Weekly Summary: April 4 – April 8, 2022

Key Observations:

- The Federal Reserve (Fed) minutes of its March 15-16 meeting (meeting) confirm our opinion that the Fed will not ”back down” from its very aggressive monetary policy tightening stance. Given the “necessity” of reining in inflation, we believe that this attitude is desirable.

- Most of the individuals and their constituents connected to the Russia-Ukraine war (war) are also “gonna stand their ground.” We don’t view this as very desirable, since we must have at least a limited amount of compromise to reach an agreement to end this terrible war.

- According to the minutes, the participants at the meeting “judged” that the Fed should implement its tighter monetary policies “expeditiously.” We agree.

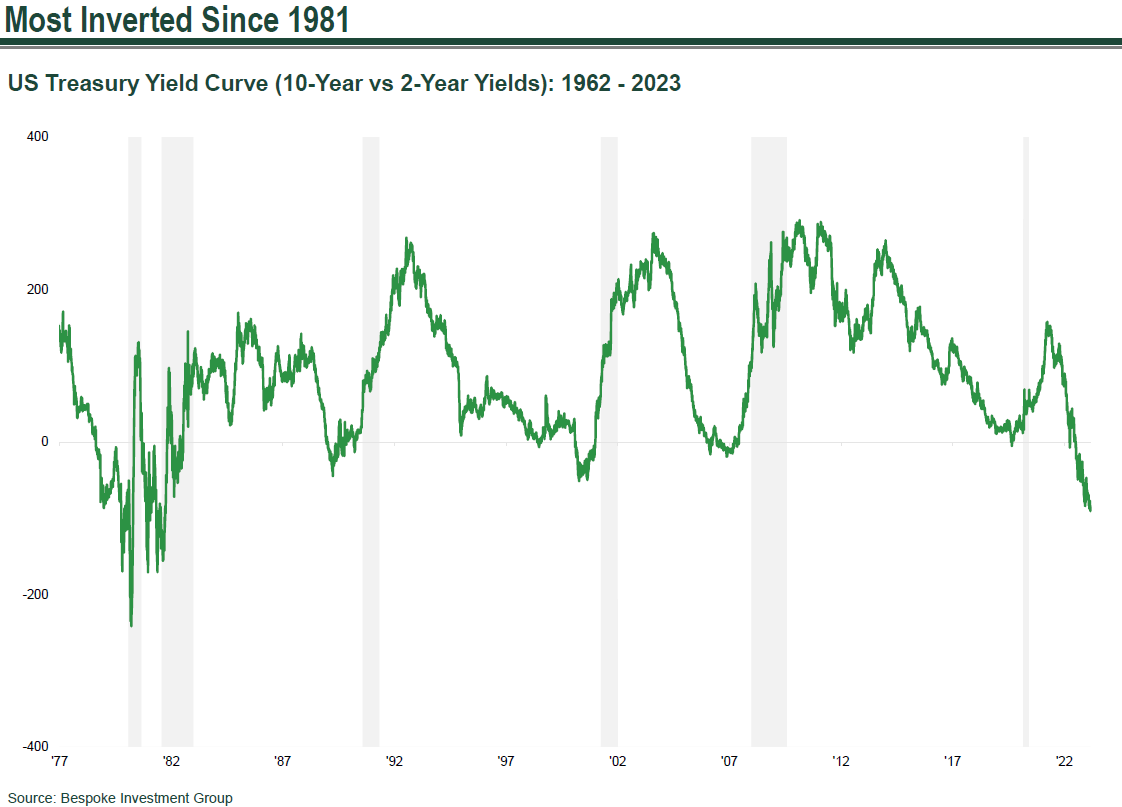

- Decreasing liquidity in many financial markets alongside extreme “positioning” by traders and/or investors could exacerbate volatility. We postulate that this might account for the re-steepening of the two-year, 10-year Treasury yield curve this week.

