Yeah, you already know

How this will end

“How It Ends”, DeVotchka

Last week, Goldman Sachs’ Portfolio Strategy Research team caused quite a stir when they evoked DeVotchka’s 2004 indie hit “How It Ends” (without lyrics the song is titled “The Winner Is” and provides the contemplative backdrop for the dysfunctional and endearing indie film Little Miss Sunshine. Take this as a sign to go ahead and eat the ice cream.)

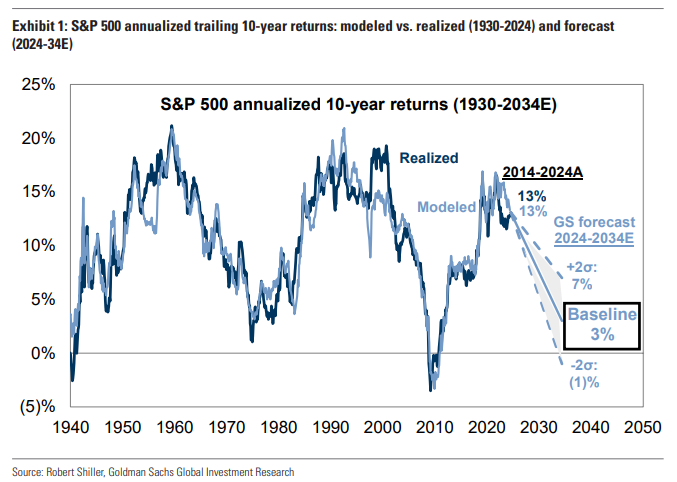

Goldman argued, based on a host of metrics like S&P 500 valuation, Return on Equity, index concentration, the starting point of yields, and expectations of future economic contraction (at some point), that they “already know how this will end”: they expect forward returns for the S&P 500 to be notably mediocre, at just 3% over the next decade.

This expected 3% compares to the prior decade’s 13%, and would be notably lackluster by historical standards, ranking in just the 7th percentile of returns since 1930.

As of October 18, 2024

This, of course, is a startling assertion for investors who have grown accustomed to fulsome, above-average returns in recent years. But even if we knew with certainty that 3% returns over the next 10 years is, in fact, “How It Ends”, the conclusion as to what to do with this information is not a simple “avoid equities”, but instead has many caveats that are necessary to navigate a potentially low return environment.

This week’s Weekly Edge will explore those caveats.

We wrote about how to approach a low return environment back in March of this year, following an Economist article that argued that the golden age for U.S. stocks was over (the S&P 500 is up ~15% since the article). The piece is a helpful backdrop to today’s discussion, with many of the points we made in March revisited today. Our key point from March, which we repeat today, is that a projection for lower returns, even if true, does not mean to write off equity investing entirely.

Caveat #1: The Forecasts Can Be Wrong

Whenever we examine long-term projections, we should always keep Yogi Berra’s quip in our minds: “It’s tough to make predictions, especially about the future.”

The reality is that these projections for weaker returns could quite simply be wrong.

We can use the last decade of projections as a helpful example.

The screen shot below is from JP Morgan’s 2014 Long Term Capital Market Return Assumptions. Though the piece is well researched and theoretically solid, it is a great display of how challenging it is to project long-term returns.

For example, note the projection of U.S. large cap returns being just 7.5%. The reality has been much stronger than that, with 12.5% annualized returns since 2014 for the S&P 500 and 19% for the Nasdaq 100.

In contrast, emerging markets have vastly underperformed expectations, with the MSCI Emerging Markets Index delivering just 1% annualized returns over the last decade.

If an investor’s conclusion in 2014 after reading this report had been to underweight U.S. stocks and overweight emerging markets, it would have simply been wrong. As Yogi said, “it is tough to make predictions.”

But this doesn’t mean we should simply write off these predictions of lower forward returns. We happen to agree with Goldman and the likes of Stifel’s Barry Bannister, who has been writing about lower long-term returns throughout 2024, that there is risk that returns over the next decade will be lower than the prior decade.

