“People worry about the riskiness of stocks, but bonds can be just as risky.”- Peter Lynch

Summary

- Yields have risen to 15-year highs and may offer compelling opportunities for long-term investors. Investors must tread carefully when considering extending duration because interest rates may still climb, which could result in short-term bond price losses.

- If rates were to rise further, the losses on bonds could be cushioned by today’s higher coupon interest. When rates fall, the upside for long-maturity bonds could be substantial.

- Year-to-date losses in longer maturity bonds offer tax loss harvesting opportunities.

- Higher coupon fixed income, such as high-quality investment grade, intermediate and longer maturity municipals, private credit, Treasury Bills, and securitized credit, presents diversification in an uncertain interest rate environment.

In general, interest rates tend to “follow” what is happening in the economy. When growth is strong, interest rates often rise. Conversely, when there is a downturn, interest rates often decline.

The recent strength of the economy surprised many, and forecasts of a recession have been pushed out to later next year, supporting the Federal Reserve’s assertions that it intends to hold interest rates higher for a longer period.

In addition to stronger growth pushing yields higher, the US Treasury is currently issuing more debt, with a meaningful uptick in long-maturity debt issuance, in order to fund swelling budget deficits. Demand for this increased debt issuance has been dented, though, with the Federal Reserve still shrinking its balance sheet through Quantitative Tightening (compare this to 2020 when higher deficit spending and debt issuance were absorbed by the Fed’s bond-buying through Quantitative Easing), changes to global central bank policy reducing foreign demand, and resilient economic data keeping “flight to safety” positioning muted.

Whatever the reason is for interest rates to rise, investors have had to accept that bonds have been riskier than they were in recent history, as unprecedented intervention and economic disruptions in the pandemic era have been followed by unprecedented repricing of yields.

Yields are now much higher than they were two years ago, before the start of this post-pandemic “normalization” process, making the risk-reward for long-term investors to own long-term debt more balanced than it has been.

Importantly, yields may still climb because inflation is not cooling enough, and the budget deficit requires more long-maturity bond issuance. All of 2023, there has been a growing investor consensus, however, that believed that yields have peaked.

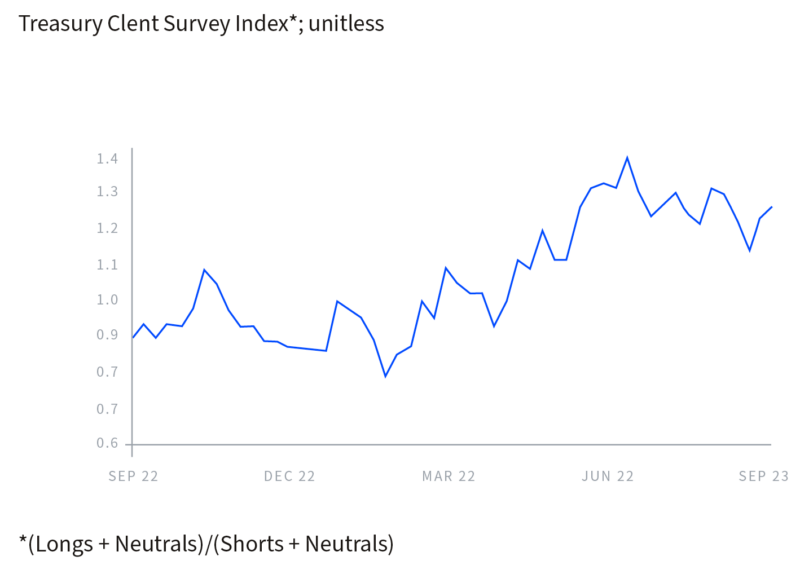

The JP Morgan Client Treasury Survey from September 29 shows that the ratio of investors who are long US Treasuries (expecting rates to fall) relative to those who are short (expecting rates to rise) has climbed in 2023, despite the march higher in yields. The rise in the ratio indicates that most survey respondents believe that rates have likely reached a top and, therefore, are in favor of buying long-maturity US Treasuries to extend the duration of their portfolios (Figure 1).