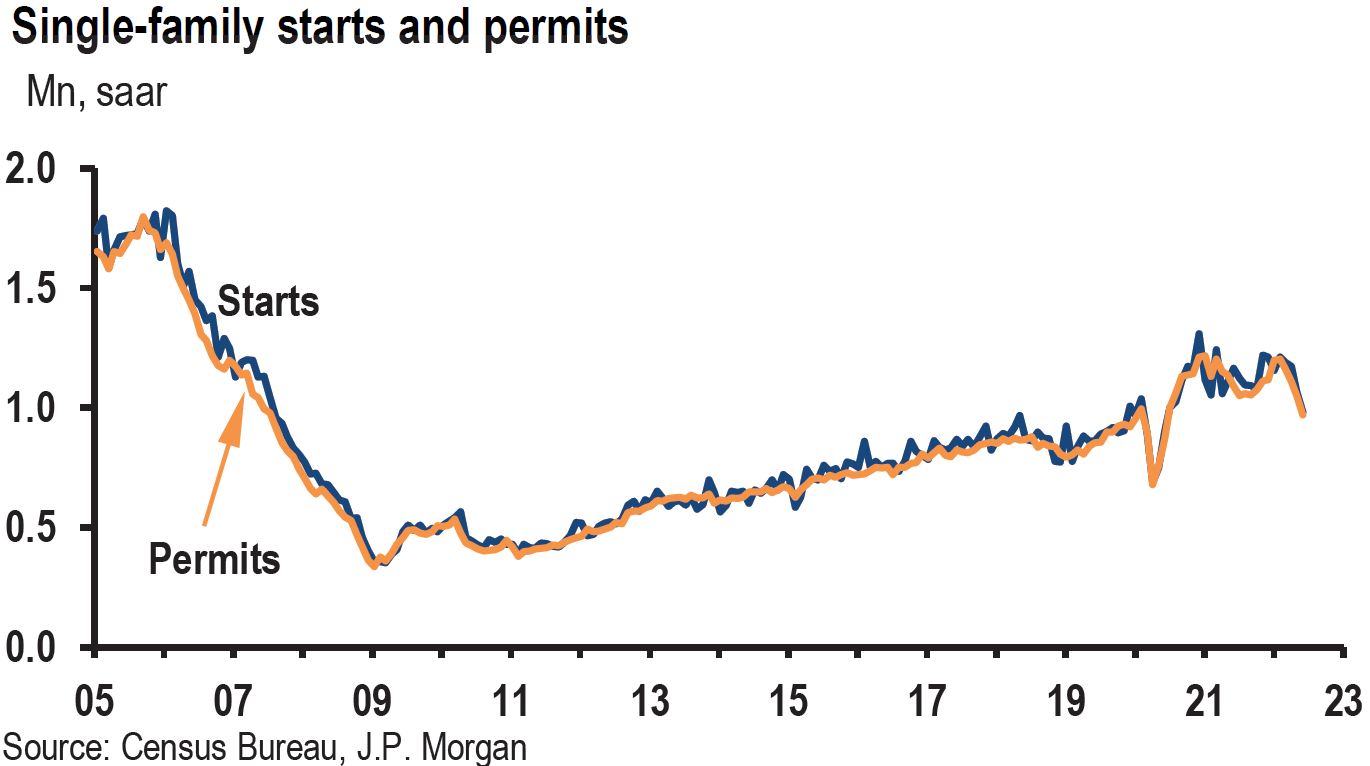

The Upshot: Our general approach remains the same. Many long-term investors could strive to maintain a diversified portfolio of high quality stocks of companies that have strong balance sheets, somewhat predictable cash flows and an ability to maintain strong profit margins. Additionally, these portfolios could include at least some exposure to commodities. As part of our recommended “barbell” approach going into 2022, we expressed our opinion that, on a very selective basis, health care stocks was one of our favored sectors for 2022. Mid-March, we thought that it could be the time to take a more favorable view of the health care sector in general. Through Thursday, health care was the best performing sector of the week. We now foresee that health care could remain a favored sector in a barbell equity strategy for the remainder of 2022. But given the great amount of uncertainty surrounding the war, inflation and slowing economic growth, we still favor a very diversified portfolio. We will continue to monitor many economic factors. We view the steep rise in U.S. 30-year fixed mortgages as significant for the U.S. housing market. This rate rose to cross above 5% (5.02%) this week for the first time in a while. Except for a couple of days in 2018, it was the first time that this rate broke above the 5% level since 2011, and it had not remained consistently above 5% since 2009. We regard a strong housing market as critical to continue a robust U.S. economy. The upcoming ”earnings season” that begins next week with a few major U.S. banks reporting their Q1 results could be determinative for stocks and interest rates, at least in the short term. We suppose that analysts and investors will focus in particular on profit margins. As always, management’s ”guidance” on future results could be the dominant driver of stock prices. We predict a volatile market to continue. Furthermore, we contemplate many instances of lowered guidance on earnings, revenues and/or margins.

Source: J.P. Morgan, Home Price Monitor (4/5/22)\

Fed “Won’t Back Down”

The attitude in Tom Petty’s song “I Won’t Back Down” seems to be applicable to many contexts recently. This attitude was prominently displayed this week by statements of Fed Governor and vice chair Lael Brainard, other Fed officials and by the minutes of the Fed’s March 15-16 meeting released mid-week. Many of the lyrics of this week’s song could have been written for the Fed’s current and very aggressive monetary tightening pronouncements: “Well, I won’t back down; Gonna stand my ground; …there ain’t no easy way out; Well, I know what’s right.” We viewed more clarity of the Fed’s stance and intentions as a “stabilizing” force for financial markets, even as the actual implementation of these clearly stated policies could further destabilize markets. Our view is that it is always better to know what is coming most likely. We also agree with the Fed’s aggressive tightening monetary policies as necessary to rein in very elevated rates of inflation.

Source: Goldman Sachs, GOAL Post: Recession obsession and chasing your tail risk (4/8/22)

Others not “Backing Down” More Problematic

But unfortunately, this same attitude appears to be taking hold on both sides of the Russia-Ukraine war. Although apparently retreating from Kyiv, we really don’t know what Russia’s next move or ultimate intentions could be at this point. We do not foresee Russia’s president Putin “backing down.” Ukraine’s president Zelensky also appears to be following along similar lines. J.P. Morgan (JPM) observed on April 4 that after weekend updates which further illustrated Putin’s potential “war crimes,” Zelensky indicated that it was tougher to do a deal with Putin given this type of information. The U.S., NATO and their allies were increasingly ready to “stand their ground” as they continued to add new sanctions against Russia. A “compromise” and agreement to end the war could be approaching an almost “illusory” status. We view this status as unsustainable. China’s “zero-COVID-19” policy, whereby lockdowns of selected areas of China have become the principal solution to contain coronavirus infections wherever they appear, is yet another example of the adoption of a policy where the government “knows what’s right.” Our opinion is that none of these situations is sustainable.

Same Attitude but “Unfavorable” Outcomes More Likely

We believe that the Fed will maintain its resolve, which we characterize as desirable given the need to rein in inflation and quell expectations for increasing inflation. We understand that as long as a “won’t back down” attitude prevails in the other situations depicted above, instability and uncertainty could continue to increase. We contemplate that global inflation could be higher and economic growth slower to the extent that the war persists and to the extent China continues to implement lockdowns. Such policies inevitably cause more supply disruptions and less demand for goods and services. The success of the Fed’s policies becomes correspondingly more problematic.

