“Everyone’s entitled to one good scare.” – Rounding up the Latest Economic News

It’s officially November. The trick-or-treating is over, and the days of noshing on leftover candy have begun. As investors, the past several weeks made us feel a bit like a group of foolish teenagers looking over the motionless body of Halloween’s Michael Myers, only to have him suddenly sit up and begin his deadly chase once more. In this case, the terror has taken the form of rising interest rates and narrower equity market leadership.

These dual phenomena dominated the first half of 2024 but had seemed to give way to something new – and better – in the summer months, when rates were dropping and a wider array of stocks were performing well. But fans of the Halloween franchise know well by now that getting rid of Michael Myers for good is no easy task.

In today’s piece, after recapping the new October labor market report and what it implies for our outlook, we’ll delve into what’s driven interest rates higher over the past six weeks. Finally, we’ll assess the current economic state of affairs and render a verdict on how things are likeliest to go wrong from here…and how this informs our positioning.

“I have a feeling that you’re way off on this.”

The October U.S. employment report delivered bad news across the board, even after controlling for the likely effects of hurricane season on the labor market and the data collection process. Nonfarm payrolls rose a mere 12k, compared to expectations for 100k job additions. Private nonfarm payrolls fell by 28k, the first negative reading since December 2020. Revisions to prior months reduced total payrolls by 112k.

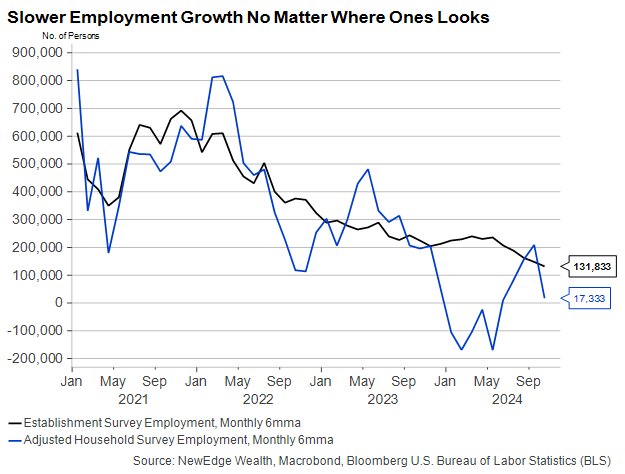

Unemployment held at 4.1%, but the underlying details were worse. Unemployment rose by 150,000 while the overall labor force shrunk by 220,000. Dissecting the labor market report can often feel like a game of Choose Your Own Adventure, but as the chart below indicates, every measure of job growth we look at is slowing.

Despite the weaker data, yields staged a significant reversal through Friday, closing higher. The constant press higher in yields over the last two months is what we will spend the balance of this report discussing.

“Boogeyman is coming!” – Rates Weren’t Supposed to Rise in Q4!

We are only a few weeks removed from the Fed’s September rate cut, its first cut since 2020, and less than a week until it’s widely expected to cut rates again. But the U.S. bond market is not getting the message. The 10-year U.S. Treasury yield has risen over 60 basis point since the last FOMC meeting. Why is this happening?

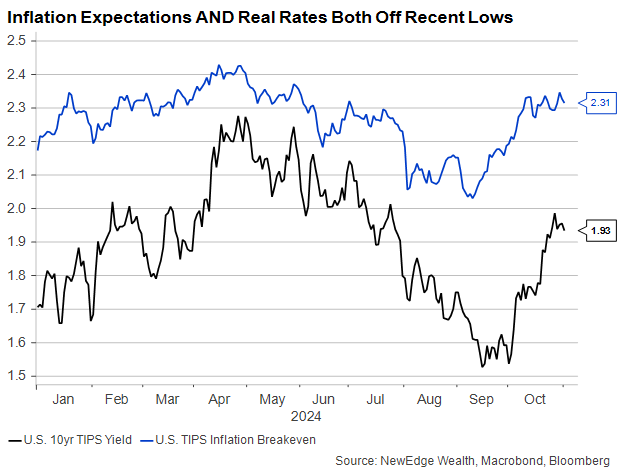

A look at the components of the 10-year yield – inflation expectations and the real yield – hint at multiple causes. The chart below shows how the movement higher in yields has been driven by both components, inflation expectations and higher real yields. This tells us that more modest expectations for Fed rate cuts, concerns about growing federal deficits, and upward reassessments of the economic outlook may all be playing a role.

