Introduction

The phrase, “life is a journey, not a destination,” is often attributed to Ralph Waldo Emerson, but there is no record of him saying or writing it. It first became widely used in the 1920s and has made its way into the lyrics of songs by artists as varied as Aerosmith and India.Arie. It has also become a well-worn saw in the investment community, particularly during periods of volatility when gallows humor is often required.

Today, the “journey” vs. “destination” dichotomy is showing up in an unusual place: the public (and, one assumes, private) debate among members of the Federal Reserve’s Open Market Committee (FOMC). The disagreement centers on whether the Fed should focus on data and proceed cautiously (“journey”) or have a set policy target in mind that it seeks to reach as soon as possible (“destination”). Whether the Fed adopts a “journey” or “destination” model going forward is a question that will be litigated sooner than later, as President Trump will name a candidate to replace Jerome Powell as Chair in the next few months.

This debate has clear implications for investors and has already begun to influence markets, as we’ll show after we summarize and explain the puzzling post-FOMC market reaction in this edition of the Weekly Edge.

Markets “Bought the Rumor” but Have “Sold the News” of the First Fed Rate Cut

It has been just over a week since the FOMC reduced its policy rate target for the first time since last December, citing increasing risks to the labor market coupled with somewhat less concern about a durable rise in inflation. At the same time, it outlined a more dovish path of interest rate policy than most observers had expected.

Virtually every asset class from stocks to bonds to gold had been rallying heading into the meeting, but those rallies slowed, halted, or reversed last week. This would not be the first time a “buy the rumor/sell the news” pattern has taken hold after the start of a rate-cutting cycle. Just last year, interest rates had been falling and stocks were near all-time highs heading into the September FOMC meeting at which the Fed cut its policy rate by an outsized 50bps.

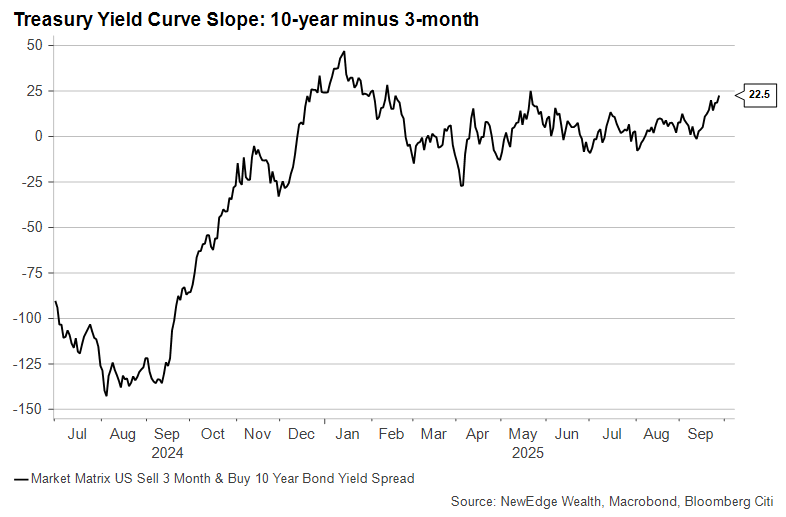

It’s also common for the Treasury yield curve to steepen at the outset of a Fed easing cycle. Last year, the 10-year yield bottomed and began to rise just as the Fed was beginning its mini-easing cycle, which caused the curve to move out of inverted territory for the first time since 2022:

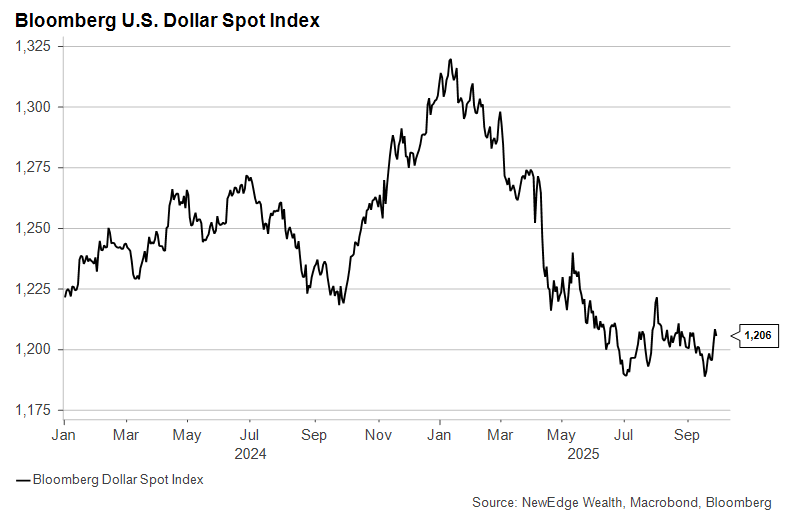

Similarly, while it’s been a rough year for the U.S. dollar, the greenback has found some strength in the second half of September. Despite promises of further rate cuts in the fourth quarter, short-term real interest rates (which are often drivers of currency movies) have risen:

Awkward! Data Has Improved Just as the Rate Cuts Have Begun

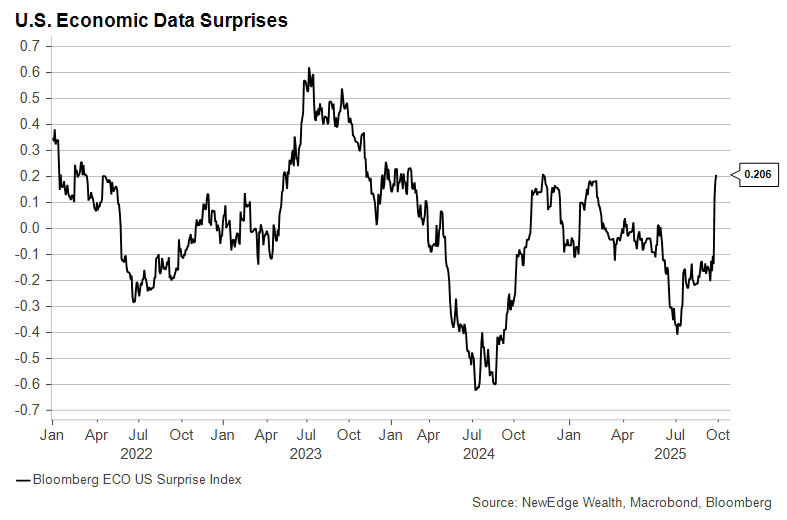

Those who hoped that rate cuts would stimulate the housing market via lower mortgage rates or create a more competitive global landscape for businesses via a weaker dollar may be wondering what’s happened. The answer is hiding in plain sight. Just as the labor market began to improve in 2024 as the Fed was cutting rates, the preponderance of economic data from August released over the past two weeks has been quite strong, clouding the case for rate cuts.

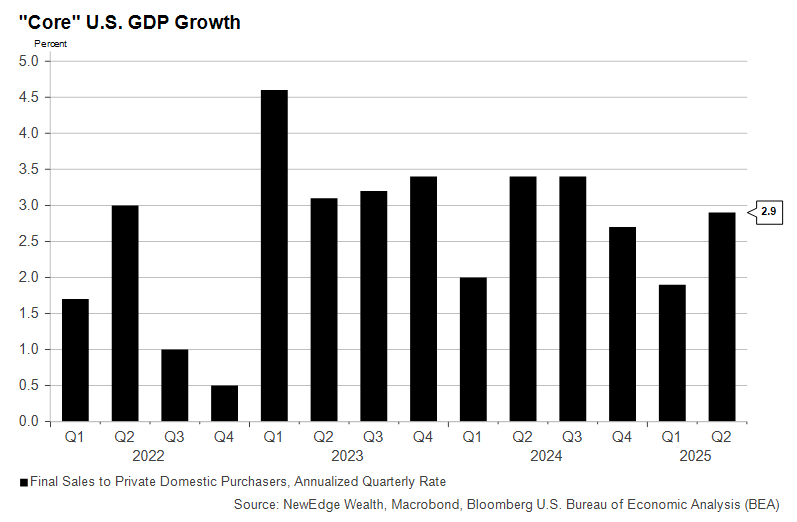

We have seen unexpectedly good data in areas ranging from New Home Sales to Consumer Spending to Capital Goods Orders. And, while it’s obviously a stale data point by now, the upward revision to Q2 GDP growth released last week changes the narrative around what was happening to the U.S. economy in the spring and early summer. While wage growth and hiring rates have inarguably slowed this year, the one-two punch of resilient consumer spending and AI-related infrastructure investments pushed core growth up close to 3% last quarter:

While the Fed has eased during periods of relatively strong growth before (see 1995, 2019 and 2024 as examples), it is unusual for an easing cycle to be deep and prolonged absent major concerns about the growth picture. This makes the setup for the current FOMC debate – between two broad camps that are currently in favor of more rate cuts but for different reasons – all the more fascinating.

Divergence Among FOMC Doves

The main point of brewing disagreement is between the more seasoned members of the FOMC like Governors Chris Waller and Michelle Bowman (both appointed in the first Trump term) and Governor Steven Miran, the newest member of the Board and on leave as Chair of the White House Council of Economic Advisors.

Based on their recent speeches and public comments, Waller and Bowman both take a data-dependent approach to setting interest rate policy. They currently favor further reductions in the federal funds target rate to address growing risks in the labor market, and neither is concerned about tariff-driven price increases metastasizing into persistently high inflation. Bowman has hinted that larger rate cuts may be needed at upcoming meetings, while Waller has thrown out an estimate that the “neutral” rate is still 100-125bps below the current target.