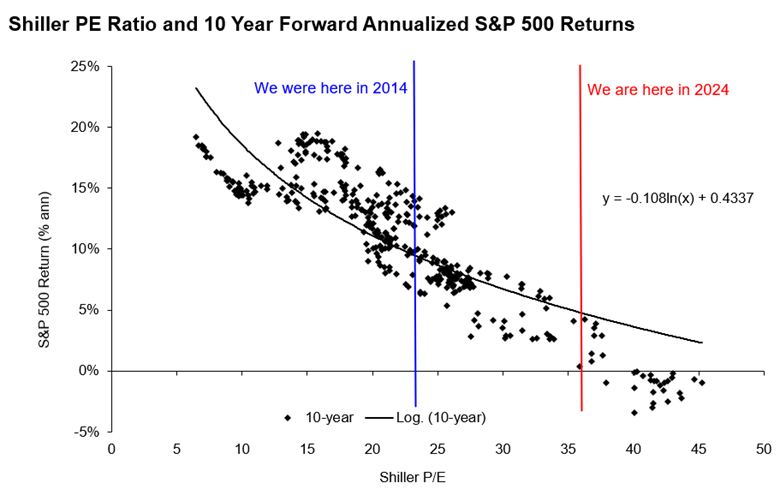

As we wrote back in March, starting points matter. At the start of the last decade, equity ownership was lower, equity valuations were lower, and bonds were still in their 40 year bull market. These factors all contributed to the last decade’s solid returns.

The chart below shows the difference in these starting points in 2014 vs. 2024 from a valuation perspective, using the Shiller Cyclically Adjusted Price to Earnings Ratio (CAPE) and the 10 year forward annualized returns from the S&P 500. It is undeniable that the starting point of today’s valuations have historically been accompanied by periods of lower forward returns, while 2014’s starting point of valuations is consistent with the returns that we have experienced over the last decade.

Source: Yale, Robert Shiller, New Edge Wealth, as of October 2024

As we wrote last week, we think there are reasonable reasons that valuations are higher today (scarcity of equities, higher quality of companies in the index, more intangible earnings), but we do not go so far to utter those “Famous Last Words” that “it’s different this time”, arguing that high valuations today will eventually weigh on forward returns.

But, again, even if we knew for certain “How It Ends” with equity returns this decade, knowing the final destination does not tell us anything about how we get to that destination, which brings us to our next caveat.

Caveat #2: The Outcome is Path Dependent

There are many ways to get to low forward returns. The market could chop sideways for an extended period of time, like 1968-1980. The market could experience a crash and then a recovery, like 2004-2014. Or the market could experience a bubble and then a crash, like 1997-2007.

Each of these different paths can deliver vastly different outcomes for investors based on how they react to the inevitable volatility that typically comes with lower return periods.

If investors had a crystal ball to know “How It Ends” at the beginning of each of these “lost decades” in markets and concluded to avoid equities during these times, a) they would have missed out on the opportunity for tax efficient compounding through longer cycles, and b) they would have also avoided generational buying opportunities like 1974, 2002, and 2009.

We always work to see volatility as opportunity and having a plan and mindset to take advantage of volatility when it arises is critical. Further, volatility is a feature of equity investing that we have to accept. At times when volatility is low and returns are powerful, it is easy to forget the inherent, volatile nature of equities.

As we face today’s high valuations and the prospect for lower forward returns, we have to appreciate that these long-term projections must be balanced with short-term considerations, just like how the March Economist article calling for the “end of the golden age for equities” has been followed by ~15% returns in the S&P 500.

Our mantra all this year has be “respect the trend, but don’t ignore the risks.” We continue to see a relatively robust economy, supporting forward earnings growth. We see valuations as stretched and see potential that these high valuations weigh on returns in 2025, but that ample opportunities exist within equity markets even if 2025 ends up not being an “up and to the right” market like 2023 and 2024. These opportunities are the topic of our next caveat.