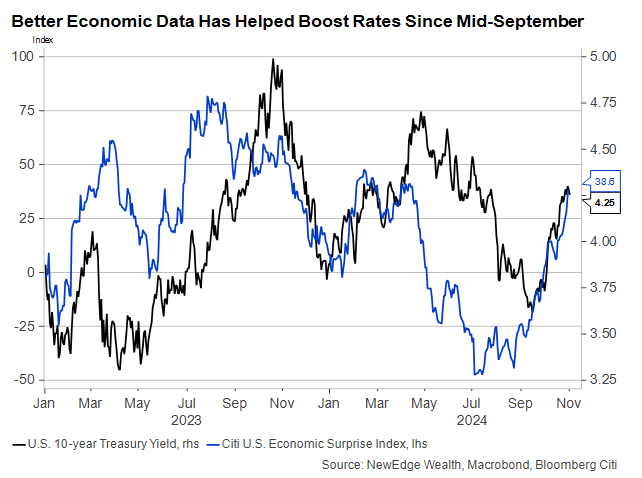

Starting with the September labor market report and carrying through the solid consumer data from the past few weeks (until this morning), economic data has generally been stronger than expected, a welcome change from the growth scare over the summer. Interest rates often move in line with data surprises, and the past few weeks have been no exception. The next chart shows this relationship with improved economic surprises coinciding with the jump higher in yields.

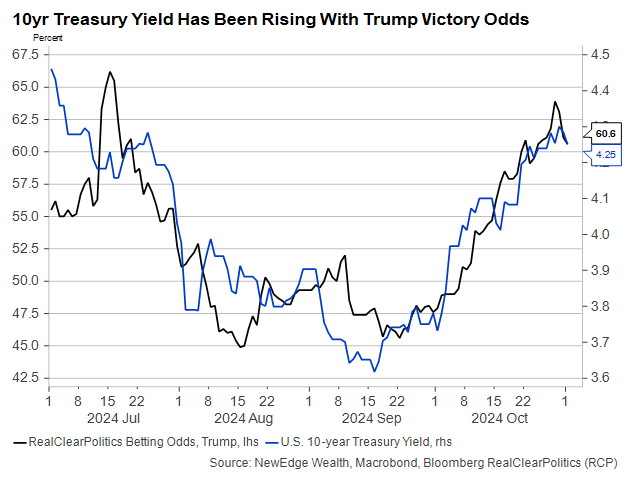

Politics may also be playing a role in higher yields. Rightly or wrongly, markets are a) pricing in a better chance of a Trump victory and a Republican sweep on Tuesday; and b) assuming that the mix of growth and inflation in these scenarios would be stronger, resulting in higher rates. The fit between the 10-year Treasury yield and Trump’s political betting market odds is even stronger than the one between the 10-year and the data surprise index above:

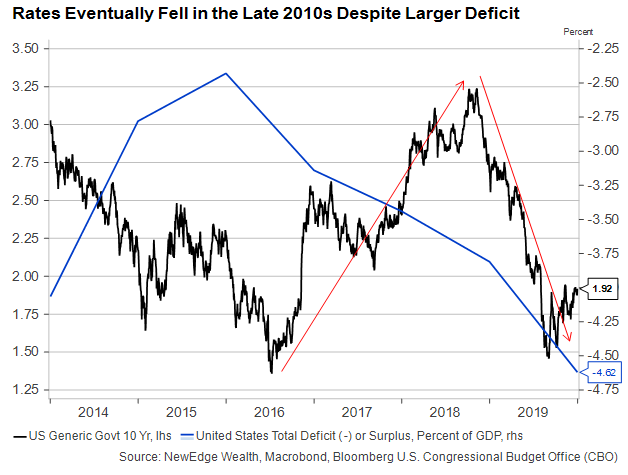

We’re skeptical that politics will be a primary determinant of interest rate moves over the coming four years. Investors may expect that Trump’s policies would, on net, increase the federal deficit beyond what is currently expected, boosting some combination of growth and inflation and forcing the Fed to keep interest rates high in response. One problem with that theory is that rates fell during the first Trump administration after the signature tax bill and fiscal expansion occurred:

The initial reaction to Trump’s win in 2016 was, indeed, for rates to move higher. They rose again as the Tax Cuts and Jobs Act (TCJA) moved toward passage in late 2017. But rates peaked soon after that. All it takes is a few crises – manufacturing recession, government shutdown, trade war – for risk aversion to kick in and the economy to wobble. By mid-2019, the Fed was cutting rates, and the 10-year yield had retraced virtually its entire rise from the previous election.