Brainard Comments Precipitate Decline in U.S. Equities

U.S. equities began the week on a positive trajectory until Brainard’s comments on Tuesday morning. Equities reacted to Brainard’s comments by trading lower and interest rates rose. The financial markets acted like her statements were a big “surprise.” One commentator’s hyperbole even went so far as to describe her statements as the “Brainard bomb.” Our assessment of Brainard’s statements was that there was nothing “new” compared to what Fed chair Powell had indicated previously. But the market treated her comments as incrementally hawkish since she is considered generally as a dove. We considered her statements as further preparation for financial markets before the Fed minutes were to be released the next day. On April 4, Reuters quoted Brainard during her appearance that day at a Minneapolis Fed conference: “I think we can all absolutely agree inflation is too high and bringing inflation down is of paramount importance.” She went on to focus on how the Fed would handle the “run-off” of its nearly $9 trillion balance sheet. The financial markets were perhaps awaiting most anxiously for the details of this policy change in the minutes after Powell had alerted the markets that this explanation would be included in the minutes. We thought that Brainard’s depiction was exactly on point: “Given that the recovery has been considerably stronger and faster than in the previous cycle, I expect the balance sheet to shrink considerably faster than in the previous recovery, with significantly larger caps and a much shorter period to phase in the maximum caps compared with 2017-19.”

Crude Oil Prices, Equities and Interest Rates

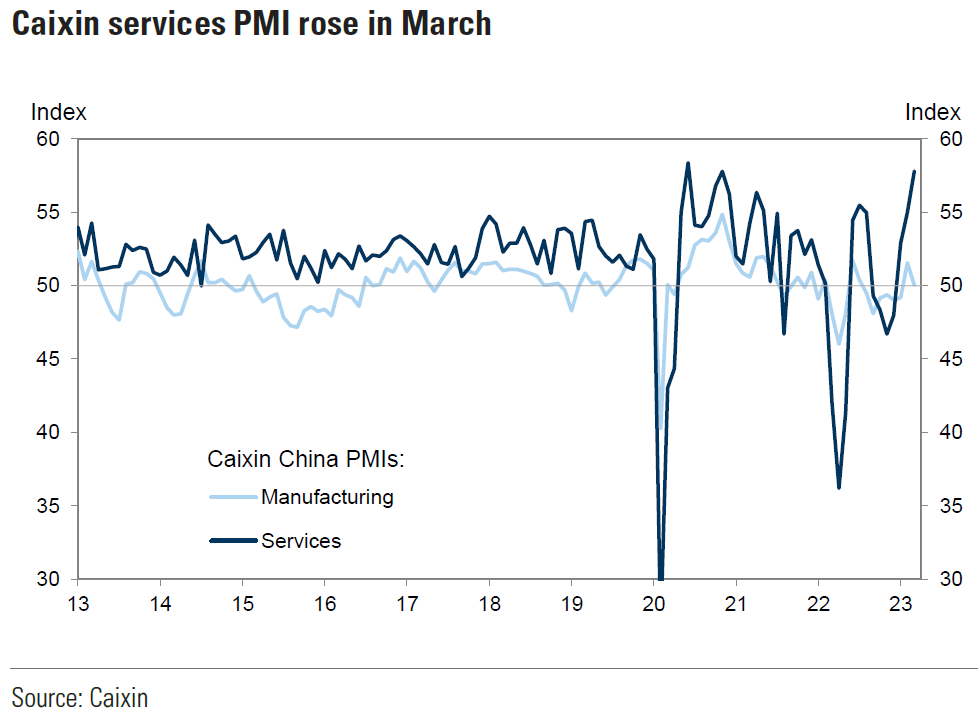

The release of the Fed’s minutes mid-week did not materially change the downward trajectory of U.S. equities on the release day. Interest rates also continued their ascent. We thought that these market moves were particularly noteworthy given that crude oil prices decreased more than 4% that day. During the past month, the typical financial market reaction to when crude oil prices decline by any material amount is for equities to appreciate and for interest rates to decline. We suspect that these oil price declines were due in part to the disclosure reported by Bloomberg on April 6 that the member countries of the International Energy Agency would “deploy 60 million barrels of oil from their emergency stockpiles.” We also deem the very significant March declines of China’s services PMIs – released that same day by the Chinese company Caixin – as another very important contributor to that oil price decline. Caixin conducts a private survey of companies in China that tend to be smaller than average and more coastal. Just the prior week, China’s National Bureau of Statistics (NBS) released the official services PMI survey which focuses on China’s largest companies, including those that are state-owned. The results of the NBS survey also showed a contraction in China’s services industries in March, but to a much lesser extent than the Caixin survey. We presume that these slowdowns in China’s economy were precipitated by China’s lockdowns – especially those related to Shanghai and its approximately 26 million inhabitants. The financial markets inevitably assume that any significant slowdown in China’s economy will translate into less demand for commodities, including oil.

