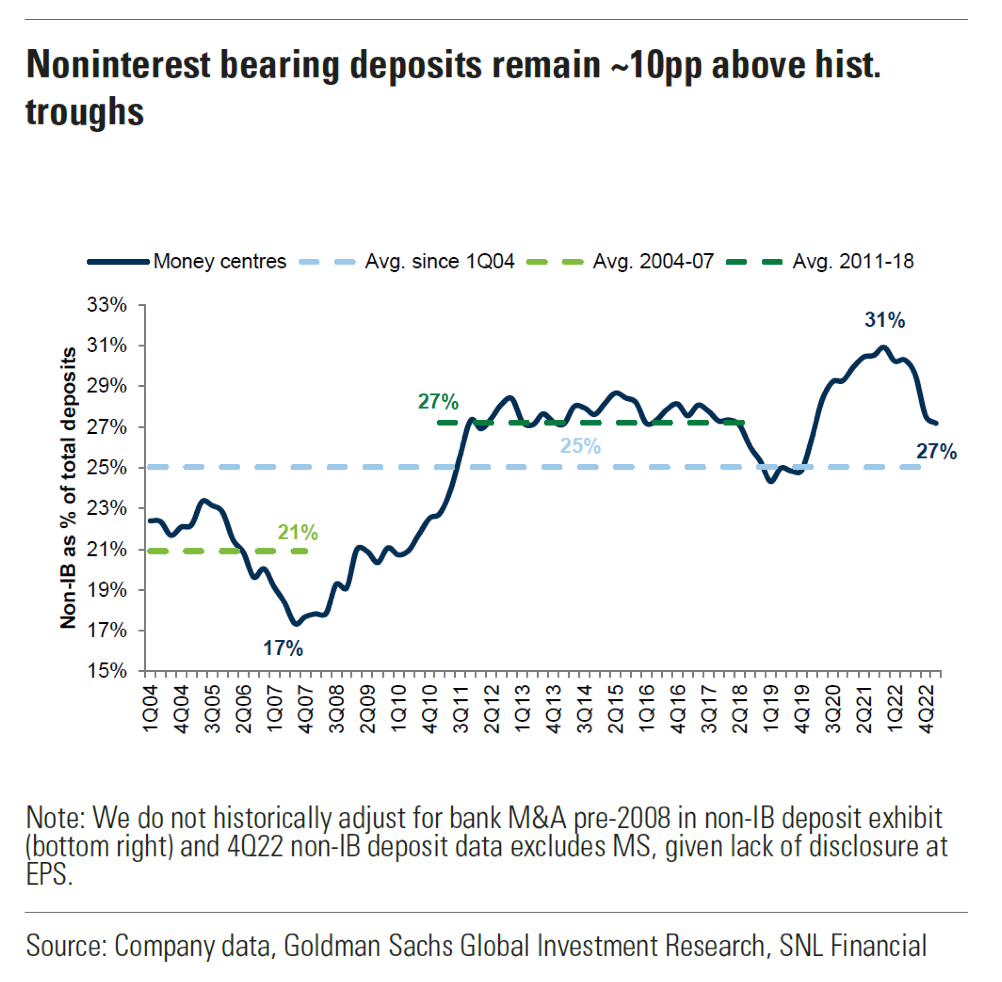

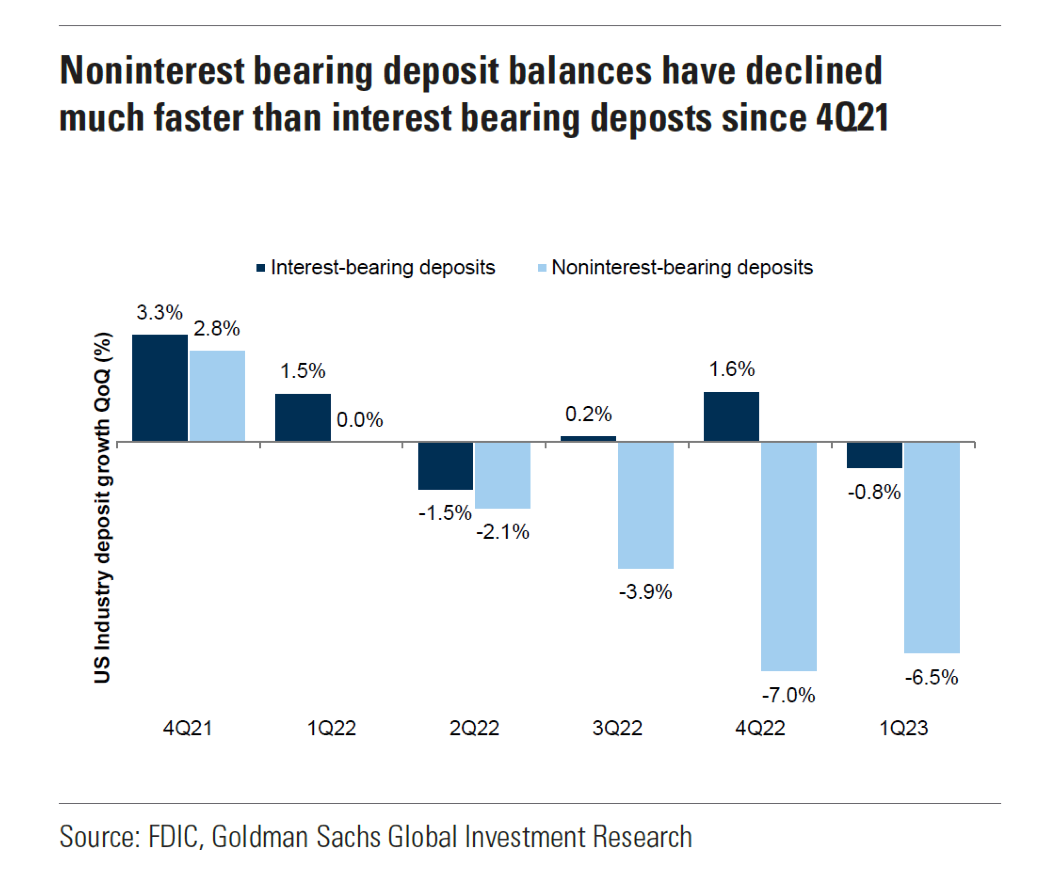

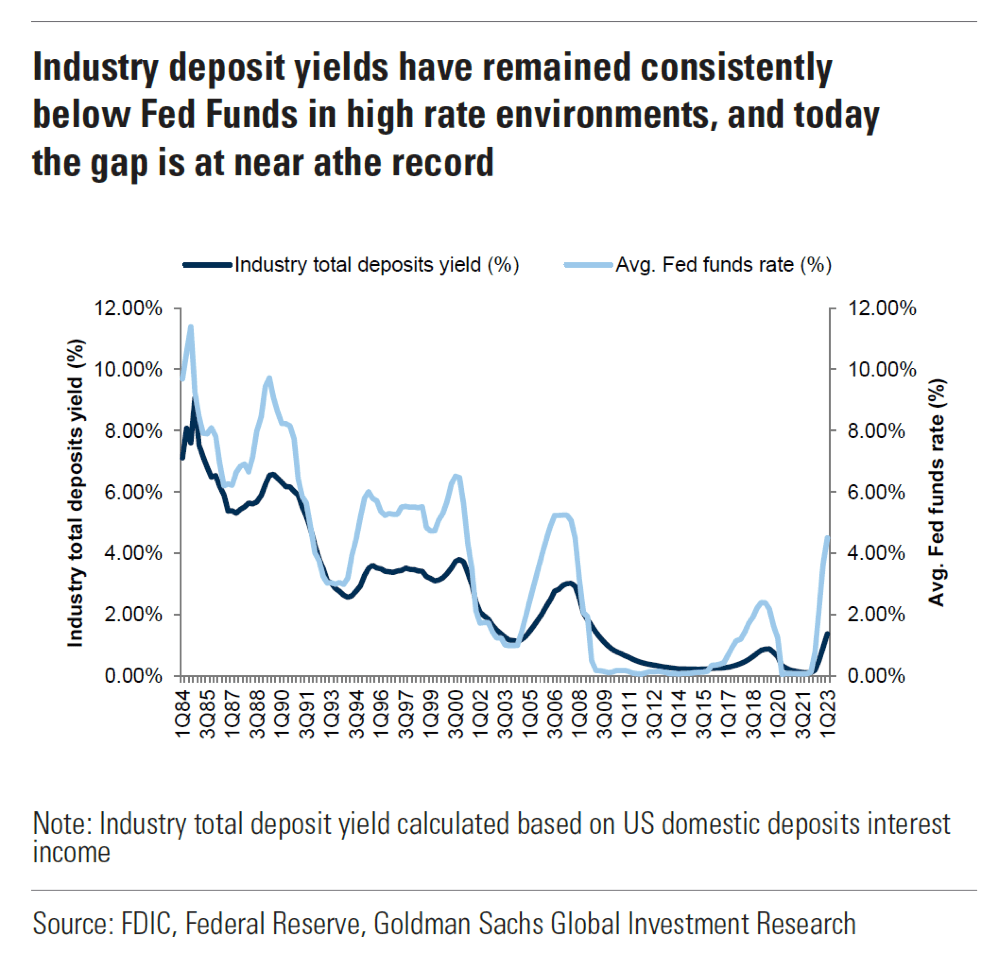

Source: Goldman Sachs Equity Research Americas Banks: Contextualizing earnings risk from rising fundings costs (Ramsden, Yaro, Jiang, Chhaya, Rai) (6/7/2023)

Definitions

Core Consumer Price Index (Core CPI) – Core inflation removes the CPI components that can exhibit large amounts of volatility from month to month, which can cause unwanted distortion to the headline figure. The most commonly removed factors are those relating to the costs of food and energy. Food prices can be affected by factors outside of those attributed to the economy, such as environmental shifts that cause issues in the growth of crops. Energy costs, such as oil production, can be affected by forces outside of traditional supply and demand, such as political dissent.