Figure 1: JP Morgan Treasury Survey

This survey shows that consensus calls for a top in rates in 2023 have been premature: however, given the sharp jump higher in just the past two weeks, we are now reaching levels of yields that have the potential to provide a better risk-reward for long-term investors.

This may not be the peak in yields (we do see potential for yields to press higher), meaning there is still meaningful risk in the short-term in extending duration and buying long-term bonds.

However, as we will show below, the risk/reward is becoming more balanced for investors who can tolerate short-term losses in order to “lock in” elevated long-term yields at levels not seen in a decade and a half.

Total Return and Tax Loss Harvesting

Current levels of interest rates offer scope for positive returns in both rising and falling rate scenarios.

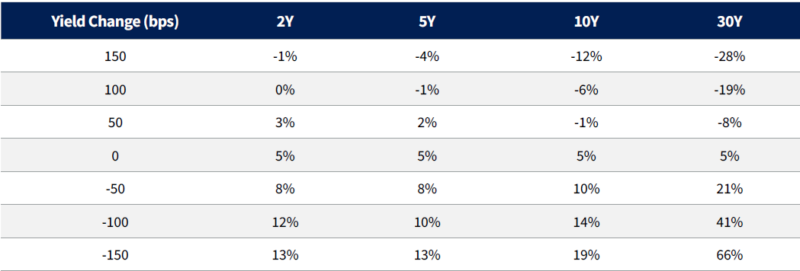

If yields were to rise another 50 to 100 basis points, the total return of shorter maturities bonds could be moderately positive. Short term bonds’ duration is shorter (duration is the sensitivity of a bond’s price to a change in yields, with shorter duration bonds seeing a smaller drop in price than long duration bonds given the same change in yields). Further, the coupon interest for short duration bonds is higher, which limits the fall in price and market value. Short duration bonds do have “rollover” risk, however, meaning as the bonds mature over a shorter time frame, there is risk that proceeds will be deployed at lower yields in the future.

Conversely, a 50-basis point decline in yields could deliver high returns for 10Y and 30Y bonds. Their duration is longer, and with coupon interest over 5%, the total return potential could be substantial.

We show these calculations in the table below but note these are not guaranteed returns.

Figure 2: Total Return of Bonds by Maturity in Rising and Falling Interest Rates Scenarios

Based on the total return distribution in Figure 2, there are several tax-loss harvesting strategies to consider.

In fixed-income, tax-loss harvesting involves selling bonds to realize capital losses and offset capital gains. The strategy can be applied to both taxable and tax-exempt bonds.

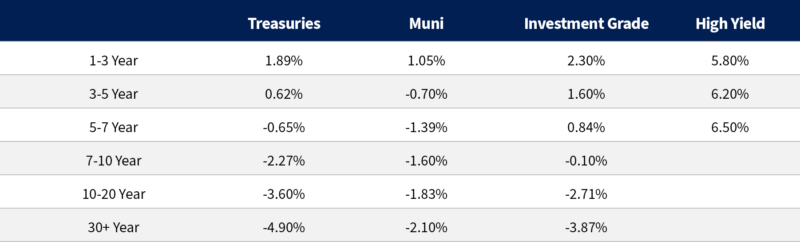

So far this year, the losses have been in the 10+ year segment of the Treasury, Muni, and Investment Grade, whereas gains are in the shorter maturities (Figure 3).

Investors could offset gains in T-bills and short maturity Munis and High Yield by harvesting losses in 3 to 10-year maturity Treasuries and Investment Grade.

Figure 3: Year to Date Bond Index Total Return (%)

Risks

Investors, however, should be mindful of long-maturity Treasuries and corporate bonds that are still not trading at an adequate risk-reward profile.

As Figure 3 demonstrates, even with investor expectations of rates peaking, long-maturity bonds have generated significant negative returns year to date, highlighting the risks of “being early” to call this peak in yields.