Source: Goldman Sachs, Americas Transportation: The Monthly Mosaic March 2022 (4/6/22)

Our Conclusions Based on Minutes of Fed March Meeting

After reading the Fed minutes we assume that the Fed will hike the federal funds rate by 50 bps at each of its May and June meetings. We assume at least 25 bps hikes at its subsequent four meetings this year. Quoting from the minutes: “Participants judged that it would be appropriate to move the stance of monetary policy toward a neutral posture expeditiously,” i.e. very quickly. We translate this statement to mean front-loading tighter monetary with 50 bps hikes for at least the next two Fed meetings. We also foresee the Fed announcing and implementing the runoff of its balance sheet at its May meeting as well. According to the minutes, the participants at the March Federal Open Market Committee (FOMC) meeting “generally agreed that monthly caps of about $60 billion for Treasury securities and about $35 billion for MBS [mortgage-backed securities] would likely be appropriate. Participants also generally agreed that the caps could be phased in over a period of three months or modestly longer if market conditions warrant.” The runoff would be achieved by letting Treasury securities mature without reinvesting the proceeds. The same would apply for MBS, except that once the balance sheet runoff was “well underway” their sale would be considered so that the Fed’s balance sheet would be eventually comprised primarily of Treasury securities. The Fed pledged to make MBS sales only if they were first announced “well in advance.”

Possible Fed Concerns about Economy – Secondary for Now

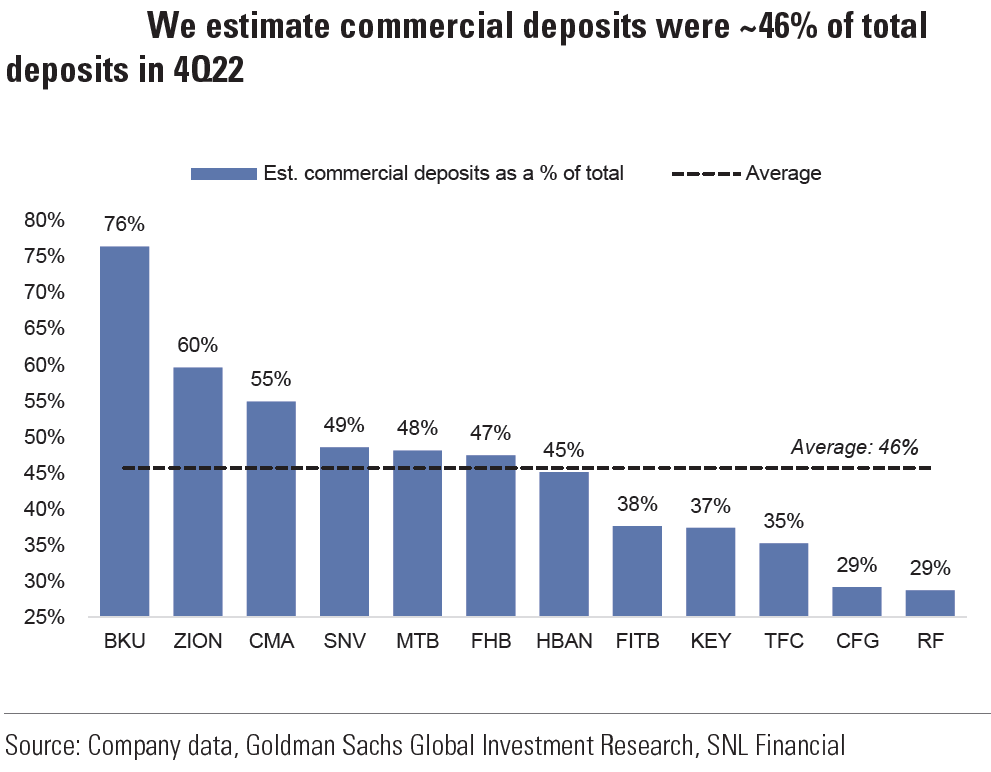

The minutes portrayed a Fed as very forceful in “standing its ground.” We extrapolate this conclusion because the minutes showed a Fed that was well aware of potential “cracks” to continued robust U.S. economic growth as it nonetheless outlined its aggressive tightening of monetary policy. The Fed referred to “available data” that showed how motor vehicle production in February declined sharply as “ongoing shortages of semiconductors and other supply chain problems continued to restrain output.” The minutes also indicated that “credit quality in the commercial real estate sector continued to show some signs of stress.” Additionally, the minutes stated that the “spreads on investment and speculative grade corporate bonds widened noticeably since the previous FOMC meeting.” In contrast, the minutes noted that credit quality for households remained “fairly healthy.” The participants also judged that the war created additional upside risks to inflation and “could weigh on economic activity.” At least partly due to lower inventory investments, participants expected Q1 2022 to be weaker relative to Q4 2021.

Source: Goldman Sachs, GOAL Post: Recession obsession and chasing your tail risk (4/8/22)

Decreasing Liquidity in Financial Markets = More Volatility

One of the minutes’ most striking aspects was the Fed’s acknowledgement that ”strained liquidity” in certain financial markets had potentially exacerbated volatility. We have noted often that illiquidty and positioning could account for unexpected and otherwise unaccountable large movements in financial markets. The MOVE index, which portrays Treasury security volatility, is perhaps an indication of this volatility as well. The last month’s MOVE index is the highest it has been since March 2020. We attribute the returning steepness of the two-year and 10-year Treasury yield curve this week to illiquidity and extreme positioning in these maturities. We could not discern any fundamental reason for this re-steepening. Let us not forget that the very large holdings of Treasuries by the Fed have helped reduce the liquidity of the Treasury market. The shrinkage of the Fed’s balance sheet will continue to drain liquidity from the financial system in general. We equate less liquidity with potentially greater volatility. We also would like to remind the reader that when it first discussed the reduction of its balance sheet in the minutes of a much earlier meeting, the Fed disclosed that it was contemplating using the shrinkage of its balance sheet as a means of steepening the yield curve. The Fed has never mentioned this as a possible policy ever since that first occasion. To implement such a strategy, the Fed would have to sell the Treasuries with the maturities that it wished to rise in their yields. But the minutes have made it very clear that the Fed has no current plans to sell selectively any of its Treasury holdings for the foreseeable future. Therefore, we conclude that this could not be an explanation of the yield curve steepening this week.