“I spent eight years trying to reach him, and then another seven trying to keep him locked up.” – Is “Lower for Longer” Really Dead?

The Q3 U.S. GDP report provided yet more evidence that the world’s largest economy remains resilient – in most sectors – to this prolonged period of elevated interest rates. This matters a great deal for the Fed, because high growth in the face of what was thought to be restrictive monetary policy implies a higher “neutral” rate of interest, which could mean rates stay higher moving forward.

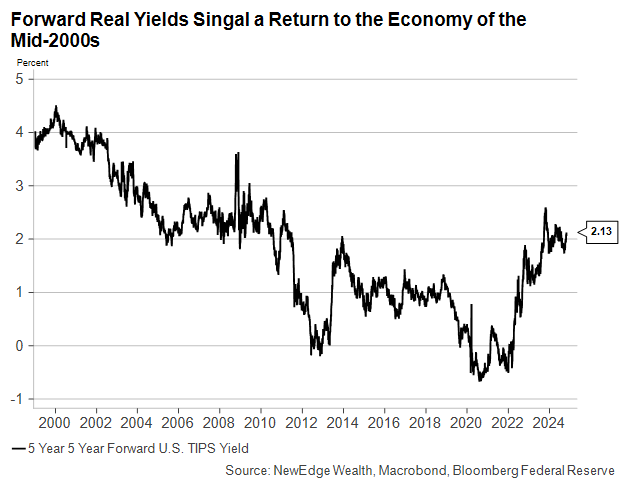

Of course, it’s hard to pin down precisely where the market thinks the new neutral is, but a look at the forward U.S. Treasury curve gives us a clue. The 5-year real (i.e., inflation-adjusted) Treasury yield five years forward is currently 2.1%, double its average level during the 2010s. This implies that the market thinks the neutral Fed Funds rate (assuming 2% inflation) is north of 4%, perhaps not too far from where it will reside by the end of this year.

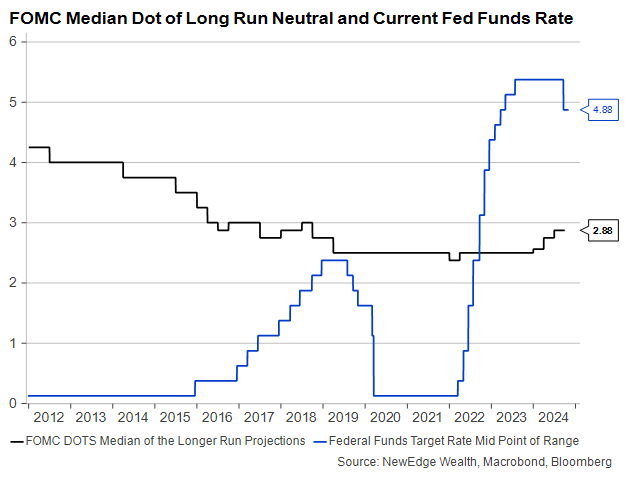

The Fed itself has been nudging up its estimate of neutral, but the September projections still leave it just shy of 3%. Powell’s description of the neutral rate has become downright biblical. At his latest press conference, all he could say about it was that we will “know it by its works”.

The chart below shows that the Fed Funds rate has been above the Fed’s estimate of neutral for about two years, which hasn’t stopped GDP from growing above trend in just about every quarter. Either the neutral rate is higher than the Fed thinks and there won’t be a need to cut rates much further, or it isn’t, which means that policy is simply taking longer to have an effect in this cycle.

This neutral rate debate stems from a growing fear that even a modest Fed cutting cycle will invite inflation to rise from its grave and exact revenge on the economy and investors in 2025. It’s certainly possible that a geopolitical flare up could send oil prices higher or that new taxes on imports could make certain goods more expensive for consumers next year. Severe restrictions on immigration could tighten the labor market and reignite a wage-price spiral, which would certainly make the Fed think twice about cutting rates much more.