Bowman and Waller are in the “journey” camp, meaning their arguments about reducing interest rates hinge on incoming data. A faster deterioration in employment would make them open to more cuts, while a fall in unemployment or a pickup in payroll growth could cause them to ease off the rhetorical gas pedal. Chair Powell himself has been the avatar of data dependence in recent years, and he has the results (both good and bad) to prove it.

On the plus side, this approach keeps the Fed and the markets closely aligned on the rate view (i.e., when the facts change, both the Fed and the markets change), and this has generally helped volatility remain low. In addition, data dependence often leads to consistency of movement across the yield curve. A bad jobs report, for instance, would lead the market to reflect a greater chance of a rate cut at the front end of the curve, but it would also likely cause long-term rates to fall on greater risk aversion and a flight to relative safety.

The drawback of data dependence becomes clear when the data changes or is revised. It will tend to make the Fed slow to spot major economic inflection points, and by tying policy to something that is hard to forecast – the economy! – it can make policy less predictable.

Governor Miran, it would appear, has had enough of all that. While he also considers inflation and employment as part of his approach to monetary policy, he is most concerned about changes in the so-called neutral rate of interest, the rate at which the economy will run neither too hot nor too cold. If this rate changes, it can cause policy to become tighter or looser without the Fed making any official change to its target.

The neutral rate (sometimes referred to as r*) is not directly observable, making it very fun to debate, at least according to economists’ definition of “fun”. It’s level at any moment and over time is a function of demographics, productivity, and, Miran argues, fiscal policy as it affects national savings.

Miran’s view is that r* was unusually high from 2022-2024 because of massive net migration flows and large fiscal deficits. This meant that despite raising interest rates significantly during this period, the Fed was not running an overly tight monetary policy. Now, as net immigration has slowed materially and deficits are running lower than last year (partly because of tariff collection), r* has started to come down. Miran argues that this justifies lowering the policy rate by 100-125bps immediately, a view he communicated clearly in his outlier “dot” in the Fed’s September Summary of Economic Projections.

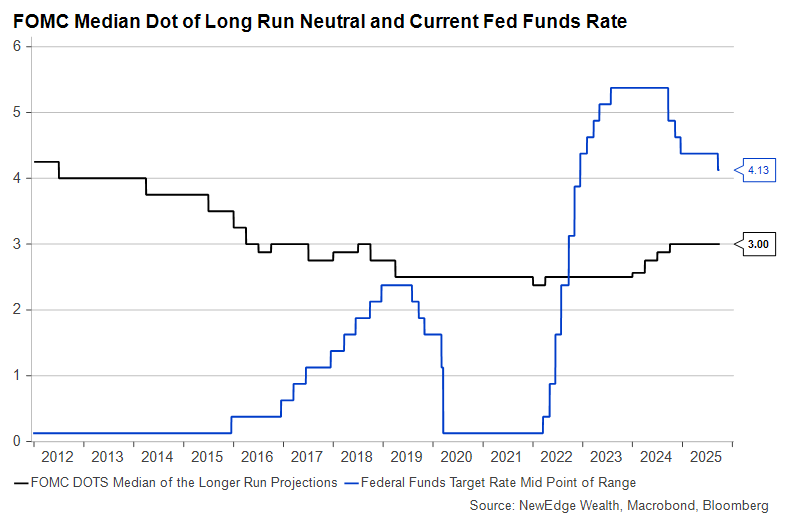

Notably, the median FOMC member agrees with Miran that current policy is over 100bps tighter than the neutral rate:

Miran is in the “destination” camp. He wants to bring down the fed funds rate because he thinks the Fed policy is tight and getting tighter, threatening to slow the economy unnecessarily in the coming quarters. His argument does not rest on fears about a current labor market slowdown or inflation concern and would not change materially based on how data evolves in the near term.

The obvious upside of this approach is that it lays out a predictable and credible path of interest rates, and, assuming the Fed’s estimate of r* is correct, it would make the Fed less likely to be “late” to inflection points.

The first drawback of the “destination” approach is that because it is agnostic to current data and market behavior, it could prescribe aggressive easing during a period of surging risk assets and strong economic data. The euphoria such a policy could create could easily give way to confusion or cause bubbles to form.

The second drawback to Miran’s destination approach is that it might not work. A Fed seen as cutting for dogmatic reasons might not find it easy to bring down longer-term interest rates. This could steepen the yield curve and tighten policy precisely at a time when the Fed is hoping for the opposite. A loss of Fed credibility on inflation could likewise cause long-term rates to increase as bond investors required more insurance against an irresponsible central bank.

