Latest Investments & Planning Insights

Weekly Edge

At the end of the trading week, the team at NewEdge Wealth publishes its commentary on the week that was, as well as some insights into what it means for clients looking ahead.

Golden Eye

Another week, and another new all-time high. No, not for the S&P 500 (this time), but for gold.

Such Great Heights

High valuations have been a source of persistent consternation to investors looking at S&P 500 price levels.

Is Monetary Policy About the Journey or the Destination?

The Fed’s “journey vs. destination” debate is reshaping markets. Discover what investors should watch in the this week’s Weekly Edge.

Looking for Clarity After the Summer of Mud

The question as we move into autumn is whether enough mud has been cleared away to provide clarity on the way forward for corporate earnings and economic growth and, ultimately, more good returns for investors.

Wealth Strategy

A successful wealth strategy process benefits from a team of advisors, collectively focused on the goals specific to your family. Below are some of the insights and strategies the team at NewEdge has published on what it means to have a wealth strategy, rather than a simple financial plan.

Articles, Webinars & Media Appearances

Bloomberg Appearance: “Earnings revisions are still moving higher, but healthy digestion would be good,” says Cameron Dawson, CFA®

Cameron Dawson, CFA®, Chief Investment Officer joins Bloomberg Surveillance to discuss challenges facing equities amid high valuations, loose financial conditions, and elevated investor optimism, warning of limited capacity to absorb negative surprises.

Investopedia Appearance: “In the very short term, the market is certainly overbought,” says Cameron Dawson, CFA®

Cameron Dawson, CFA®, Chief Investment Officer, joins Investopedia to discuss

what to expect from the Fed’s meeting on interest rates, the July jobs report, and the most important corporate earnings of the cycle.

Maximizing College Savings with 529 Plans

To address concerns around leftover funds and to expand upon the potential avenues for funding and utilizing 529 plans efficiently, we have compiled this report to delve into potentially optimal strategies for high-net-worth investors to leverage 529 plans effectively.

2025 Suggested Reading List, by our Wealth Strategy Team

Summer is the perfect time to grow your knowledge, along with your wealth. Our Wealth Strategy Team has compiled a summer reading list to inform and inspire your financial journey. Discover what’s on our bookshelf this season today.

Understanding Medical Practice Transitions: A Comprehensive Guide to Maximizing Value and Ensuring a Successful Transition

Selling a medical practice is a monumental decision that requires careful planning beyond just achieving a favorable financial deal. Effective presale preparation — covering operational, financial, legal, and personal aspects — can make the difference between a smooth transition and an unsatisfactory outcome. Whether you’re planning a sale or just considering it, expert guidance is crucial to ensure a successful outcome.

CNBC Appearance: Cameron Dawson, CFA® Shares How Tariffs are Testing Market Complacency

Cameron Dawson, CFA®, Chief Investment Officer, joins CNBC’s “Closing Bell” to discuss how trade policy fears are weighing on markets amid new tariff announcements and more.

Spotlight on Venture with Nava Ventures

We’re pleased to share a recent conversation between NewEdge Wealth’s Chloe Reed, Vice President, Investment Solutions, Alternatives, had with Freddie Martignetti, Founder of Nava Ventures, as part of our spotlight on venture.

Bloomberg Appearance: “If you’re looking into the bond market right now, you have to do it with open eyes,” says Brian Nick of NewEdge Wealth.

Brian Nick, Managing Director, Head of Portfolio Strategy at NewEdge Wealth, warns that U.S. economic growth is weakening fast, making equity market gains harder to justify and bond markets more uncertain.

Mid-Year Outlook: The Summer of Mudd

Here we are already, a blink away from the beginning of July, and the year has positively flown by.