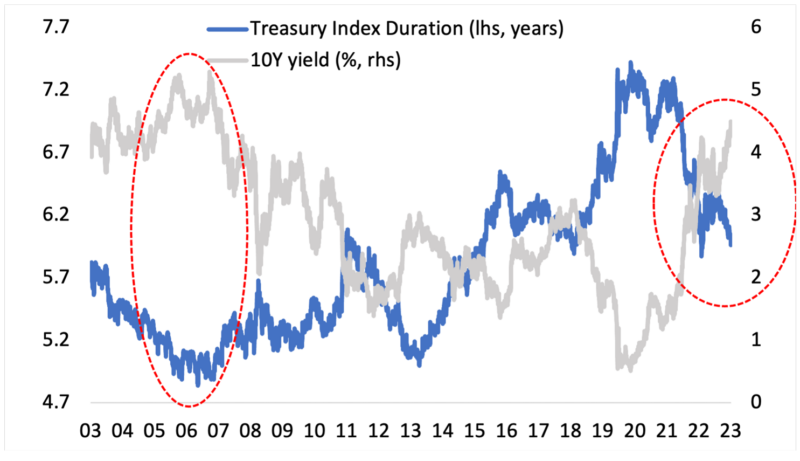

Even though interest rates have risen by 500 basis points on the short end and are close to 2007 levels, the duration of bond indices remains above their levels preceding the Great Financial Crisis. The main reason for this is a decade of low to zero rates that caused the duration of bond indices to extend to historic highs.

The interest duration factor continues to flag that longer-maturity bonds may not have high enough yields to compensate for the duration risk. As such, investors must consider ways to diversify duration when purchasing longer-maturity bonds. In the section at the end of this piece, we talk about our risk-controlled methodology to diversify duration.

Figure 4: Higher Yield but Also Higher Duration

Conclusion

Yields have risen to highs not seen since 2007. But the stakes are also higher because it is unclear how high rates may have to rise to tackle inflation. There is political uncertainty overhanging the fiscal deficit, while the rise in energy prices and labor unions wage negotiations can add further pressure to inflation.

Despite these uncertainties, yields are, on average, 2% to 4% higher than in the previous decade, providing a level of interest income that could be attractive to long-term investors.

In a rising rate environment, coupon interest can offer a cushion against capital losses. The total return of short-maturity bonds could be positive, provided no unexpected shocks or events, and overweighting these securities creates a ballast in portfolios against interest volatility.

Higher coupon fixed income, such as high-quality investment grade, intermediate and longer maturity municipals, private credit, Treasury Bills, and securitized credit, offer diversification in an uncertain interest rate environment.

On the other hand, there are opportunities for long-maturity Treasuries. A continued moderation in core inflation and/or a cooling in economic activity could put downward pressure on bond yields (this downside move may be rapid, given how rapid the rise in yields has been). Monitoring political uncertainty and the fiscal outlook will be an important factor in considering the incremental supply of Treasuries, with greater fiscal deficit needs potentially spurring higher yields. While timing the peak in interest rates is a complex form of art, for investors, there is a simple principle: follow the economy.

The prospects for longer-maturity bonds have improved in terms of reinvestment, coupon, and price return, but investors must stay aware of the risks.

Diversifying Duration

To successfully manage the duration of a bond portfolio in the current macro environment, we view it as essential to follow a risk-control discipline. Not all bonds are the same, which requires strategies for diversification of portfolio duration.

In our investment framework, we choose the following set of risk factors and parameters to identify opportunities and risks in fixed income and to diversify duration and optimize the coupon interest:

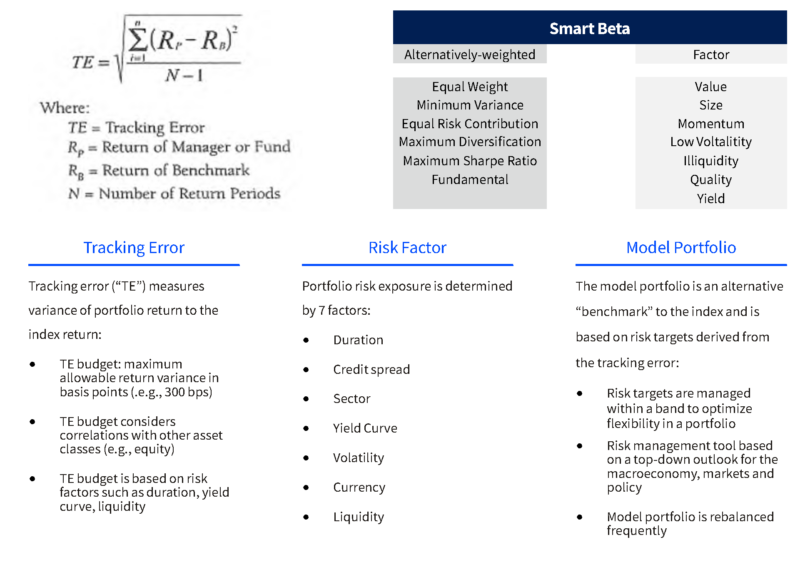

- We follow a “tracking error” model. The tracking error measures the variance of the portfolio return to the index return. We establish a tracking error budget, which allows for maximum volatility of the portfolio. The budget quantifies how much additional risk the portfolio can take.

- We track risk factors in a similar fashion as “smart beta” for stocks. We identify the drifts in risk factors like the yield curve, spread duration, volatility, liquidity, currency, and sectors to determine portfolio weightings and exposure across fixed income.

- We run a model portfolio with risk targets that are determined by the tracking error risk budget and our Investment Committee’s top-down macro analysis.

These three pillars determine how we position across the fixed-income universe, including in tax-free and taxable municipal bonds. We believe following the risk-control approach allows for a diversified duration of the portfolio and provides flexibility to invest across any fixed-income asset class, irrespective of duration.

In our opinion, without the framework, investors would have less visibility into what is driving the duration risk of the portfolio. As such, we implement the framework by analyzing the change in the risk factors to determine the composition of the duration of the portfolio. The shifts in individual factors such as credit, yield curve, and specific sectors allow us to make tactical changes in duration and to stay disciplined with the risk budget. The portfolio ends up with an appropriate diversification of duration, which provides a stable yield and the potential for more sustainable performance.

Figure 5: Risk Control Framework

IMPORTANT DISCLOSURES

Abbreviations/Definitions: Quantitative Easing refers to the Fed buying assets to lower longer-term interest rates. Quantitative Tightening means the Fed is selling assets to put upward pressure on longer-term rates. Tracking error determines the difference between the return fluctuations of an investment portfolio and the return fluctuations of a chosen benchmark.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

The Bloomberg US Treasury Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury. Treasury bills are excluded by the maturity constraint but are part of a separate Short Treasury Index. STRIPS are excluded from the index because their inclusion would result in double-counting. The Bloomberg Municipal Index measures the performance of the Bloomberg U.S. Municipal bond market, which covers the USD- denominated Long-Term tax-exempt bond market with four main sectors: state and local general obligation bonds, revenue bonds, insured bonds, and pre-refunded bonds. The Bloomberg US Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and non-US industrial, utility, and financial issuers. The Bloomberg U.S. Corporate High Yield Index measures the performance of USD-denominated, non-investment grade, fixed rate, taxable corporate bonds, including corporate bonds, fixed-rate bullet, putable, and callable bonds, SEC Rule 144A securities, Original issue zeroes, Pay-in-kind (PIK) bonds, Fixed-rate and fixed-to-floating capital securities.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Fixed income risks include interest-rate, credit risk, income risk, index sampling risk and liquidity risk. Typically, when interest rates rise, there is a corresponding decline in bond values. Credit risk refers to the possibility that the bond issuer will be able to make principal and interest payments. Income risk refers to the chance that the portfolio’s income will decline because of falling interest rates. Index sampling risk refers to the chance that the securities selected for a portfolio, in the aggregate, will not provide investment performance matching that of the index. Liquidity risk refers to the chance that a portfolio may not be able to sell a security in a timely manner at a desired price.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/fast-answers/answersindiceshtm.html.

All data is subject to change without notice.

© 2023 NewEdge Wealth, LLC