Investing for Uncertain Dovishness in 2026

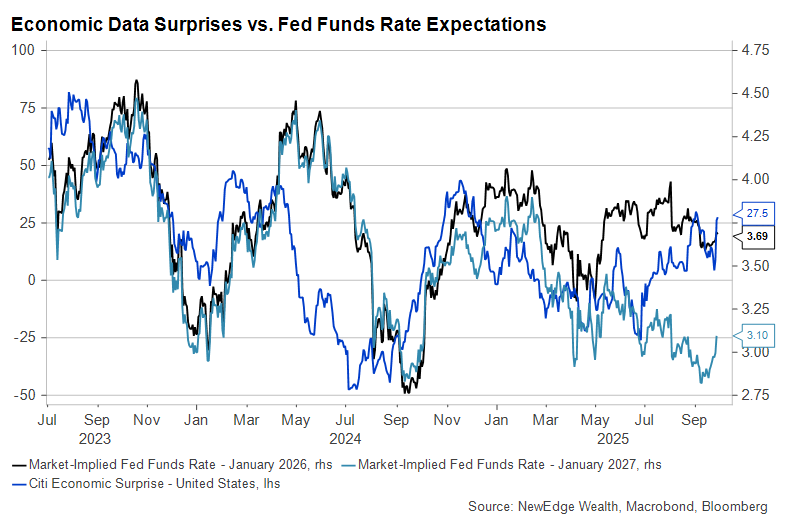

Markets believe the Fed will follow the Waller/Bowman in 2025. There is still a correlation between economic data surprises and expectations for where Fed policy will be at the end of 2025 (the blue and black lines on the graph below).

Out a year or more, however, things get interesting. Even after the “sell the news” bounce in rates, futures markets continue to show a steeper path of rate cuts with a lower terminal rate at the end of 2026 (the green line on the graph above) than does the Fed itself. Two things could explain this. First, investors could be more worried than the Fed is about recession. But the simultaneous rise in the 10-year yield since the last FOMC meeting tells us this is likely not the case. Second, investors could be assuming a more Miran-like reaction function at the Fed in 2026, with rate cuts down to 3% regardless of what the economic data might be saying. This might prove correct, especially if Miran himself becomes Fed Chair or someone with similar views eventually gets the top job.

What Happens Now?

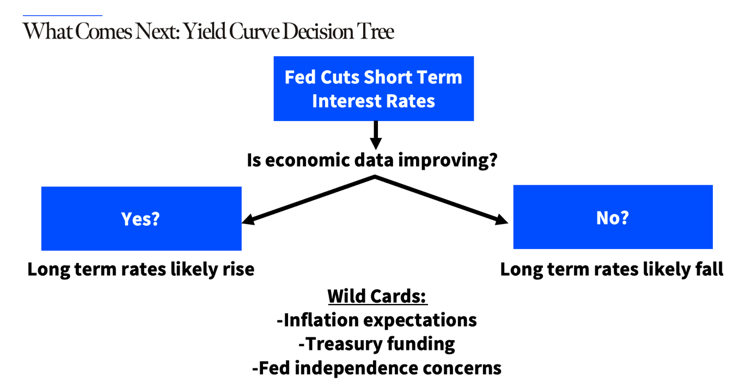

It is, frankly, hard for us to imagine at this point that the White House and the Fed will not find a way to get the policy rate down to 3% next year, even if it requires some creative handling of personnel at the Board involving protracted legal battles. How that affects investors will depend on what’s happening in the economy, as this simple decision tree shows:

If unemployment rises above 4.5%, there will be little daylight between the Waller/Bowman view and the Miran view. Slashing rates another 100-125bps will be a no-brainer. If, however, the economy remains solid to strong, the argument for aggressive cuts will be harder to make, and the markets’ willingness to accept lower short-term rates could be tested.

Investors could, for example, begin to reject Treasury Bills if the yield curve steepens significantly. Lower short-term rates make money market holdings less attractive, and money market funds have been a big buyer of the U.S. Treasury’s large Bill issuance in recent years.

Concern about a steeper yield curve could lead the Fed to attempt some measure of yield curve control: buying longer-term and selling short-term debt or buying longer-term Treasuries outright and expanding the money supply. However, this policy would be difficult to pass through an FOMC still populated by independent Regional Fed Presidents and holdover Board members.

Investors should not throw up their hands at this uncertainty. There are obvious ways to hedge against the first scenario of a slowing economy, including owning defensive and higher-quality segments of the equity market and extending duration in bond portfolios to prepare for a run-of-the-mill slowdown.

The second scenario could encourage further weakness in the dollar but might result in better relative returns in sectors like financials, which perform better when the yield curve is steeper. Gold is already at all-time highs in part because investors want to hedge the risk of a dovish Fed, but it tends to find support during periods of low or negative short-term real interest rates like the one a “destination”-driven Fed might create.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/answers/indices.htm.

All data is subject to change without notice.

© 2026 NewEdge Capital Group, LLC