Caveat #3: Low Return Environments Often Are Accompanied By Big Rotations

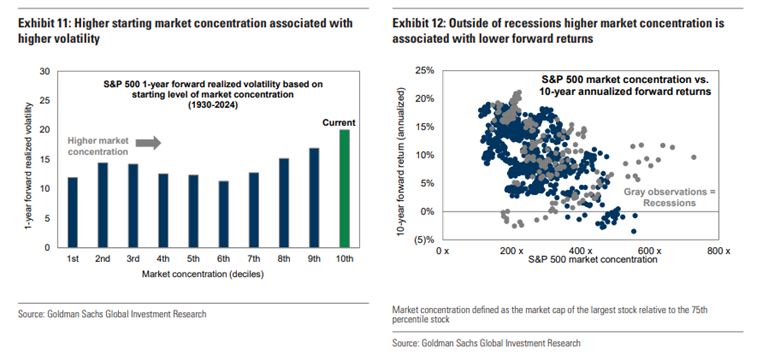

One important point that Goldman included in its recent report was on index concentration and how high degrees of concentration, like in today’s market, have been associated with both higher volatility and lower forward returns, as shown in the figure from the report below.

But this raises the point that if today’s high valuation and high concentration are to weigh on forward index returns, this does not mean that all equities in all indices will do poorly. At other peaks of high concentration, like with the Nifty Fifty stocks in the early 1970s and at the peak of the tech bubble in 2000, prior leading indices struggled to deliver strong returns, but there were huge leadership shifts under the surface that provided attractive opportunities.

As a repeat from our March piece, take the 5 years following the bursting of the tech bubble in 2000: the Russell 1000 Growth Index was -47% while the Russell 1000 Value Index was +16%. The broad market struggled during this time period, however selectivity created substantial value.

But the decision to ditch prior winners and rotate into laggards is fraught with the challenge of timing. The reality is that the same arguments about the market being expensive and too concentrated were made at the beginning of 2024, but these longer-term factors have yet to weigh on the performance of the broad market and its persistent Growth leadership. This is not to say that high valuations, high concentration, and crowded positioning won’t eventually have an impact on returns, we certainly see the potential for large leadership rotations to happen in the future, we just have to respect the near-term trends and fundamentals.

We wrote about the fundamentals of Growth vs. Value in detail over the summer, with the conclusion that a catalyst was needed for a durable rotation. That catalyst could be something that causes Value earnings to rebound significantly (such as a much weaker USD and a commodity supercycle), Growth earnings to weaken (such as from overspending on AI or regulation), or Growth valuations to normalize (such as a spike higher in interest rates or tightening liquidity). We always must balance long-term, strategic projections with shorter-term, tactical considerations (like technicals and fundamentals), as being early to these calls for big rotations is the equivalent of being wrong.

Overall, we typically see big leadership rotations during periods of weaker overall index returns. This is good news for investors who can remain valuation disciplined in good times and open-minded to new narratives and leadership in challenging times.

Conclusion

We respect the thoughtfulness, method, and conclusion of Goldman’s low returns analysis. We add our caveats that “predictions are tough”, the path is important, and that leadership rotations create opportunities for investors.

Through all of this discussion, it is vitally important to keep long term goals and wealth strategy in mind, with considerations like tax-efficiency and asset selection being increasingly important in a lower return world.

IMPORTANT DISCLOSURES

The views and opinions included in these materials belong to their author and do not necessarily reflect the views and opinions of NewEdge Capital Group, LLC.

This information is general in nature and has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy.

NewEdge and its affiliates do not render advice on legal, tax and/or tax accounting matters. You should consult your personal tax and/or legal advisor to learn about any potential tax or other implications that may result from acting on a particular recommendation.

The trademarks and service marks contained herein are the property of their respective owners. Unless otherwise specifically indicated, all information with respect to any third party not affiliated with NewEdge has been provided by, and is the sole responsibility of, such third party and has not been independently verified by NewEdge, its affiliates or any other independent third party. No representation is given with respect to its accuracy or completeness, and such information and opinions may change without notice.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No assurance can be given that investment objectives or target returns will be achieved. Future returns may be higher or lower than the estimates presented herein.

An investment cannot be made directly in an index. Indices are unmanaged and have no fees or expenses. You can obtain information about many indices online at a variety of sources including: https://www.sec.gov/answers/indices.htm.

All data is subject to change without notice.

© 2025 NewEdge Capital Group, LLC