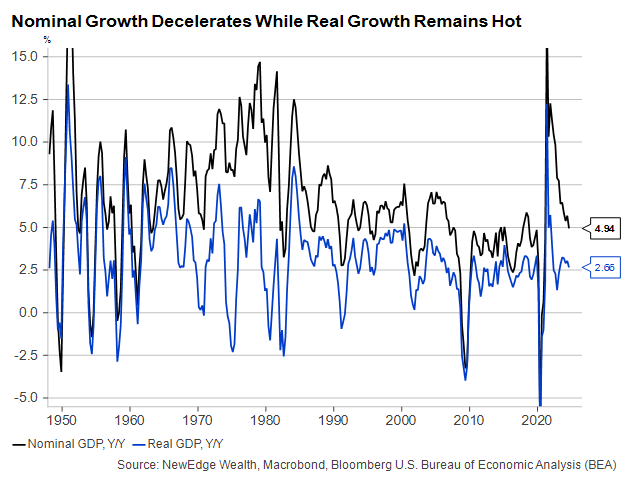

An equal and opposite risk is that the combination of strong productivity growth and a growing labor force have been responsible for keeping growth above trend but may begin to falter. When productivity is booming, as it has been over the past two years, the bar for monetary policy to be “restrictive” moves higher. Firms can pay workers more without charging customers higher prices, despite higher rates. As the chart below shows, that’s just what’s happened.

Likewise, when the labor force expands rapidly, it can shift the economy into a higher gear, even if only temporarily. But should the rates of labor force expansion or productivity growth slow (e.g., because high rates are discouraging productivity-enhancing investments), the economy could begin to feel more like it did in the 2010s, when even a 0% Fed Funds rate was insufficient to stoke inflation or stimulate growth.

“You’ve fooled them, haven’t you? But not me.” – Balanced Risks for Investors

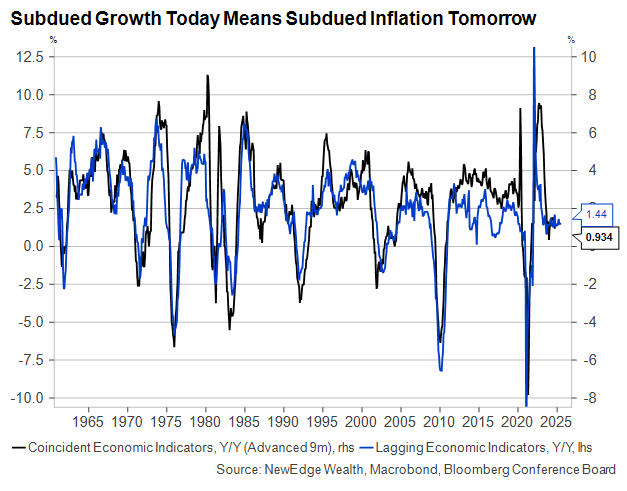

Neutral rate debates aside, falling inflation can’t coexist with hot economic growth forever, so something in this formula is likely to go awry in 2025. We don’t dismiss the possibility that interest rates rise even further from here, especially if inflation expectations become unanchored due to changes in fiscal policy. However, especially in light of the weak October employment report, we view slower growth as at least as large a risk to diversified portfolios over the next 12 months.

Leading indicators of rate-sensitive parts of the economy like construction and manufacturing are not showing an imminent upturn. Why should they, with rates back on the rise? And the deceleration in GDP, wage, and employment growth tells us we have little reason to fear a wage-price spiral anytime soon.

Slower economic growth, even if it falls well short of recession, is normally associated with declining risk appetite and stronger negative correlation between stocks and bonds. This presents downside risk to interest rates over the medium term even if momentum and uncertainty send them higher in the coming weeks. It’s also a difficult moment for bond investors to “hide” in corporate credit, where spreads are at their narrowest levels in decades. This means they provide less yield pickup and more downside macro risk than usual.

In our experience, slower growth also makes investors pickier about price, which could make stocks with the highest valuations the most vulnerable. This could mean a “fall back to earth” – relative to the rest of the market, anyway – in the priciest Growth stocks that have driven the market this year. We saw flickers of this in small-cap stocks’ strong performance over the summer and as recently as this week in the wake of some shaky earnings reports from the so-called Magnificent 7 firms.

“Sleep tight, kids.” – Conclusion

The past several weeks of interest rate volatility (a euphemism for “swift moves higher in interest rates”) evokes painful memories of 2022, when few investment strategies managed to protect against losses. While this bout should prove temporary, as the previous one ultimately did, it provides investors with a window to reposition out of cash and look to less-expensive-looking parts of the equity and fixed income markets for new investments. This wider variety of assets should prepare portfolios for a more balanced array of risks in the year ahead, including those not correlated to either stocks or bonds.

We are positioned for a moderation in growth, not a crash, but investors should prepare for almost any scenario in the months ahead once the economic data is no longer warped by Hurricane season and we have a clear election outcome for markets to process. Until then, the specter of uncertainty and the dying embers of inflation may continue to haunt investors’ dreams.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/answers/indices.htm.

All data is subject to change without notice.

© 2025 NewEdge Capital Group, LLC