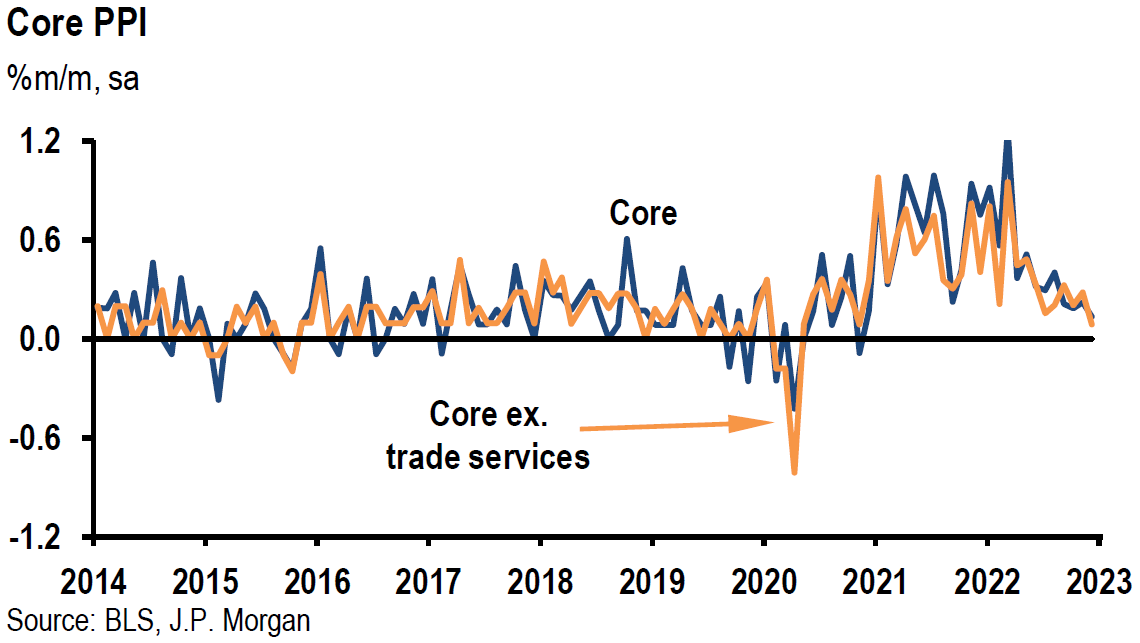

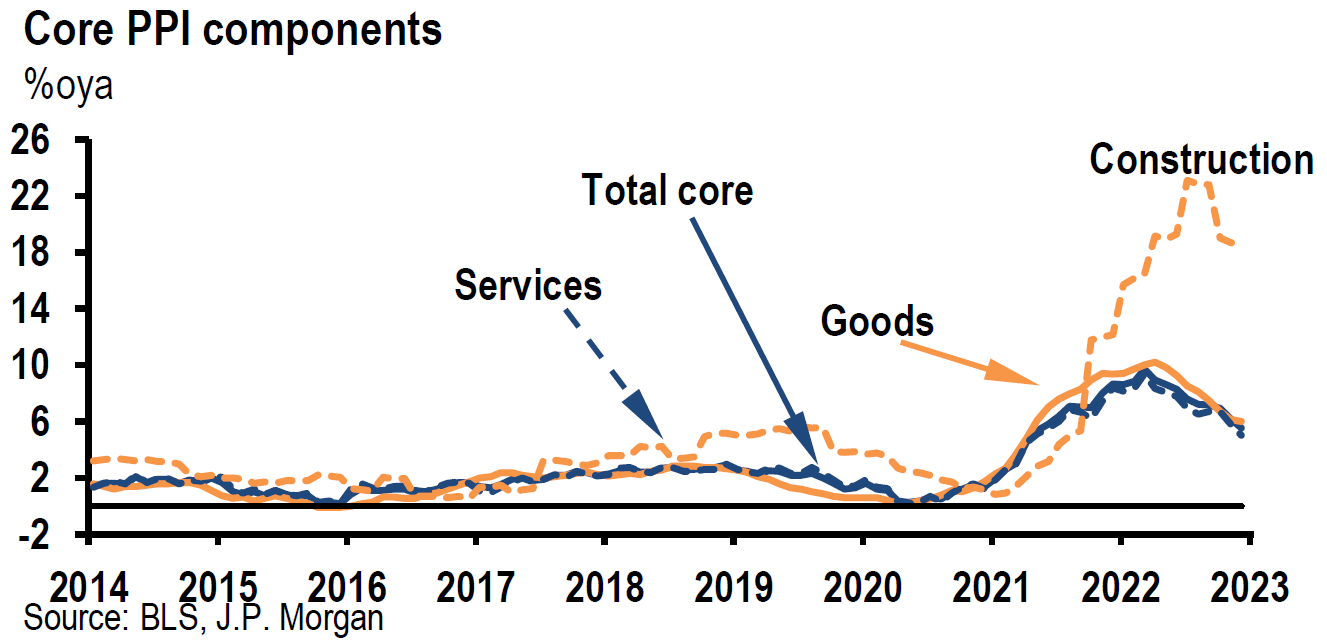

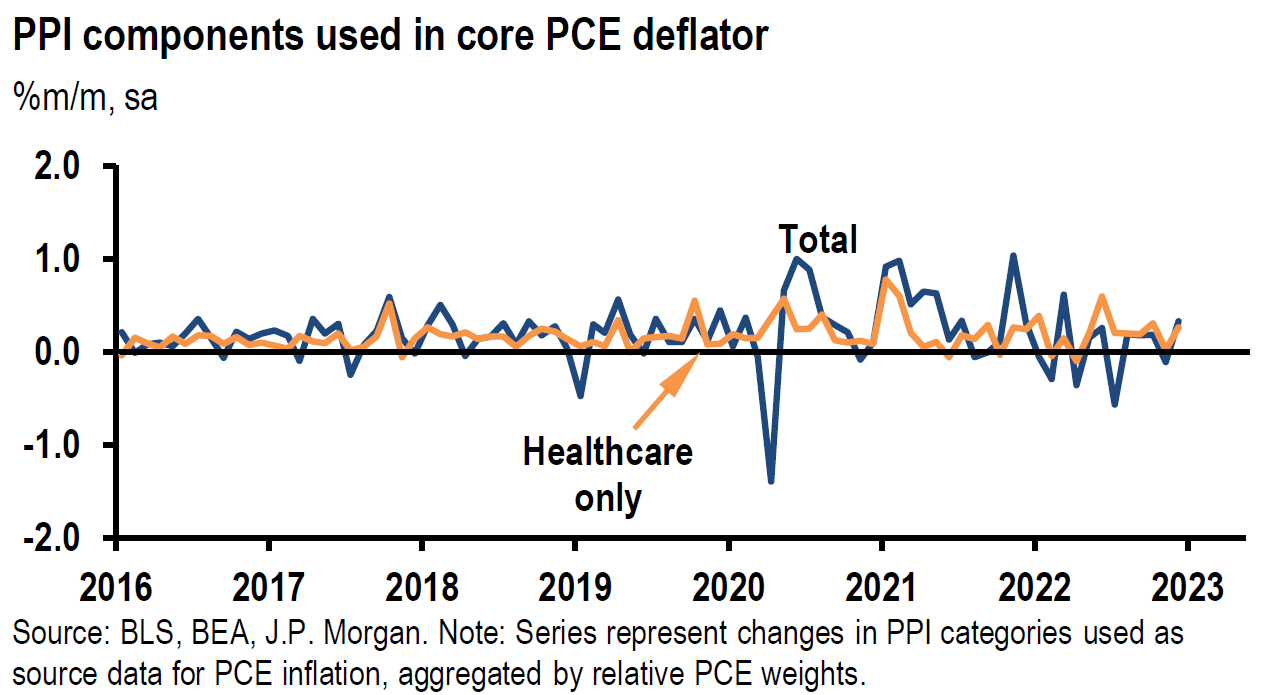

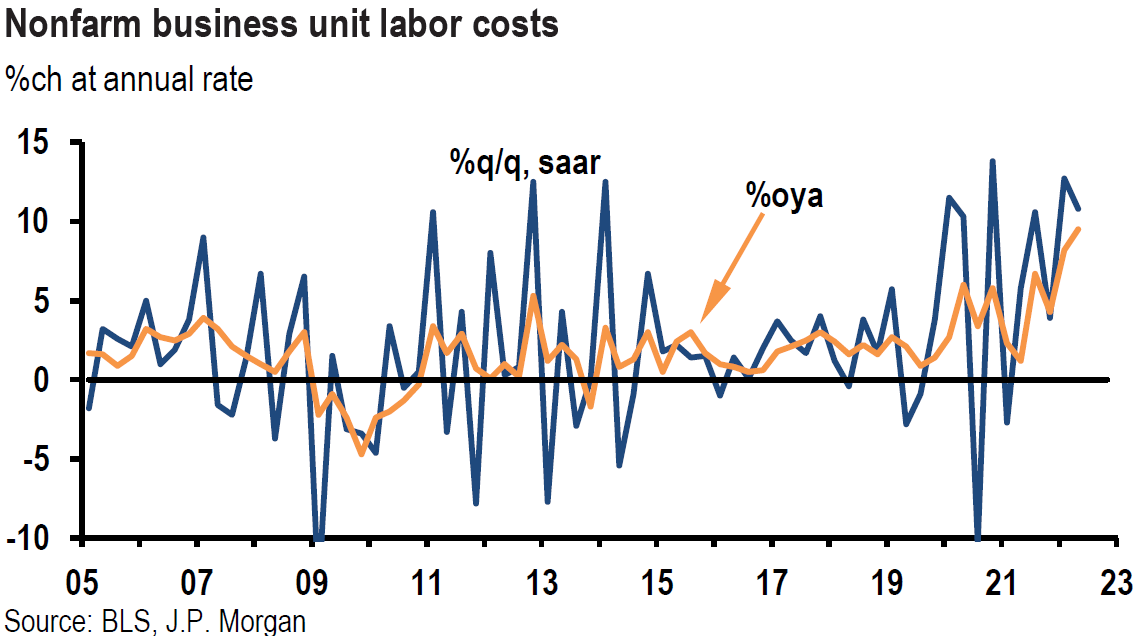

Inflation Broadens

The minutes’ observation that “wage pressures had begun to spread across the income and skill distributions” further highlighted the Fed determination to tighten its monetary policy aggressively. Furthermore, the minutes went on to state that “some participants noted that elevated inflation had continued to broaden from goods into services, especially rents, and into sectors that had not experienced large price increases, such as education, apparel and health care.” A few participants then expressed their concern that elevated inflation expectations could become entrenched “if the public began to question the Committee’s resolve to adjust its stance of policy as appropriate to achieve the Committee’s 2% longer-run objective for inflation.” Although not stated specifically in these minutes, they clearly reflected Powell’s concern about a possible wage-price spiral. In our opinion, virtually every aspect of these minutes supported the view that the Fed must tighten its monetary policies as quickly as possible since it was clearly “behind the curve” in implementing its tighter monetary policies.