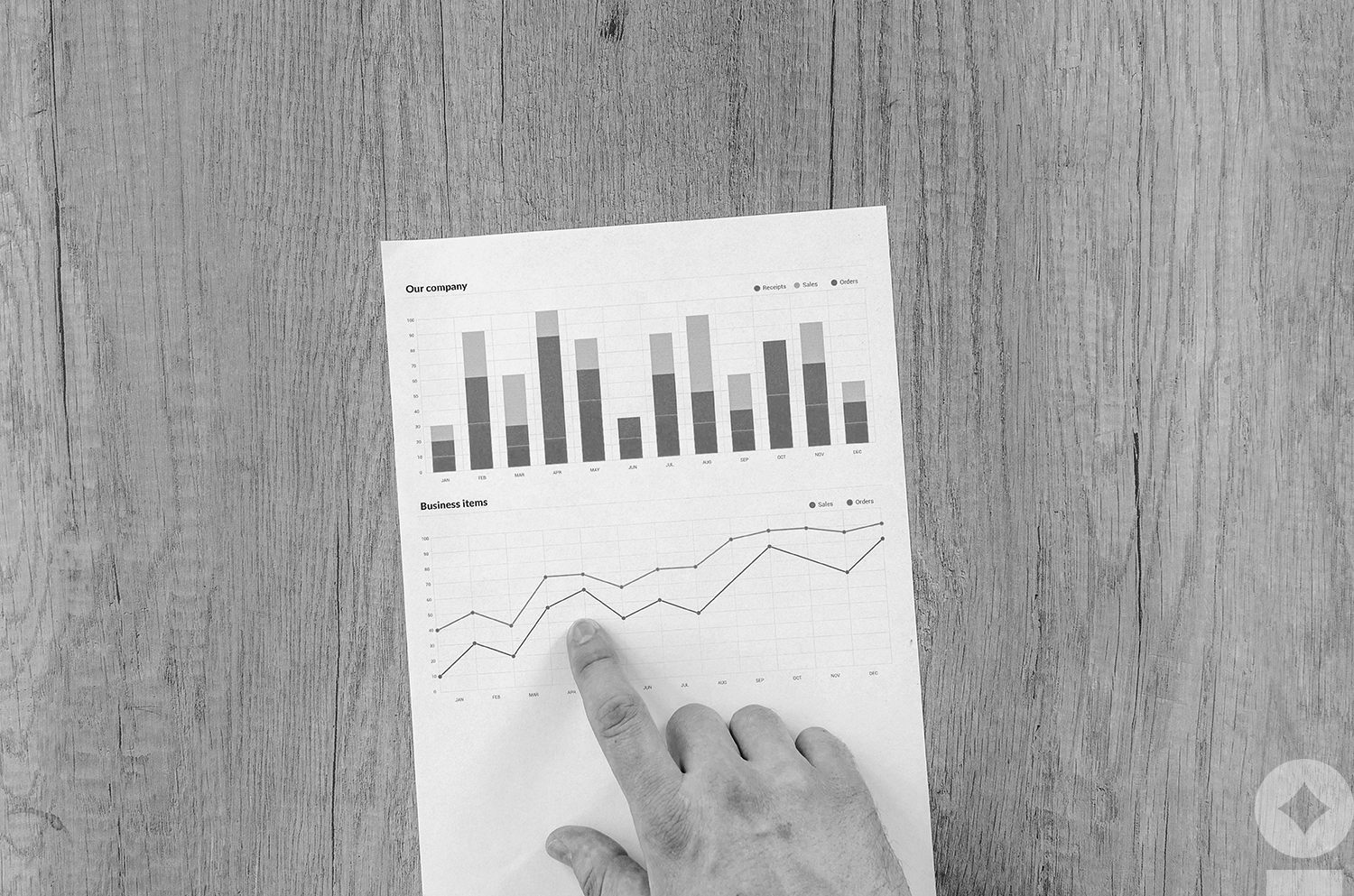

Investors have certainly had to stomach bouts of high volatility caused by these “interesting” times, but for all the chop and churn, returns have actually been rather healthy. In fact, a straight 60/40 portfolio, made up of 60% Equities in the All-Country World Index (ACWI) and 40% Fixed Income in the Bloomberg U.S. Aggregate Bond Index has returned a sturdy 7.2%!