Core Producer Price Index (PPI) – The core producer price index (PPI), published by the Bureau of Labor Statistics (BLS), is a group of indexes that calculates and represents the average movement in selling prices from domestic production over time that excludes food and energy prices, which are the more volatile parts of inflation.

Russell 2000 – The term Russell 2000 Index refers to a stock market index that measures the performance of the 2,000 smaller companies. The Russell 2000 is managed by London’s FTSE Russell Group and is widely regarded as a bellwether of the U.S. economy because of its focus on smaller companies that focus on the U.S. market.

ISM Services PMI – The Institute of Supply Management (ISM) services PMI (formerly known as Non-Manufacturing Index) is an economic index based on surveys of more than 400 non-manufacturing (or services) firms’ purchasing and supply executives.

China Caixin Manufacturing Purchasing Managers Index – The Caixin PMI is a composite indicator designed to provide an overall view of activity in the manufacturing sector and acts as a leading indicator for the whole economy.

S&P 500 – The S&P 500 is a total return index that reflects both changes in the prices of stocks in the S&P 500 Index as well as the reinvestment of the dividend income from its underlying stocks.

Invesco S&P 500 equal weight ETF – The Invesco S&P 500® Equal Weight ETF (Fund) is based on the S&P 500® Equal Weight Index (Index). The Fund will invest at least 90% of its total assets in securities that comprise the Index. The Index equally weights the stocks in the S&P 500® Index.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/fast-answers/answersindiceshtm.html or http://www.nasdaq.com/reference/index-descriptions.aspx.

All data is subject to change without notice.

© 2024 NewEdge Capital Group, LLC