Source: Goldman Sachs, What’s Top of Mind in Macro Research: Soft landing?, commodities upside, higher G10 yields (4/6/22)

Latest U.S. Economic Data Remains “Robust”

In our March 25 weekly commentary we emphasized that the Fed would be basing its decisions on actual data as opposed to expected data. In other words, the Fed was determined not to “look through” the latest available economic data like it did when it was characterizing inflation inaccurately as “transitory.” For a myriad of reasons, we never thought that the inflation of 2021 was mostly transitory. In our determination, the most important economic information released this week in regard to the U.S. economy was the ISM services PMI for March. It came in at 58.3%, roughly in line with expectations and rebounding from February’s reading of 56.5%. We generally viewed this report as “strong” and assumed that the easing of pandemic restrictions played a major role in this rebound. The March data reflected increases in business activity, new orders and employment. The report stated: “There was an uptick in business activity in March, but respondents have indicated that they continue to be impacted by capacity constraints, logistical challenges and inflation. Labor shortages have eased slightly, as COVID-19 cases have declined and public-health restrictions have been relaxed. Geopolitical concerns – particularly the Russia/Ukraine war, which has impacted material costs, most notably fuel and chemical prices – have created uncertainty for many businesses.” The S&P Global U.S. services March PMI showed very similar findings. In that survey, new business activity in March expanded at the fastest pace since June 2021, selling prices rose at a record fast pace, and backlogs of work grew at a series record high. We saw nothing in these reports that would dissuade the Fed from a very aggressive monetary tightening posture.

Source: J.P. Morgan, US: ISM services report shows firming in March (4/5/22)

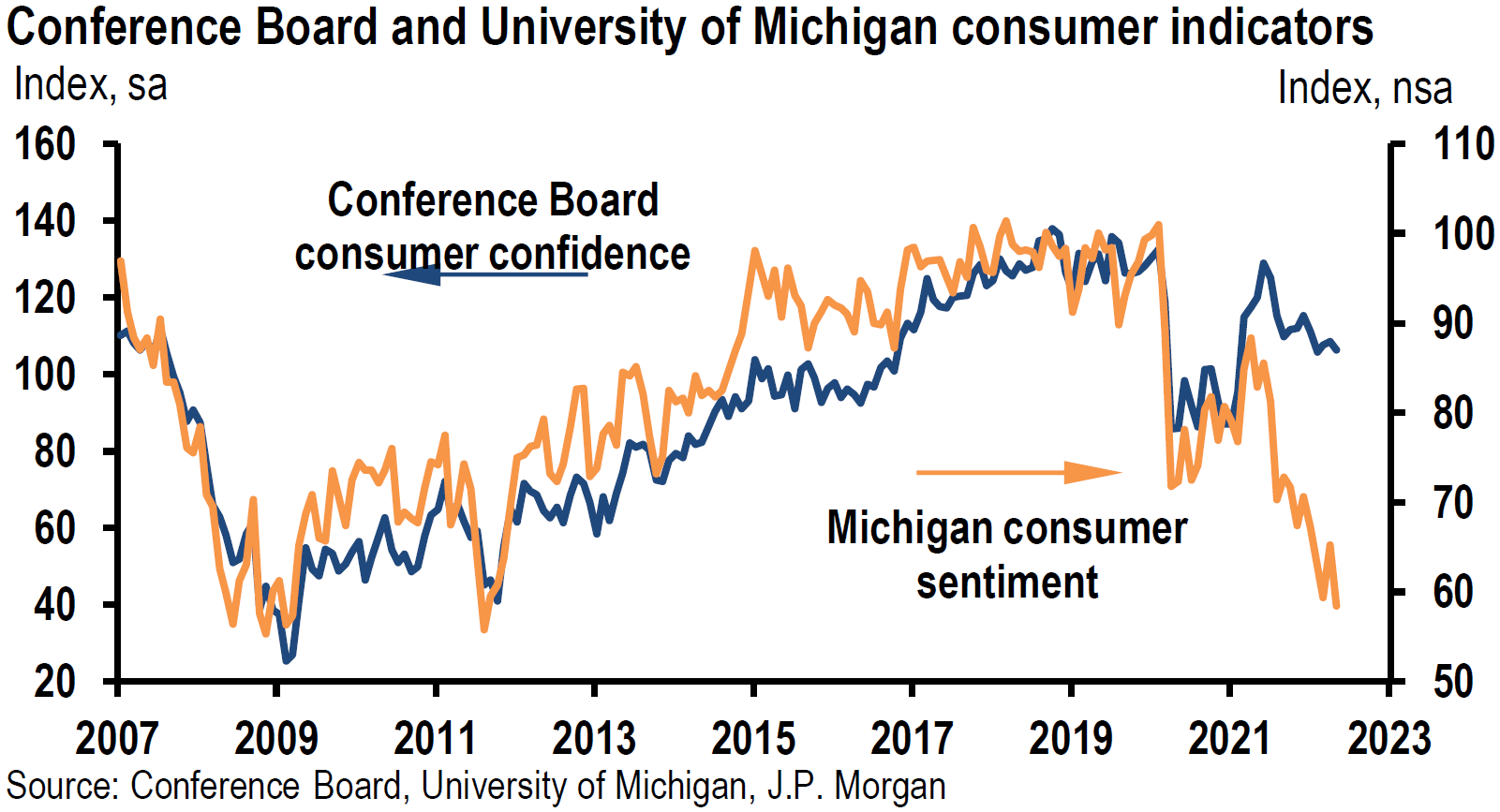

sa = seasonally adjusted

nsa = non-seasonally adjusted

Eurozone Economy – “Robust” for Now

The S&P Global Eurozone composite March PMI surprisingly maintained a relatively healthy mid-50s reading, which was mainly boosted by the highest rate of services growth in four months. Like in the U.S., services received a big boost from looser coronavirus restrictions. Inflation accelerated “markedly” to a new survey record. But the most noticeable difference between the European and U.S. March PMIs was in the business confidence of the Europeans “slumping” to a 17-month low. We have highlighted in our prior commentaries that when compared to most regions, Europe is probably most at risk for higher inflation and slower economic growth due to the war and its great reliance on commodities from Russia and Ukraine.

Source: Goldman Sachs, Americas Transportation: The Monthly Mosaic March 2022 (4/6/22)

Bottom Line

After digesting the latest Fed minutes, we postulate that the Fed will raise the federal funds rate by 50 bps at its next two meetings. Currently, we expect 25 bps increases at the subsequent four meetings. Furthermore, we anticipate both the announcement and implementation of the reduction of the Fed’s nearly $9 trillion balance sheet to begin at the May 3-4 Fed meeting.

We assume continued volatility across virtually all financial markets for at least as long as the war persists. Also, we continue to forecast higher interest rates as part of a volatile trajectory. We suppose that a well-diversified portfolio of selected high-quality stocks that includes some commodity exposure could be the best strategy for many long-term investors. Our preferred approach is to anticipate and recognize “tradable bottoms” in equity markets so that we might take advantage of attractive entry points to purchase selected equities. We forecast the healthcare sector to be a relative outperformer compared to most other sectors for the remainder of this year. This sector could continue to be part of a “barbell” approach in a well-diversified portfolio.

We foresee that most global economic growth rates will be revised lower and that most inflation forecasts will be revised higher due to the war. Additionally, we assume that downward earnings revisions for many companies might soon reflect these patterns. Predictable margins should become increasingly important in evaluating appropriate investments. Managements’ guidance on future earnings and revenue could be a driving force behind stock market reactions in the upcoming earnings season.

Source: FactSet, Earnings Insight (4/1/22)

Definitions:

Inflation Dove (Dovish) – A dove is an economic policy advisor who promotes monetary policies that usually involve low-interest rates. Doves tend to support low-interest rates and an expansionary monetary policy because they value indicators like low unemployment over keeping inflation low. If an economist suggests that inflation has few negative effects or calls for quantitative easing, then they are called a dove or labeled as dovish.

Inflation Hawk (Hawkish) – An inflation hawk, also known in monetary jargon as a hawk, is a policymaker or advisor who is predominantly concerned with the potential impact of interest rates as they relate to fiscal policy. Hawks are seen as willing to allow interest rates to rise in order to keep inflation under control.

Basis Points (bps) – A basis point is one hundredth of one percent, used chiefly in expressing differences of interest rates.

Purchasing Managers’ Index (PMI) – The Purchasing Managers’ Index (PMI) is an index of the prevailing direction of economic trends in the manufacturing and service sectors. It consists of a diffusion index that summarizes whether market conditions, as viewed by purchasing managers, are expanding, staying the same, or contracting. The purpose of the PMI is to provide information about current and future business conditions to company decision makers, analysts, and investors.

Eurozone Composite PMI (Purchasing Managers’ Index) – The Eurozone Composite PMI (Purchasing Managers’ Index) is produced by S&P Global and is based on original survey data collected from a representative panel of around 5,000 manufacturing and services firms. National manufacturing data are included for Germany, France, Italy, Spain, the Netherlands, Austria, the Republic of Ireland and Greece. National services data are included for Germany, France, Italy, Spain and the Republic of Ireland.

Federal Funds Rate – The term federal funds rate refers to the target interest rate set by the Federal Open Market Committee (FOMC). This target is the rate at which commercial banks borrow and lend their excess reserves to each other overnight.

Federal Open Market Committee (FOMC) – The Federal Open Market Committee (FOMC) is the branch of the Federal Reserve System that determines the direction of monetary policy specifically by directing open market operations. The committee is made up of 12 members: the seven members of the Board of Governors; the president of the Federal Reserve Bank of New York; and four of the remaining 11 Reserve Bank presidents on a rotating basis.

MOVE Index – The Merrill Lynch Option Volatility Estimate (MOVE) Index is a well-recognized measure of U.S. interest rate volatility that tracks the movement in U.S. Treasury yield volatility implied by current prices of one-month over-the-counter options on 2-year, 5-year, 10-year and 30-year Treasuries.

Eurozone – The eurozone, officially called the euro area, is a monetary union of 19 member states of the European Union that have adopted the euro as their primary currency and sole legal tender.

Positioning – Investors taking a position in a security. This could be a long position where investors expect price appreciation, or a short position where investor expect prices to fall.

Liquid Market – A liquid market a one with many available buyers and sellers and comparatively low transaction costs. The details of what makes a market liquid may vary depending on the asset being exchanged. In a liquid market, it is easy to execute a trade quickly and at a desirable price because there are numerous buyers and sellers and the product being exchanged is standardized and in high demand.

The North Atlantic Treaty Organization (NATO) – A national security alliance among the U.S., Canada, and their European allies. It was formed in the wake of World War II to keep the peace and encourage political and economic cooperation on both sides of the Atlantic Ocean.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/fast-answers/answersindiceshtm.html or http://www.nasdaq.com/reference/index-descriptions.aspx.

All data is subject to change without notice.

© 2024 NewEdge Capital Group, LLC